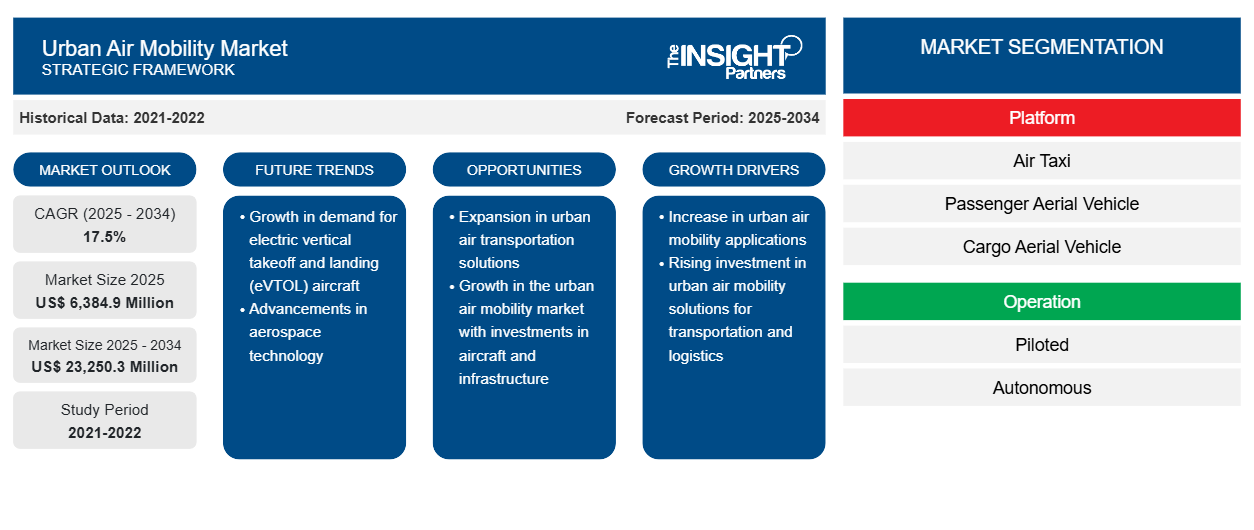

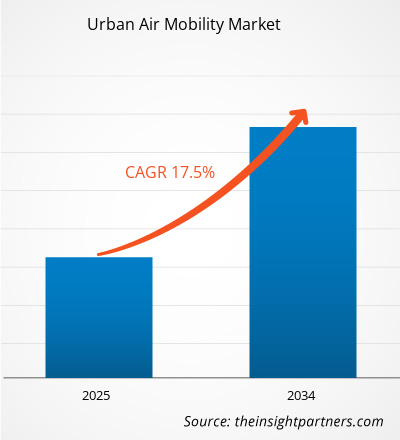

The urban air mobility market is expected to valued at US$ 6,384.9 Million in 2025 and is projected to reach US$ 23,250.3 Million by 2034. The Urban Air Mobility market is expected to grow at a CAGR of 17.5% during the forecast period of 2025 to 2034 .

A minimum of three and a maximum of five-six passengers can travel by urban air mobility passenger carriers. In rural areas, more than six passengers travel by three-wheeler passenger carriers as per requirement. Increasing traffic congestions in urban cities is major factor driving the market growth. As the world’s urban population grows, traffic congestion has been seriously affecting people’s quality of life and taking a toll on general economic growth. For example, according to INRIX (a traffic analysis firm), a U.S. commuter spends approximately 41 hours in traffic each year during peak congestion times. It also mentioned that traffic congestions had cost U.S. drivers approximately US$ 305 Bn in 2017, implying an average of US$ 1,445 per driver. Furthermore, the U.S. Environmental Protection Agency estimated an average passenger car emits 4.7 metric tons of carbon dioxide each year. Furthermore, car accidents have surged, along with increasing vehicle ownership in developing countries such as India and China. According to the World Health Organization (WHO), roughly 1.25 million people are killed in car accidents each year, reaching to about 3,400 deaths per day. This does not consider the millions of injuries incurred in non-fatal accidents.

The global urban air mobility market is segmented by type into passenger carrier and goods carrier. Based on fuel type, the urban air mobility market is segmented into Diesel, Petrol, CNG, LPG, and Electric. Increasing demand for electric urban air mobility, and increasing population, and increasing need for a vehicle that helps in traffic congestion in the region have been bolstering the growth of the global urban air mobility market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Urban Air Mobility Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Urban Air Mobility Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Urban air mobility Market Insights

Aviation and Autonomous Driving Technology Advancements

Advances in aviation technologies are creating the potential to provide convenient and efficient on-demand transportation for people and cargo in metropolitan areas. Urban Air Mobility (UAM) is a transportation concept that has the potential to reconstruct societal mobility. It proposes highly affordable, accessible, and fast urban air transit, which would reduce ground-based congestion by off-loading the existing roadways transportation infrastructure. UAM relies on the gain in technologies such as distributed electric propulsion, new business models such as application-based ride-sharing, and trends in advanced aerospace manufacturing that will reduce production costs. Increasing the credit of vehicle automation and autonomous vehicle operations will be critical in achieving the autonomous UAM vision. Autonomy will be needed for an economically viable transportation system capable of supporting the high anticipated demand. Significant increases in the technological maturity of stable, maneuverable, vertical takeoff and landing (VTOL) vehicle, and highly automated flight are primarily going to propel the UAM industry.

Platform -Based Market Insights

The urban air mobility market is bifurcated on basis of platform into air taxi, passenger aerial vehicle, cargo aerial vehicle, and air ambulance. Broad array of applications are present for UAM which facilitates easy and rapid transportation of cargo as well as human being. These UAMs are extensively utilized for the transportation of small items, medical products, and carries passengers as well. However, these mobility solutions have their own flying limits depending upon their usage. UAM vehicles are neither allowed to fly at a low range as it would hit the mid-sized and tall buildings nor at a high range to hit any airlines.

Operation -Based Market Insights

The urban air mobility market is bifurcated on basis of operation into piloted and autonomous. The autonomous segment is estimated to lead the market during the forecast period, as autonomous eVTOLs are better suited for cargo and passenger transportation and are anticipated to be increasingly utilized for intercity transportation.

Players operating in the Urban air mobility market focus on strategies, such as market initiatives, acquisitions, and product launches, to maintain their positions in the urban air mobility market. A few developments by key players of the urban air mobility market are:

In February 2020, Airbus and the Civil Aviation Authority of Singapore signed a MOU to enable urban air mobility in Singapore. This collaboration would enable the urban air mobility in the country in the country.

In February 2019 Airspace Experience Technologies entered into a definitive agreement with Spirit AeroSystems to create certified all-electric, vertical take-off and landing (eVTOL) aircraft.

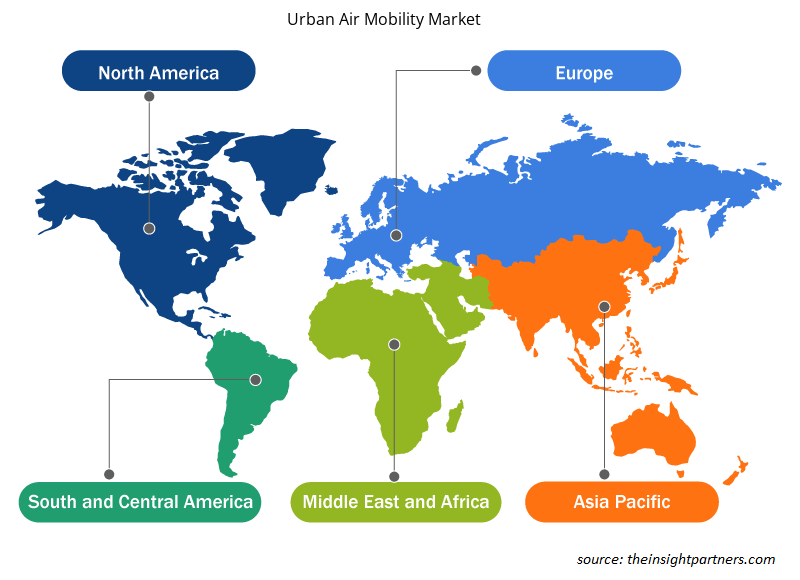

Urban Air Mobility Market Regional Insights

The regional trends and factors influencing the Urban Air Mobility Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Urban Air Mobility Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Urban Air Mobility Market

Urban Air Mobility Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 6,384.9 Million |

| Market Size by 2034 | US$ 23,250.3 Million |

| Global CAGR (2025 - 2034) | 17.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2025-2034 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

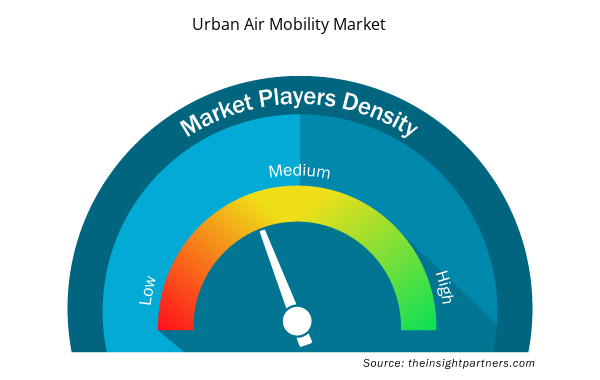

Urban Air Mobility Market Players Density: Understanding Its Impact on Business Dynamics

The Urban Air Mobility Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Urban Air Mobility Market are:

- Airbus SAS

- Aurora Flight Sciences

- Airspace Experience Technologies, Inc.

- Bell Textron Inc

- EHang Intelligent Technology Co. Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Urban Air Mobility Market top key players overview

Urban Air Mobility Market – by Platform

- Air Taxi

- Passenger Aerial Vehicle

- Cargo Aerial Vehicle

- Air Ambulance

Urban Air Mobility Market – by Operation

- Piloted

- Autonomous

Urban Air Mobility Market – by Geography

North America

- US

- Canada

Europe

- France

- Germany

- UK

- Russia

- Rest of Europe

Rest of World

Urban Air Mobility Market – Company Profiles

- Airbus SAS

- Aurora Flight Sciences

- Bell Helicopter Textron Inc.

- EHang

- EmbraerX

- Honeywell International Inc.

- Kitty Hawk

- Moog Inc.

- Volocopter GmbH

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Platform, Operation

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Which platform led the urban air mobility market?

Air Taxi segment led the urban air mobility market. The air taxi usage case is a door-to-door (or near-ubiquitous) ridesharing operation, which permits customers to call vertical takeoff and landing aircraft (VTOLs) to their preferred pickup locations and stipulate drop-off destinations at rooftops across the given city. These rides are on-demand and unscheduled, just like ridesharing applications the customers use in the present scenario. Similar to the air metro case, the aerial vehicles are both autonomous as well as operated by the pilots and can accommodate 2 to 5 passengers simultaneously, by an average load of 1 passenger per trip.

Which factor is driving the urban air mobility market?

Advances in aviation technologies are creating the potential to provide convenient and efficient on-demand transportation for people and cargo in metropolitan areas. Urban Air Mobility (UAM) is a transportation concept that has the potential to reconstruct societal mobility. It proposes highly affordable, accessible, and fast urban air transit, which would reduce ground-based congestion by off-loading the existing roadways transportation infrastructure. Therefore, the technological advancements in the aviation industry and increasing traffic congestion are the major factors driving the growth of urban air mobility market.

Which region will lead the urban air mobility market in 2025?

The North America region will lead the Urban air mobility market in 2025 owing to the supportive government initiatives and an increasing number of companies spending rigorously on the development of urban air mobility products.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Urban Air Mobility (UAM) Market

- Airbus SAS

- Aurora Flight Sciences

- Airspace Experience Technologies, Inc.

- Bell Textron Inc

- EHang Intelligent Technology Co. Ltd

- EmbraerX

- Jaunt Air Mobility LLC

- Kitty Hawk

- Moog Inc.

- Volocopter GmbH

Get Free Sample For

Get Free Sample For