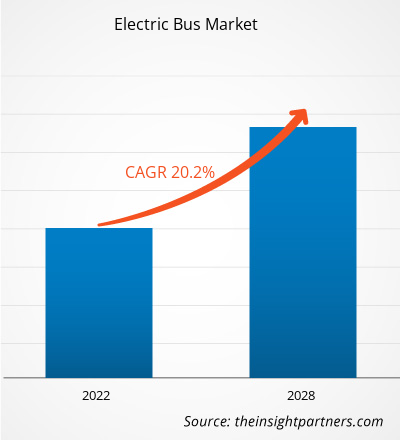

[研究报告] 2021年,电动公交车市场规模为291.7951亿美元,预计到2028年将达到1058.0815亿美元;预计2021-2028年的复合年增长率为20.2%。

分析师观点:

近年来,电动公交车市场经历了显著的增长和转型。随着人们对环境可持续性和减少碳排放需求的日益增长,电动公交车已成为公共交通的一种有前景的解决方案。电动公交车由电力驱动,而非传统的化石燃料,具有零尾气排放、降低噪音污染和提高能源效率等诸多优势。这些因素推动了全球电动公交车的普及。许多国家的政府和交通运输机构一直在积极推动电动公交车的部署,将其作为可持续交通计划的一部分。他们实施了各种激励措施、补贴和法规,以鼓励电动公交车的普及,并加速向更环保的公共交通转型。电动公交车领域的主要市场参与者一直在大力投资研发,以增强电池技术、改善充电基础设施,并提高电动公交车的续航里程和效率。因此,电动公交车的性能和可靠性随着时间的推移得到了显著提升,使其成为传统公交车的可行替代品。

中国已成为最大的电动公交车市场,占全球销量的很大份额。中国政府的大力支持和优惠政策,以及国家雄心勃勃的减排目标,推动了中国电动公交车市场的快速增长。然而,电动公交车并不仅限于中国。包括美国、欧洲国家和印度在内的其他几个国家也见证了电动公交车普及率的激增。在欧洲,受严格的排放法规和可持续交通目标的推动,荷兰、德国和英国等国家一直处于电动公交车部署的前沿。电动公交车市场也正在见证技术进步,例如自动驾驶电动公交车的开发。这些自动驾驶公交车有望通过提供高效便捷的出行解决方案,彻底改变公共交通。

市场概览:

纯电动、不使用传统内燃机 (ICE) 驱动的公交车被称为电动公交车或电动公交车。一组电池或车载电池为车载电动机提供动力,从而驱动电动公交车。由于电动公交车不排放任何污染物,而且比传统的汽油/柴油公交车更具成本效益,因此被认为是环保的交通工具。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

电动公交车市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

电动公交车在各城市和地区的成功部署对推动电动公交车市场的发展发挥着至关重要的作用。当城市和交通部门成功部署电动公交车队并展示其有效性时,它将产生积极的影响,并通过多种方式波及整个市场。首先,成功的部署可以作为概念验证,向其他城市和地区展示电动公交车的可行性和优势。当一个城市展示出采用电动公交车的积极成果时,它将激励和鼓舞其他城市效仿。交通部门和市政当局观察了电动公交车的实际运营性能、环境影响和公众接受度,从而增强了人们对其作为可持续交通解决方案的潜力的信心。

其次,成功的部署会产生多米诺骨牌效应,促进城市和地区之间的竞争意识。当邻近的城市或地区部署电动公交车并取得积极成果时,它将促使附近的辖区考虑采用电动公交车,以保持竞争力。这创造了良性的市场竞争,随着越来越多的城市加入到向更清洁、更环保的公共交通转型的行列,电动公交车市场也将随之增长。此外,成功的部署也为电动公交车市场提供了学习的机会。城市和交通部门可以借鉴早期采用者的经验,包括最佳实践、面临的挑战以及克服障碍的策略。这种知识共享使得后续部署能够更加顺畅、高效地实施,从而加速电动公交车市场的整体增长。成功的部署还能吸引媒体的关注和公众的兴趣,为电动公交车带来积极的宣传效果。媒体对城市通过电动公交车实现环境里程碑和改善空气质量的报道,提高了公众的认知度。它支持公众将电动公交车视为传统公交车的可行且可持续的替代方案。电动公交车知名度的提高有助于营造积极的市场情绪,鼓励更多城市、交通部门和利益相关者采用电动公交车。这反过来又使电动公交车更加经济实惠,对更广泛的城市和地区具有吸引力,从而推动市场增长。

细分分析:

根据车型,市场分为纯电动公交车、混合动力公交车和插电式混合动力公交车。纯电动公交车细分市场在 2020 年占据了最大的市场份额,预计在预测期内将实现最高的复合年增长率。纯电动公交车已成为电动公交车市场的主导技术,占据了最大的市场份额。这主要是因为它们具有环境可持续性,因为它们的尾气排放为零,符合全球减少碳排放的努力。电池技术的进步,包括提高能量密度和增加续航里程,提高了纯电动公交车的性能和可行性。不断增长的充电基础设施网络进一步支持了它们的实用性。有利的政府政策和激励措施,加上主要公交车制造商的积极参与,促进了纯电动公交车的广泛应用。在这些因素推动市场增长的背景下,预计纯电动公交车将保持其行业领先地位。

区域分析:

2021 年亚太地区电动公交车市场价值为 263.7534 亿美元,预计到 2028 年将达到 153.8611 亿美元;预计预测期内的复合年增长率为 20.2%。亚太地区已成为电动公交车的主导市场,增长显著,并占据了相当大的市场份额。有几个关键因素促成了这一区域主导地位。首先,亚太地区,尤其是中国,一直处于电动公交车普及的前沿。中国实施了雄心勃勃的政策和目标,以解决空气污染问题并减少温室气体排放。

中国政府提供了强有力的支持和激励措施,包括补贴和补助,以加速电动公交车的部署。这种积极主动的策略推动中国成为全球最大的电动公交车市场,并推动亚太地区占据主导地位。此外,亚太地区庞大的人口和城市中心迫切需要可持续高效的公共交通解决方案。快速的城市化以及对空气污染和交通拥堵日益增长的担忧,促使印度、日本和韩国等国的政府和交通部门优先考虑采用电动公交车。密集的城市环境和繁忙的交通流量使电动公交车成为减少排放和改善空气质量的诱人选择。此外,亚太地区强大的制造业生态系统在其占据主导地位方面发挥了重要作用。亚洲国家,尤其是中国,拥有强大的制造业基础设施和生产电动汽车(包括公交车)的专业知识。本地制造商在研发方面投入了大量资金,推动了电池技术和成本效益生产方法的进步。这导致了竞争激烈的市场格局,以及各种价位的电动公交车型号的供应,进一步巩固了市场主导地位。此外,政府的支持性政策和举措加速了亚太地区电动公交车市场的发展。各国政府已出台法规、制定排放标准并推出财政激励措施,以鼓励电动公交车的普及。这些政策营造了良好的商业环境,并推动了交通运输机构投资电动公交车队。

主要参与者分析:

电动公交车市场分析涵盖的参与者包括金龙联合汽车工业有限公司、沃尔沃集团、深圳五洲龙汽车有限公司、比亚迪股份有限公司、戴姆勒、亚历山大·丹尼斯有限公司、EBUSCO、Proterra Solaris Bus & Coach SA 和 NFI Group Inc.。在电动公交车领域,沃尔沃集团和 EBUSCO 凭借其多样化的产品组合位居前两位。

电动公交车市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响电动巴士市场的区域趋势和因素。本节还探讨了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的电动巴士市场细分和地域分布。

电动公交车市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2021 | US$ 29.18 Billion |

| 市场规模 2028 | US$ 105.81 Billion |

| 全球复合年增长率 (2021 - 2028) | 20.2% |

| 历史数据 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

By 车辆类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

电动公交车市场参与者密度:了解其对业务动态的影响

电动公交车市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的转变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 电动公交车市场 主要参与者概述

电动巴士市场中的企业广泛采用并购等非有机和有机战略。以下列出了一些近期的关键市场动态:

- 2022 年 3 月:Proterra Inc 宣布与 Shyft 集团达成一项战略性多年期供应协议,为其 Blue Arc 专用电动送货车和电动汽车底盘提供动力。

- 2020 年 7 月,沃尔沃集团与西澳大利亚公共交通管理局 (PTA) 建立合作伙伴关系,将沃尔沃首批电动巴士引入澳大利亚。这些协议旨在确保在沃尔沃澳大利亚产品线采用该技术后,将替代能源车辆引入公共交通巴士网络。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 电动公交车市场

获取免费样品 - 电动公交车市场