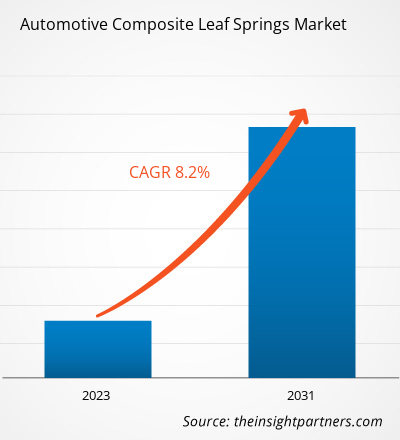

汽车复合材料板簧市场规模预计将从 2023 年的 8043 万美元增至 2031 年的 1.514 亿美元。预计 2023-2031 年期间市场复合年增长率将达到 8.2%。复合材料的持续改进可能仍是市场的主要趋势。

汽车复合材料板簧市场分析

在分析的时间范围内,汽车零部件制造对复合材料的需求增加预计将推动市场增长。此外,全球商用车和乘用车(如 SUV 和轻型卡车)销量的增加预计将在分析的时间范围内推动汽车复合板簧市场的增长。此外,电动汽车中复合材料的集成和日益普及预计将为 2023 年至 2031 年在汽车复合板簧市场运营的公司创造机会。

汽车复合材料板簧市场概况

汽车复合材料板簧市场生态系统由以下利益相关者组成:原材料供应商、复合材料板簧制造商、OEM 和最终用户。原材料供应商提供制造汽车复合材料板簧所需的复合材料,例如聚合物基复合材料、碳纤维增强塑料和环氧基复合材料。汽车行业的扩张导致各种复合材料供应商(例如 TPI Composites)与汽车制造商和汽车零部件制造商合作。汽车复合材料铅簧制造商从事各种流程,例如设计、组装和生产,以将原始复合材料转化为成品。Muhr und Bender KG、KraussMaffei 和 SGL Carbon 是一些领先的汽车复合材料板簧制造商。这些公司为宝马、戴姆勒、沃尔沃和福特汽车公司等 OEM 提供高质量的复合材料板簧,最终在车辆生产过程中安装产品。最终用户是大量客户,从个人车辆购买者到大型车队运营商。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

汽车复合材料板簧市场驱动因素和机遇

汽车行业对复合材料的需求不断增长,利好市场

复合板簧相对于传统板簧的优势正在推动其在汽车行业的应用。它们比钢弹簧轻约 70%,更薄更紧凑,而且耐用且耐负载。此外,它们在设计上具有更大的灵活性,并具有出色的驾驶特性。复合板簧还可提高车辆的减震器性能,推动其在专注于有效负载平衡解决方案的汽车制造商中得到采用。例如,Hexcel 开发了先进的复合材料板簧,可帮助皮卡有效地管理货物。该公司提供的新型复合板簧有助于将皮卡的总重量减轻约 45 磅/辆。在预测期内,对汽车应用中使用轻质复合材料的关注度不断提高预计将推动市场增长。此外,通过减轻重量来提高车辆性能和效率的关注度不断提高预计将推动 2023 年至 2031 年的市场增长。

电动汽车中复合材料的集成

电动汽车代表了汽车行业的一个新兴趋势,因为消费者和政府在各种应用中都强烈倾向于绿色能源消费。电动汽车在整个汽车市场中所占的份额较小,但增长率高于燃油汽车。电动汽车制造商正在使用复合材料作为电池来减轻汽车重量。这有助于他们补偿电池的额外重量,电池会随着时间的推移变得越来越笨重,从而增加汽车的续航里程。Aura 是一款全新的全电动双座概念跑车,于 2021 年 9 月亮相,采用天然纤维复合材料开发而成,有助于减轻汽车重量并使制造工艺更加可持续。此外,印度的一组研究人员发表了一项关于电动汽车复合板簧的研究,以降低噪音、振动和声振粗糙度。因此,与钢制阶梯式板簧相比,复合板簧的特点是重量减轻 40%,应力集中降低 76.39%,变形降低 50%。

汽车复合板簧市场报告细分分析

有助于得出汽车复合材料板簧市场分析的关键部分是安装类型、位置类型、工艺类型和车辆类型

- 根据安装类型,汽车复合材料板簧市场分为横向和纵向。横向部分在 2023 年占据了最大的市场份额。

- 根据位置类型,市场分为前板簧和后板簧。后板簧部分在 2023 年占据了最大的市场份额。

- 就工艺类型而言,市场分为高压树脂传递模塑工艺、预浸料铺层工艺和其他工艺。高压树脂传递模塑工艺在 2023 年占据了相当大的市场份额。

- 根据车型,市场分为乘用车、轻型商用车、中型和重型汽车。乘用车市场在 2023 年占据了最大的市场份额。

汽车复合材料板簧市场份额分析(按地区)

汽车复合材料板簧市场报告的地理范围主要分为五个区域:北美、亚太、欧洲、中东和非洲、南美和中美。

汽车复合材料板簧市场报告的范围包括北美(美国、加拿大和墨西哥)、欧洲(德国、法国、意大利、西班牙、英国和欧洲其他地区)、亚太地区(中国、印度、澳大利亚、日本、韩国和亚太地区其他地区)、中东和非洲(南非、沙特阿拉伯、阿联酋和中东和非洲其他地区)和南美(巴西、阿根廷和南美其他地区)。就收入而言,欧洲在 2023 年占据了汽车复合材料板簧市场份额的主导地位。亚太地区是全球汽车复合材料板簧市场的第二大收入贡献者,其次是北美。

汽车复合材料板簧市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响汽车复合板簧市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的汽车复合板簧市场细分和地理位置。

- 获取汽车复合板簧市场的区域特定数据

汽车复合材料板簧市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 8043万美元 |

| 2031 年市场规模 | 1.514亿美元 |

| 全球复合年增长率(2023 - 2031) | 8.2% |

| 史料 | 2021-2022 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

按安装类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

汽车复合板簧市场参与者密度:了解其对业务动态的影响

汽车复合板簧市场正在快速增长,这得益于最终用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在汽车复合板簧市场运营的主要公司有:

- 亨德森控股有限公司

- Flex-Form

- 克劳斯玛菲

- 穆尔和弯管两合公司

- 奥尔贡·切利克

- SGL 碳素公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解汽车复合板簧市场主要参与者概况

汽车复合材料板簧市场新闻及最新发展

汽车复合材料板簧市场通过收集一手和二手研究后的定性和定量数据进行评估,其中包括重要的公司出版物、协会数据和数据库。以下列出了汽车复合材料板簧市场的一些发展情况:

- Bcomp(可持续轻量化公司)宣布在新款沃尔沃 EX30 中应用名为 ampliTex 的天然纤维复合材料技术。(来源:Bcomp,新闻稿,2023 年 6 月)

- Hexion, Inc. 与 Rassini 合作。此次合作旨在将 EPIKOTE 环氧树脂系统应用于新款福特 F-150 车型的复合板簧。(来源:Hexion, Inc.,新闻稿,2021 年 6 月)

汽车复合板簧市场报告覆盖范围和交付成果

“汽车复合板簧市场规模和预测(2021-2031)”报告对以下领域进行了详细的市场分析:

- 汽车复合材料板簧市场规模及全球、区域和国家层面所有关键细分市场的预测

- 汽车复合材料板簧市场趋势以及市场动态,如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 汽车复合材料板簧市场分析,涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者以及汽车复合板簧市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 汽车复合材料板簧市场

获取免费样品 - 汽车复合材料板簧市场