North America HVAC Chillers Market Key Players and Forecast by 2031

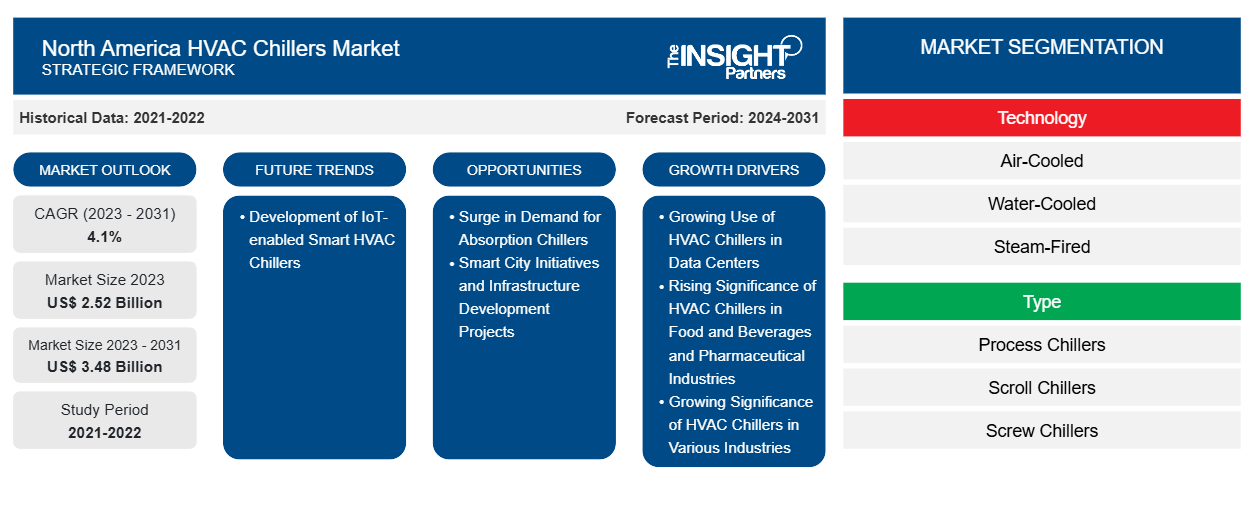

North America HVAC Chillers Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Air-Cooled, Water-Cooled, and Steam-Fired), Type (Process Chillers, Scroll Chillers, Centrifugal Chillers, and Absorption Chillers), Application (Industrial, Commercial, and Residential), and Country

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Nov 2024

- Report Code : TIPRE00026117

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 107

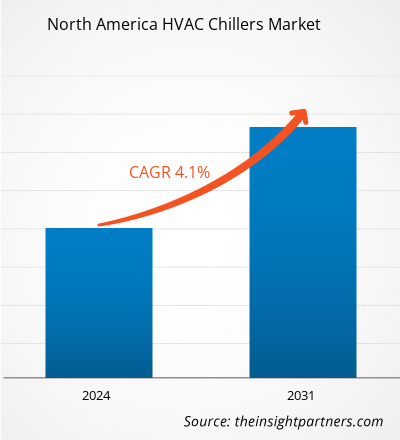

The North America HVAC chillers market size is expected to reach US$ 3.48 billion by 2031 from US$ 2.52 billion in 2023. The market is estimated to record a CAGR of 4.1% from 2023 to 2031. The development of IoT-enabled smart HVAC chillers is likely to be a key market trend.

North America HVAC Chillers Market Analysis

Heating, ventilation, and air conditioning (HVAC) chillers play a significant role in the cooling process in residential, industrial, and commercial places. Growing industrialization and rising number of commercial hubs such as offices, hotels, eateries, shopping malls, and entertainment places are positively impacting the utilization of HVAC chillers across North America. Additionally, the rising humidity concerns in both developed and developing countries in the region and the surging demand for air conditioning systems for comfort are boosting developments in the North America HVAC chillers market. HVAC chillers are widely used across industries such as chemicals, manufacturing, pharmaceuticals, electronics & semiconductors, aerospace & defense, food & beverages, metal and mining, cold storage, turbine, and leather processing. The growing number of manufacturing plants, industrial hubs, and commercial data centers is fueling the application of HVAC chillers. The increased inclination toward district cooling systems in industries and high-rise buildings is a major factor boosting the North America HVAC chillers market growth.

North America HVAC Chillers Market Overview

The rising adoption of HVAC chillers in the residential sector, growing disposable income, rapid urbanization, and continuous development of tourism industries in different countries in the region contribute to the North America HVAC chillers market growth. The construction of new hotels, individual houses, residential complexes, and public infrastructure has increased the demand for HVAC chillers across North America.

The growing proliferation of green building projects and third-party data centers is expected to create favorable opportunities for HVAC chillers market players in North America. In addition, the growing emphasis on energy-efficient and cost-effective HVAC chillers is also creating immense scope for specific HVAC chillers, such as water-cooled and air-cooled chillers, in industrial, commercial, and residential spaces..

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America HVAC Chillers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America HVAC Chillers Market Drivers and Opportunities

Rising Significance of HVAC Chillers in Food and Beverages and Pharmaceutical Industries

In the food and beverages industry, HVAC chillers are predominantly utilized to maintain a temperature-controlled environment to preserve stored food and beverage products. The demand for processed, canned, and easy-to-make food items is on the rise in the US with the growing population, rising urbanization, increasing disposable income, and busy lifestyles. Moreover, their taste and convenience of cooking render them popular among youth in the country. Canned or convenience food items require proper storage facilities to maintain them in consumable conditions. Processed foods are highly likely to rot within a few days or weeks if not preserved well. Optimal temperature and proper storage conditions are critical for extending the shelf life of processed or canned food, which results in the demand for HVAC chillers. Thus, the significance of HVAC chillers in industries such as food and beverages propel the North America HVAC chillers market.

Imports and exports of food products have a significant impact on North American and US food security and the economy. The import of food products has intensified in recent years with population growth and urbanization. In 2023, India exported pharmaceuticals and drugs worth INR 606 billion (~US$ 7.21 billion) to the US. On the other hand, the US exported ~US$ 93.6 billion and imported ~US$ 163 billion worth of pharmaceutical products in 2022. In 2023, the value of food and farm products exported from the US to the world totaled nearly ~US$ 175 billion. Soybeans, cotton, corn, wheat, and other bulk commodities accounted for ~34% of all US agricultural exports in 2023. Thus, the growing development in the food and beverages and pharmaceutical industries and rising import and export activities are driving the North America HVAC chillers market.

Surge in Demand for Absorption Chillers

Absorption chillers mainly contain lithium bromide-water (LiBr/H2O) and ammonia-water as prime elements for refrigeration application. Distinct from conventional compression chillers, absorption chillers exploit heat energy instead of mechanical energy for cooling purposes. One of the major end-use applications of absorption chillers is witnessed in residential refrigerators. Absorption chillers are also used in industrial and commercial refrigeration. Absorption chillers are finding end-use applications in the oil and petroleum industry, geothermal appliances, the chemical industry, freezing, and food canning. By utilizing heat as their elementary energy source, absorption chillers can substantially decrease the electrical consumption correlated with cooling. Absorption chillers can contribute to lower greenhouse gas emissions by improving energy usage and potentially using renewable energy sources such as solar thermal collectors. In addition, absorption chillers typically have fewer moving parts than other electric chillers. This reduces wear and tear, indicating lower maintenance requirements and reduced downtime. Johnson Controls Inc., Carrier, and Thermax Limited are among the absorption chiller manufacturers operating in the HVAC chillers market. Hitachi-Johnson Controls Air Conditioning has developed a single-effect, double-lift absorption chiller called "DXS." Thus, the rising importance of absorption chillers and the growing demand for absorption chillers are anticipated to offer lucrative opportunities for the North America HVAC chillers market over the forecast period.

North America HVAC Chillers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America HVAC chillers market analysis is technology, type and applications.

- Based on technology, the market is segmented into air-cooled, water-cooled, and steam-fired. The water-cooled segment dominated the market in 2023.

- In terms of type, the market is categorized into process chillers, scroll chillers, centrifugal chillers, and absorption chillers. The scroll chillers segment dominated the market in 2023.

- Based on application, the market is segmented into, industrial, commercial, and residential. The industrial segment dominated the market in 2023.

North America HVAC Chillers Market Share Analysis by Geography

- The North America HVAC chillers market is segmented into three major countries: the US, Canada, and Mexico. The US dominated the market in 2023, followed by Canada and Mexico.

- The US Department of Energy (DoE) is heavily investing in improving energy efficiency standards nationwide. The DoE's mission is to ensure the security and prosperity of the US by addressing its environmental, energy, and nuclear challenges through transformative science and technology solutions. With the growing preference for adopting energy-efficiency standards, the adoption of energy-efficient and sustainable chillers is also rising in the country due to their low environmental impact. Further, continuous developments in machine learning and the Internet of Things (IoT) are propelling the deployment of smart and advanced HVAC chillers in residential projects, which is also boosting the North America HVAC chillers market.

North America HVAC Chillers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.52 Billion |

| Market Size by 2031 | US$ 3.48 Billion |

| CAGR (2023 - 2031) | 4.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America HVAC Chillers Market Players Density: Understanding Its Impact on Business Dynamics

The North America HVAC Chillers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America HVAC Chillers Market top key players overview

North America HVAC Chillers Market News and Recent Developments

The North America HVAC chillers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America HVAC chillers market are listed below:

- Johnson Controls International plc, the global leader in smart, healthy, safe, and sustainable buildings, announced it had reached a definitive agreement to sell its Residential and Light Commercial (R&LC) HVAC business in an all-cash transaction to the Bosch Group ("Bosch"). The transaction includes the North America Ducted business and global Residential joint venture with Hitachi, Ltd. ("Hitachi"), of which Johnson Controls owns 60% and Hitachi owns 40%. The total transaction is valued at US$ 8.1 billion, and the company's portion of the consideration is approximately US$ 6.7 billion. As part of the transaction, Hitachi will retain certain ductless HVAC assets located in Shimizu, Japan.

(Source: Johnson Controls International plc, Press Release, July 2024)

- Airedale by Modine, the critical cooling specialists, announced the US launch of the Cooling System Optimizer in response to industry demand for sustainable, stable, and secure cooling systems. First launched in Europe in 2022 and able to manage chilled water loops of up to 20 MW and beyond, the demand for the Optimizer has grown as data center providers adopt larger, more complex cooling systems. The Optimizer is an intelligent controls layer that sits between product controls in chillers and CRAHs and below the site building management system (BMS). It is programmed to unify indoor and outdoor cooling equipment to proactively manage the three most important things in any data center cooling system: resilience, redundancy, and energy use.

(Source: Airedale, Press Release, July 2024)

North America HVAC Chillers Market Report Coverage and Deliverables

The "North America HVAC Chillers Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- North America HVAC chillers market size and forecast at country levels for all the key market segments covered under the scope

- North America HVAC chillers market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- North America HVAC chillers market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America HVAC chillers market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For