Digital Pathology Market Growth and Forecast by 2028

Digital Pathology Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Product (Scanners, Software, Storage, and Communication Systems), Type (Human Pathology and Veterinary Pathology), Application (Drug Discovery, Disease Diagnostics, Teleconsultation, and Training & Education), and End User (Pharma and Biotech Companies, Hospitals, and Academics)

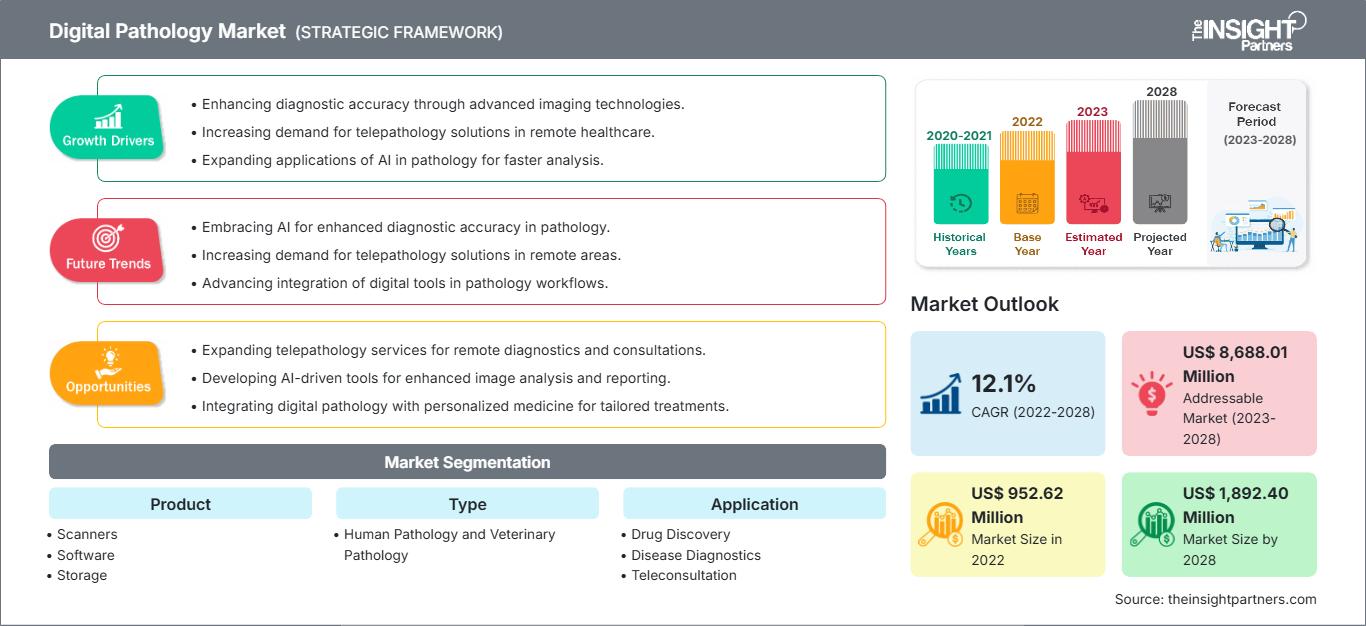

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Aug 2022

- Report Code : TIPHE100000855

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 226

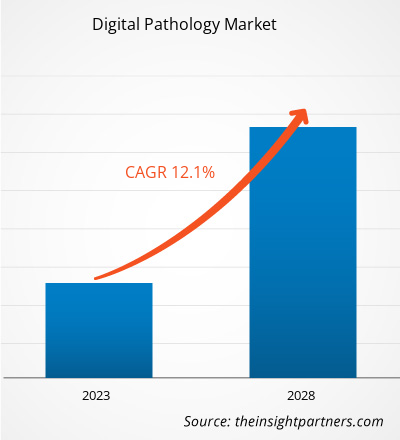

[Research Report] The digital pathology market is expected to grow from US$ 952.62 million in 2022 to US$ 1,892.40 million by 2028; it is estimated to grow at a CAGR of 12.1% from 2022 to 2028.

Market Insights and Analyst View:

Digital pathology includes the acquisition, management, sharing, and interpretation of pathology information, which includes slides and data in a digital environment. A digital slide image file is generated, allowing for high-resolution viewing, interpretation, and image analysis of digital pathology slides. Digital pathology allows pathologists to engage, evaluate, and collaborate rapidly and remotely, with transparency and consistency, thus improving efficiency and productivity. The future of digital pathology could eventually encompass enhanced translational research, computer-aided diagnosis (CAD), and personalized medicine. Digital pathology offers benefits not easily achieved with glass slides alone, such as improved analysis and reduced errors.One of the significant benefits of digital pathology is the many ways it improves productivity in the short and long term.

Growth Drivers and Challenges:

Periodic diagnosis is the first step of every cancer treatment. With the help of the traditional pathology services, one can only understand where the tumors cells are located; this makes it difficult to share the cases for a second review. The use of digital pathology allows the in-depth diagnosis of tumors. The digital pathology procedure for cancer diagnosis typically involves scanning conventional glass slides and, after digitally uniting successive images into a single, whole image that replicates the information on the glass slide. The pictures are clubbed with associated clinical/hospitals or labs to provide pathologists with an integrated picture of each unique cancer condition. In April 2017, Philips received an FDA clearance to market the Philips IntelliSite Pathology Solution for primary diagnostic use in the US. With the continuously growing number of cancer cases, the complexity and number of tests are increasingly simultaneously. The Philips IntelliSite Pathology Solution facilitates automated digital pathology via image creation, viewing, and management systems, among others, featuring ultrafast pathology slide scanner, among other features of the scanner. Similarly, in January 2021, Roche launched the CE-IVD automated digital pathology algorithms, capable of uPath HER2 Dual ISH image analysis and uPath HER2 (4B5) image analysis for breast cancer diagnosis, which also helps healthcare providers determine the best treatment strategy for each patient. Artificial intelligence is used in image analysis algorithms to assist pathologists in achieving quick and accurate patient diagnoses of breast cancer. Thus, technological developments in the cancer diagnostics are boosting the digital pathology market growth.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDigital Pathology Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Digital Pathology Market” is segmented based on product, type, application, end user, and geography. Based on product, the digital pathology market is segmented into scanners, software, communication system, and storage. Based on type, the digital pathology market is bifurcated into human pathology and veterinary pathology. Based on application, the digital pathology market is segmented into teleconsultation, disease diagnosis, drug discovery and training & education. Based on end user, the digital pathology market is segmented into pharma & biotech companies, hospitals, and academic. The digital pathology market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on product, the digital pathology market is segmented into scanners, software, storage, communication. The scanners segment held the largest share of the market in 2021, also the same segment is anticipated to register the highest CAGR of 12.3% in the market during the forecast period. Scanners help in producing quick, reliable, and high-resolution images of cells. It helps pathologists, histologists, and other medical professionals scan slides and upload the images on the network for remote access and to collaborate with peers. The scanners provide automated cellular imaging for fixing cell assays and fluorescence, phase contrast and transmit light. The technological advancement has added integrated software along with the scanners for further analysis, edit, manage, and share virtual slides. For instance, in April 2021, Optra scan, the leading end-to-end digital pathology solution provider, launched OS-ultra 320 the world’s first-ever affordable high-speed digital pathology scanner.

The pathology imaging system uses the new scanner technology and software for pathological exams to digitise the slides. It has replaced the standard slides and microscope pathology workflow. Pathologists can examine high-quality digital photographs of the pathology workflow with the assistance of precision instruments by digitising slides. This system can store images in a computer, improving the pathology workflow. Thus, the pathology imaging system market is expected to grow.

Based on type, the digital pathology market is segmented into human pathology and veterinary pathology. The human pathology segment is anticipated to hold the largest market share of 65.94% in 2022 and is expected to register the highest CAGR of 12.5% during the forecast period. The major driving factors for the growth of the human pathology segment are the increasing number of cancer research activities and growing collaborations among research institutes, universities, and pathology laboratories. Human Pathology is delineated to bring information of clinicopathologic significance to human disease to the laboratory and clinical physician. It represents information drawn from morphologic and clinical laboratory studies with direct applicability to understanding human diseases. It covers every aspect of patient care, from diagnostic testing and treatment advice to using cutting-edge genetic technologies and preventing disease.

Based on application, the digital pathology market is segmented into teleconsultation, disease diagnosis, drug discovery and training & education. In 2021, the drug discovery segment is likely to hold the largest share of the market, and same segment is expected to grow at the fastest rate during the coming years. The advantages of digital pathology are not just restricted to improved speed and accurate results, but it also allows pathologists to present their expertise over geographic distances but also to pharmaceutical and biotechnological companies. The biotechnology and pharmaceutical companies always face problems with reviewing and analyzing thousands of slides in a preclinical study, digital pathology automates image analysis, provide instant and intelligent access to unmanageable amounts of histopathologic data to speed the discovery process ultimately. The researchers in companies can view digital slides on internet for vast improvement over current single field of view image viewing approaches.

Based on end users, the digital pathology market is segmented into pharma & biotech companies, hospitals, and academics. The pharma & biotech companies’ segment is likely to hold the largest share of the market in 2021 however, the recombinant vaccines segment is anticipated to register the highest CAGR of 12.5% of the market during the forecast period. Pharmaceutical and biotechnology companies are taking initiatives to manage their work digitally; the companies are constantly engaged in discovering molecules and biomarkers for drugs or therapies. Digital pathology aids in transforming global pharmaceutical research by enabling data sharing to pharmaceutical companies and R&D labs. These companies evaluate drugs by collecting and analyzing data with the help of patient’s conditions. Digital pathology solution helps these companies to maintain records and for effective workflow management of the workflow. For instance, companies such as Agilent Technologies, Genentech are partnering with AI companies to upgrade their process such as digitization of their pathology labs and advanced therapy production.

Regional Analysis:

Based on geography, the digital pathology market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America is likely to capture a significant share of the global market in 2021, owing to the increasing burden of chronic diseases, the growing adoption of technologies in chronic disease management, rising investments, increasing product launches, and initiatives the market leaders take. The US is expected to grow significantly during the forecast period. The growing cases of chronic diseases such as cancer, Alzheimer's disease, and others are anticipated to propel the digital pathology market. For instance, the American Cancer Society 2022 report estimated that around 2,36,740 new cases of lung cancer will be diagnosed in the US in 2022. The same source also stated that 79,000 new cases of kidney cancer will be reported in 2022. Furthermore, the International Diabetes Federation (IDF) report in December 2021 estimated that 14 million adults in Mexico were living with diabetes in 2021. Also, as per a press release by the government of Canada published in August 2021, diabetes is the major chronic disease affecting Canadians, where over 3 million Canadians and 6.1% of Canadian adults were at high risk of developing diabetes as of August 2021. The high burden of cancer is expected to boost the demand for digital pathology, thereby driving market growth.

Europe is the second leading region in the global cell development market. Germany is holding the largest share in the Europe digital pathology market during the forecast period due to the factors such as the increase in the support for the digital pathology projects, education, and training programs in France, rising cancer prevalence and adoption of digital pathology solution in UK and increasing number of conferences in Germany are likely to boost the growth of digital pathology market in Europe are the factors fueling the growth of digital pathology market in Europe.

Digital Pathology Market Regional InsightsThe regional trends and factors influencing the Digital Pathology Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Digital Pathology Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Digital Pathology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 952.62 Million |

| Market Size by 2028 | US$ 1,892.40 Million |

| Global CAGR (2022 - 2028) | 12.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Digital Pathology Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Pathology Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Digital Pathology Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global digital pathology market are listed below:

- In June 2022, SpIntellx, Inc., and Inspirata collaborated to integrate the SpIntellx HistoMapr-Breast platform and Inspirata’s Dynamyx software into a seamless solution. HistoMapr-Breast is the only computational pathology software that taps the power of explainable artificial intelligence (xAI) for healthcare providers to diagnose, prognosticate and treat breast cancer more accurately and efficiently.

- In June 2022, Roche got CE-IVD approval, marking the next-generation Ventana DP 600 slide scanner for digital pathology.

- In May 2020, Danahar (Leica Biosystems) launched the Aperio GT 450 DX, its next generation digital pathology scanner, in the APAC region. With continuous loading, no-touch operation, and 32 second scan time at 40x magnification, the Aperio GT 450 DX, registered as CE IVD and TGA, allows healthcare organizations to scale up digital pathology so they can meet ever-increasing demands without sacrificing quality.

- In July 2020, three key members of 3DHISTECH’s PANNORAMIC scanner range, PANNORAMIC 250 Flash III, PANNORAMIC Scan II and PANNORAMIC Midi II as well as their control software have been upgraded to even better serve the diverse needs of cancer and pharmaceutical research, molecular and developmental histology, neuroscience and many more.

- In August 2020, Danahar (Leica Biosystems), a global leader in pathology workflow solutions, announced the European launch of its Aperio GT 450 DX digital pathology scanner. This next generation imaging system was unveiled at the highly successful Leica Biosystems Digital Pathology Virtual Summit and is already installed at the Centre of Excellence at Leeds Teaching Hospitals NHS Trust NHS, UK.

- In October 2020, Indica Labs, announced the formal launch of an enterprise-wide, cloud-based deployment of Indica Labs’ software within the National Cancer Institute (NCI), including HALO, HALO AI, HALO Link and HALO AP. Accessible to hundreds of users within the NCI, managing millions of digital images, and facilitating the analysis of thousands of images daily, this is the largest single deployment of Indica Labs’ software world-wide.

- In May 2020, Danahar (Leica Biosystems), the global leader in pathology workflow solutions, and the international medical imaging IT and cybersecurity company, Sectra, announced a collaboration to seek a combined 510(k) clearance from the U.S. Food & Drug Administration (FDA) soon. The goal is for the integrated clinical digital pathology solution to address the clinical needs of enterprise level customers such as academic medical centers, clinical research organizations and large hospital networks.

Competitive Landscape and Key Companies:

Some of the prominent players digital pathology companies include Koninklijke Philips N.V., Nikon Corporation, Perkin Elmer, Inc., Indica Labs, 3DHISTECH Ltd., Danaher, Hamamatsu Photonics K.K., F. HOFFMANN-LA ROCHE LTD., Visiopharm A/S, and Glencoe Software, Inc among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their digital pathology market share.

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For