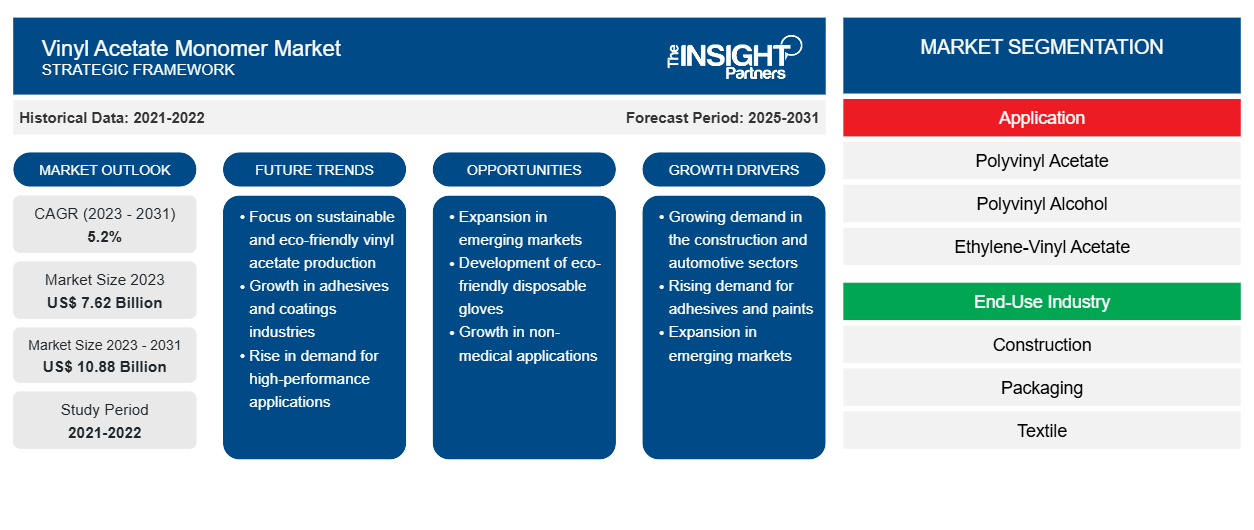

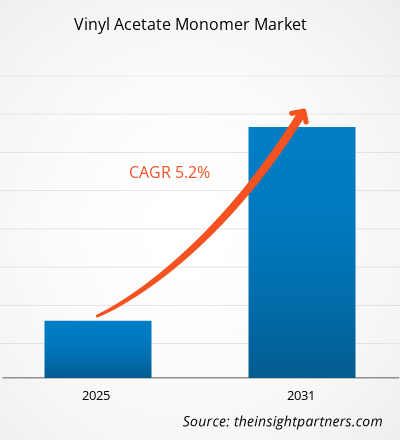

The Vinyl Acetate Monomer Market size is projected to reach US$ 10.88 billion by 2031 from US$ 7.62 billion in 2023. The market is expected to register a CAGR of 5.2% in 2023–2031. Growing demand from various end-use industries is likely to remain key vinyl acetate monomer market trends.

Vinyl Acetate Monomer Market Analysis

The market is primarily driven by the factors such as increasing demand of vinyl acetate monomer from various end-use industries. Vinyl acetate monomer (VAM) is an important intermediate used to make a number of polymers and resins. Vinyl acetate monomer is a crucial raw material used to make chemicals, which are then utilized to manufacture a wide range of consumer and industrial products. Polyvinyl acetate has strong adhesion properties for various materials, including paper, wood, plastic films, and metals. These factors are significantly driving the global vinyl acetate monomer market globally.

Vinyl Acetate Monomer Market Overview

The vinyl acetate monomer market is an important segment of the chemical industry. Vinyl acetate monomer is an important building element in the synthesis of different polymers and resins, such as polyvinyl acetate (PVA), polyvinyl alcohol (PVOH), and ethylene-vinyl acetate (EVA) copolymer. These materials are commonly utilized in sectors such as adhesives, paints, coatings, textiles, and packaging. Factors influencing the worldwide vinyl acetate monomer market include economic expansion, industrialization, and technological advancement.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vinyl Acetate Monomer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vinyl Acetate Monomer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Vinyl Acetate Monomer Market Drivers and Opportunities

Growing Demand from Various End-Use Industries

Vinyl acetate monomer is an essential material in the manufacture of many polymers and resins. Vinyl acetate monomer is the key raw material used for the production of polyvinyl acetate (PVA), polyvinyl alcohol (PVOH), ethylene-vinyl acetate (EVA), etc. Polyvinyl acetate has strong adhesion properties for various materials, including paper, wood, plastic films, and metals. It is also an important ingredient in wood glue, white glue, carpenter’s glue, and school glue. Polyvinyl alcohol is used for adhesive packaging films. The increasing demand for adhesives from various industries such as construction, furniture, etc., is driving the market growth.

Increasing Utilization in Electronics Manufacturing

Ethylene-vinyl acetate is a thermoplastic polymer, which is used in solar cells/modules as an encapsulating agent. Ethylene-vinyl acetate is one of the most widely used encapsulant materials for photovoltaic modules. The photovoltaic module with this type of encapsulation protects cells from mechanical damage and moisture infiltration. Encapsulant sheets play an essential role in preventing water and dirt from penetrating solar panels. There is increasing use of ethylene-vinyl acetate for encapsulating solar panels due to its various properties desired for solar modules such as high electrical resistance, low water absorption characteristics, excellent optical transmission, good adhesive properties, high elasticity, etc.

Vinyl Acetate Monomer Market Report Segmentation Analysis

Key segment that contributed to the derivation of the vinyl acetate monomer Market analysis is grade.

- Based on application, the vinyl acetate monomer market is segmented into polyvinyl acetate (PVA), polyvinyl alcohol (PVOH), ethylene-vinyl acetate (EVA), and others. The polyvinyl acetate (PVA)sub-segment held a larger market share in 2023.

- Based on end-use industry, the vinyl acetate monomer market is sub-segmented into construction, packaging, textile, and others. The construction sub-segment held a larger market share in 2023.

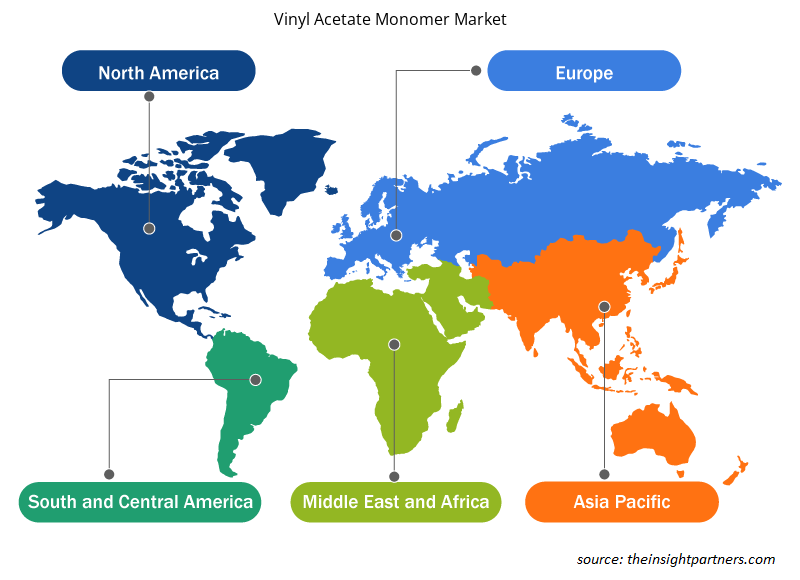

Vinyl Acetate Monomer Market Share Analysis by Geography

The geographic scope of the Vinyl Acetate Monomer Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Asia Pacific is witnessing an upsurge due to growth in urbanization, the robust growth of the automotive and construction sectors which offers ample opportunities for key market players in the vinyl acetate monomer market. Thus, the rise in the construction activities is expected to further boost the global vinyl acetate monomer market expansion in the coming years.

Vinyl Acetate Monomer Market Regional Insights

The regional trends and factors influencing the Vinyl Acetate Monomer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Vinyl Acetate Monomer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Vinyl Acetate Monomer Market

Vinyl Acetate Monomer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.62 Billion |

| Market Size by 2031 | US$ 10.88 Billion |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Vinyl Acetate Monomer Market Players Density: Understanding Its Impact on Business Dynamics

The Vinyl Acetate Monomer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Vinyl Acetate Monomer Market are:

- Celanese Corporation

- Chang Chun Group

- China Petroleum & Chemical Corporation

- Dairen Chemical Corporation

- Japan VAM & POVAL Co. Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Vinyl Acetate Monomer Market top key players overview

Vinyl Acetate Monomer Market News and Recent Developments

The Vinyl Acetate Monomer Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for vinyl acetate monomer and strategies:

- Dairen Chemical Aims to Cease VAM Production at Mayliao Facility in March. (Source: Dairen Chemical, Website, 2024)

- Celanese Corporation announced the completion of an ultra-low capital initiative to repurpose existing manufacturing and infrastructure assets to enable extra ethylene vinyl acetate (EVA) capacity at its Edmonton, Alberta site. The development will help the Acetyl Chain's downstream vinyl offering expand significantly. (Source: Celanese Corporation, News, 2023)

Vinyl Acetate Monomer Market Report Coverage and Deliverables

The “Vinyl Acetate Monomer Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Thermal Energy Storage Market

- Data Center Cooling Market

- Virtual Event Software Market

- Flexible Garden Hoses Market

- Digital Pathology Market

- Transdermal Drug Delivery System Market

- Rare Neurological Disease Treatment Market

- Intraoperative Neuromonitoring Market

- Europe Tortilla Market

- Single Pair Ethernet Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For