Wire Harness Market Growth and Recent Trends by 2030

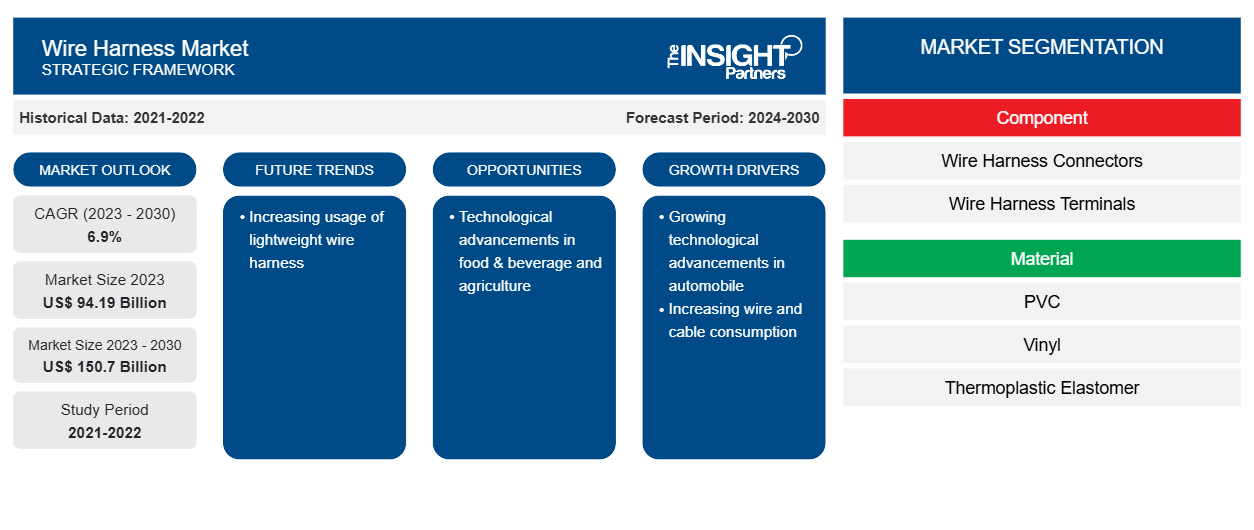

Wire Harness Market Forecast to 2030 - Industry Analysis by Component (Wire Harness Connectors, Wire Harness Terminals, and Others), Material (PVC, Vinyl, Thermoplastic Elastomer, Polyurethane, and Polyethylene), and End User (Automotive, Marine, Aerospace & Defense, Consumer Durables, Medical, Agriculture, Industrial, and Others)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2030- Report Date : Jul 2023

- Report Code : TIPRE00017188

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 218

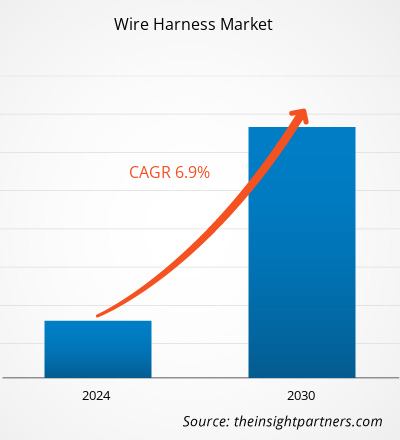

The wire harness market size is projected to reach US$ 150.70 billion by 2030 from US$ 94.19 billion in 2023. It is expected to register a CAGR of 6.9% during 2023–2030.

Analyst Perspective

The governments’ encouragement in various industries is one of the factors contributing to the wire harness market growth. For instance, in December 2021, the Government of India announced an extra tax deduction of US$ 1,879.46 on the purchase of an electric vehicle on loan. Due to this, electric vehicles are gaining traction, leading to the massive demand for wire harnesses. Based on material, the wire harness market is segmented into PVC, vinyl, thermoplastic elastomer, polyurethane, and polyethylene. Wire harnesses manufactured using these materials can withstand varied environmental conditions, thus end users purchase wire harness as per the need. For instance, a wire harness made of polyethylene is suitable for use in moist environment, as polyethylene has ability to resist moisture.

Market Overview

Wire harness (also known as cable harness) are used to transmit electrical power and signals in industries such as automobile, food & beverage, agriculture, and electronics. The wire harness market players are compelled to follow stringent regulations and standards. One such standard is IPC/WHMA-A-620 Revision D, introduced by IPC and Wiring Harness Manufacturer’s Association (WHMA), for the acceptance and requirements of wire harness assemblies. Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; Yura Corporation are among the key players profiled during this market study. In addition to these players, several other essential companies were studied and analyzed to get a holistic view of the wire harness market and its ecosystem. Various strategic initiatives by major wire harness market players and government initiatives are driving the market growth. For instance, in September 2020, Furukawa Automotive Systems Inc. opened its new production facility in North America and Japan to accelerate its production capacity of wire harness.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONWire Harness Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Technological Advancements in Automobiles to Drive Growth of Wire Harness Market

The automotive industry's rapid shift toward advanced technologies is significantly driving the growth of the global wire harness market. To remain competitive and meet evolving consumer expectations, automobile manufacturers are continuously integrating innovative features into new vehicle models. Key technological advancements such as adaptive cruise control, automatic high beam adjustment, self-driving capabilities, and hands-free liftgates are becoming increasingly standard in both premium and mid-range segments. These innovations necessitate highly sophisticated electrical systems, in which wire harnesses serve as critical infrastructure. Wire harnesses function as the central nervous system of a vehicle's electrical architecture, bundling thousands of wires and connectors into organized, secure pathways. On average, a modern vehicle may contain around 40 wire harnesses, incorporating approximately 3,000 wires and 700 connectors—equivalent to nearly 5 kilometers of cabling. These harnesses support connectivity across vital automotive systems, including powertrains, lighting, infotainment, battery management, climate control, and advanced driver-assistance systems (ADAS). As vehicle complexity continues to grow, so does the demand for reliable and efficient wire harness solutions. Recent automotive launches underscore this trend. For instance, in July 2022, Mahindra introduced the new-generation Scorpio-N, which includes cutting-edge features such as the AdrenoX infotainment interface, a 12-speaker Sony audio system, and connected car technology. These additions significantly increase the complexity of the vehicle’s electrical network, thereby boosting demand for high-performance wire harness systems. Similarly, Toyota's teaser launch of the i-Connect system further demonstrates the automotive sector’s growing emphasis on connected technology, requiring robust and adaptable wiring solutions. In parallel, the global shift toward electric mobility is further amplifying demand. The rise of electric vehicles (EVs) and plug-in hybrid models introduces a new layer of complexity to electrical architecture, with additional requirements for high-voltage wiring, thermal management, and battery integration. Wire harnesses must now accommodate the unique needs of EV platforms, from power delivery and energy regeneration to real-time data transmission between vehicle subsystems. Additionally, developments in vehicle-to-grid (V2G) technology, such as Pacific Gas and Electric Company’s pilot programs launched in May 2022, highlight new applications where electric vehicles can function as mobile energy storage units. This advancement introduces further demand for intelligent and high-capacity wire harnesses capable of managing bi-directional power flow. In conclusion, as the automotive sector continues to embrace digital transformation and electrification, the role of wire harnesses becomes increasingly integral. Suppliers and OEMs investing in high-quality, durable, and flexible harness systems will be well-positioned to capitalize on this sustained market momentum.

Segmental Analysis:

Based on end user, the wire harness market size is segmented into automotive, marine, aerospace & defense, consumer durables, medical, agriculture, industrial, and others. The automotive segment led the market in 2022, owing to the growing production of vehicles globally as a normal passenger car employs over 3,000 wire harness connectors.

Regional Analysis

The global wire harness market is divided into five regions: North America, Asia Pacific (APAC), Europe, the Middle East & Africa (MEA), and South America (SAM). Asia Pacific held the highest market share with a CAGR of 8.9% in the wire harness market in 2022. The region comprises some of the world's fastest-growing and leading economies. The Asia Pacific wire harness market is segmented as China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The region is characterized by the presence of developed economies such as Japan and Australia along with emerging economies such as China, India, Vietnam, and Malaysia. Some of these are agriculture-dominated countries. Moreover, the rise in GDP, large-scale industrialization, and rise in the standard of living are some of the factors propelling the growth of the wire harness market in the region.

Key Player Analysis

The wire harness market consists of players such as Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; and Yura Corporation. Among the players in the wire harness market Yazaki Corporation Inc and Sumitomo Electric Industries are the top two players owing to the diversified product portfolio offered.

Wire Harness

Wire Harness Market Regional InsightsThe regional trends influencing the Wire Harness Market have been analyzed across key geographies.

Wire Harness Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 94.19 Billion |

| Market Size by 2030 | US$ 150.7 Billion |

| Global CAGR (2023 - 2030) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wire Harness Market Players Density: Understanding Its Impact on Business Dynamics

The Wire Harness Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Recent Developments

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the wire harness market. A few recent key market developments are listed below:

- In 2021 Faraday Future, a smart mobility ecosystem company, partnered with DRAXLMAIER Group for the supply of Interior consoles for FF 91 vehicles. Under the partnership agreement, DRAXLMAIER Group would supply front and rear center consoles for FF 19.

- In 2021, Lear entered into a joint venture with Hu Lane Associate Inc., automotive connector products manufacturer. This joint venture extends Lear's ability of connector system products manufacturing and makes it more competitive in the wire harness business. In the same year, Lear became the leading investor for the Series C round of financing in CelLink Corporation, flat and flexible circuit manufacturer.

- In 2021, Sumitomo Electric and Valens Semiconductor formed a collaboration for making Sumitomo's wiring harness systems meet the channel needs of the A-PHY specifications. The collaboration has been made for A-PHY technology and departments.

- In 2021, Lear acquired M&N Plastics, Michigan-based engineered plastic components for automotive electrical distribution manufacturer and injection moulding specialist. This acquisition extends Lear's capacity of production of high-voltage wire harnesses.

- In 2021, Nexus expanded its production ability by opening of cable harness production facility at Tinjanin, China. With the addition of this facility, Nexans owns a global production capacity of production of more than a million harnessed cables every year.

Frequently Asked Questions

2. Increasing Wire and Cable Consumption

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For