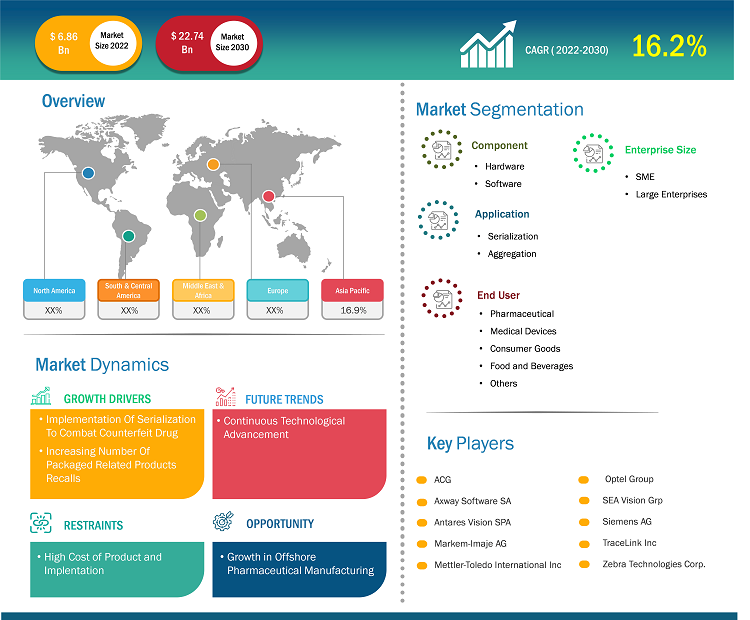

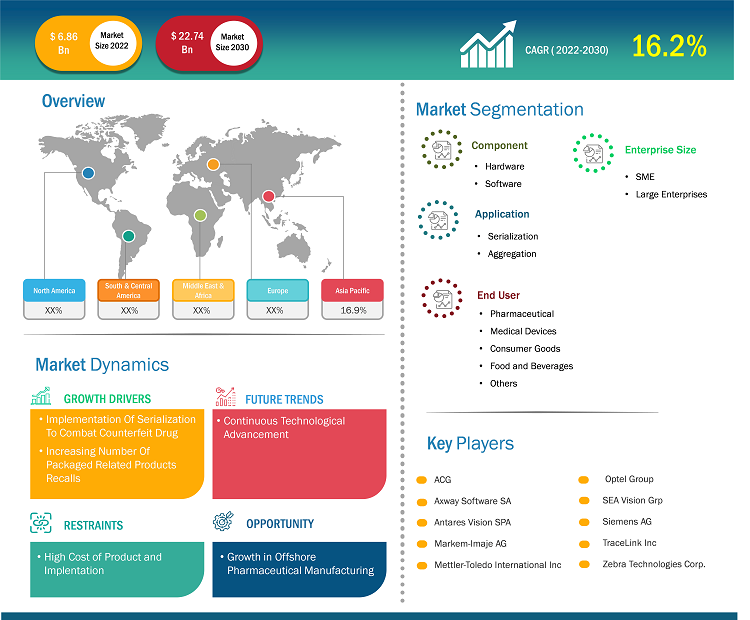

[Research Report] The track and trace solutions market size was valued at US$ 6.85 billion in 2022 and is projected to reach US$ 22.70 billion by 2030; the market is expected to register a CAGR of 16.2% from 2022 to 2030.

Market Insights and Analyst View:

Track & trace solution aims to support compliance regulations across geographies. Once adopted, it provides a comprehensive knowledge-rich environment that enables pharmaceutical companies to easily steer through track and trace compliance mandates, manage recalls better, and increase the overall efficiency of the manufacturing process. Stringent regulations and criteria for implementation of serialization and an increasing number of packaging-related product recalls are the factors responsible for the influential growth of the market. Additionally, growth in offshore pharmaceutical manufacturing offers lucrative market opportunities for the overall market growth during the forecast period. Implementation of serialization to combat counterfeit drugs, as well as the increasing number of packaging-related product recalls, fuels the track and trace solutions market growth. Further, continuous technological advancement is expected to bring new track and trace solutions market trends in the coming years.

Track and Trace Solutions Market Drivers:

Globally, pharmaceutical companies are adhering to regulatory compliance for serialization to ensure anti-counterfeiting and traceability of drugs. Most developed and developing economies have either already laid out the regulatory roadmap for serialization or plan to implement it. The regulatory push to secure the pharmaceutical supply chain is due to the rising drug-related illegal activities and supply chain inefficiencies. Efforts are aimed at addressing drug counterfeits and unauthorized parallel supply chains, improving supply chain visibility, tracking returns or recalls, and the scarcity of data-driven tools for predicting patient behavior. A few examples of government regulations mandating the serialization of medical products include:

In the US, the Drug Supply Chain Security Act (DSCSA) started in 2013. The DSCSA defines the requirements for an interoperable electronic system to identify and trace pharmaceutical products throughout their distribution in the country. As part of the requirements, pharmaceutical products must be marked with a National Drug Code (NDC), serial number, lot number, and expiration date. The Food and Drug Administration (FDA) mandates manufacturers to track specific devices through the entire distribution chain when and if they receive an order from the FDA to implement a tracking system. These devices could belong to Class I, II, or III.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Track and Trace Solutions Market: Strategic Insights

Market Size Value in US$ 6,855.2 million in 2022 Market Size Value by US$ 16,553.8 million by 2028 Growth rate CAGR of 15.9% from 2023 to 2028 Forecast Period 2023-2028 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Track and Trace Solutions Market: Strategic Insights

| Market Size Value in | US$ 6,855.2 million in 2022 |

| Market Size Value by | US$ 16,553.8 million by 2028 |

| Growth rate | CAGR of 15.9% from 2023 to 2028 |

| Forecast Period | 2023-2028 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

In addition, the European Union (EU) has followed suit with a compliance requirement by enacting the Falsified Medicines Directive (FMD). Unit-level serialization and dispenser authentication have been mandated. Further, in Turkey, the first step for implementing serialization is the in-line printing of the relevant code and information on each unit pack. The Turkish and French Pharma plants’ early requirements revealed the risks and difficulties linked to in-line printing of a 2D code, and it took three years to deal with them. The European Union Medical Device Regulation (EU MDR) of May 2021 intends to improve the safety and performance of medical devices throughout their entire lifecycle. The rule plans to enhance the coordination of information on medical devices with better transparency and information access in the EU member states.

In 2012, India’s Directorate General of Foreign Trade (DGFT) also mandated the serialization of secondary and tertiary levels and set guidelines for reporting export shipments. Several other countries have imposed similar regulations for manufacturing and imports. In Brazil, serializing the unit and case (transport packing container) of all pharmaceutical products is mandatory. Cases will have to include information about the units they contain. Tracking of the supply chain will be required at each level, including manufacturer/importer, wholesaler, distributor, and pharmacy levels.

Governments of various countries believe that counterfeiting is an organized crime that can be tackled by implementing product serialization, and many countries are taking steps in this regard. Serialization enables running advanced analytics programs to gather deep insights into consumption patterns, geographical penetration, sales, marketing spend effectiveness, etc. According to the 2013 Drug Supply Chain Security Act, starting from November 2017, all pharmaceutical companies selling prescription drug products in the US must serialize each salable drug unit to aid tracking from manufacturer to pharmacy or doctor’s office.

According to the EU Falsified Medicines Directive (EU FMD) mandates, by February 2019, drug manufacturers conducting business in the EU market must implement serialization. Drug manufacturers are at risk for noncompliance if they fail to follow these mandates, which can lead to huge penalties ranging from paying fines for every occurrence to being barred from product launches. If companies fails to serialize, no wholesalers in the US will purchase their products. Apart from furnishing quality, visibility, and complete traceability within the supply chain, successful serialization programs will be a key differentiator and a clear competitive reward for the companies. Thus, the serialization of pharmaceutical products to avoid counterfeiting drugs in developing countries fuels the track and trace solutions market growth.

Report Segmentation and Scope:

The track and trace solutions market analysis has been carried out by considering the following segments: component, enterprise size, application, industry, and geography. By component, the market is bifurcated into hardware and software. Hardware component is further segmented into barcode scanner, radiofrequency identification reader, and others. Software component is further divided into plant manager, line controller and others. Based on enterprise size, the market is segmented into SMEs and large enterprise. Based on application, the market is divided into serialization and aggregation. Based on industry, the market is segmented into pharmaceutical, medical devices, consumer goods, food and beverages, and others. The scope of the track and trace solutions market report covers North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, Japan, India, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The track and trace solutions market, by type, is bifurcated into hardware and software. The hardware component is further segmented into barcode scanner, radiofrequency identification reader, and others. The software component is further categorized into plant manager, line controller, and others. In 2022, the software segment held a larger share of the market and is expected to record a higher CAGR during 2022–2030. Track and trace software is used for various purposes and offers complete management of the entire serialization and aggregation process. The solutions provide flexibility, whether they have a single line with limited connectivity or require software for monitoring all processes across multiple production lines. The software delivers all necessary documentation and information to meet compliance. The track and trace software is used for pharmaceuticals, production, food & beverage, and seafood. Rfxcel Corp.; METTLER TOLEDO; and JDA Software Group, Inc are among the companies that offer track and trace software. The software provides unique benefits such as reduced administration and increased confidence for quality events, faster containment of quality events with a broader purview of exposed products, and protection of customers and brand image.

The track and trace solutions market, by application, is divided into serialization solutions and aggregation solutions. In 2022, the serialization solutions segment held a larger track and trace solutions market share. Moreover, the same segment is expected to record the highest CAGR during 2022–2030. Serialization refers to the assigning of a predetermined type of coding to all product items, tagging it with a unique identity in order to track the product at virtually any moment, and can be traced to its location at any stage of the production, supply chain and/or marketing chain it is presently involved in, or any point during the product life cycle. Nowadays, the supply chain for all industries is becoming longer and more complex than ever. Hence, incidences such as counterfeiting, gray marketing, and product mix-ups are rising rapidly. Most of the countries with a series of regulatory requirements for global compliance for industries such as pharmaceutical, medical devices, and life science are in need of a standardized method in order to ensure and prove end-to-end product integrity. Serialization solutions for track and trace systems have increased accountability in the pharmaceutical and medical devices supply chain by directly addressing these issues. In the global pharmaceutical industry, the ability to track and trace pharmaceutical drugs in the supply chain has been regulatory vital and evolving in order to improve drug safety and avoid counterfeits. With the help of a serialization solution, one can encode the products with an expiration date, lot code, serial number, GTIN, a 2D matrix code, and a GSI-DataMatrix symbol in order to track products for anti-counterfeiting efforts. Serialization also allows for tracking and tracing the product throughout the supply chain and provides brand and consumer protection, along with regulatory compliance.

Based on enterprise size, the global track and trace solutions market is divided into SMEs and large enterprises. In 2022, the large enterprise segment held a larger market share. The SMEs segment is expected to record a higher CAGR during 2022–2030.

The track and trace solutions market, by industry, is segmented into pharmaceutical, medical devices, consumer goods, food & beverages, and others. In 2022, the pharmaceutical segment held the largest share of the market and is expected to record the highest CAGR during 2022–2030.

Regional Analysis:

Geographically, the market is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the largest contributor to the global market. Asia Pacific is predicted to register the highest CAGR in the market during 2022–2030. North America held the largest share of the global track and trace solutions market in 2022 owing to the presence of large players launching innovative product launches and technological advancements in track and trace solutions. In North America, the US held the largest share of the track and trace solutions market share in 2022.

Track and Trace Solutions Market Report Scope

Industry Developments and Future Opportunities:

The track and trace solutions market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Strategies by key players operating in the track and trace solutions market are listed below:

- In November 2023, Sys-Tech Solutions Inc. announced the launch of the UniSecure platform into the market. The platform is a comprehensive product security solution that detects diversion and counterfeiting. It offers unique product identification, traceability, and product verification through smartphones throughout the supply chain process. The newly launched platform caters to pharmaceutical, nutraceutical, medical products, skincare, and other markets.

- In October 2022, Zebra Technologies Corporation announced the new PartnerConnect Location and Tracking Specialization for partners focused on selling RFID and real-time location systems (RTLS). Developed as a strategic component of Zebra’s award-winning PartnerConnect program, the new Location and Tracking Specialization provides resellers with the tools they need to drive RFID and RTLS sales and help businesses successfully deploy these solutions for transformational business benefits.

Competitive Landscape and Key Companies:

ACG, Axway Software SA, Antares Vision SPA, Markem-Imaje AG, Mettler-Toledo International Inc, Optel Group, SEA Vision Grp, Siemens AG, TraceLink Inc, and Zebra Technologies Corp are among the prominent players profiled in the track and trace solutions market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and product launches to meet the growing demand from consumers worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Enterprise Size, Application, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The track & trace solutions market, by type, is bifurcated into hardware and software. In 2022, the software segment held a larger share of the market and is expected to record a higher CAGR during 2022–2030.

The market, by application, is segmented into serialization solutions and aggregation solutions. In 2022, the serialization solutions segment held the largest track & trace solutions market share. Moreover, the same segment is expected to record the highest CAGR during 2022–2030.

Based on enterprise size, the global track & trace solutions market is divided into SMEs and large enterprise. In 2022, the large enterprise segment held the largest market share. The SMEs segment is expected to record the highest CAGR during 2022–2030. The track & trace solutions market, by industry, is segmented into pharmaceuticals, medical devices, consumer goods, food & beverages, and others. In 2022, the pharmaceuticals segment held a larger share of the market and is expected to record a higher CAGR during 2022–2030.

Based on geography, the track & trace solutions market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). North America is the largest contributor to the growth of the global track & trace solutions market. Asia Pacific is expected to register the highest CAGR in the track & trace solutions market during 2022–2030.

Track and trace solution aims to support compliance regulations across geographies. Once adopted, it provides a comprehensive knowledge-rich environment that enables pharmaceutical companies to easily steer through track and trace compliance mandates, manages recalls better, and increases the overall efficiency of the manufacturing process. Further, a track and trace solution offer numerous benefits involving purchase order numbers, container numbers, bill of lading numbers, customer information, item counts, weight, status and delivery date, freight charges, and many more.

Implementation of serialization to combat counterfeit drugs and increasing number of packaging-related product recalls propel the market growth. However, the high cost of products and implementation are hampering the growth of the market.

The track & trace solutions market majorly consists of the players such ACG, Axway Software SA, Antares Vision SPA, Markem-Imaje AG, Mettler-Toledo International Inc, Optel Group, SEA Vision Grp, Siemens AG, TraceLink Inc, and Zebra Technologies Corp.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Track and Trace Solutions Market Landscape

4.1 Overview

4.2 PEST Analysis

5. Track and Trace Solutions Market – Key Market Dynamics

5.1 Track and Trace Solutions Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Implementation of Serialization to Combat Counterfeit Drugs

5.2.2 Increasing Number of Packaging-Related Product Recalls

5.3 Market Restraints

5.3.1 High Cost of Products and Implementation

5.4 Market Opportunities

5.4.1 Growth in Offshore Pharmaceutical Manufacturing

5.5 Future Trends

5.5.1 Continuous Technological Advancements

5.6 Impact of Drivers and Restraints:

6. Track and Trace Solutions Market – Global Market Analysis

6.1 Track and Trace Solutions Market Revenue (US$ Million), 2022–2030

6.2 Track and Trace Solutions Market Forecast Analysis

7. Track and Trace Solutions Market Analysis – by Component

7.1 Software

7.1.1 Overview

7.1.2 Software: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Hardware

7.2.1 Overview

7.2.2 Hardware: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

8. Track and Trace Solutions Market Analysis – by Application

8.1 Serialization Solution

8.1.1 Overview

8.1.2 Serialization Solution: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Aggregation Solution

8.2.1 Overview

8.2.2 Aggregation Solution: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

9. Track and Trace Solutions Market Analysis – by Enterprises Size

9.1 SMEs

9.1.1 Overview

9.1.2 SMEs: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

9.2 Large Enterprises

9.2.1 Overview

9.2.2 Large Enterprises: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

10. Track and Trace Solutions Market Analysis – by End Users

10.1 Pharmaceutical

10.1.1 Overview

10.1.2 Pharmaceutical: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

10.2 Medical Devices

10.2.1 Overview

10.2.2 Medical Devices: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

10.3 Consumer Goods

10.3.1 Overview

10.3.2 Consumer Goods: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Food and Beverages

10.4.1 Overview

10.4.2 Food and Beverages: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

10.5 Others

10.5.1 Overview

10.5.2 Others: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11. Track and Trace Solutions Market – Geographical Analysis

11.1 Overview

11.2 North America

11.2.1 North America Track and Trace Solutions Market Overview

11.2.2 North America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.2.3 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Component

11.2.3.1 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Software

11.2.3.2 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Hardware

11.2.4 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Application

11.2.5 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Enterprises Size

11.2.6 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by End Users

11.2.7 North America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Country

11.2.7.1 United States: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.1.1 United States: Track and Trace Solutions Market Breakdown, by Component

11.2.7.1.1.1 United States: Track and Trace Solutions Market Breakdown, by Software

11.2.7.1.1.2 United States: Track and Trace Solutions Market Breakdown, by Hardware

11.2.7.1.2 United States: Track and Trace Solutions Market Breakdown, by Application

11.2.7.1.3 United States: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.2.7.1.4 United States: Track and Trace Solutions Market Breakdown, by End Users

11.2.7.2 Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.2.1 Canada: Track and Trace Solutions Market Breakdown, by Component

11.2.7.2.1.1 Canada: Track and Trace Solutions Market Breakdown, by Software

11.2.7.2.1.2 Canada: Track and Trace Solutions Market Breakdown, by Hardware

11.2.7.2.2 Canada: Track and Trace Solutions Market Breakdown, by Application

11.2.7.2.3 Canada: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.2.7.2.4 Canada: Track and Trace Solutions Market Breakdown, by End Users

11.2.7.3 Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.3.1 Mexico: Track and Trace Solutions Market Breakdown, by Component

11.2.7.3.1.1 Mexico: Track and Trace Solutions Market Breakdown, by Software

11.2.7.3.1.2 Mexico: Track and Trace Solutions Market Breakdown, by Hardware

11.2.7.3.2 Mexico: Track and Trace Solutions Market Breakdown, by Application

11.2.7.3.3 Mexico: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.2.7.3.4 Mexico: Track and Trace Solutions Market Breakdown, by End Users

11.3 Europe

11.3.1 Europe Track and Trace Solutions Market Overview

11.3.2 Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Component

11.3.3.1 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Software

11.3.3.2 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Hardware

11.3.4 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Application

11.3.5 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Enterprises Size

11.3.6 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by End Users

11.3.7 Europe: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Country

11.3.7.1 Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.1.1 Germany: Track and Trace Solutions Market Breakdown, by Component

11.3.7.1.1.1 Germany: Track and Trace Solutions Market Breakdown, by Software

11.3.7.1.1.2 Germany: Track and Trace Solutions Market Breakdown, by Hardware

11.3.7.1.2 Germany: Track and Trace Solutions Market Breakdown, by Application

11.3.7.1.3 Germany: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.3.7.1.4 Germany: Track and Trace Solutions Market Breakdown, by End Users

11.3.7.2 France: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.2.1 France: Track and Trace Solutions Market Breakdown, by Component

11.3.7.2.1.1 France: Track and Trace Solutions Market Breakdown, by Software

11.3.7.2.1.2 France: Track and Trace Solutions Market Breakdown, by Hardware

11.3.7.2.2 France: Track and Trace Solutions Market Breakdown, by Application

11.3.7.2.3 France: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.3.7.2.4 France: Track and Trace Solutions Market Breakdown, by End Users

11.3.7.3 United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.3.1 United Kingdom: Track and Trace Solutions Market Breakdown, by Component

11.3.7.3.1.1 United Kingdom: Track and Trace Solutions Market Breakdown, by Software

11.3.7.3.1.2 United Kingdom: Track and Trace Solutions Market Breakdown, by Hardware

11.3.7.3.2 United Kingdom: Track and Trace Solutions Market Breakdown, by Application

11.3.7.3.3 United Kingdom: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.3.7.3.4 United Kingdom: Track and Trace Solutions Market Breakdown, by End Users

11.3.7.4 Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.4.1 Italy: Track and Trace Solutions Market Breakdown, by Component

11.3.7.4.1.1 Italy: Track and Trace Solutions Market Breakdown, by Software

11.3.7.4.1.2 Italy: Track and Trace Solutions Market Breakdown, by Hardware

11.3.7.4.2 Italy: Track and Trace Solutions Market Breakdown, by Application

11.3.7.4.3 Italy: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.3.7.4.4 Italy: Track and Trace Solutions Market Breakdown, by End Users

11.3.7.5 Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.5.1 Spain: Track and Trace Solutions Market Breakdown, by Component

11.3.7.5.1.1 Spain: Track and Trace Solutions Market Breakdown, by Software

11.3.7.5.1.2 Spain: Track and Trace Solutions Market Breakdown, by Hardware

11.3.7.5.2 Spain: Track and Trace Solutions Market Breakdown, by Application

11.3.7.5.3 Spain: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.3.7.5.4 Spain: Track and Trace Solutions Market Breakdown, by End Users

11.3.7.6 Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.6.1 Rest of Europe: Track and Trace Solutions Market Breakdown, by Component

11.3.7.6.1.1 Rest of Europe: Track and Trace Solutions Market Breakdown, by Software

11.3.7.6.1.2 Rest of Europe: Track and Trace Solutions Market Breakdown, by Hardware

11.3.7.6.2 Rest of Europe: Track and Trace Solutions Market Breakdown, by Application

11.3.7.6.3 Rest of Europe: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.3.7.6.4 Rest of Europe: Track and Trace Solutions Market Breakdown, by End Users

11.4 Asia Pacific

11.4.1 Asia Pacific Track and Trace Solutions Market Overview

11.4.2 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Component

11.4.3.1 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Software

11.4.3.2 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Hardware

11.4.4 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Application

11.4.5 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Enterprises Size

11.4.6 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by End Users

11.4.7 Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Country

11.4.7.1 China: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.7.1.1 China: Track and Trace Solutions Market Breakdown, by Component

11.4.7.1.1.1 China: Track and Trace Solutions Market Breakdown, by Software

11.4.7.1.1.2 China: Track and Trace Solutions Market Breakdown, by Hardware

11.4.7.1.2 China: Track and Trace Solutions Market Breakdown, by Application

11.4.7.1.3 China: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.4.7.1.4 China: Track and Trace Solutions Market Breakdown, by End Users

11.4.7.2 Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.7.2.1 Japan: Track and Trace Solutions Market Breakdown, by Component

11.4.7.2.1.1 Japan: Track and Trace Solutions Market Breakdown, by Software

11.4.7.2.1.2 Japan: Track and Trace Solutions Market Breakdown, by Hardware

11.4.7.2.2 Japan: Track and Trace Solutions Market Breakdown, by Application

11.4.7.2.3 Japan: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.4.7.2.4 Japan: Track and Trace Solutions Market Breakdown, by End Users

11.4.7.3 India: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.7.3.1 India: Track and Trace Solutions Market Breakdown, by Component

11.4.7.3.1.1 India: Track and Trace Solutions Market Breakdown, by Software

11.4.7.3.1.2 India: Track and Trace Solutions Market Breakdown, by Hardware

11.4.7.3.2 India: Track and Trace Solutions Market Breakdown, by Application

11.4.7.3.3 India: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.4.7.3.4 India: Track and Trace Solutions Market Breakdown, by End Users

11.4.7.4 South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.7.4.1 South Korea: Track and Trace Solutions Market Breakdown, by Component

11.4.7.4.1.1 South Korea: Track and Trace Solutions Market Breakdown, by Software

11.4.7.4.1.2 South Korea: Track and Trace Solutions Market Breakdown, by Hardware

11.4.7.4.2 South Korea: Track and Trace Solutions Market Breakdown, by Application

11.4.7.4.3 South Korea: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.4.7.4.4 South Korea: Track and Trace Solutions Market Breakdown, by End Users

11.4.7.5 Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.7.5.1 Australia: Track and Trace Solutions Market Breakdown, by Component

11.4.7.5.1.1 Australia: Track and Trace Solutions Market Breakdown, by Software

11.4.7.5.1.2 Australia: Track and Trace Solutions Market Breakdown, by Hardware

11.4.7.5.2 Australia: Track and Trace Solutions Market Breakdown, by Application

11.4.7.5.3 Australia: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.4.7.5.4 Australia: Track and Trace Solutions Market Breakdown, by End Users

11.4.7.6 Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.4.7.6.1 Rest of APAC: Track and Trace Solutions Market Breakdown, by Component

11.4.7.6.1.1 Rest of APAC: Track and Trace Solutions Market Breakdown, by Software

11.4.7.6.1.2 Rest of APAC: Track and Trace Solutions Market Breakdown, by Hardware

11.4.7.6.2 Rest of APAC: Track and Trace Solutions Market Breakdown, by Application

11.4.7.6.3 Rest of APAC: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.4.7.6.4 Rest of APAC: Track and Trace Solutions Market Breakdown, by End Users

11.5 Middle East and Africa

11.5.1 Middle East and Africa Track and Trace Solutions Market Overview

11.5.2 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.5.3 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Component

11.5.3.1 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Software

11.5.3.2 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Hardware

11.5.4 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Application

11.5.5 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Enterprises Size

11.5.6 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by End Users

11.5.7 Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Country

11.5.7.1 Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.1.1 Saudi Arabia: Track and Trace Solutions Market Breakdown, by Component

11.5.7.1.1.1 Saudi Arabia: Track and Trace Solutions Market Breakdown, by Software

11.5.7.1.1.2 Saudi Arabia: Track and Trace Solutions Market Breakdown, by Hardware

11.5.7.1.2 Saudi Arabia: Track and Trace Solutions Market Breakdown, by Application

11.5.7.1.3 Saudi Arabia: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.5.7.1.4 Saudi Arabia: Track and Trace Solutions Market Breakdown, by End Users

11.5.7.2 South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.2.1 South Africa: Track and Trace Solutions Market Breakdown, by Component

11.5.7.2.1.1 South Africa: Track and Trace Solutions Market Breakdown, by Software

11.5.7.2.1.2 South Africa: Track and Trace Solutions Market Breakdown, by Hardware

11.5.7.2.2 South Africa: Track and Trace Solutions Market Breakdown, by Application

11.5.7.2.3 South Africa: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.5.7.2.4 South Africa: Track and Trace Solutions Market Breakdown, by End Users

11.5.7.3 United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.3.1 United Arab Emirates: Track and Trace Solutions Market Breakdown, by Component

11.5.7.3.1.1 United Arab Emirates: Track and Trace Solutions Market Breakdown, by Software

11.5.7.3.1.2 United Arab Emirates: Track and Trace Solutions Market Breakdown, by Hardware

11.5.7.3.2 United Arab Emirates: Track and Trace Solutions Market Breakdown, by Application

11.5.7.3.3 United Arab Emirates: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.5.7.3.4 United Arab Emirates: Track and Trace Solutions Market Breakdown, by End Users

11.5.7.4 Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.4.1 Rest of Middle East and Africa: Track and Trace Solutions Market Breakdown, by Component

11.5.7.4.1.1 Rest of Middle East and Africa: Track and Trace Solutions Market Breakdown, by Software

11.5.7.4.1.2 Rest of Middle East and Africa: Track and Trace Solutions Market Breakdown, by Hardware

11.5.7.4.2 Rest of Middle East and Africa: Track and Trace Solutions Market Breakdown, by Application

11.5.7.4.3 Rest of Middle East and Africa: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.5.7.4.4 Rest of Middle East and Africa: Track and Trace Solutions Market Breakdown, by End Users

11.6 South and Central America

11.6.1 South and Central America Track and Trace Solutions Market Overview

11.6.2 South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.6.3 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Component

11.6.3.1 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Software

11.6.3.2 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Hardware

11.6.4 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Application

11.6.5 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Enterprises Size

11.6.6 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by End Users

11.6.7 South and Central America: Track and Trace Solutions Market – Revenue and Forecast Analysis – by Country

11.6.7.1 Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.6.7.1.1 Brazil: Track and Trace Solutions Market Breakdown, by Component

11.6.7.1.1.1 Brazil: Track and Trace Solutions Market Breakdown, by Software

11.6.7.1.1.2 Brazil: Track and Trace Solutions Market Breakdown, by Hardware

11.6.7.1.2 Brazil: Track and Trace Solutions Market Breakdown, by Application

11.6.7.1.3 Brazil: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.6.7.1.4 Brazil: Track and Trace Solutions Market Breakdown, by End Users

11.6.7.2 Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.6.7.2.1 Argentina: Track and Trace Solutions Market Breakdown, by Component

11.6.7.2.1.1 Argentina: Track and Trace Solutions Market Breakdown, by Software

11.6.7.2.1.2 Argentina: Track and Trace Solutions Market Breakdown, by Hardware

11.6.7.2.2 Argentina: Track and Trace Solutions Market Breakdown, by Application

11.6.7.2.3 Argentina: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.6.7.2.4 Argentina: Track and Trace Solutions Market Breakdown, by End Users

11.6.7.3 Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

11.6.7.3.1 Rest of South and Central America: Track and Trace Solutions Market Breakdown, by Component

11.6.7.3.1.1 Rest of South and Central America: Track and Trace Solutions Market Breakdown, by Software

11.6.7.3.1.2 Rest of South and Central America: Track and Trace Solutions Market Breakdown, by Hardware

11.6.7.3.2 Rest of South and Central America: Track and Trace Solutions Market Breakdown, by Application

11.6.7.3.3 Rest of South and Central America: Track and Trace Solutions Market Breakdown, by Enterprises Size

11.6.7.3.4 Rest of South and Central America: Track and Trace Solutions Market Breakdown, by End Users

12. Industry Landscape

12.1 Overview

12.2 Growth Strategies Done by the Companies in the Market, (%)

12.3 Organic Developments

12.3.1 Overview

12.4 Inorganic Developments

12.4.1 Overview

13. Company Profiles

13.1 Sys-Tech Solutions Inc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 SAP SE

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Uhlmann Pac-Systeme GmbH & Co KG

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 WIPOTEC GmbH

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Bar Code India Ltd

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Korber AG

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 ALLTEC Angewandte Laserlicht Technologie GmbH

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Videojet Technologies Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Domino Printing Sciences plc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Kezzler AS

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 rfxcel Corp

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

13.12 NeuroTags Inc

13.12.1 Key Facts

13.12.2 Business Description

13.12.3 Products and Services

13.12.4 Financial Overview

13.12.5 SWOT Analysis

13.12.6 Key Developments

13.13 Catalyx

13.13.1 Key Facts

13.13.2 Business Description

13.13.3 Products and Services

13.13.4 Financial Overview

13.13.5 SWOT Analysis

13.13.6 Key Developments

13.14 Jekson Vison Pvt Ltd

13.14.1 Key Facts

13.14.2 Business Description

13.14.3 Products and Services

13.14.4 Financial Overview

13.14.5 SWOT Analysis

13.14.6 Key Developments

14. Appendix

14.1 About Us

14.2 Glossary of Terms

List of Tables

Table 1. Track and Trace Solutions Market Segmentation

Table 2. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Table 3. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Component

Table 4. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Software

Table 5. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Hardware

Table 6. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Application

Table 7. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Enterprises Size

Table 8. Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by End Users

Table 9. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 10. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 11. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 12. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 13. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 14. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 15. Recommendations for Executive Actions by the FDA

Table 16. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 17. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 18. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 19. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 20. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 21. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 22. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 23. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 24. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 25. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 26. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 27. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 28. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 29. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 30. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 31. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 32. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 33. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 34. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 35. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 36. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 37. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 38. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 39. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 40. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 41. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 42. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 43. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 44. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 45. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 46. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 47. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 48. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 49. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 50. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 51. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 52. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 53. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 54. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 55. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 56. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 57. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 58. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 59. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 60. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 61. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 62. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 63. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 64. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 65. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 66. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 67. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 68. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 69. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 70. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 71. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 72. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 73. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 74. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 75. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 76. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 77. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 78. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 79. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 80. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 81. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 82. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 83. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 84. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 85. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 86. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 87. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 88. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 89. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 90. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 91. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 92. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 93. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 94. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 95. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 96. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 97. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 98. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 99. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 100. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 101. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 102. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 103. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 104. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 105. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 106. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 107. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 108. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 109. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 110. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 111. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 112. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 113. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 114. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 115. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 116. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 117. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 118. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 119. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 120. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 121. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 122. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 123. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 124. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 125. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 126. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 127. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 128. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 129. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 130. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 131. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 132. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 133. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 134. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 135. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 136. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 137. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 138. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 139. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 140. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 141. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 142. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 143. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 144. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 145. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 146. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 147. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 148. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 149. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 150. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 151. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 152. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 153. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 154. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 155. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 156. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 157. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 158. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 159. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 160. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 161. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Software

Table 162. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Hardware

Table 163. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 164. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by Enterprises Size

Table 165. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million) – by End Users

Table 166. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Component

Table 167. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Software

Table 168. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Hardware

Table 169. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Application

Table 170. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by Enterprises Size

Table 171. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million) – by End Users

Table 172. Organic Developments Done by Companies

Table 173. Inorganic Developments Done by Companies

Table 174. Glossary of Terms, Track and Trace Market

List of Figures

Figure 1. Track and Trace Solutions Market Segmentation, by Geography

Figure 2. PEST Analysis

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Track and Trace Solutions Market Revenue (US$ Million), 2022–2030

Figure 5. Track and Trace Solutions Market, by Geography – Forecast and Analysis (2022–2030)

Figure 6. Track and Trace Solutions Market Share (%) – by Component (2022 and 2030)

Figure 7. Software: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Hardware: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Track and Trace Solutions Market Share (%) – by Application (2022 and 2030)

Figure 10. Serialization Solution: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Aggregation Solution: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Track and Trace Solutions Market Share (%) – by Enterprises Size (2022 and 2030)

Figure 13. SMEs: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Large Enterprises: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Track and Trace Solutions Market Share (%) – by End Users (2022 and 2030)

Figure 16. Pharmaceutical: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Medical Devices: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Consumer Goods: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Food and Beverages: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Others: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Track and Trace Solutions Market Breakdown by Region, 2022 and 2030 (%)

Figure 22. North America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 23. North America: Track and Trace Solutions Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 24. United States: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 25. Canada: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 26. Mexico: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 27. Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 28. Europe: Track and Trace Solutions Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 29. Germany: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 30. France: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 31. United Kingdom: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 32. Italy: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 33. Spain: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 34. Rest of Europe: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 35. Asia Pacific: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 36. Asia Pacific: Track and Trace Solutions Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 37. China: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 38. Japan: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 39. India: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 40. South Korea: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 41. Australia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 42. Rest of APAC: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 43. Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 44. Middle East and Africa: Track and Trace Solutions Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 45. Saudi Arabia: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 46. South Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 47. United Arab Emirates: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 48. Rest of Middle East and Africa: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 49. South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 50. South and Central America: Track and Trace Solutions Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 51. Brazil: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 52. Argentina: Track and Trace Solutions Market – Revenue and Forecast to 2030(US$ Million)

Figure 53. Rest of South and Central America: Track and Trace Solutions Market – Revenue and Forecast to 2030 (US$ Million)

Figure 54. Growth Strategies Done by the Companies in the Market, (%)

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review: