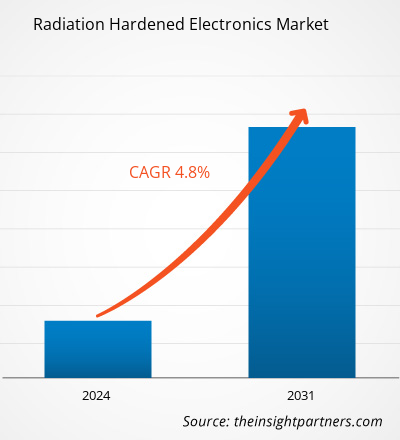

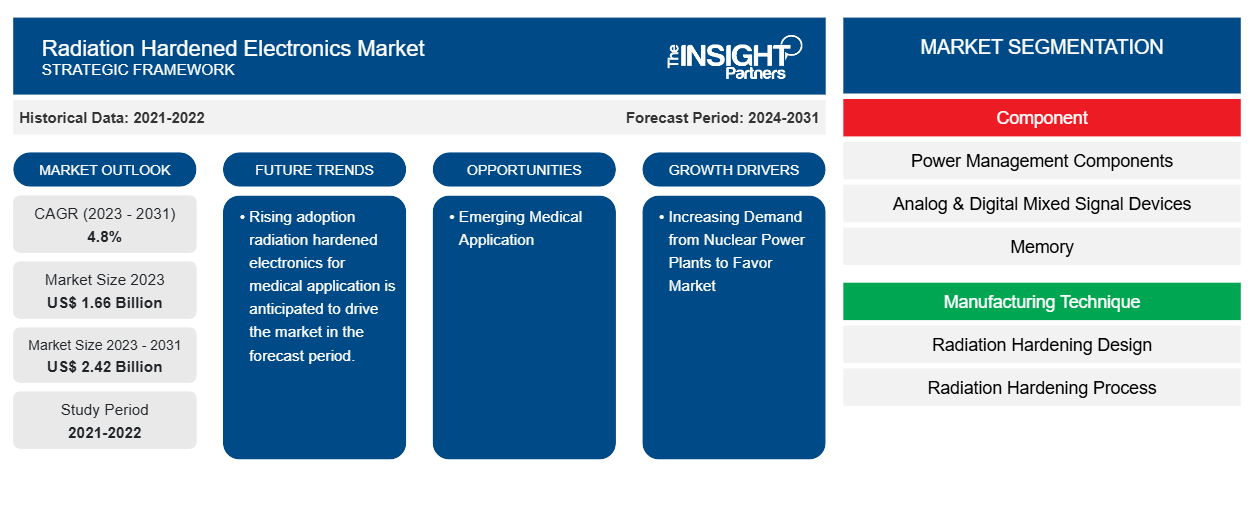

预计到 2031 年,抗辐射电子产品市场规模将从 2023 年的 16.6 亿美元增至 24.2 亿美元。预计 2023-2031 年期间该市场的复合年增长率为 4.8%。抗辐射电子产品的采用率不断提高以及对太空计划的投资不断增加可能仍是市场的主要趋势和驱动因素。

抗辐射电子产品市场分析

全球关键设备和系统制造商对辐射加固反馈传感器的需求不断增长,预计将在预测期内推动辐射加固反馈传感器市场的发展。辐射加固反馈传感器广泛集成到航空航天和国防系统、航天器、卫星、太空探测器、医疗设备等。技术进步、辐射加固反馈传感器的小型化、对可再生能源的需求不断增长以及研发活动的不断增加正在推动辐射加固反馈传感器市场的发展。

抗辐射电子产品市场概况

抗辐射反馈传感器是专为承受高辐射而设计的设备,这种辐射在核和太空环境中最为常见。这些传感器采用反馈机制,持续监测其性能,并进行相应调整,确保在强辐射下可靠、准确地运行。传感器利用反馈回路来检测因辐射引起的损坏而导致的任何偏离预期行为的情况。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

抗辐射电子产品市场驱动因素和机遇

核电站需求增加利好市场

核电站通过核裂变过程发电。在此过程中,会产生大量电力,从而产生大量辐射。这种辐射对人体有害,并可能损坏电子设备,这增加了对辐射加固反馈传感器的需求。辐射加固反馈传感器战略性地放置在整个工厂内,以监测关键区域的温度变化,例如冷却剂系统、反应堆堆芯和各种组件。这些传感器向控制系统提供持续反馈,使工厂操作员能够采取必要的措施来维持所需的温度范围,并做出明智的决策来改善系统的性能。几家公司正在对开发发电厂进行大量投资。例如,根据美国能源部 (DOE) 于 2024 年 1 月发布的数据,美国能源部在沃格特尔电厂投资了约 120 亿美元,一旦投入运营,将为电网提供超过 1,100 兆瓦的清洁能源。

新兴医疗应用。

抗辐射反馈传感器在确保医疗行业使用的医疗设备的安全性、准确性和可靠性方面发挥着至关重要的作用。这些传感器集成到各种医疗设备中,包括伽马射线、X 射线和电子束,使它们能够承受高水平的辐射。抗辐射反馈传感器主要集成到放射治疗设备中,以支持医生治疗癌症患者。放射治疗,也称为放射疗法,是癌症患者最常见的治疗方式,其中使用高能辐射束来瞄准和摧毁癌细胞,这需要抗辐射反馈传感器来监测各种参数,包括剂量输送、光束密度和光束定位。医疗保健专业人员使用抗辐射反馈传感器来确保准确和精确的治疗,最大限度地减少对健康组织的损害。例如,2022 年 4 月,Maxon Group 推出了 ENX GAMA 编码器,设计用于多叶准直器等设备上的医疗线性加速器附近。ENX GAMA 编码器是集成直流电机的抗辐射编码器,非常适合放射治疗设备。

抗辐射电子产品市场报告细分分析

有助于得出抗辐射电子产品市场分析的关键部分是组件、制造技术和应用。

- 根据组件,抗辐射电子产品市场分为电源管理组件、模拟和数字混合信号设备、内存以及控制器和处理器。预计电源管理组件部分将在预测期内占据相当大的市场份额。

- 根据制造技术,抗辐射电子产品市场分为按设计抗辐射 (RHBD) 和按工艺抗辐射 (RHBP)。预计按设计抗辐射 (RHBD) 部分将在预测期内占据相当大的市场份额。

- 根据应用,市场分为航空航天和国防、核电站、太空和其他。预计航空航天和国防在预测期内将占据相当大的市场份额。

抗辐射电子产品市场份额(按地区)分析

抗辐射电子产品市场报告的地理范围主要分为五个地区:北美、亚太、欧洲、中东和非洲、南美和中美。

北美主导了抗辐射电子市场。不断扩张的航天工业正在推动北美抗辐射反馈传感器市场的发展。美国在航天领域处于领先地位已有 60 多年。它拥有世界上最大的政府太空计划。2022 年,在美国注册的卫星占所有运行卫星的一半以上。美国目前是唯一一个拥有太空活动专题账户的国家。此外,美国和加拿大等发达经济体高度重视研发,这迫使北美参与者将技术先进的解决方案引入市场。此外,美国拥有大量抗辐射电子市场参与者,他们越来越专注于开发创新解决方案。所有这些因素都促进了该地区抗辐射电子市场的增长。

抗辐射电子产品市场区域洞察

Insight Partners 的分析师已详尽解释了预测期内影响抗辐射电子市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的抗辐射电子市场细分和地理位置。

- 获取抗辐射电子市场的区域特定数据

抗辐射电子产品市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 16.6亿美元 |

| 2031 年市场规模 | 24.2亿美元 |

| 全球复合年增长率(2023 - 2031) | 4.8% |

| 史料 | 2021-2022 |

| 预测期 | 2024-2031 |

| 涵盖的领域 |

按组件

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

抗辐射电子产品市场参与者密度:了解其对业务动态的影响

耐辐射电子产品市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在抗辐射电子产品市场运营的主要公司有:

- 英国航太系统公司

- 数据设备公司

- 霍尼韦尔国际公司

- 英飞凌科技股份公司

- 瑞萨电子公司

- 德州仪器公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解抗辐射电子市场顶级关键参与者概况

抗辐射电子产品市场新闻和最新发展

抗辐射电子产品市场通过收集一手和二手研究后的定性和定量数据进行评估,其中包括重要的公司出版物、协会数据和数据库。抗辐射电子产品市场的一些发展情况如下:

- EPC Space 推出了一款抗辐射氮化镓 (GaN) 栅极驱动器 IC EPC7009L16SH。这款创新的 GaN 驱动器采用 EPC 独有的 eGaN IC 技术,使设计工程师能够充分利用 eGaN FET 技术的功能。(来源:EPC Space,公司网站,2024 年 4 月)

- 先进半导体解决方案供应商瑞萨电子株式会社 (Renesas Electronics Corporation) 推出了一系列用于卫星电源管理系统的塑料封装抗辐射 (rad-hard) 器件。这四款新器件包括 ISL71001SLHM/SEHM 负载点 (POL) 降压稳压器、ISL71610SLHM 和 ISL71710SLHM 数字隔离器以及 ISL73033SLHM 100V GaN FET 和集成低侧驱动器。(来源:瑞萨电子株式会社,公司网站,2021 年 7 月)

抗辐射电子产品市场报告覆盖范围和交付成果

“抗辐射电子产品市场规模和预测(2021-2031)”报告对以下领域进行了详细的市场分析:

- 范围内涵盖的所有主要细分市场的全球、区域和国家层面的抗辐射电子产品市场规模及预测。

- 抗辐射电子产品市场趋势以及驱动因素、限制因素和关键机遇等市场动态。

- 详细的 PEST/波特五力分析和 SWOT 分析。

- 抗辐射电子产品市场分析涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新的市场发展。

- 行业格局和竞争分析涵盖市场集中度、热图分析、知名参与者以及防辐射电子市场的最新发展。

- 详细的公司简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 抗辐射电子产品市场

获取免费样品 - 抗辐射电子产品市场