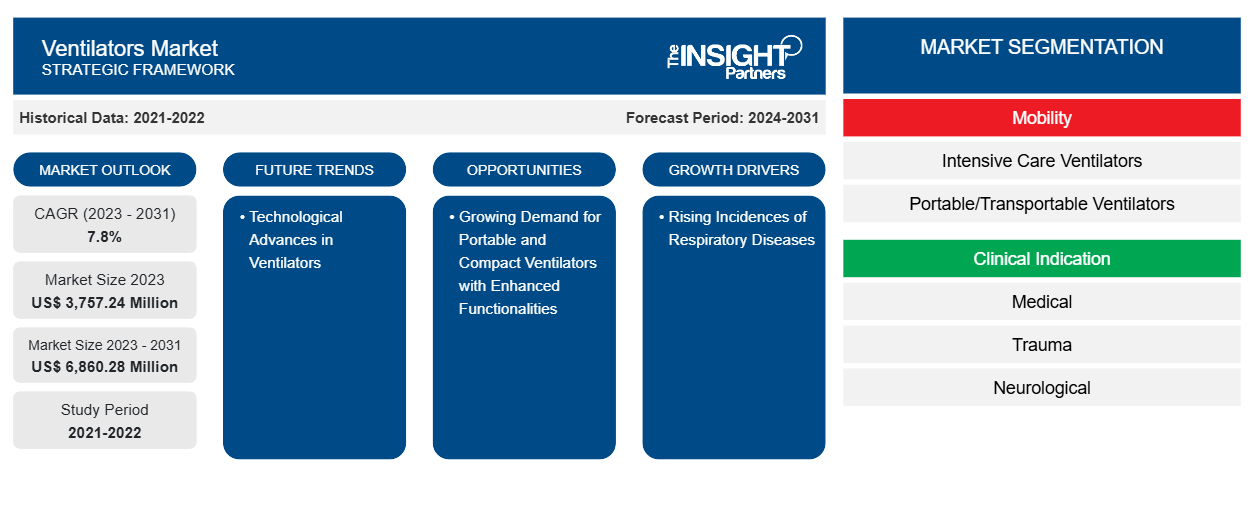

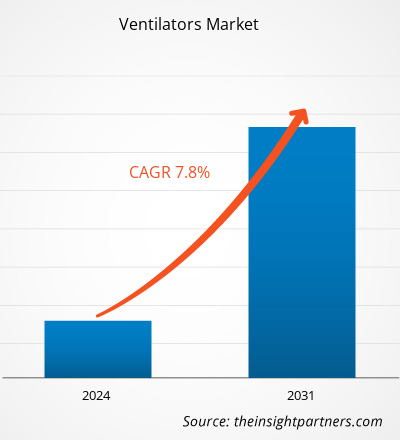

The ventilators market size is projected to reach US$ 6,860.28 million by 2031 from US$ 3,757.24 million in 2023. The market is expected to register a CAGR of 7.8% during 2023–2031. The growing demand for portable and compact ventilators with enhanced functionalities is likely to serve as one of the key trends in the market.

Ventilators Market Analysis

Factors driving the ventilators market growth are growing cases of chronic obstructive pulmonary disease (COPD), respiratory emergencies, and technological advancements in devices for respiratory care. The advent of patient-friendly, cost-effective, and portable size further drives the usage of ventilators, thus resulting in market growth. Moreover, government support initiatives intended to offer safe, affordable, and quality healthcare are expected to increase demand for ventilators during the forecast period. Various market players in the ventilators market provide ventilators, which is likely to boost the growth of the ventilators market. Hamilton Medical offers ventilators named HAMILTON-C1 and Hamilton-C1 neo, a neonatal ventilator combining a range of therapy options with mobility into a ventilator explicitly designed for neonates.

Ventilators Market Overview

The market is fueled by an increase in aged individuals who are susceptible to respiratory disorders, growing advancements in healthcare infrastructure, and greater adoption of advanced technologies. Older people are more prone to severe diseases caused by respiratory infections than younger people due to age-related issues, such as frailty, which increases the number of hospitalizations and deaths. The increase in the elderly population has caused an upsurge in geriatric ailments, leading to an enormous requirement for intensive care, which includes mechanical ventilation. According to the Centers for Disease Control and Prevention (CDC) database 2020, the number of COPD patients and deaths is much greater among older age groups, contributing to 86% of COPD deaths among these age groups. Aging is the main factor contributing to the increase in chronic-degenerative disease cases. In a few cases, it leads to the need for interventions that require admission to ICUs. Thus, rapid growth in the geriatric population encourages the demand for ventilatory support, which fuels the ventilators market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ventilators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ventilators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Ventilators Market Drivers and Opportunities

Rising Incidences of Respiratory Diseases to Favor Market Growth

COPD, asthma, acute lower respiratory tract infections, tuberculosis, lung cancer, and other respiratory diseases are among the most common causes of severe illness and death worldwide. As per the 2023 American Lung Association data, ~34 million American people suffer from chronic lung diseases such as asthma and COPD. As per the Office of Disease Prevention and Health Promotion, in 2020, ~14.8 million adults were diagnosed with COPD in the US. A ventilator assists the patient affected by respiratory diseases or other such conditions in breathing. Therefore, the treatment of respiratory diseases requires mechanical ventilation. Thus, the increasing burden of respiratory diseases supports the demand for ventilators, thereby propelling the market growth.

Technological Advances in Ventilators

The demand for innovative, smaller, quieter, and more comfortable ventilators that respond to patients' needs is increasing, enabling healthcare providers to treat patients in the ICU effectively. Over the past two decades, technical improvements have greatly enhanced ICU ventilator performance. With developments in ICU ventilators, additional modes are readily available, and the user interface has been modified. Most of the new generation of ICU ventilators have a computer screen that controls the user interface, automated weaning strategies, and ventilator synchrony. In addition, portable ventilators are a recent technological advancement in ventilators. The device's compact size is expected to transform ventilatory care by providing portability, ease of use, versatility, and a longer battery life. It is less expensive than other ICU ventilators and has both invasive and non-invasive capabilities. As a result, the rising ventilators sector is expected to offer growth opportunities to the market.

Ventilators Market Report Segmentation Analysis

Key segments that contributed to the derivation of the ventilators market analysis are mobility, clinical indication, interface, patients, mode, and end user.

- Based on mobility, the ventilators market is classified into intensive care ventilators and portable/transportable ventilators. The intensive care ventilators segment held the largest share of the market in 2023. The portable/transportable ventilators segment is anticipated to register the highest CAGR during the forecast period.

- In terms of clinical indication, the market is categorized into medical, trauma, neurological, surgical, and others. The medical segment held the largest share of the market in 2023. The neurological segment is anticipated to register the highest CAGR during the forecast period.

- Based on patients, the ventilators market is bifurcated into adult and paediatric & neonatal. The adult segment held a larger market share in 2023 and is anticipated to register a higher CAGR during the forecast period.

- Based on interface, the ventilators market is bifurcated into invasive and non-invasive. The invasive segment held a larger market share in 2023. The non-invasive segment is anticipated to register a higher CAGR during the forecast period.

- In terms of mode, the market is segmented into combined mode ventilation, volume mode ventilation, pressure mode ventilation, neurally adjusted ventilatory assists, inverse ratio ventilation, prone ventilation, high-frequency oscillatory ventilation, high-frequency percussive ventilation, and others. The combined mode ventilation segment held the largest share of the market in 2023 and is anticipated to register the fastest CAGR during the forecast period.

- Based on end user, the market is segmented into hospitals & clinics, home care, ambulatory care centers, and emergency medical services. The hospitals & clinics segment held the largest share of the market in 2023 and is projected to register the fastest CAGR during the forecast period.

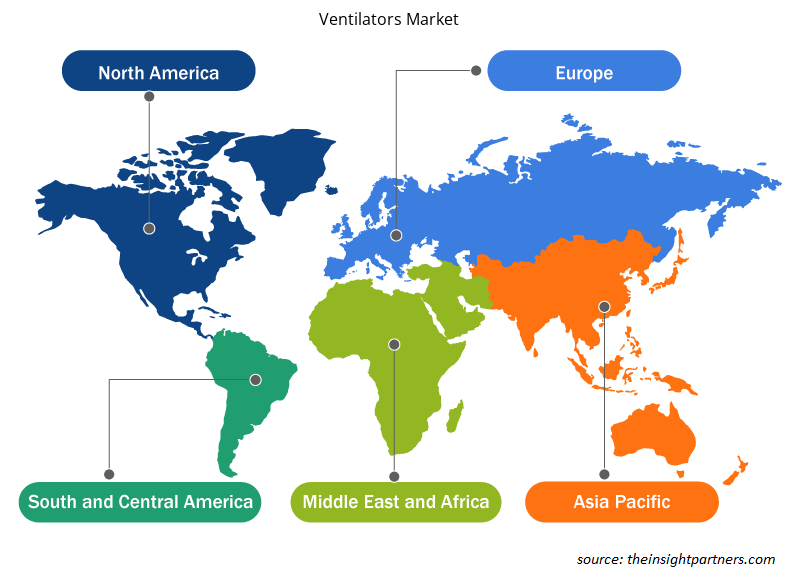

Ventilators Market Share Analysis by Geography

The geographic scope of the ventilators market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the ventilators market. The growth of the market in this region is attributed to the increasing focus of market players in the US and Canada, the high prevalence of respiratory diseases, the increasing geriatric population, the high prevalence of smoking, the highly developed healthcare system, and growing healthcare expenditure. According to the Bronchitis Facts and Statistics published in November 2022, bronchitis is a common reason for the hospitalization of adults in the US. About 1 in 20 US adults suffer from acute bronchitis yearly, and ∼10 million people (i.e., 3% of the population) are affected by chronic bronchitis. Moreover, the Canadian Nurse Association estimated that ~3 million Canadians suffer from one of serious respiratory diseases such as asthma, COPD, lung cancer, cystic fibrosis, sleep apnea, and occupational lung diseases. Further, Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Ventilators Market Regional Insights

The regional trends and factors influencing the Ventilators Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ventilators Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ventilators Market

Ventilators Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3,757.24 Million |

| Market Size by 2031 | US$ 6,860.28 Million |

| Global CAGR (2023 - 2031) | 7.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Mobility

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

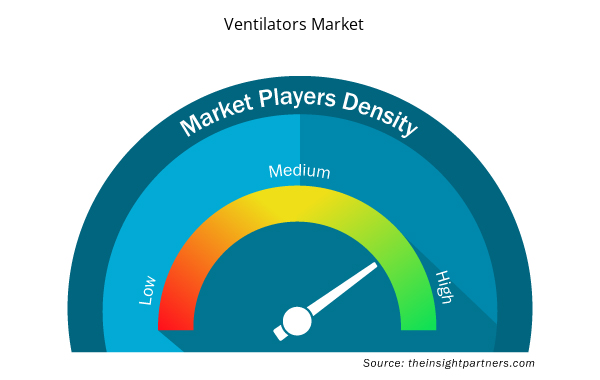

Ventilators Market Players Density: Understanding Its Impact on Business Dynamics

The Ventilators Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ventilators Market are:

- Vyaire Medical Inc

- Getinge AB

- Dragerwerk AG & Co. KGaA

- Fisher and Paykel Healthcare

- GE Healthcare

- Hamilton Medical

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ventilators Market top key players overview

Ventilators Market News and Recent Developments

The ventilators market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the ventilators market are listed below:

- Getinge launched its new Servo-c mechanical ventilator targeting selected markets, offering lung-protective therapeutic tools to treat both paediatric and adult patients. Servo-c is intended to make health care accessible and affordable for more hospitals around the world. (Source: Getinge, Press Release, January 2023)

- Max Ventilator launched multifunctional non-invasive (NIV) ventilators, which come with built-in oxygen therapy and a humidifier. The new offering by the company is easy to use, lightweight, and has unique multifunctional capabilities. A prominent feature of the device that makes it stand out in an ICU setup is that there is a specific provision for connecting this device to a ‘scavenging line.’ (Source: Max Ventilator, Press Release, May 2022)

Ventilators Market Report Coverage and Deliverables

The “Ventilators Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Ventilators market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Ventilators market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Ventilators market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the ventilators market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Mobility, Clinical Indication, Patients, Interface, Mode, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoE, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the ventilators market?

The global ventilators market is estimated to register a CAGR of 7.8% during the forecast period 2023–2031.

What would be the estimated value of the ventilators market by 2031?

The estimated value of the ventilators market accounted for US$ 6,860.28 million in 2031.

Which are the leading players operating in the ventilators market?

Vyaire Medical Inc., Getinge AB, Dragerwerk AG & Co. KGaA, Fisher and Paykel Healthcare, GE Healthcare, Hamilton Medical, Koninklijke Philips NV, Medtronic Plc, ResMed Inc, and BPL Medical Technologies are the market players in the ventilators market.

What are the driving factors impacting the ventilators market?

The growing prevalence of respiratory diseases and rapid growth in geriatric population are the most influential factors responsible for market growth.

Which region dominated the ventilators market in 2023?

North America region dominated the ventilators market in 2023.

Get Free Sample For

Get Free Sample For