The electric three wheelers market in Sri Lanka was valued INR 2,604.2 Lakh in 2019 and is projected to reach INR 8,624.7 Lakh by 2027; it is expected to grow at a CAGR of 33.4% from 2020 to 2027.

Governments in of various statesof India are taking the initiative for the adoption of electric three-wheelers. For instance, in March 2018, the Ministry of Heavy Industries & Public Enterprises, India, launched Phase-II of the FAME India Scheme, which was initiated on 1st April 2019 for next three years, with total budgetary support of US$ 1.39 billion. This phase is launched to mainly support the electrification of public & shared transportation and aims to support through subsidies 7000 e-Buses, 5 lakh e-3 Wheelers, 55000 e-4 Wheeler Passenger Cars, and 10 lakh e-2 Wheelers. This phase of the FAME Scheme is looking forward to setting up adequate public charging infrastructure to develop confidence among EV users. With this, the ministry of heavy industries & public enterprises is looking ahead for involvement and active participation of various stakeholders, including industries and public sector enterprises (PSEs) and government agencies. The key players in the market are aiming at developing electric vehicles. For instance, the Piaggio& C. SpA, and Italian motor vehicle manufacturer launched Piaggio Ape E-City under its range of Piaggio Ape Electrik Electric 3-Wheeler. The E-auto comes with a swappable Lithium-ion battery and can cover the range of around 70-80 km when charged once. Furthermore, in August 2019, Euler Motors announced that it would launch electric three-wheeler light commercial cargo vehicles in India in early 2020.

Electrification of auto-rickshaws plays an important role in meeting the transport requirement of many large and medium Indian cities and is critical for reducing air pollution and providing clean mobility solutions. The auto-rickshaws, generally three-wheelers, with both four and two-stroke internal combustion engines, are fuelled by Diesel, Compressed Natural Gas (CNG), and Liquefied Petroleum Gas (LPG). According to a recent study by TERI, an average conventional LPG auto emits approximately 0.005 tonnes of Particulate Matter-10 (PM10) in a year and about 3.72 tonnes of carbon dioxide in a year (TERI, 2018)1. On the other hand, electric auto-rickshaws (e-autos) provide zero tailpipe emission and no-noise solution while meeting the mobility needs of people.The urban transportation system in India includes various modes, with private transport (cars, two-wheelers, and cycles), public transport (metro, rail and city buses) and intermediate public transport, IPT, (auto-rickshaws and taxis) that serve an essential role in the transportation systems of the city. Within the urban transport framework, IPT contributes 3 to 8% of the daily trips (EMBARQ). Within the IPT segment, auto-rickshaws in particular act as cost and time effective mode of travel, especially in cities where there is inadequacy or absence of public transport. In the current scenario, despite the rise of app-based taxi services, auto-rickshaws continue to serve as a crucial mode to meet the mobility demand.

The India and Sri Lankaelectric three wheelers market is expected to grow at a good CAGR during the forecast period. The National Climate Change Policy of Sri Lanka has been developed to provide supervision and directions for all the stakeholders to address the unfavourable impacts of climate change effectively and efficiently. It contains a mission, a vision, goals, and a set of guiding principles followed by broad policy statements under the headings Vulnerability, Adaptation, Mitigation, Sustainable Consumption and Production, Knowledge Management, and General Statements. The transport sector strategy is stated as “taking action to promote integrated transportation systems, low emission fuels, and improved fuel efficiency, taking into consideration the long-term sustainability of the existing resources.”

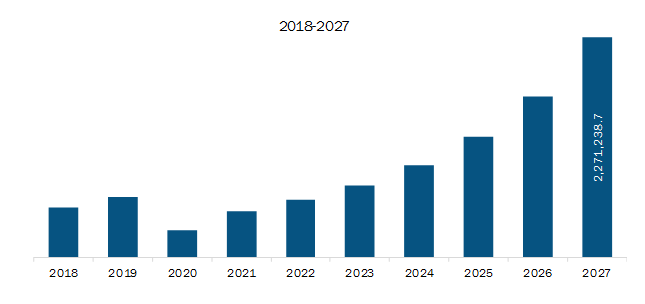

India Electric three wheelers market Revenue and Forecasts to 2027 (INR Lakh)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

India and Sri LankaElectric three wheelers market–Segmentation

India Electric three wheelers market – By Type

- E-Auto (High Speed)

- People Carrier

- Goods Carrier

- Special Vehicles

- E-Rickshaw (Low Speed)

- People Carrier

- Goods Carrier

- Special Vehicles

Sri Lanka Electric three wheelers market – By Type

- E-Auto (High Speed)

- People Carrier

- Goods Carrier

- Special Vehicles

- E-Rickshaw (Low Speed)

- People Carrier

- Goods Carrier

- Special Vehicles

India and Sri Lanka Electric three wheelers Market-Companies Mentioned

- Gayam Motor Works Pvt. Ltd

- Exide Industries Limited

- Green Shuttle Technology Pvt Ltd

- Dilli Electric Auto Pvt Ltd

- REEP Industries Private Limited

- DSF Industries

- Adapt Motors Pvt. Ltd

- SAARTHI e-RICKSHAWS

- SL Mobility

- KSL Cleantech Limited

- Omega Seiki Pvt. Ltd

- Altigreen

- OK Play EV

- LOHIA AUTO INDUSTRIES

- Kinetic Green Energy & Power Solutions Ltd

- ATUL Auto Limited

- Piaggio& C. SpA

- Bajaj Auto Ltd

- J.S. AUTO (P) LTD.

- Speego Vehicles Co Pvt Limited

- Mahindra & Mahindra Ltd.

- Scooters India Limited

- TVS Motor Company

- Terra Motors Corporation

- XiangheQiangsheng Electric Tricycle Factory

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. India and Sri Lanka Electric Three-Wheeler - Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Electric Three-Wheeler Market – India PEST Analysis

4.2.2 Electric Three-Wheeler Market – Sri Lanka PEST Analysis

4.3 Premium Insights

4.3.1 E-Rickshaw Sales by Major States in India

4.3.2 E-Auto Sales by Major States in India

4.3.3 Sri Lanka Electric Three-Wheeler Sales

4.4 Benefits Offered by Indian Government to Manufacturers

4.4.1 National Urban Transport Policy (NUTP), 2006

4.4.2 National Electric Mobility Mission Plan (NEMMP), 2020

4.4.3 Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME - India)-I &II

4.4.4 State EV policies

4.4.5 International best practices

4.5 Government Approvals

5. India Electric Three-Wheeler Market – Key Industry Dynamics

5.1 Key Market Driver

5.1.1 Growing demand for eco-friendly three wheelers

5.1.2 Traffic Congestion

5.2 Key Market Restraint

5.2.1 Instability and lack of safety norms

5.3 Key Market Opportunity

5.3.1 Improving charging infrastructure across the country

5.4 Future Trend

5.4.1 Increasing the Range Covered by Electric Three-Wheeler Would Stimulate Market Growth

5.5 Impact Analysis of Drivers and Restraints

6. Electric Three-Wheeler Market – India Analysis

6.1 India Electric Three-Wheeler Market – Revenue and Forecast to 2027 (US$ Million)

7. India Electric Three-Wheeler Market – By Type

7.1 Overview

7.2 India Electric Three-Wheeler Market Breakdown, by Type (2018 and 2027)

7.3 E-Auto (High Speed)

7.3.1 Overview

7.3.2 E-Auto (High-Speed): Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

7.3.2.1 India: Electric Three-wheeler Market, by E-Auto (High-Speed) Type (INR Lakh)

7.3.2.2 India: Electric Three-wheeler Market, by E-Auto (High-Speed) Type (Units)

7.4 E-Rickshaw (Slow Speed)

7.4.1 Overview

7.4.2 E-Rickshaw (Slow Speed): Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

7.4.2.1 India: Electric Three-wheeler Market, by E-Rickshaw (Low-Speed) Type (INR Lakh)

7.4.2.2 India: Electric Three-wheeler Market, by E-Auto (High-Speed) Type (Units)

8. Sri Lanka Electric Three-Wheeler Market – Key Industry Dynamics

8.1 Key Market Driver

8.1.1 Public Transport Issues

8.1.2 Traffic Congestion

8.2 Key Market Restraint

8.2.1 Lack of local manufacturers

8.3 Key Market Opportunity

8.3.1 Increasing adoption of three wheelers in Sri Lanka

8.4 Future Trend

8.4.1 Increasing the Range Covered by Electric Three-Wheeler Would Stimulate Market Growth

8.5 Impact Analysis of Drivers and Restraints

9. Electric Three-Wheeler Market – Sri Lanka Analysis

9.1 Sri Lanka Electric Three-Wheeler Market – Revenue and Forecast to 2027 (US$ Million)

10. Sri Lanka Electric Three-Wheeler Market – By Type

10.1 Overview

10.2 Sri Lanka Electric Three-Wheeler Market Breakdown, by Type (2018 and 2027)

10.3 E-Auto (High Speed)

10.3.1 Overview

10.3.2 E-Auto (High-Speed): Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

10.3.2.1 Sri Lanka: Electric Three-wheeler Market, by E-Auto (High-Speed) Type (INR Lakh)

10.3.2.2 Sri Lanka: Electric Three-wheeler Market, by E-Auto (High-Speed) Type (Units)

10.4 E-Rickshaw (Slow Speed)

10.4.1 Overview

10.4.2 E-Rickshaw (Slow Speed): Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

10.4.2.1 Sri Lanka: Electric Three-wheeler Market, by E-Rickshaw (Low-Speed) Type (INR Lakh)

10.4.2.2 Sri Lanka: Electric Three-wheeler Market, by E-Auto (High-Speed) Type (Units)

11. Impact of Coronavirus Outbreak

11.1 Impact of COVID-19 Pandemic On Electric Three-Wheeler Market

11.1.1 India: Impact Assessment of COVID-19 Pandemic

11.1.2 Sri Lanka: Impact Assessment of COVID-19 Pandemic

12. Company Profiles

12.1 Gayam Motor Works Pvt. Ltd

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Exide Industries Limited

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Green Shuttle Technology Pvt Ltd

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Dilli Electric Auto Pvt Ltd

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 REEP Industries Private Limited

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 DSF Industries

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Adapt Motors Pvt. Ltd

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 SAARTHI e-RICKSHAWS

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 SL Mobility

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 KSL Cleantech Limited

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

12.11 Omega Seiki Pvt. Ltd.

12.11.1 Key Facts

12.11.2 Business Description

12.11.3 Products and Services

12.11.4 Financial Overview

12.11.5 SWOT Analysis

12.11.6 Key Developments

12.12 Altigreen

12.12.1 Key Facts

12.12.2 Business Description

12.12.3 Products and Services

12.12.4 Financial Overview

12.12.5 SWOT Analysis

12.12.6 Key Developments

12.13 OK Play EV

12.13.1 Key Facts

12.13.2 Business Description

12.13.3 Products and Services

12.13.4 Financial Overview

12.13.5 SWOT Analysis

12.13.6 Key Developments

12.14 LOHIA AUTO INDUSTRIES

12.14.1 Key Facts

12.14.2 Business Description

12.14.3 Products and Services

12.14.4 Financial Overview

12.14.5 SWOT Analysis

12.14.6 Key Developments

12.15 Kinetic Green Energy & Power Solutions Ltd.

12.15.1 Key Facts

12.15.2 Business Description

12.15.3 Products and Services

12.15.4 Financial Overview

12.15.5 SWOT Analysis

12.15.6 Key Developments

12.16 ATUL Auto Limited

12.16.1 Key Facts

12.16.2 Business Description

12.16.3 Products and Services

12.16.4 Financial Overview

12.16.5 SWOT Analysis

12.16.6 Key Developments

12.17 Piaggio & C. SpA

12.17.1 Key Facts

12.17.2 Business Description

12.17.3 Products and Services

12.17.4 Financial Overview

12.17.5 SWOT Analysis

12.17.6 Key Developments

12.18 Bajaj Auto Ltd.

12.18.1 Key Facts

12.18.2 Business Description

12.18.3 Products and Services

12.18.4 Financial Overview

12.18.5 SWOT Analysis

12.18.6 Key Developments

12.19 J.S. AUTO (P) LTD.

12.19.1 Key Facts

12.19.2 Business Description

12.19.3 Products and Services

12.19.4 Financial Overview

12.19.5 SWOT Analysis

12.19.6 Key Developments

12.20 Speego Vehicles Co Pvt Limited

12.20.1 Key Facts

12.20.2 Business Description

12.20.3 Products and Services

12.20.4 Financial Overview

12.20.5 SWOT Analysis

12.20.6 Key Developments

12.21 Mahindra & Mahindra Ltd.

12.21.1 Key Facts

12.21.2 Business Description

12.21.3 Products and Services

12.21.4 Financial Overview

12.21.5 SWOT Analysis

12.21.6 Key Developments

12.22 Scooters India Limited

12.22.1 Key Facts

12.22.2 Business Description

12.22.3 Products and Services

12.22.4 Financial Overview

12.22.5 SWOT Analysis

12.22.6 Key Developments

12.23 TVS Motor Company

12.23.1 Key Facts

12.23.2 Business Description

Products and Services

12.23.3 Financial Overview

12.23.4 SWOT Analysis

12.23.5 Key Developments

12.24 Terra Motors Corporation

12.24.1 Key Facts

12.24.2 Business Description

12.24.3 Products and Services

12.24.4 Financial Overview

12.24.5 SWOT Analysis

12.24.6 Key Developments

12.25 Xianghe Qiangsheng Electric Tricycle Factory

12.25.1 Key Facts

12.25.2 Business Description

12.25.3 Products and Services

12.25.4 Financial Overview

12.25.5 SWOT Analysis

12.25.6 Key Developments

LIST OF TABLES

Table 1. E-Rickshaw Sales by Major States in India (Units)

Table 2. E-Auto Sales by Major States in India (Units)

Table 3. Sri Lanka Electric Three-Wheeler Sales (Units)

Table 4. Provisions for which test reports from test agency are required

Table 5. Provisions for which test reports from Vehicle Manufacturer / Component Supplier / Third Party test agency are required

Table 6. India Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Table 7. India Electric Three-Wheeler Market – Volume and Forecast to 2027 (Units)

Table 8. E-Rickshaw and E-Auto Difference

Table 9. India: Three-wheeler Market, by Type, 2018–2027 (INR Lakh)

Table 10. India: Three-wheeler Market, by E-Auto (High-Speed) Type, 2018–2027 (Units)

Table 11. India: Three-wheeler Market, by E-Rickshaw (Slow-Speed) Type, 2018–2027 (INR Lakh)

Table 12. India: Three-wheeler Market, by Type, 2018–2027 (Units)

Table 13. Sri Lanka Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Table 14. Sri Lanka Electric Three-Wheeler Market – Volume and Forecast to 2027 (Units)

Table 15. E-Rickshaw and E-Auto Difference

Table 16. Sri Lanka: Three-wheeler Market, by Type, 2018–2027 (INR Lakh)

Table 17. Sri Lanka: Three-wheeler Market, by E-Auto (High-Speed) Type, 2018–2027 (Units)

Table 18. Sri Lanka: Three-wheeler Market, by E-Rickshaw (Slow-Speed) Type, 2018–2027 (INR Lakh)

Table 19. Sri Lanka: Three-wheeler Market, by Type, 2018–2027 (Units)

LIST OF FIGURES

Figure 1. Three Wheeler Market Segmentation

Figure 2. Three-Wheeler Market Overview

Figure 3. Sri Lanka Three-Wheeler Market, by Type

Figure 4. India Three-Wheeler Market, by Type

Figure 5. India – PEST Analysis

Figure 6. Sri Lanka – PEST Analysis

Figure 7. India and Sri Lanka Electric Three-Wheeler Market Impact Analysis of Drivers and Restraints

Figure 8. India Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Figure 9. India Electric Three-Wheeler Market Revenue Share, by Type (2019 and 2027)

Figure 10. India Electric Three-Wheeler Market Volume Share, by Type (2019 and 2027)

Figure 11. India E-Auto (High-Speed): Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Figure 12. E-Rickshaw (Slow Speed): Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Figure 13. India and Sri Lanka Electric Three-Wheeler Market Impact Analysis of Drivers and Restraints

Figure 14. Sri Lanka Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Figure 15. Sri Lanka Electric Three-Wheeler Market Revenue Share, by Type (2019 and 2027)

Figure 16. Sri Lanka Electric Three-Wheeler Market Volume Share, by Type (2019 and 2027)

Figure 17. Sri Lanka E-Auto (High-Speed): Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

Figure 18. E-Rickshaw (Slow Speed): Electric Three-Wheeler Market – Revenue and Forecast to 2027 (INR Lakh)

The List of Companies - India and Sri Lanka Electric Three Wheeler Market

- Gayam Motor Works Pvt. Ltd

- Exide Industries Limited

- Green Shuttle Technology Pvt Ltd

- Dilli Electric Auto Pvt Ltd

- REEP Industries Private Limited

- DSF Industries

- Adapt Motors Pvt. Ltd

- SAARTHI e-RICKSHAWS

- SL Mobility

- KSL Cleantech Limited

- Omega Seiki Pvt. Ltd

- Altigreen

- OK Play EV

- LOHIA AUTO INDUSTRIES

- Kinetic Green Energy & Power Solutions Ltd

- ATUL Auto Limited

- Piaggio& C. SpA

- Bajaj Auto Ltd

- J.S. AUTO (P) LTD.

- Speego Vehicles Co Pvt Limited

- Mahindra & Mahindra Ltd.

- Scooters India Limited

- TVS Motor Company

- Terra Motors Corporation

- XiangheQiangsheng Electric Tricycle Factory

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Jun 2020

Heavy Commercial Vehicle Air Brake Systems Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Compressor, Reservoir, Foot Valve, Brake Lining and Drum or Rotors, Brake Shoes, and Others), Type (Air Disc Brake and Air Drum Brake), Technology (Conventional Air Brake System, Electronically Controlled Air Braking System, and Antilock Braking System), Distribution Channel (OEMs and Aftermarket), Vehicle Type (Bus, Truck, Construction Equipment, and Tractor), and Geography

Jun 2020

Heavy Commercial Vehicle Clutch Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Distribution Channel (OEM and Aftermarket), Product (Single Plate Clutches, Multi-Plate Clutches, Diaphragm Spring Clutches, Centrifugal Clutches, and Hydraulic Clutches), Vehicle Type (Bus, Truck, Construction Equipment, and Tractors), and Geography

Jun 2020

Electric Vehicle Heat Pump Systems Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propulsion Type (BEV, HEV, PHEV), Component (Evaporator, Condenser, Compressors, Others), Vehicle Type (Passenger Vehicle, Commercial Vehicle), and Geography

Jun 2020

Hydrogen Fuel Cell Train Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, and Others), Component (Hydrogen Fuel Cell Pack, Batteries, Electric Traction Motors, and Others), Rail Type (Passenger Rail, Commuter Rail, Light Rail, Trams, Freight, and Others) and Geography

Jun 2020

Automotive Seat Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Heated, Heated-Ventilated, Ventilated, With Massage Functions, and Others), Adjustment Type (Electrically Adjusted and Manual), Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle), and Seat Type (Front Row, Second Row, and Third Row) and Geography

Jun 2020

Connected Vehicle Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Technology (5G, 4G/LTE, 3G & 2G), Connectivity (Integrated, Tethered, Embedded), Application (Telematics, Infotainment, Driving assistance, Others) and Geography

Jun 2020

Automotive High Voltage Cable Market

Forecast to 2030 - Global Analysis by Vehicle Type [Battery Electric Vehicles (BEV), Plugin Hybrid Electric Vehicles (PHEV), and Plugin Hybrid Vehicles (PHV)], Conductor Type (Copper and Aluminum), and Core Type (Multi Core and Single Core)

Get Free Sample For

Get Free Sample For