Pluggable Optics for Data Center Market Analysis and Opportunities by 2031

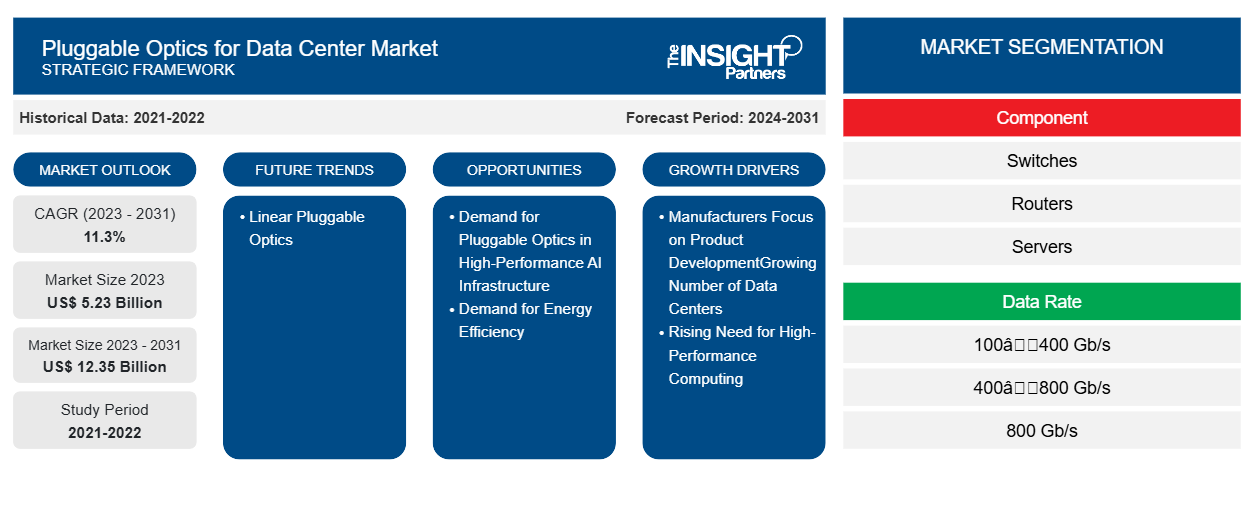

Pluggable Optics for Data Center Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Switches, Routers, and Servers), Data Rate (100-400 Gb/s, 400-800 Gb/s, and 800 Gb/s and above), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Oct 2024

- Report Code : TIPRE00039321

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 171

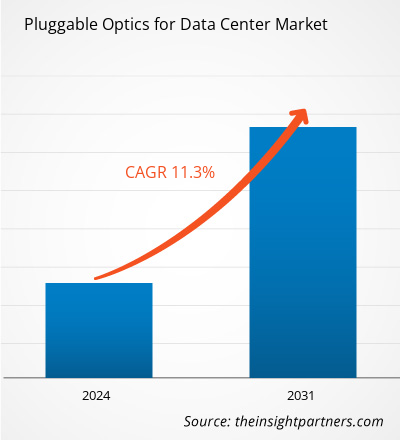

The pluggable optics for data center market size was valued at US$ 5.23 billion in 2023 and is expected to reach US$ 12.35 billion by 2031. The pluggable optics for data center market is estimated to record a CAGR of 11.3% from 2023 to 2031. The expansion of linear pluggable optics is likely to trend in the market during the forecast period.

Pluggable Optics for Data Center Market Analysis

Rising adoption of the Internet of Things (IoT), increasing need for storage for massive amounts of data, and growing digitalization are propelling the demand for data centers. It is an excellent data storage solution that provides companies with fast and secure access to vast data. Centralized data management, scalability, and security encourage businesses to adopt these solutions to achieve a data-driven business landscape. Thus, several companies are investing in the development of data centers in North America. According to Linklaters, North America has maintained its lead in data center transaction values, accounting for an impressive 62% of the global total in 2023 and 69% of investments through April 2024, totalling US$ 15 billion, with the US accounting for the largest share of the total.

Pluggable Overview

Pluggable optics are interchangeable transceiver modules that connect various network components, including switches, routers, and servers, to convert high-speed electrical signals into optical signals and vice versa. Pluggable optics are most commonly used in data center optics as they are flexible, scalable, and compatible with a broad range of networking devices and standards. One advantage of pluggable optics is that the user can tailor the transceiver inside the module to the data rate and other network architecture requirements, while other optical interconnects use light to transmit data within a compute architecture. The demand for pluggable optics is increasing in data centers, owing to their benefits, such as cost-effectiveness, wide compatibility, and ability to reduce power consumption. They are typically a high-speed and low-power solution and are compatible with various other devices.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPluggable Optics for Data Center Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pluggable Optics for Data Center Market Drivers and Opportunities

Focus on Product Development to Favor Market

Pluggable optics enable data center operators to easily upgrade or replace transceivers without having to completely rebuild the cable system. The rising demand for pluggable optics in data centers encourages manufacturers to develop new innovative products that are capable of meeting the dynamic requirements of customers. For instance, in March 2024, Infinera Corporation launched a new line of ICE-D to improve intra-data center connectivity. ICE-D is a new line of high-speed intra-data center optics based on monolithic indium phosphide (InP) and photonic integrated circuit (PIC) technology. ICE-D optics are designed to significantly reduce cost and power per bit while offering intra-data center connectivity at speeds of 1.6 terabits per second (Tb/s) or more. This technology allows data center operators to keep up with the ever-increasing demand for bandwidth while being cost-effective.

Growing Demand for Energy Efficiency

The advent of green data centers is another factor that contributes to the growing demand for energy efficiency. Green data centers are sustainable data centers that use energy-efficient technologies to reduce energy consumption and environmental impact. Businesses are shifting toward green data centers to reduce data center costs and minimize carbon impact. This can be achieved by using energy-efficient equipment and components, which can generate the demand for compact and highly integrated pluggable optics as they are more energy efficient. Installing pluggable optics could save network operational expenditures such as cooling costs. Therefore, the demand for energy-efficient solutions is a key factor that results in the deployment of pluggable optics and can create lucrative opportunities for the pluggable optics for data center market growth.

Pluggable Optics for Data Center Market Report Segmentation Analysis

Key segments that contributed to the derivation of the pluggable optics for data center market analysis are component and data rate.

- In terms of component, the market is segmented into switches, routers, and servers. The switches segment dominated the market in 2023.

- Based on data rate, the market is categorized into 100–400 Gb/s, 400–800 Gb/s, and 800 Gb/s and above. The 400–800 Gb/s segment dominated the market in 2023.

Pluggable Optics for Data Center Market Share Analysis by Geography

The geographic scope of the pluggable optics for data center market report is mainly divided into five regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Germany, France, the UK, and Italy are among the key countries contributing to the growth of the European pluggable optics for data center market. The overall volume of data is increasing exponentially, resulting in strong demand in the European data center industry. Rapidly expanding technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are driving up demand for pluggable optics, which is expected to continue to surpass supply over the next three to five years. For instance, according to TMT Consultants Ltd data published in June 2024, the use of AI technology and data storage capacity is growing in European data centers.

The pluggable optics for data center market in Germany is projected to expand at a significant rate in the upcoming years due to the growing investment and increasing IT capacity of colocation data centers. According to a Data Center Impact Report, Germany 2024, published by the GERMAN DATACENTER ASSOCIATION e.V., data center in Germany is expected to receive an investment of more than US$ 26.58 billion (24 billion euros) for the expansion of colocation capacity by 2029. According to the same source mentioned above, the IT capacity of colocation data centers in Germany is expected to expand from 1.3 GW to 3.3 GW by 2029. The growing capacity expansion of data centers, increase in data processing demand, and increasing investment to develop data centers are among the factors driving the market.

Pluggable Optics for Data Center Market Regional Insights

The regional trends and factors influencing the Pluggable Optics for Data Center Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Pluggable Optics for Data Center Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Pluggable Optics for Data Center Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.23 Billion |

| Market Size by 2031 | US$ 12.35 Billion |

| Global CAGR (2023 - 2031) | 11.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Pluggable Optics for Data Center Market Players Density: Understanding Its Impact on Business Dynamics

The Pluggable Optics for Data Center Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Pluggable Optics for Data Center Market top key players overview

Pluggable Optics for Data Center Market News and Recent Developments

The pluggable optics for data center market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the pluggable optics for data center market are listed below:

- Nokia Corp announced a comprehensive set of new optical transport solutions optimized for metro edge deployments for CSP, webscale and Enterprise customers. The company's portfolio additions include 100 Gb/s, 400 Gb/s, and 800 Gb/s pluggable coherent modules, a new compact optical transport platform and new cards optimized for metro edge applications. (Source: Nokia Corp, Press Release, March 2024)

- Infinera announced to have expanded its partnership with APRESIA Systems, Ltd. (APRESIA), a Japanese provider of network infrastructure solutions, through the integration of Infinera’s software-programmable ICE-X coherent pluggables into APRESIA’s portfolio of locally manufactured Layer 2/3 switching and optical transmission products. Infinera’s ICE-X coherent pluggables enable APRESIA to enhance its access network solutions and offer its customers increased operational value, including new revenue-generating services, reduced CapEx and OpEx, and maximized utilization of fiber assets. (Source: Infinera, Press Release, July 2024)

Pluggable Optics for Data Center Market Report Coverage and Deliverables

The “Pluggable Optics for Data Center Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Pluggable optics for data center market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Pluggable optics for data center market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Pluggable optics for data center market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the pluggable optics for data center market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For