The North America Agricultural Biologicals market is accounted to US$ 2,787.7 Mn in 2018 and is expected to grow at a CAGR of 12.7% during the forecast period 2019 – 2027, to account to US$ 8,144.9 Mn by 2027.

Agricultural biologicals constitutes a broad range of plant extracts, insects, microbials, and other agricultural biologicals materials, which are used by the farmers to improve crop health and yield and for the pests control. It also helps in enhancing the availability of nutrients, nutrient uptake capacity of plant, assists in product’s strong resistance to insects, and residue managements, as well as improving total productivity of the plant crops. US is dominating the North America Agricultural Biologicals market followed by Canada. This dominance is due to the preference over bio-based crop nutrition products in the region. The country has been deploying the natural and organic way of agricultural using better and improved production techniques. The growing cost of chemical materials and their negative impact on environment, and the rising consciousness regarding balanced plant nutrition are chief factors stimulating the market demand in the region. The remarkable biotechnological growth in the area of fermentation technology is also boosting the overall demand of the bio fertilizers market in the country.

North America Agricultural Biologicals Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

Increase in adoption of natural products over synthetic products

Agricultural biologicals are increasingly being used as a replacement of synthetic or chemical plant protection products like chemical pesticides, fungicides or insecticides. Agricultural biologicals products like bio pesticides, bio stimulants, and bio fertilizers serve as a natural products which leads to soil health development, plant’s disease control, enhancement of nutrient uptake, plant growth enhancement, and various others. The customers are highly adopting agricultural biologicals products over other synthetic products due to its capability to target specific microorganisms with low impact on other organisms, low environmental impacts, and a low risk of product resistance towards the pests. Synthetic products are toxic and harmful to humans, pets, plant crops, beneficial organisms, and also environment. Applications of synthetic products causes crop product’s contamination with injurious chemical residues, contamination of groundwater and soil, and various health risks while applying these products. Continuous protection of plants through the usage of synthetic products also leads to strong insect’s resistance towards those chemicals. The manufacturing costs of synthetic products are also higher than agricultural biologicals, which is also contributing towards the rising adoption of natural products. As compared to synthetic products, agricultural biologicals products are non-pollutants towards environment, soil, water or plant, along with inexhaustible, easily accessible, biodegradable, renewable, non-phytotoxic, and a cost effective option. Agricultural biologicals consists of essential oils, alkaloids, terpenoids, polypeptides, polyphenols, phenolics, and other natural compounds which assists in prevention of harmful pests. Also, the synthetic products passes through much more regulatory processes as compare to natural products. These factors are mainly contributing towards the increasing adoption of natural products over synthetic products.

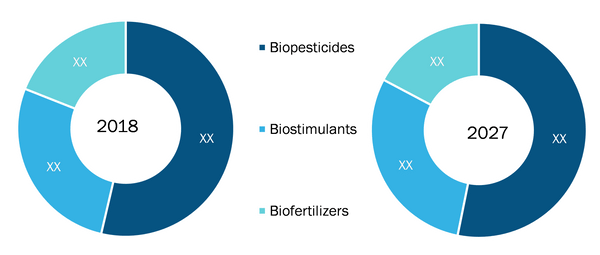

Type Insights

The North America Agricultural Biologicals market is segmented on the basis of type as – bio pesticides, bio stimulants, and bio fertilizers. The bio pesticides segment in the North America agricultural biologicals market is estimated to hold a leading share in the market. Bio pesticides is the most widely used type for the agricultural biologicals products. It is widely used to control agricultural pests through specific biologicals effects which contains bio control agents such as natural organisms or substances derived from animals, plants, bacteria or minerals. Bio pesticides covers a wide spectrum of potential products like microbial pesticides, plant incorporated protectants and bio chemical pesticides. The demand for bio pesticides is rising due to rising environmental and health concerns regarding usage of synthetic pesticides. Also, the changing trend towards adoption of organic products leads in rise of North America bio pesticides market. Governments of the North American countries have been promoting advantages offered by bio pesticides and is largely contributing towards market growth.

Source Insights

The North America agricultural biologicals market is segmented based on source as microbials, bio chemicals, and others. In 2018, the microbials segment accounts for the largest share in the North America agricultural biologicals market, while the bio chemicals segment also contributes a significant share in the market. Microbials are mainly used as a source for agricultural biologicals. Microbials are small bacterial and fungal organisms which can be categorized into fungi, bacteria, viruses, protozoa, etc. It improves the soil’s nutrient uptake, offering insect control for protection against diseases and enhance yield. It helps in absorption of important nutrients like nitrogen, potassium, phosphorus and sulphur, and widely known for solving key agricultural problems such as plant health control, crop productivity, and soil’s health maintenance along with environmental concerns such as soil and water bioremediation from inorganic and organic contaminants. The higher development costs of chemical agricultural products, along with stringent regulations to limit the growth of chemical or synthetic products usage leads to microbials market growth.

Application Mode Insights

The North America agricultural biologicals market is segmented on the basis of application mode as foliar sprays, soil treatment, and seed treatment. The seed treatment segment was estimated to hold a major share in the market. Seeds are treated with application of insecticides, fungicides, etc. to protect them from seed-borne pathogenic organisms or other insects. Seeds are also subjected to exposure of solar energy or immersion in conditioned water. It provides various advantages such as improved germination, control of insects present in soil, prevention of plant diseases, early growth and establishment, and protection from seedling blights and seed rot. Latest innovations in biologicals farming technologies, energy-efficient production, economical and eco-friendly methods of seed treatments contribute towards the market growth. High costs of genetically modified and hybrid seeds also leads to market growth of seed treatments.

Application Insights

The North America agricultural biologicals market is segmented on the basis of application as cereals and grains, oilseeds and pulses, fruits and vegetables, and others. The cereals and grains segment accounts for the largest share in the North America agricultural biologicals market, while the fruits and vegetables segment also contributes a significant share in the market. Cereal and grains are cultured in almost all parts of the world which is driving the overall agricultural biologicals industry. Its seeds are mainly treated with fungicides or insecticides to avoid transmission of diseases. Weeds directly competes with cereal and grains crops for light, mineral nutrients and water which are generally controlled through chemical pesticides applications. The North America agricultural biologicals market is majorly driven through continuous demand from cereals and grains plant as these crops avail larger amounts of water, bio fertilizers, and nutritional materials to maintain its overall development. The continuous and rising demands of rice and wheat by the consumers leads to market growth of agricultural biologicals in cereals and grains.

US Agricultural Biologicals Market by Type

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

NORTH AMERICA AGRICULTURAL BIOLOGICALS MARKET SEGMENTATION

North America Agricultural Biologicals Market – By Type

- Bio pesticides

- Bio stimulants

- Bio fertilizers

North America Agricultural Biologicals Market – By Source

- Microbials

- Bio chemicals

- Others

North America Agricultural Biologicals Market – By Application Mode

- Foliar Sprays

- Soil Treatment

- Seed Treatment

North America Agricultural Biologicals Market – By Applications

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

North America Agricultural Biologicals Market – By Country

- U.S.

- Canada

- Mexico

Company Profiles

- BASF SE

- Biolchim S.p.A.

- Certis USA L.L.C.

- DowDuPont Inc.

- Isagro S.p.A.

- Koppert Biologicals Systems

- Marrone Bio Innovations, Inc.

- Syngenta

- UPL

- Valent BioSciences LLC

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Source, Application Mode, & Application,

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Agricultural Biologicals Market – By Type

1.3.2 North America Agricultural Biologicals Market – By Source

1.3.3 North America Agricultural Biologicals Market – By Application Mode

1.3.4 North America Agricultural Biologicals Market – By Applications

1.3.5 North America Agricultural Biologicals Market – By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Agricultural Biologicals Market Landscape

4.1 Market Overview

4.1.1 North America PEST Analysis

5. Agricultural biologicals Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Increase in adoption of natural products over synthetic products

5.2 Key Market Restraints

5.2.1 Stringent Government Regulations

5.3 Key Market Opportunities

5.3.1 Rising demand of qualitative and healthier food products in the North American Region

5.4 Future Trends

5.4.1 Rising use of nanobiopesticides

5.5 Impact Analysis Of Drivers And Restraints

6. Agricultural biologicals – North America Market Analysis

6.1 North America Agricultural Biologicals Market Overview

6.2 North America Agricultural biologicals Market Forecast and Analysis

7. North America Agricultural Biologicals Market Analysis – By Type

7.1 Overview

7.2 North America Agricultural Biologicals Market Breakdown, By Type, 2018 & 2027

7.3 Bio pesticides

7.3.1 Overview

7.3.2 North America Bio pesticides Agricultural Biologicals Market Revenue and Forecasts to 2027 (US$ Mn)

7.4 Bio stimulants

7.4.1 Overview

7.4.2 North America Bio stimulants Agricultural Biologicals Market Revenue and Forecasts to 2027 (US$ Mn)

7.5 Bio fertilizers

7.5.1 Overview

7.5.2 North America Bio fertilizers Agricultural Biologicals Market Revenue and Forecasts to 2027 (US$ Mn)

8. North America Agricultural Biologicals Market Analysis – By Source

8.1 Overview

8.2 North America Agricultural Biologicals Market Breakdown, By Source, 2018 & 2027

8.3 Microbials

8.3.1 Overview

8.3.2 North America Microbials Market Revenue and Forecasts to 2027 (US$ Mn)

8.4 Bio chemicals

8.4.1 Overview

8.4.2 North America Bio chemicals Market Revenue and Forecasts to 2027 (US$ Mn)

8.5 Others

8.5.1 Overview

8.5.2 North America Others Market Revenue and Forecasts to 2027 (US$ Mn)

9. North America Agricultural Biologicals Market Analysis – By Application Mode

9.1 Overview

9.2 North America Agricultural Biologicals Market Breakdown, By APPLICATION MODE, 2018 & 2027

9.3 Foliar Sprays

9.3.1 Overview

9.3.2 North America Foliar Sprays Market Revenue and Forecasts to 2027 (US$ Mn)

9.4 Soil Treatment

9.4.1 Overview

9.4.2 North America Soil Treatment Market Revenue and Forecasts to 2027 (US$ Mn)

9.5 Seed Treatment

9.5.1 Overview

9.5.2 North America Seed Treatment Market Revenue and Forecasts to 2027 (Mn Units, US$ Mn)

10. Global Agricultural Biologicals Market Analysis – By Application

10.1 Overview

10.2 North America Agricultural Biologicals Market Breakdown, By APPLICATION, 2018 & 2027

10.3 Cereals & Grains

10.3.1 Overview

10.3.2 North America Cereals and Grains Market Revenue and Forecasts to 2027 (US$ Mn)

10.4 Oilseeds And Pulses

10.4.1 Overview

10.4.2 North America Oilseeds and Pulses Market Revenue Forecasts to 2027 (US$ Mn)

10.5 Fruits And Vegetables

10.5.1 Overview

10.5.2 Global Fruits and Vegetables Market Revenue and Forecasts to 2027 (US$ Mn)

10.6 Others

10.6.1 Overview

10.6.2 North America Others Market Revenue and Forecasts to 2027 (US$ Mn)

11. Agricultural biologicals Market – Country Analysis

11.1 Overview

11.1.1 North America Agricultural biologicals Market Breakdown, by Key Countries

11.1.1.1 U.S. Agricultural Biologicals Market Revenue and Forecasts to 2027 (US$ MN)

11.1.1.1.1 U.S. Agricultural Biologicals Market Breakdown By Type

11.1.1.1.2 U.S. Agricultural Biologicals Market Breakdown By Source

11.1.1.1.3 U.S. Agricultural Biologicals Market Breakdown By Application Mode

11.1.1.1.4 U.S. Agricultural Biologicals Market Breakdown By Application

11.1.1.2 Canada Agricultural Biologicals Market Volume and Revenue Forecasts to 2027 (US$ MN )

11.1.1.2.1 Canada Agricultural Biologicals Market Breakdown by Type

11.1.1.2.2 Canada Agricultural Biologicals Market Breakdown By Source

11.1.1.2.3 Canada Agricultural Biologicals Market Breakdown by Application Mode

11.1.1.2.4 Canada Agricultural Biologicals Market Breakdown by Application

11.1.1.3 Mexico Agricultural Biologicals Market Revenue Forecasts to 2027 (US$ MN )

11.1.1.3.1 Mexico Agricultural Biologicals Market Breakdown By Type

11.1.1.3.2 Mexico Agricultural Biologicals Market Breakdown By Source

11.1.1.3.3 Mexico Agricultural Biologicals Market Breakdown by Application Mode

11.1.1.3.4 Mexico Agricultural Biologicals Market Breakdown by Application

12. Industry Landscape

12.1 Merger and Acquisitions

12.2 Product News

13. Company Profiles

13.1 BASF SE

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Biolchim S.p.A.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Certis USA L.L.C.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 DowDuPont Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Isagro S.p.A.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Koppert Biologicals Systems

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Marrone Bio Innovations, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 SYNGENTA

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 UPL

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Valent BioSciences LLC

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Insight Partners

LIST OF TABLES

Table 1. North America Agricultural biologicals Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. U.S. Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Type (US$ Mn)

Table 3. U.S. Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Source (US$ Mn)

Table 4. U.S. Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Application Mode (US$ Mn)

Table 5. U.S. Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Application (US$ Mn)

Table 6. Canada Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Type (US$ Mn)

Table 7. Canada Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Source (US$ Mn)

Table 8. Canada Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Application Mode (US$ Mn)

Table 9. Canada Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Application (US$ Mn)

Table 10. Mexico Agricultural Biologicalss Market Revenue And Forecasts To 2027 – By Type (US$ Mn)

Table 11. Mexico Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Source (US$ Mn)

Table 12. Mexico Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Application Mode (US$ Mn)

Table 13. Mexico Agricultural Biologicals Market Revenue And Forecasts To 2027 – By Application (US$ Mn)

LIST OF FIGURES

Figure 1. North America Agricultural Biologicals Market Segmentations

Figure 2. North America Agricultural biologicals Market Segmentation – By Country

Figure 3. North America Agricultural biologicals Market Overview

Figure 4. Bio pesticides Held Largest Share In The North America Agricultural Biologicals Market By Type

Figure 5. U.S. Dominated The North America Agricultural Biologicals Market In 2018

Figure 6. North America Agricultural biologicals Market, Industry Landscape

Figure 7. North America – Pest Analysis

Figure 8. Agricultural Biologicals Market Impact Analysis Of Driver And Restraints

Figure 9. North America Agricultural biologicals Market Forecast And Analysis, (US$ Mn)

Figure 10. North America Agricultural Biologicals Market Breakdown By Type, Value, 2018 & 2027 (%)

Figure 11. North America Bio pesticides Agricultural Biologicals Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 12. North America Bio stimulants Agricultural Biologicals Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 13. North America Bio fertilizers Agricultural Biologicals Market Revenue Forecasts To 2027 (US$ Mn)

Figure 14. North America Agricultural Biologicals Market Breakdown, By Source, 2018 & 2027 (%)

Figure 15. North America Microbials Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 16. North America bio chemicals Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 17. North America Others Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 18. North America Agricultural Biologicals Market Breakdown by Application Mode, By Value, 2018 & 2027 (%)

Figure 19. North America Foliar Sprays Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 20. North America Soil Treatment Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 21. North America Seed Treatment Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 22. North America Agricultural Biologicals Market Breakdown By Application, By Value, 2018 & 2027 (%)

Figure 23. North America Cereals And Grains Market Revenue Forecasts To 2027 (US$ Mn)

Figure 24. North America Oilseeds And Pulses Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 25. Global Fruits And Vegetables Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 26. North America Others Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 27. North America Agricultural biologicals Market Breakdown by Key Countries, 2018 & 2027(%)

Figure 28. U.S. Agricultural Biologicals Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 29. Canada Agricultural Biologicals Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 30. Mexico Agricultural Biologicals Market Revenue And Forecasts To 2027 (US$ Mn)

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Feb 2020

Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Others Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

Feb 2020

Synthetic Ester Lubricants for the Telecommunications Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, and Grease), End Use (Data Centers, Telecommunication Infrastructure, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America

Feb 2020

Synthetic Ester Lubricants for Electrical and Electronics Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others) and End Use (General Air Conditioners, Automotive Air Conditioners, Refrigerators, and Others)

Feb 2020

Synthetic Ester Lubricants for Construction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (Construction Machinery, Concrete and Construction Tools, Wire Ropes and Chains, and Others)

Feb 2020

Synthetic Ester Lubricants for Energy and Power Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (River Dam, Offshore Wind Power, Energy Storage Systems, and Others)

Feb 2020

Aviation Synthetic Ester Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Refrigeration Oil, Grease, Turbine Oil, Metalworking Fluids, and Others), End Use (Commercial Aircraft, Military Aircraft, Spacecraft/Satellites, Drone and UAV, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Feb 2020

Marine Synthetic Ester Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Refrigeration Oil, Grease, Turbine Oil, and Others], and End Use [Cargo Ships, Passenger Ships, Naval Vessels (Military End Uses), Offshore Support Vessels, Fishing and Leisure, Port Equipment, and Others], and Geography [North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America]

Feb 2020

Automotive Synthetic Ester Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil [MCO, PCMO, HDEO, and Others], Hydraulic Oil, Gera Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others), End Use (Conventional Vehicles and Electric Vehicles), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For