Wire Rod Market - Global Size, Share, Trends & Forecast to 2031

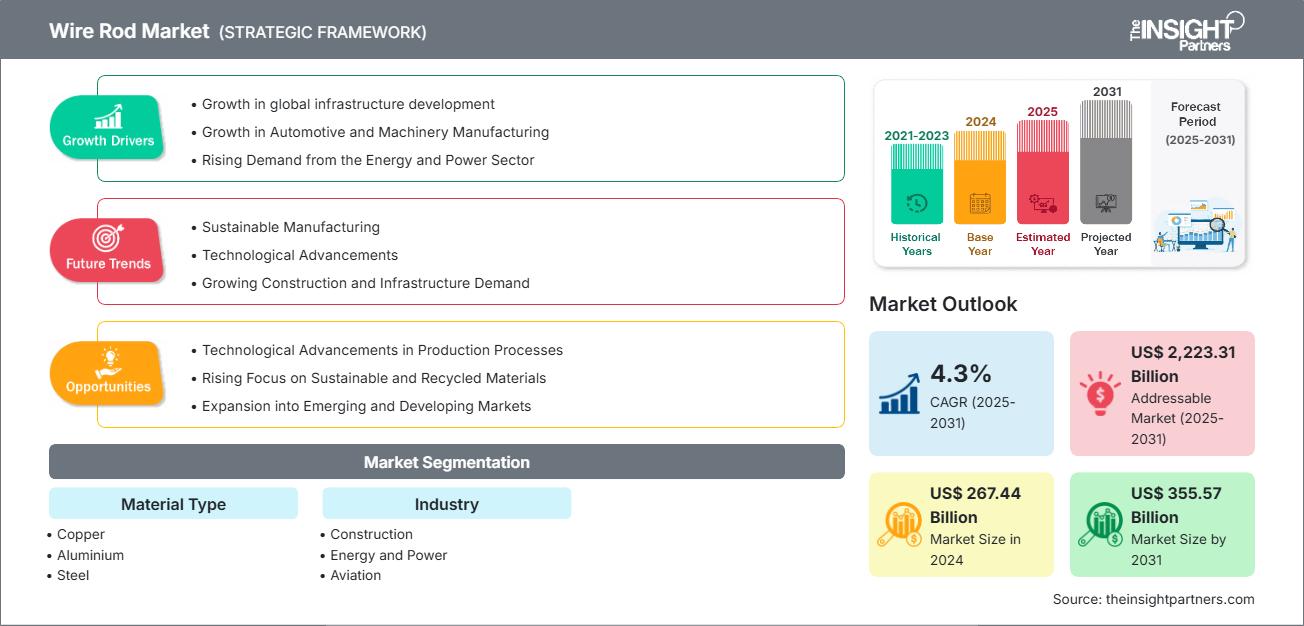

Wire Rod Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type (Copper, Aluminium, and Steel), By Industry [Construction (Copper, Aluminium, and Steel), Energy and Power (Copper, Aluminium, and Steel), Aviation (Copper, Aluminium, and Steel), Automotive (Copper, Aluminium, and Steel), and Others (Copper, Aluminium, and Steel)], and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00029840

- Category : Manufacturing and Construction

- No. of Pages : 225

- Available Report Formats :

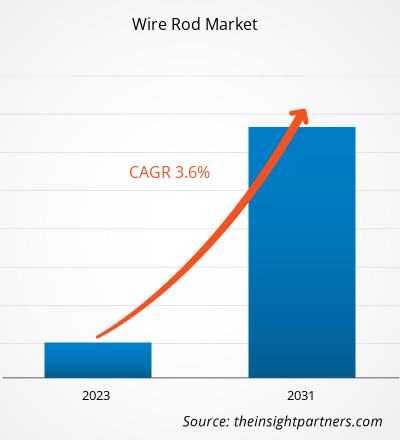

The wire rod market size is projected to reach US$ 355.57 billion by 2031 from US$267.44 billion in 2024. The market is expected to register a CAGR of 4.3% during 2025–2031.

Wire RodMarket Analysis

The wire rod market is driven by several interrelated factors that catalyze demand and shape industry growth. A primary driver is the increasing use of wire rods in key end-use sectors such as construction, automotive, and infrastructure development. Moreover, the ongoing urbanization and infrastructural expansion worldwide, especially in emerging economies such as China and India, necessitate large-scale consumption of wire rods for reinforcing concrete structures, making metal products, and manufacturing steel wires. This sustained demand from the construction sector is fundamental in propelling the market forward.

Wire RodMarket Overview

Wire rods are long, coiled steel bars with relatively small diameters produced through hot rolling, which serve as fundamental raw materials in various industries due to their versatility, high strength, ductility, and flexibility. Moreover, the wired rods, typically made using steel, are essential components used to manufacture a wide range of products and structural elements. Furthermore, wire rods are widely used in the construction industry for producing welding wire, steel mesh, tie wire, and reinforcement bars, providing structural stability and tensile strength for buildings, bridges, and other infrastructure projects. Furthermore, in the automotive sector, wire rods are crucial for making strong and durable components such as suspension springs and brake cables. Additionally, in the electrical and electronics manufacturing, wire rods are used to produce electrical cables and wires, etc, due to their conductivity and consistent quality.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONWire Rod Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Wire Rod Market and Opportunities

Market Drivers:

- Growth in global infrastructure development The expansion of public infrastructure, including bridges, railways, and highways, has spurred demand for wire rods. Economies such as India and Indonesia are aggressively rolling out construction projects backed by government capital spending, creating a strong consumption base for wire rods.

- Growth in Automotive and Machinery Manufacturing Automotive producers and industrial equipment manufacturers are increasing their output capacities and adopting higher-strength materials, creating significant opportunities for wire rods used in fasteners, bearings, and springs.

- Rising Demand from the Energy and Power Sector Wire rods are essential for producing cables, conductors, and various mechanical components used in power generation and grid expansion. As global energy consumption continues to expand, the demand for reliable wire rod products will continue to grow in the near future.

Market Opportunities:

- Technological Advancements in Production Processes Manufacturers investing in automation, sensor-based quality control, and green production systems can achieve better energy utilization and reduced emissions, key differentiators in winning large-scale industrial contracts.

- Rising Focus on Sustainable and Recycled Materials Producers integrating recycled steel or low-carbon production practices are increasingly favored by regulatory bodies and customers alike. This creates market opportunities for eco-conscious manufacturers to build brand equity.

- Expansion into Emerging and Developing Markets Rapid industrialization, urban expansion, and increasing foreign direct investment in manufacturing are driving local demand for wire rod products. Strategic entry into emerging markets such as Asia significantly strengthens global market presence.

Wire Rod Market Report Segmentation Analysis

The global wire rod market is segmented to provide a clearer view of its operation, growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Material Type

- Copper: Copper is a dominant material in the wire rod market due to its exceptional electrical and thermal conductivity.

- Aluminium: The high conductivity-to-weight ratio makes it ideal for electrical transmission lines, overhead cables, and large-scale power distribution projects.

- Steel: Steel is a versatile and widely used material in the wire rod market, valued for its high tensile strength, durability, and mechanical robustness.

By Industry

- Construction (Copper, Aluminium, and Steel): The construction industry is one of the largest consumers of wire rods, primarily due to their critical role in reinforcing concrete structures.

- Energy and Power (Copper, Aluminium, and Steel): The energy and power segment represents a pivotal end-user industry within the global wire rod market, particularly regarding the use of copper, aluminium, and steel wire rods.

- Aviation (Copper, Aluminium, and Steel): The aviation industry demands high-performance materials that can withstand extreme operational conditions, making wire rods a critical component in aircraft manufacturing and maintenance.

- Automotive (Copper, Aluminium, and Steel): The demand for wire rods in the automotive industry is driven by the need for materials that offer high tensile strength, fatigue resistance, and corrosion resistance while maintaining cost-efficiency.

- Others (Copper, Aluminium, and Steel): Wire rods find extensive applications in several other industries, including energy, machinery, railways, shipbuilding, and electronics

By Geography:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The wire rod market blades in Asia Pacific are expected to witness the fastest growth. The growth in the market is driven due to rapid industrialization and urbanization in key countries such as China, India, and Japan, which collectively contribute a major portion of the global production and consumption of wire rods.

Wire Rod Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 267.44 Billion |

| Market Size by 2031 | US$ 355.57 Billion |

| Global CAGR (2025 - 2031) | 4.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wire Rod Market Players Density: Understanding Its Impact on Business Dynamics

The Wire Rod Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Global Wire Rod Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South America and the Middle East and Africa also have many untapped opportunities for wire rod providers to expand.

The global wire rod market grows differently in each region, owing to differences in economic development, industrial activity, infrastructural investments, and sectoral demands. Below is a summary of market share and trends by region:

1. North America

- Market Share: Growth is fueled by the expansion of industrial manufacturing and the increasing demand from automotive and construction sectors.

- Key Drivers: Modernization of the construction industry and growing infrastructure developments.

- Trends: Growing usage of eco-friendly production processes.

2. Europe

- Market Share: Substantial share due to growing infrastructural developments.

- Key Drivers: The growing automotive industry within the region, coupled with advancements in manufacturing technologies.

- Trends: Growing usage of eco-friendly production processes.

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year.

- Key Drivers: Industrial manufacturing growth in machinery, construction equipment, and electronics, coupled with growing urbanization and industrialization.

- Trends: Growing adoption of advanced manufacturing technologies.

4. South America

- Market Share: A growing market with steady progress driven by expansion in the automotive as well as construction sectors.

- Key Drivers: Rising demand for high-performance cutting tools alongside growing construction projects and automobile production.

- Trends: Growing use of high-strength and corrosion-resistant wire rods enabled by technological improvement

5. Middle East and Africa

- Market Share: Growth is driven primarily by the expanding automotive industry, rapid urbanization, and infrastructure development.

- Key Drivers: Growing automotive production and sales, coupled with increasing investments in renewable energy projects such as solar and wind power.

- Trends: Increasing adoption of aluminum wire rods in the automotive and electrical industries.

Wire Rod Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of established players such as Hindalco Industries Ltd, Mitsubishi Materials Trading Corp, and Norsk Hydro ASA. Regional and niche providers such as EVRAZ North America (North America), Gerdau S/A (Brazil), SHAGANG GROUP Inc. (China), and Nippon Steel (Japan) are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by:

- Modernize production by making use of automation, digitalization, as well as AI-driven process controls.

- Invest in advanced manufacturing technologies such as continuous annealing.

- Develop specialty wire rods that are tailored to emerging needs, such as automotive components for electric vehicles.

Opportunities and Strategic Moves

- Develop customized wire rod grades with advanced surface treatments to address specialized applications.

- The adaptation of automation, AI-driven process control, and digitalization

- Expand product portfolios to serve a wider range of industries.

Other companies analyzed during the course of research:

- ArcelorMittal Bars & Rods

- EVRAZ North America

- Gerdau S/A

- SHAGANG GROUP Inc.

- Nippon Steel

- Central Wire Industries

- FAGERSTA STAINLESS AB (Marcegaglia Group)

- Emirates Steel (UAE)

- Bhushan Power & Steel Limited (BPSL)

- Qingdao Ansteel Group Co., Ltd.

- CITIC Pacific Special Steel Co., Ltd

- Jiangyin Zenith Metals Co., Ltd.

- Ivaco Rolling Mills

- Dubai Cable Company (Private) Limited

- Southwire Company, LLC

Wire Rod Market News and Recent Developments

- Hindalco Industries Ltd Invests in its aluminium, copper, and specialty alumina business in India The Hindalco Industries Ltd, a Mumbai-based metals company, will invest 450 billion rupees ($5.21 billion) in its aluminum, copper, and specialty alumina businesses in India.

Wire Rod Market Report Coverage and Deliverables

The "Global Wire Rod Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Global Wire Rod market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Global Wire Rod market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Global Wire Rod market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Global Wire Rod market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For