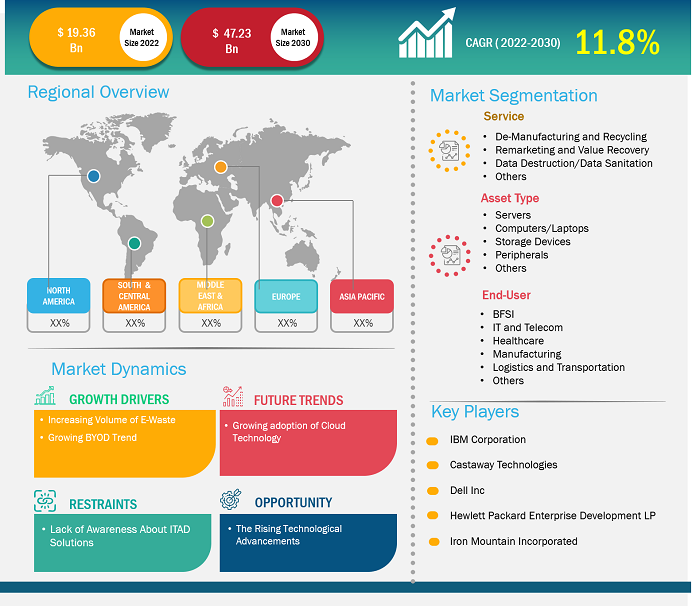

[Research Report] The IT asset disposition market size is expected to grow from US$ 19.36 billion in 2022 to US$ 47.23 billion by 2030; it is estimated to grow at a CAGR of 11.8% from 2022 to 2030.

Analyst Perspective:

The rising demand for consumer electronics and growing consumer awareness of the significance of properly disposing of IT assets are driving the development of IT asset disposition (ITAD) services. To reduce its environmental effect, ITAD fixes, recycles, and repurposes outdated IT equipment. Reusing the internal components of IT equipment can help cut down on electronic waste. It also helps to keep plastics and heavy metals from environmental damage as they can be recycled. Additionally, the sales are influenced by the requirement for appropriate e-waste disposal methods, environmental regulations that businesses must adhere to, and the massive volume of e-waste produced. Furthermore, a rise in the need for IT asset disposal, particularly due to the growing worries regarding data security and regulatory compliance, is expected to boost the growth of the IT asset disposition market in the forecasted period. In addition, it is anticipated that in the near future, the BYOD trend, which is gaining traction and is bolstered by state-of-the-art technology, will significantly raise the need for IT asset disposal, fueling the growth of the IT asset disposition market.

Market Overview:

Information Technology Asset Disposition is referred to as ITAD. It is the safe and secure disposal of obsolete or unwanted technology assets. Recycling, repurposing, reselling, or giving these assets are all part of ITAD, which aims to minimize environmental impact and reduce e-waste. Data destruction is a step in the ITAD process that guarantees all sensitive data is removed from devices before being disposed of. By doing this, confidential data is protected from any potential security breaches. By assisting businesses in tracking their IT assets from acquisition to retirement, IT asset management plays a crucial part in ITAD procedures. An effective asset tracking system contributes to adherence to laws like GLBA and HIPAA. Organizations can expedite their asset disposal procedures and guarantee regulatory compliance by collaborating with a reputable and accredited ITAD supplier. Businesses can reduce the risk of fines and brand damage connected with inappropriate disposal methods by selecting the appropriate vendor.

Strategic Insights

Market Driver:

Increasing Volume of E-Waste is Driving the Growth of the IT Asset Disposition Market

As the lives of people are becoming ever more electrified, the demand for new electronic devices or advanced devices such as smartphones, tablets, laptops, and others are continuously coming into the market. Because of the growing innovation and launches of new electronic devices, the older ones end up as e-waste, leading to a tremendous increase in the e-waste stream and making it the fastest-growing waste stream worldwide. According to the World Health Organization (WHO), e-waste is the fastest-growing solid waste stream in the world, growing 3 times faster than the world’s population. Nevertheless, e-waste streams comprise valuable and limited resources that can be recycled properly to extend their useful life. People with low and middle incomes, especially children, are more vulnerable to the risks associated with e-waste if it is not adequately managed. This is because there are insufficient laws, recycling facilities, and training programs. Also, e-waste contains dangerous components or, if improperly handled, might produce harmful chemicals, making it hazardous waste. Hence, as the growing e-waste is harmful to human health and the environment, the need for IT asset disposition services is increasing worldwide, fueling the growth of the IT asset disposition market.

Segmental Analysis:

Based on service, the IT asset disposition market is segmented into de-manufacturing and recycling, remarketing and value recovery, data destruction/data sanitation, and others. The data destruction/data sanitation segment held the largest IT asset disposition market share in 2022 and is anticipated to register the highest CAGR during 2022-2030. Data destruction or data sanitation involves permanently deleting or destroying of data from any storage device to ensure it cannot be recovered. Proper data destruction can help businesses protect confidential information and ensure that they comply with legal requirements. In addition, by securely disposing of digital data, companies can protect themselves from potential risks, further fueling the IT asset disposition market growth.

Regional Analysis:

North America is expected to witness significant growth in the IT asset disposition market in the forecasted period. In the region, the US will hold the largest IT asset disposition market share in 2022 and will register the highest CAGR during the forecasted period. North American countries like the US and Canada have been pioneers in the adoption of new technology across their businesses over the years. Also, the growing product innovation, stringent regulations, and environmental consciousness are other factors fueling the growth of the IT asset disposition market in the region. Additionally, a thriving IT industry and an increase in cloud data centers in the area are anticipated to support the growth of the North American IT asset disposition market in the forecast year. Furthermore, as businesses have grown more aware of the risks connected with data breaches, the demand for IT asset disposal for safe and legal data deletion is increasing in the region. Moreover, due to the rising demand for IT asset disposition services, various global market players are expanding their presence in the region. For instance, in August 2023, TES, an IT lifecycle solution company, announced a plan to build a new Virginia-based IT asset disposition and disposal (ITAD) facility. The site will cover 128,000 sq ft (11,900 sqm) and will cater exclusively to ITAD data center asset processing, handling all aspects of the data center retirement process from decommissioning to testing or repair to disposition. Thus, all the above factors are fueling the IT asset disposition market growth in North America.

Key Player Analysis:

Apto Solution Inc, IBM Corporation, Castaway Technologies, Dell Inc, Hewlett Packard Enterprise Development LP, Iron Mountain Incorporated, Lifespan International Inc, Sims Lifecycle Services Inc, TBS Industries Inc, and TES are among the key IT asset disposition market players. These IT asset disposition market players are focused on continuous product development and innovation.

Recent Developments:

Inorganic and organic strategies such as product launches, partnerships, collaboration, and mergers and acquisitions are highly adopted by companies in the IT asset disposition market. A few recent key market developments by these companies are listed below:

- In November 2023, Iron Mountain, a global leader in information management, innovative storage, data center infrastructure, and asset lifecycle management, announced that it has entered into a definitive agreement to acquire Regency Technologies, a leading provider of IT asset disposition (ITAD) services in the United States. Building on Iron Mountain's extensive logistics network, which already provides customers with leading information security in IT Asset Lifecycle Management (ALM), the combined platform will establish a market-leading distributed footprint for the remarketing and recycling of IT assets. This will result in enhanced environmental sustainability and increased value recovery at the end of the IT asset lifecycle.

- In October 2023, Full Circle Electronics (FCE), backed by private equity firm Tide Rock, announced the acquisition of an IT Asset Disposition (ITAD) business from SIPI Asset Recovery. With the acquisition, Full Circle gained ITAD geographic reach across Northern California, Illinois, Texas, Mexico, and Columbia. SIPI ITAD provides a "full ITAD pick-up scheduling system, detailed auditing, and integrated testing, wiping, and grading for optimal data security and product quality.

- In March 2023, TES, a global leader in sustainable IT asset disposition (ITAD) and IT lifecycle management services, announced the opening of its new 40,000-square-foot facility in Las Vegas in January 2023. This facility expands TES's processing capacity and offers a full suite of IT Asset Disposition services to support the large community of technology companies on the West Coast. The Las Vegas facility will provide onsite data destruction, data center decommissioning, and the redeployment or resale of parts and assets, with additional services, including testing, grading, repairing, refurbishment, and recycling. This facility will complement TES's existing infrastructure and will bring TES's investment to almost $10 million in ITAD infrastructure across its North American facilities over the previous five years.

- In November 2022, Hewlett Packard Enterprise announced that Yahoo! JAPAN has chosen HPE Asset Upcycling Services to ensure end-of-use hardware gets refurbished and reused wherever possible to meet its sustainability goals. This service is part of HPE’s full range of solutions to help customers modernize multi-generational IT estates, extend the life of legacy systems and associated software, and extract value from end-of-use technology.

- In June 2022, Apto Solutions announced the launch of its new Environmental Impact Reporting Tool - offering companies real-time data specifically designed to aid in ESG reporting. This new tool empowers the customers by putting the data right at their fingertips so that they can use it however they’d like in ESG and Sustainability reports to show the positive impact of their ITAD programs against their other emissions.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service, Asset Type, and End-User

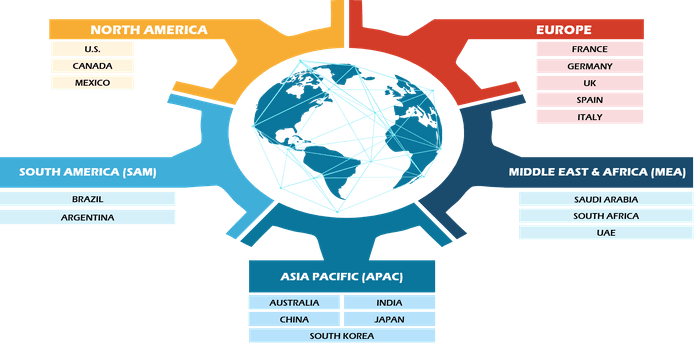

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 IT Asset Disposition (ITAD) Market - By Service

1.3.2 IT Asset Disposition (ITAD) Market - By Asset Type

1.3.3 IT Asset Disposition (ITAD) Market - By End-User

1.3.4 IT Asset Disposition (ITAD) Market - By Region

1.3.4.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. IT ASSET DISPOSITION (ITAD) MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PORTER'S FIVE FORCES ANALYSIS

4.2.1 Bargaining Power of Buyers

4.2.1 Bargaining Power of Suppliers

4.2.1 Threat of Substitute

4.2.1 Threat of New Entrants

4.2.1 Competitive Rivalry

4.3. ECOSYSTEM ANALYSIS

4.4. EXPERT OPINIONS

5. IT ASSET DISPOSITION (ITAD) MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. IT ASSET DISPOSITION (ITAD) MARKET - GLOBAL MARKET ANALYSIS

6.1. IT ASSET DISPOSITION (ITAD) - GLOBAL MARKET OVERVIEW

6.2. IT ASSET DISPOSITION (ITAD) - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING/MARKET SHARE

7. IT ASSET DISPOSITION (ITAD) MARKET - REVENUE AND FORECASTS TO 2028 - SERVICE

7.1. OVERVIEW

7.2. SERVICE MARKET FORECASTS AND ANALYSIS

7.3. DE-MANUFACTURING AND RECYCLING

7.3.1. Overview

7.3.2. De-Manufacturing and Recycling Market Forecast and Analysis

7.4. REMARKETING AND VALUE RECOVERY

7.4.1. Overview

7.4.2. Remarketing and Value Recovery Market Forecast and Analysis

7.5. DATA DESTRUCTION/DATA SANITIZATION

7.5.1. Overview

7.5.2. Data Destruction/Data Sanitization Market Forecast and Analysis

7.6. OTHERS

7.6.1. Overview

7.6.2. Others Market Forecast and Analysis

8. IT ASSET DISPOSITION (ITAD) MARKET - REVENUE AND FORECASTS TO 2028 - ASSET TYPE

8.1. OVERVIEW

8.2. ASSET TYPE MARKET FORECASTS AND ANALYSIS

8.3. SERVERS

8.3.1. Overview

8.3.2. Servers Market Forecast and Analysis

8.4. COMPUTERS/LAPTOPS

8.4.1. Overview

8.4.2. Computers/Laptops Market Forecast and Analysis

8.5. STORAGE DEVICES

8.5.1. Overview

8.5.2. Storage Devices Market Forecast and Analysis

8.6. PERIPHERALS

8.6.1. Overview

8.6.2. Peripherals Market Forecast and Analysis

8.7. OTHERS

8.7.1. Overview

8.7.2. Others Market Forecast and Analysis

9. IT ASSET DISPOSITION (ITAD) MARKET - REVENUE AND FORECASTS TO 2028 - END-USER

9.1. OVERVIEW

9.2. END-USER MARKET FORECASTS AND ANALYSIS

9.3. BFSI

9.3.1. Overview

9.3.2. BFSI Market Forecast and Analysis

9.4. IT AND TELECOM

9.4.1. Overview

9.4.2. IT and Telecom Market Forecast and Analysis

9.5. HEALTHCARE

9.5.1. Overview

9.5.2. Healthcare Market Forecast and Analysis

9.6. MANUFACTURING

9.6.1. Overview

9.6.2. Manufacturing Market Forecast and Analysis

9.7. LOGISTICS AND TRANSPORTATION

9.7.1. Overview

9.7.2. Logistics and Transportation Market Forecast and Analysis

9.8. OTHERS

9.8.1. Overview

9.8.2. Others Market Forecast and Analysis

10. IT ASSET DISPOSITION (ITAD) MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

10.1. NORTH AMERICA

10.1.1 North America IT Asset Disposition (ITAD) Market Overview

10.1.2 North America IT Asset Disposition (ITAD) Market Forecasts and Analysis

10.1.3 North America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Service

10.1.4 North America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Asset Type

10.1.5 North America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By End-User

10.1.6 North America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Countries

10.1.6.1 United States IT Asset Disposition (ITAD) Market

10.1.6.1.1 United States IT Asset Disposition (ITAD) Market by Service

10.1.6.1.2 United States IT Asset Disposition (ITAD) Market by Asset Type

10.1.6.1.3 United States IT Asset Disposition (ITAD) Market by End-User

10.1.6.2 Canada IT Asset Disposition (ITAD) Market

10.1.6.2.1 Canada IT Asset Disposition (ITAD) Market by Service

10.1.6.2.2 Canada IT Asset Disposition (ITAD) Market by Asset Type

10.1.6.2.3 Canada IT Asset Disposition (ITAD) Market by End-User

10.1.6.3 Mexico IT Asset Disposition (ITAD) Market

10.1.6.3.1 Mexico IT Asset Disposition (ITAD) Market by Service

10.1.6.3.2 Mexico IT Asset Disposition (ITAD) Market by Asset Type

10.1.6.3.3 Mexico IT Asset Disposition (ITAD) Market by End-User

10.2. EUROPE

10.2.1 Europe IT Asset Disposition (ITAD) Market Overview

10.2.2 Europe IT Asset Disposition (ITAD) Market Forecasts and Analysis

10.2.3 Europe IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Service

10.2.4 Europe IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Asset Type

10.2.5 Europe IT Asset Disposition (ITAD) Market Forecasts and Analysis - By End-User

10.2.6 Europe IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Countries

10.2.6.1 Germany IT Asset Disposition (ITAD) Market

10.2.6.1.1 Germany IT Asset Disposition (ITAD) Market by Service

10.2.6.1.2 Germany IT Asset Disposition (ITAD) Market by Asset Type

10.2.6.1.3 Germany IT Asset Disposition (ITAD) Market by End-User

10.2.6.2 France IT Asset Disposition (ITAD) Market

10.2.6.2.1 France IT Asset Disposition (ITAD) Market by Service

10.2.6.2.2 France IT Asset Disposition (ITAD) Market by Asset Type

10.2.6.2.3 France IT Asset Disposition (ITAD) Market by End-User

10.2.6.3 Italy IT Asset Disposition (ITAD) Market

10.2.6.3.1 Italy IT Asset Disposition (ITAD) Market by Service

10.2.6.3.2 Italy IT Asset Disposition (ITAD) Market by Asset Type

10.2.6.3.3 Italy IT Asset Disposition (ITAD) Market by End-User

10.2.6.4 United Kingdom IT Asset Disposition (ITAD) Market

10.2.6.4.1 United Kingdom IT Asset Disposition (ITAD) Market by Service

10.2.6.4.2 United Kingdom IT Asset Disposition (ITAD) Market by Asset Type

10.2.6.4.3 United Kingdom IT Asset Disposition (ITAD) Market by End-User

10.2.6.5 Russia IT Asset Disposition (ITAD) Market

10.2.6.5.1 Russia IT Asset Disposition (ITAD) Market by Service

10.2.6.5.2 Russia IT Asset Disposition (ITAD) Market by Asset Type

10.2.6.5.3 Russia IT Asset Disposition (ITAD) Market by End-User

10.2.6.6 Rest of Europe IT Asset Disposition (ITAD) Market

10.2.6.6.1 Rest of Europe IT Asset Disposition (ITAD) Market by Service

10.2.6.6.2 Rest of Europe IT Asset Disposition (ITAD) Market by Asset Type

10.2.6.6.3 Rest of Europe IT Asset Disposition (ITAD) Market by End-User

10.3. ASIA-PACIFIC

10.3.1 Asia-Pacific IT Asset Disposition (ITAD) Market Overview

10.3.2 Asia-Pacific IT Asset Disposition (ITAD) Market Forecasts and Analysis

10.3.3 Asia-Pacific IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Service

10.3.4 Asia-Pacific IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Asset Type

10.3.5 Asia-Pacific IT Asset Disposition (ITAD) Market Forecasts and Analysis - By End-User

10.3.6 Asia-Pacific IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Countries

10.3.6.1 Australia IT Asset Disposition (ITAD) Market

10.3.6.1.1 Australia IT Asset Disposition (ITAD) Market by Service

10.3.6.1.2 Australia IT Asset Disposition (ITAD) Market by Asset Type

10.3.6.1.3 Australia IT Asset Disposition (ITAD) Market by End-User

10.3.6.2 China IT Asset Disposition (ITAD) Market

10.3.6.2.1 China IT Asset Disposition (ITAD) Market by Service

10.3.6.2.2 China IT Asset Disposition (ITAD) Market by Asset Type

10.3.6.2.3 China IT Asset Disposition (ITAD) Market by End-User

10.3.6.3 India IT Asset Disposition (ITAD) Market

10.3.6.3.1 India IT Asset Disposition (ITAD) Market by Service

10.3.6.3.2 India IT Asset Disposition (ITAD) Market by Asset Type

10.3.6.3.3 India IT Asset Disposition (ITAD) Market by End-User

10.3.6.4 Japan IT Asset Disposition (ITAD) Market

10.3.6.4.1 Japan IT Asset Disposition (ITAD) Market by Service

10.3.6.4.2 Japan IT Asset Disposition (ITAD) Market by Asset Type

10.3.6.4.3 Japan IT Asset Disposition (ITAD) Market by End-User

10.3.6.5 South Korea IT Asset Disposition (ITAD) Market

10.3.6.5.1 South Korea IT Asset Disposition (ITAD) Market by Service

10.3.6.5.2 South Korea IT Asset Disposition (ITAD) Market by Asset Type

10.3.6.5.3 South Korea IT Asset Disposition (ITAD) Market by End-User

10.3.6.6 Rest of Asia-Pacific IT Asset Disposition (ITAD) Market

10.3.6.6.1 Rest of Asia-Pacific IT Asset Disposition (ITAD) Market by Service

10.3.6.6.2 Rest of Asia-Pacific IT Asset Disposition (ITAD) Market by Asset Type

10.3.6.6.3 Rest of Asia-Pacific IT Asset Disposition (ITAD) Market by End-User

10.4. MIDDLE EAST AND AFRICA

10.4.1 Middle East and Africa IT Asset Disposition (ITAD) Market Overview

10.4.2 Middle East and Africa IT Asset Disposition (ITAD) Market Forecasts and Analysis

10.4.3 Middle East and Africa IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Service

10.4.4 Middle East and Africa IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Asset Type

10.4.5 Middle East and Africa IT Asset Disposition (ITAD) Market Forecasts and Analysis - By End-User

10.4.6 Middle East and Africa IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Countries

10.4.6.1 South Africa IT Asset Disposition (ITAD) Market

10.4.6.1.1 South Africa IT Asset Disposition (ITAD) Market by Service

10.4.6.1.2 South Africa IT Asset Disposition (ITAD) Market by Asset Type

10.4.6.1.3 South Africa IT Asset Disposition (ITAD) Market by End-User

10.4.6.2 Saudi Arabia IT Asset Disposition (ITAD) Market

10.4.6.2.1 Saudi Arabia IT Asset Disposition (ITAD) Market by Service

10.4.6.2.2 Saudi Arabia IT Asset Disposition (ITAD) Market by Asset Type

10.4.6.2.3 Saudi Arabia IT Asset Disposition (ITAD) Market by End-User

10.4.6.3 U.A.E IT Asset Disposition (ITAD) Market

10.4.6.3.1 U.A.E IT Asset Disposition (ITAD) Market by Service

10.4.6.3.2 U.A.E IT Asset Disposition (ITAD) Market by Asset Type

10.4.6.3.3 U.A.E IT Asset Disposition (ITAD) Market by End-User

10.4.6.4 Rest of Middle East and Africa IT Asset Disposition (ITAD) Market

10.4.6.4.1 Rest of Middle East and Africa IT Asset Disposition (ITAD) Market by Service

10.4.6.4.2 Rest of Middle East and Africa IT Asset Disposition (ITAD) Market by Asset Type

10.4.6.4.3 Rest of Middle East and Africa IT Asset Disposition (ITAD) Market by End-User

10.5. SOUTH AND CENTRAL AMERICA

10.5.1 South and Central America IT Asset Disposition (ITAD) Market Overview

10.5.2 South and Central America IT Asset Disposition (ITAD) Market Forecasts and Analysis

10.5.3 South and Central America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Service

10.5.4 South and Central America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Asset Type

10.5.5 South and Central America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By End-User

10.5.6 South and Central America IT Asset Disposition (ITAD) Market Forecasts and Analysis - By Countries

10.5.6.1 Brazil IT Asset Disposition (ITAD) Market

10.5.6.1.1 Brazil IT Asset Disposition (ITAD) Market by Service

10.5.6.1.2 Brazil IT Asset Disposition (ITAD) Market by Asset Type

10.5.6.1.3 Brazil IT Asset Disposition (ITAD) Market by End-User

10.5.6.2 Argentina IT Asset Disposition (ITAD) Market

10.5.6.2.1 Argentina IT Asset Disposition (ITAD) Market by Service

10.5.6.2.2 Argentina IT Asset Disposition (ITAD) Market by Asset Type

10.5.6.2.3 Argentina IT Asset Disposition (ITAD) Market by End-User

10.5.6.3 Rest of South and Central America IT Asset Disposition (ITAD) Market

10.5.6.3.1 Rest of South and Central America IT Asset Disposition (ITAD) Market by Service

10.5.6.3.2 Rest of South and Central America IT Asset Disposition (ITAD) Market by Asset Type

10.5.6.3.3 Rest of South and Central America IT Asset Disposition (ITAD) Market by End-User

11. INDUSTRY LANDSCAPE

11.1. MERGERS AND ACQUISITIONS

11.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

11.3. NEW PRODUCT LAUNCHES

11.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

12. IT ASSET DISPOSITION (ITAD) MARKET, KEY COMPANY PROFILES

12.1. APTO SOLUTION, INC.

12.1.1. Key Facts

12.1.2. Business Description

12.1.3. Products and Services

12.1.4. Financial Overview

12.1.5. SWOT Analysis

12.1.6. Key Developments

12.2. ARROW ELECTRONICS, INC.

12.2.1. Key Facts

12.2.2. Business Description

12.2.3. Products and Services

12.2.4. Financial Overview

12.2.5. SWOT Analysis

12.2.6. Key Developments

12.3. CASTAWAY TECHNOLOGIES

12.3.1. Key Facts

12.3.2. Business Description

12.3.3. Products and Services

12.3.4. Financial Overview

12.3.5. SWOT Analysis

12.3.6. Key Developments

12.4. DELL INC.

12.4.1. Key Facts

12.4.2. Business Description

12.4.3. Products and Services

12.4.4. Financial Overview

12.4.5. SWOT Analysis

12.4.6. Key Developments

12.5. HEWLETT PACKARD ENTERPRISE COMPANY

12.5.1. Key Facts

12.5.2. Business Description

12.5.3. Products and Services

12.5.4. Financial Overview

12.5.5. SWOT Analysis

12.5.6. Key Developments

12.6. IRON MOUNTAIN INCORPORATED

12.6.1. Key Facts

12.6.2. Business Description

12.6.3. Products and Services

12.6.4. Financial Overview

12.6.5. SWOT Analysis

12.6.6. Key Developments

12.7. LIFESPAN INTERNATIONAL INC.

12.7.1. Key Facts

12.7.2. Business Description

12.7.3. Products and Services

12.7.4. Financial Overview

12.7.5. SWOT Analysis

12.7.6. Key Developments

12.8. SIMS LIMITED

12.8.1. Key Facts

12.8.2. Business Description

12.8.3. Products and Services

12.8.4. Financial Overview

12.8.5. SWOT Analysis

12.8.6. Key Developments

12.9. TBS INDUSTRIES

12.9.1. Key Facts

12.9.2. Business Description

12.9.3. Products and Services

12.9.4. Financial Overview

12.9.5. SWOT Analysis

12.9.6. Key Developments

12.10. TES GROUP

12.10.1. Key Facts

12.10.2. Business Description

12.10.3. Products and Services

12.10.4. Financial Overview

12.10.5. SWOT Analysis

12.10.6. Key Developments

13. APPENDIX

13.1. ABOUT THE INSIGHT PARTNERS

13.2. GLOSSARY OF TERMS

The List of Companies

1. Apto Solution, Inc.

2. Arrow Electronics, Inc.

3. Castaway Technologies

4. Dell Inc.

5. Hewlett Packard Enterprise Company

6. Iron Mountain Incorporated

7. Lifespan International Inc.

8. Sims Limited

9. TBS Industries

10. TES group

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to IT Asset Disposition Market

Apr 2024

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Apr 2024

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Apr 2024

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Apr 2024

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Apr 2024

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Apr 2024

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Apr 2024

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Apr 2024

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)