[Research Report] The IP camera market is expected to grow from US$ 10.98 billion in 2023 to US$ 26.43 billion by 2031; it is estimated to grow at a CAGR of 11.61% from 2025 to 2031.

Analyst Perspective:

Due to the increasing number of home burglaries and squatters, the rising need for security monitoring has recently acquired popularity; domestic security has been the top priority of homeowners. Over the projected period, this factor is expected to boost the expansion of the Internet protocol (IP) camera sector. Because of the growing population in major cities, home surveillance has become popular. Interactive product introductions, new product launches, ongoing research and development, and innovation activities in camera and networking technologies are just a few of the critical strategic milestones for manufacturers.

Homeowners are embracing IoT devices, which is helping the market grow. To strengthen the security of their facilities, users are increasingly preferring smart IP cameras over standard mountable Wi-Fi cameras. This bodes well for players in the Internet protocol (IP) camera sector. The deployment of infrared cameras, as well as the rising usage of IoT in video surveillance, has increased the need for these cameras dramatically. The expanding smart home trend, greater use of these cameras in commercial buildings, and the need for security in residential are expected to drive the IP camera market over the projection period. The growing number of smartphone users and the availability of attractive installment options for security are driving the residential industry.

IP Camera Market Overview:

An IP camera, or Internet Protocol camera, is a form of digital video camera that accepts control input and broadcasts picture data via an IP network. They are often used for surveillance. However, unlike analog closed-circuit television (CCTV) cameras, they do not require a local recording device; instead, they require only a local area network. Most IP cameras are webcams, although the name IP camera or netcam usually refers to those that can be viewed directly over a network connection.

A digital system that is designed around an existing WI-FI or internet network can be integrated with other systems that are also running on the same network. An IP security camera CCTV system has several advantages over analog systems. IP security cameras are compatible with a broad range of options and technologies, granting users the ability to record video in high definition (HD), handle changing light levels during the day, and even remotely focus the user's camera. Advanced camera features include HD analog technology, image sensor, remote focus, PTZ technology, HD resolution, frame rates, video compression, lens, and camera Iris.

Hardware components held a market share of approximately XX% in 2022, owing to the advancement of hardware systems in the industry during the previous years. A few government organizations are using face detection and body detection technologies developed by manufacturers to launch new products with technological improvements and greater features enabled by AI and IoT. Because of the development and innovation of these camera system technologies, manufacturers and service providers are providing to the market demand for improved solutions throughout the forecast period of 2022-2031. To meet IP camera market demand for IP camera systems, manufacturers are increasing their portfolio.

Strategic Insights

IP Camera Market Driver:

The rising demand for security surveillance is expected to drive significant growth in the IP camera market. This growth is being fueled by several factors, such as:

- Increasing concerns about security and crime: Public safety concerns have been rising in recent years, leading to a growing demand for security surveillance solutions. These cameras are becoming increasingly popular to deter crime and monitor property.

- Advances in IP camera technology: These cameras have become more affordable and feature-rich in recent years. They now offer high-resolution images, wide-angle viewing, and advanced features, including motion detection and facial recognition.

- The growth of the Internet of Things (IoT): The IoT is a network of physical devices, vehicles, and buildings that are embedded with software, sensors, and network connectivity that enables them to exchange and collect data. These cameras are an important part of the IoT, as they can provide real-time video surveillance data to a variety of applications.

The increasing demand for security surveillance can be a very important factor behind the growth of the IP camera market. Increased demand for these cameras will lead to higher sales volume and revenue for the camera manufacturers. The need for more of these cameras will create opportunities for new IP camera companies to enter the IP camera market. The growth of the IP camera market will lead to increased innovation and the development of new camera technologies. The adoption of these cameras will create new opportunities for service providers to offer installation, maintenance, and monitoring services. Therefore, the rising demand for security surveillance is a positive trend for the IP camera market. As security concerns continue to grow, these cameras are becoming an increasingly crucial tool for deterring crime and protecting property.

IP Camera Market Segmental Analysis:

Due to the increased demand for advanced security technologies in the banking and financial sectors, which is driving the commercial industry and thus impacting the growth of the IP camera market, the commercial application of IP cameras is anticipated to generate a market revenue of around US$ xx million in 2022. The rise in retail theft stimulates the implementation of modern video systems that may alert and inform security workers about unauthorized entry and admission into the premises. Several industry players are attempting to provide safety products that are specifically designed for commercial use.

Residential applications will have a big market impact in the future years. The growing use of IoT in smart homes is also propelling market growth. Consumers are shifting away from traditional CCTV cameras and towards IP cameras with new revolutionary features to improve the security of their properties. These unique smart home security cameras offer numerous benefits, which encourage their installation in many families.

These cameras have become an increasingly important tool for government agencies of all levels, providing a wide range of benefits for security, public safety, and operational efficiency. Here are some of the key applications of IP cameras in government settings. These cameras are widely used to deter crime, investigate incidents, and collect evidence in public spaces such as streets, parks, schools, and government buildings. Their high-resolution images and real-time monitoring capabilities enable law enforcement to identify suspects, track their movements, and respond promptly to emergencies. IP cameras are employed to monitor traffic flow, identify congestion, and detect incidents on roads and highways. This data is used to optimize traffic signals, improve traffic management strategies, and reduce congestion, thereby enhancing road safety and reducing travel time.

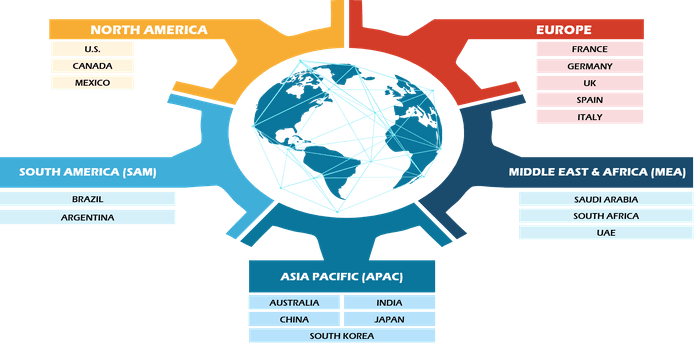

Regional Analysis:

North America is a well-off region that is witnessing rapid growth in the IP camera industry. Due to the expansion of industrial sectors and advancements in features and technology, as well as video surveillance cameras, the area is expected to grow at a CAGR of roughly xx% over the forecast period. According to BuiltWorlds Inc., only 20 locations in the United States are expected to host 50% of all construction projects between 2021 and 2023. The cities of Houston, New York, Dallas, Los Angeles, and Washington are predicted to have the biggest demand for these cameras.

In 2022, Asia Pacific's market revenue was estimated to be around USD xx million. Furthermore, the IP camera market is projected to grow significantly by 2031 due to the increasing acceptance of current security technologies for a diversity of applications, such as traffic monitoring, home security, and city surveillance. Furthermore, growing government, corporate sector, and academic investments in innovation and R&D in creating administration-related technologies are expected to boost the IP camera market.

Key Player Analysis:

The IP camera market analysis includes 3DEYE Inc., Arecont Vision Costar LLC., CAMERAFTP, Avigilon Corporation, Belkin International Inc., Bosch Security Systems GmbH, CAMCLOUD, D-Link Corporation, EOS Digital Services, GEOVISION Inc. are some of the top players owing to their diversified product portfolio.

Recent Developments:

Companies in the IP camera market highly adopt inorganic and organic strategies such as mergers and acquisitions. A few recent key IP camera market developments are listed below:

- In July 2023, Versuni, previously Philips domestic appliances, moved into home security solutions. The new line includes three smart security cameras as well as a new Home Safety app. According to the business, the Philips Home Safety solutions will mix artificial intelligence, user-friendliness, and dependability to provide consumers with a variety of benefits. Philips' latest security cameras will have smart features that will allow them to distinguish between motion, noise, and humans.

- In Jan 2023, Sony introduced the ILME-FR7, an E-mount interchangeable lens camera containing a full-frame image sensor and built-in pan/tilt/zoom (PTZ) capabilities, to its Cinema Line. Its remote control and cinematic features expand creative options in the studio, live production, and movie scenarios. The camera has a high-performance full-frame picture sensor and Sony's broad E-mount lens portfolio, which work together with the remote pan/tilt/zoom control, great flexibility in zoom capability, and wide-angle shooting to overcome location and space constraints.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Product Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 IP Camera Market - By Product

1.3.2 IP Camera Market - By Connection

1.3.3 IP Camera Market - By Application

1.3.4 IP Camera Market - By Region

1.3.4.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. IP CAMERA MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PEST ANALYSIS

4.2.1 North America - Pest Analysis

4.2.2 Europe - Pest Analysis

4.2.3 Asia-Pacific - Pest Analysis

4.2.4 Middle East and Africa - Pest Analysis

4.2.5 South and Central America - Pest Analysis

4.3. ECOSYSTEM ANALYSIS

4.4. EXPERT OPINIONS

5. IP CAMERA MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. IP CAMERA MARKET - GLOBAL MARKET ANALYSIS

6.1. IP CAMERA - GLOBAL MARKET OVERVIEW

6.2. IP CAMERA - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING/MARKET SHARE

7. IP CAMERA MARKET - REVENUE AND FORECASTS TO 2028 - PRODUCT

7.1. OVERVIEW

7.2. PRODUCT MARKET FORECASTS AND ANALYSIS

7.3. FIXED

7.3.1. Overview

7.3.2. Fixed Market Forecast and Analysis

7.4. PTZ

7.4.1. Overview

7.4.2. PTZ Market Forecast and Analysis

7.5. INFRARED

7.5.1. Overview

7.5.2. Infrared Market Forecast and Analysis

8. IP CAMERA MARKET - REVENUE AND FORECASTS TO 2028 - CONNECTION

8.1. OVERVIEW

8.2. CONNECTION MARKET FORECASTS AND ANALYSIS

8.3. CENTRALIZED

8.3.1. Overview

8.3.2. Centralized Market Forecast and Analysis

8.4. DECENTRALIZED

8.4.1. Overview

8.4.2. Decentralized Market Forecast and Analysis

9. IP CAMERA MARKET - REVENUE AND FORECASTS TO 2028 - APPLICATION

9.1. OVERVIEW

9.2. APPLICATION MARKET FORECASTS AND ANALYSIS

9.3. RESIDENTIAL

9.3.1. Overview

9.3.2. Residential Market Forecast and Analysis

9.4. COMMERCIAL

9.4.1. Overview

9.4.2. Commercial Market Forecast and Analysis

9.5. INDUSTRIAL

9.5.1. Overview

9.5.2. Industrial Market Forecast and Analysis

10. IP CAMERA MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

10.1. NORTH AMERICA

10.1.1 North America IP Camera Market Overview

10.1.2 North America IP Camera Market Forecasts and Analysis

10.1.3 North America IP Camera Market Forecasts and Analysis - By Product

10.1.4 North America IP Camera Market Forecasts and Analysis - By Connection

10.1.5 North America IP Camera Market Forecasts and Analysis - By Application

10.1.6 North America IP Camera Market Forecasts and Analysis - By Countries

10.1.6.1 United States IP Camera Market

10.1.6.1.1 United States IP Camera Market by Product

10.1.6.1.2 United States IP Camera Market by Connection

10.1.6.1.3 United States IP Camera Market by Application

10.1.6.2 Canada IP Camera Market

10.1.6.2.1 Canada IP Camera Market by Product

10.1.6.2.2 Canada IP Camera Market by Connection

10.1.6.2.3 Canada IP Camera Market by Application

10.1.6.3 Mexico IP Camera Market

10.1.6.3.1 Mexico IP Camera Market by Product

10.1.6.3.2 Mexico IP Camera Market by Connection

10.1.6.3.3 Mexico IP Camera Market by Application

10.2. EUROPE

10.2.1 Europe IP Camera Market Overview

10.2.2 Europe IP Camera Market Forecasts and Analysis

10.2.3 Europe IP Camera Market Forecasts and Analysis - By Product

10.2.4 Europe IP Camera Market Forecasts and Analysis - By Connection

10.2.5 Europe IP Camera Market Forecasts and Analysis - By Application

10.2.6 Europe IP Camera Market Forecasts and Analysis - By Countries

10.2.6.1 Germany IP Camera Market

10.2.6.1.1 Germany IP Camera Market by Product

10.2.6.1.2 Germany IP Camera Market by Connection

10.2.6.1.3 Germany IP Camera Market by Application

10.2.6.2 France IP Camera Market

10.2.6.2.1 France IP Camera Market by Product

10.2.6.2.2 France IP Camera Market by Connection

10.2.6.2.3 France IP Camera Market by Application

10.2.6.3 Italy IP Camera Market

10.2.6.3.1 Italy IP Camera Market by Product

10.2.6.3.2 Italy IP Camera Market by Connection

10.2.6.3.3 Italy IP Camera Market by Application

10.2.6.4 United Kingdom IP Camera Market

10.2.6.4.1 United Kingdom IP Camera Market by Product

10.2.6.4.2 United Kingdom IP Camera Market by Connection

10.2.6.4.3 United Kingdom IP Camera Market by Application

10.2.6.5 Russia IP Camera Market

10.2.6.5.1 Russia IP Camera Market by Product

10.2.6.5.2 Russia IP Camera Market by Connection

10.2.6.5.3 Russia IP Camera Market by Application

10.2.6.6 Rest of Europe IP Camera Market

10.2.6.6.1 Rest of Europe IP Camera Market by Product

10.2.6.6.2 Rest of Europe IP Camera Market by Connection

10.2.6.6.3 Rest of Europe IP Camera Market by Application

10.3. ASIA-PACIFIC

10.3.1 Asia-Pacific IP Camera Market Overview

10.3.2 Asia-Pacific IP Camera Market Forecasts and Analysis

10.3.3 Asia-Pacific IP Camera Market Forecasts and Analysis - By Product

10.3.4 Asia-Pacific IP Camera Market Forecasts and Analysis - By Connection

10.3.5 Asia-Pacific IP Camera Market Forecasts and Analysis - By Application

10.3.6 Asia-Pacific IP Camera Market Forecasts and Analysis - By Countries

10.3.6.1 Australia IP Camera Market

10.3.6.1.1 Australia IP Camera Market by Product

10.3.6.1.2 Australia IP Camera Market by Connection

10.3.6.1.3 Australia IP Camera Market by Application

10.3.6.2 China IP Camera Market

10.3.6.2.1 China IP Camera Market by Product

10.3.6.2.2 China IP Camera Market by Connection

10.3.6.2.3 China IP Camera Market by Application

10.3.6.3 India IP Camera Market

10.3.6.3.1 India IP Camera Market by Product

10.3.6.3.2 India IP Camera Market by Connection

10.3.6.3.3 India IP Camera Market by Application

10.3.6.4 Japan IP Camera Market

10.3.6.4.1 Japan IP Camera Market by Product

10.3.6.4.2 Japan IP Camera Market by Connection

10.3.6.4.3 Japan IP Camera Market by Application

10.3.6.5 South Korea IP Camera Market

10.3.6.5.1 South Korea IP Camera Market by Product

10.3.6.5.2 South Korea IP Camera Market by Connection

10.3.6.5.3 South Korea IP Camera Market by Application

10.3.6.6 Rest of Asia-Pacific IP Camera Market

10.3.6.6.1 Rest of Asia-Pacific IP Camera Market by Product

10.3.6.6.2 Rest of Asia-Pacific IP Camera Market by Connection

10.3.6.6.3 Rest of Asia-Pacific IP Camera Market by Application

10.4. MIDDLE EAST AND AFRICA

10.4.1 Middle East and Africa IP Camera Market Overview

10.4.2 Middle East and Africa IP Camera Market Forecasts and Analysis

10.4.3 Middle East and Africa IP Camera Market Forecasts and Analysis - By Product

10.4.4 Middle East and Africa IP Camera Market Forecasts and Analysis - By Connection

10.4.5 Middle East and Africa IP Camera Market Forecasts and Analysis - By Application

10.4.6 Middle East and Africa IP Camera Market Forecasts and Analysis - By Countries

10.4.6.1 South Africa IP Camera Market

10.4.6.1.1 South Africa IP Camera Market by Product

10.4.6.1.2 South Africa IP Camera Market by Connection

10.4.6.1.3 South Africa IP Camera Market by Application

10.4.6.2 Saudi Arabia IP Camera Market

10.4.6.2.1 Saudi Arabia IP Camera Market by Product

10.4.6.2.2 Saudi Arabia IP Camera Market by Connection

10.4.6.2.3 Saudi Arabia IP Camera Market by Application

10.4.6.3 U.A.E IP Camera Market

10.4.6.3.1 U.A.E IP Camera Market by Product

10.4.6.3.2 U.A.E IP Camera Market by Connection

10.4.6.3.3 U.A.E IP Camera Market by Application

10.4.6.4 Rest of Middle East and Africa IP Camera Market

10.4.6.4.1 Rest of Middle East and Africa IP Camera Market by Product

10.4.6.4.2 Rest of Middle East and Africa IP Camera Market by Connection

10.4.6.4.3 Rest of Middle East and Africa IP Camera Market by Application

10.5. SOUTH AND CENTRAL AMERICA

10.5.1 South and Central America IP Camera Market Overview

10.5.2 South and Central America IP Camera Market Forecasts and Analysis

10.5.3 South and Central America IP Camera Market Forecasts and Analysis - By Product

10.5.4 South and Central America IP Camera Market Forecasts and Analysis - By Connection

10.5.5 South and Central America IP Camera Market Forecasts and Analysis - By Application

10.5.6 South and Central America IP Camera Market Forecasts and Analysis - By Countries

10.5.6.1 Brazil IP Camera Market

10.5.6.1.1 Brazil IP Camera Market by Product

10.5.6.1.2 Brazil IP Camera Market by Connection

10.5.6.1.3 Brazil IP Camera Market by Application

10.5.6.2 Argentina IP Camera Market

10.5.6.2.1 Argentina IP Camera Market by Product

10.5.6.2.2 Argentina IP Camera Market by Connection

10.5.6.2.3 Argentina IP Camera Market by Application

10.5.6.3 Rest of South and Central America IP Camera Market

10.5.6.3.1 Rest of South and Central America IP Camera Market by Product

10.5.6.3.2 Rest of South and Central America IP Camera Market by Connection

10.5.6.3.3 Rest of South and Central America IP Camera Market by Application

11. INDUSTRY LANDSCAPE

11.1. MERGERS AND ACQUISITIONS

11.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

11.3. NEW PRODUCT LAUNCHES

11.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

12. IP CAMERA MARKET, KEY COMPANY PROFILES

12.1. CANON INC.

12.1.1. Key Facts

12.1.2. Business Description

12.1.3. Products and Services

12.1.4. Financial Overview

12.1.5. SWOT Analysis

12.1.6. Key Developments

12.2. DAHUA TECHNOLOGY CO., LTD

12.2.1. Key Facts

12.2.2. Business Description

12.2.3. Products and Services

12.2.4. Financial Overview

12.2.5. SWOT Analysis

12.2.6. Key Developments

12.3. HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO.,LTD.

12.3.1. Key Facts

12.3.2. Business Description

12.3.3. Products and Services

12.3.4. Financial Overview

12.3.5. SWOT Analysis

12.3.6. Key Developments

12.4. HONEYWELL INTERNATIONAL INC.

12.4.1. Key Facts

12.4.2. Business Description

12.4.3. Products and Services

12.4.4. Financial Overview

12.4.5. SWOT Analysis

12.4.6. Key Developments

12.5. JOHNSON CONTROLS, INC.

12.5.1. Key Facts

12.5.2. Business Description

12.5.3. Products and Services

12.5.4. Financial Overview

12.5.5. SWOT Analysis

12.5.6. Key Developments

12.6. PANASONIC CORPORATION

12.6.1. Key Facts

12.6.2. Business Description

12.6.3. Products and Services

12.6.4. Financial Overview

12.6.5. SWOT Analysis

12.6.6. Key Developments

12.7. PELCO, INC.

12.7.1. Key Facts

12.7.2. Business Description

12.7.3. Products and Services

12.7.4. Financial Overview

12.7.5. SWOT Analysis

12.7.6. Key Developments

12.8. ROBERT BOSCH GMBH

12.8.1. Key Facts

12.8.2. Business Description

12.8.3. Products and Services

12.8.4. Financial Overview

12.8.5. SWOT Analysis

12.8.6. Key Developments

12.9. SONY CORPORATION

12.9.1. Key Facts

12.9.2. Business Description

12.9.3. Products and Services

12.9.4. Financial Overview

12.9.5. SWOT Analysis

12.9.6. Key Developments

12.10. Z3 TECHNOLOGY

12.10.1. Key Facts

12.10.2. Business Description

12.10.3. Products and Services

12.10.4. Financial Overview

12.10.5. SWOT Analysis

12.10.6. Key Developments

13. APPENDIX

13.1. ABOUT THE INSIGHT PARTNERS

13.2. GLOSSARY OF TERMS

The List of Companies

1. Canon Inc.

2. Dahua Technology Co., Ltd

3. Hangzhou Hikvision Digital Technology Co.,Ltd.

4. Honeywell International Inc.

5. Johnson Controls, Inc.

6. Panasonic Corporation

7. Pelco, Inc.

8. Robert Bosch GmbH

9. Sony Corporation

10. Z3 Technology

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to IP Camera Market

Apr 2024

Remote Access Solution Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Secure Remote Access-VPN, Identity and Access Management (IAM) Solutions, Multi-Factor Authentication, Single Sign-On (SSO), Endpoint Security, and Others], Mode of Deployment (Cloud and On-Premise), End-Use Industry (IT and Telecommunications, BFSI, Healthcare, Government, Manufacturing, and Others), and Geography

Apr 2024

Hall Effect Teslameter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Analog Hall Effect Teslameters and Digital Hall Effect Teslameters), End Users (Automotive, Industrial, Healthcare, Aerospace, Laboratory, and Others), and Geography

Apr 2024

Automotive Board to Board Connector Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pin Headers, Sockets, Floating Connector, and Card Edge Connector), Pin Headers (Stacked Headers and Shrouded Headers), Application (Powertrain Control Systems, Infotainment and Navigation Systems, Advanced Driver Assistance Systems (ADAS), Electric Vehicles (EV) and Hybrid Vehicle Systems, Lighting Control Systems, Autonomous Vehicles, and Others), Pitch (Less Than 1 mm, 1–2 mm, and More Than 2 mm), Number of Pin (2–12 Pin, 13–30 Pin, 31–50 Pin, 51–100 Pin, and 100+ Pin), and Geography

Apr 2024

Radiation Hardened Motor Controller and Motor Drive Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Motor Controller and Motor Drive), Motor Drive (AC Drive, DC Drive, and BLDC), Application (Space Exploration, Military and Defense, Nuclear Power Plants, and Others), and Geography

Apr 2024

Pluggable Optics for Data Center Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Switches, Routers, and Servers), Data Rate (100–400 Gb/s, 400–800 Gb/s, and 800 Gb/s and above), and Geography

Apr 2024

Doors and Windows Automation Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pedestrian Doors, Industrial Doors, and Windows), Component (Sensors and Detectors, Access Control Systems, Control Panels, Motors and Actuators, and Others), Industry Vertical (Commercial, Industrial, and Residential), Control System (Fully Automatic, Semi-Automatic, and Power Assist), and Geography

Apr 2024

Substrate-Like PCB Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Line/Space (25/25 and 30/30 µm and Less than 25/25 µm), Fabrication Process (MSAP and UV LDI), Application (Consumer Electronics, Automotive, Industrial, Medical, and Others), and Geography

Apr 2024

LED Flashlight Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rechargeable LED Flashlight and Non-Rechargeable LED Flashlight), Product (Everyday Carry Flashlights, Tactical Flashlights, and Safety Flashlights), Application (Residential, Commercial, and Military and Law Enforcement), and Geography

Get Free Sample For

Get Free Sample For