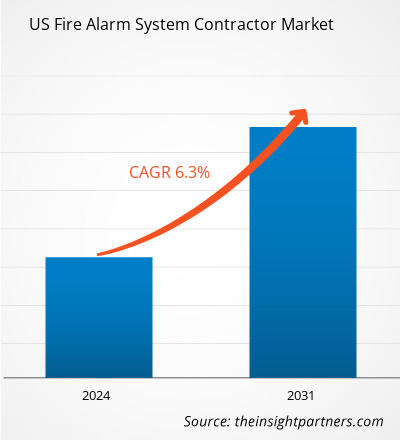

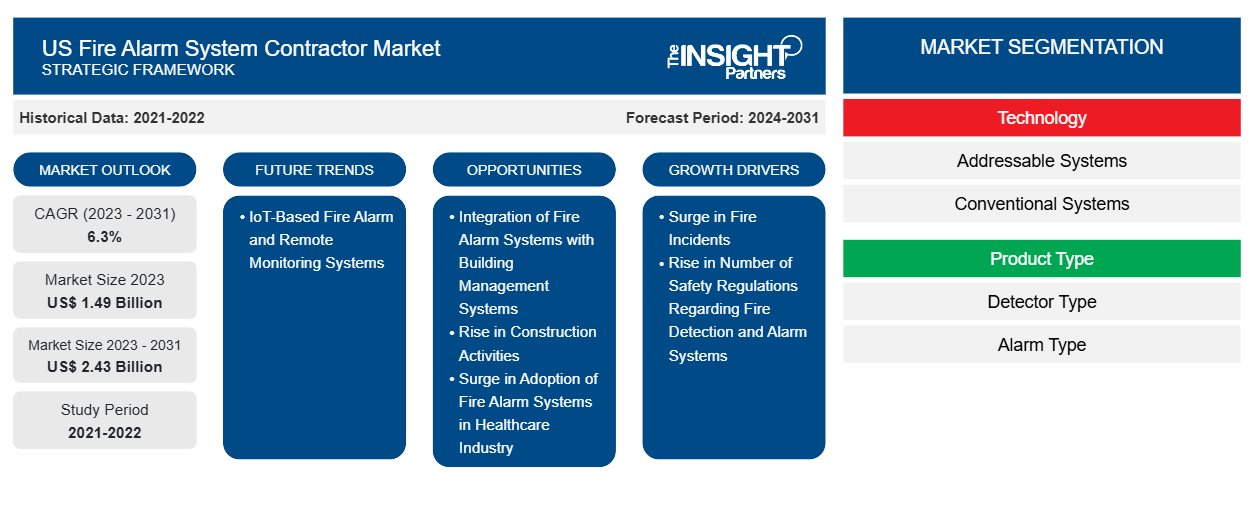

美国火灾报警系统承包商市场规模预计将从 2023 年的 14.9 亿美元增至 2031 年的 24.3 亿美元。预计 2023 年至 2031 年期间市场复合年增长率为 6.3%。基于物联网的火灾报警和远程监控系统可能会在未来几年为市场带来新的趋势。

美国火灾报警系统承包商市场分析

由于火灾事件数量不断增加,预计美国火灾报警系统承包商市场将在预测期内出现显着增长。根据美国国家消防协会 (NFPA) 的数据,2022 年,美国地方消防部门应对了约 150 万起火灾。这些事件导致 3,790 名平民死亡和 13,250 名平民受伤。这些火灾造成的财产损失预计为 180 亿美元。由于火灾事件不断增加,美国政府正在采取各种严格的举措,在住宅、商业和工业环境中安装火灾报警系统,这正在推动市场的增长。

为了提高效率并提供更安全的建筑环境,各公司正在致力于将火灾报警系统与建筑管理系统 (BMS) 集成,这可能会在预测期内为市场增长创造机会。此外,预计该国不断增长的建筑项目数量将在未来几年为市场参与者提供大量机会。此外,预计医疗保健机构越来越多地采用火灾报警系统将在预测期内推动市场增长。此外,物联网、视频烟雾探测和远程监控等技术进步的兴起预计将在不久的将来提振美国火灾报警系统承包商市场。

美国火灾报警系统承包商市场概况

火灾报警器通常安装在火灾报警系统中,为住宅和商业物业提供区域覆盖。警告信号可能包括响亮的警报器/铃声、闪光灯或两者兼有。一些火灾报警系统提供额外的警告,例如语音消息或电话。大多数先进的火灾报警系统采用无线技术和智能设备,通过远程控制面板保护和管理自动化建筑;例如,可以在智能手机上下载、安装和维护的移动应用程序。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

- 获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

美国火灾报警系统承包商市场驱动因素和机遇

有关火灾探测和报警系统的安全法规数量增加

火灾相关危害十分严重,会导致生命和宝贵资产的损失。因此,美国政府制定了有关火灾探测和报警系统的各种严格规则和法规。根据《联邦法规》,火灾探测和报警系统的设计、制造、安装和操作必须符合第 76.27-5 至 76.27-35 条或 SOLAS 第 II-2 章、第 7 条和 FSS 规则第 9 章的规定。

- 第76.27-5节中包含的规则和条例如下:

- 政府必须批准使用探测器、手动报警站、报警柜、控制面板、警报器和其他通知设备。

- 火灾探测和报警系统必须能够在船舶航行时随时立即运行。

- 火灾探测和报警系统必须控制和监控所有连接的探测器和手动拉站或呼叫点的输入信号。

- 火灾探测和报警系统必须向驾驶室或消防控制站提供火灾或故障输出信号。

- 火灾探测和报警系统必须在需要时通知船员和乘客发生火灾。

火灾探测和报警系统的布置和安装必须确保任何受保护空间内发生火灾时,都能自动在驾驶室或消防控制站以视觉和声音方式发出警报。视觉通知必须标明警报来源区域。在长度超过 150 英尺(45.72 米)的船舶上,机舱内还必须配备声音警报。

除了这些规则之外,根据第 76.27-15 节,热探测器的额定温度不得低于和高于 130°F (54°C) 和 172°F (78°C)。位于高正常环境温度空间中的热探测器的工作温度必须高达 260°F (130°C)。此外,桑拿房中的热探测器的工作温度可能高达 284°F (140°C)。此外,探测器所需的灵敏度和其他性能标准必须在 46 CFR 161.002 中规定。此外,根据第 76.27-20 节,声音警报必须产生 46 CFR 161.002 中规定的声压级。因此,有关火灾探测和报警系统的安全法规数量的增加推动了美国火灾报警系统承包商市场的增长。

建筑活动增加

根据国际货币基金组织的数据,美国拥有世界上最大的商业地产市场。此外,对智慧城市计划发展的投资激增可能会在未来几年推动该国建筑业的增长。以下列出了一些大型建筑项目:

- 洛杉矶计划举办 2028 年洛杉矶夏季奥运会。随着这一消息的宣布,新设施建设将于 2023 年开始,预计将于 2028 年上半年完工。这个庞大的项目专注于为奥运选手建造住房和比赛设施。

- 2024年第二季度,南国会街和M街混合用途开发项目已在华盛顿特区开工,预计将于2024年第四季度完工。该项目旨在为 该市提供更好的住宅、零售和办公设施。

- 由于旅游业的兴起和即将举行的奥运会,美国正在进行多项机场建设和航站楼扩建活动。纽约和新泽西港务局投资 190 亿美元建造新的约翰肯尼迪国际机场 (JFK),这是美国最繁忙的机场之一的重大改造。该项目已进入施工阶段,预计于 2026 年完工。

预计火灾报警系统的需求在不久的将来将继续增长,因为这些系统有助于检测并警告人们建筑物或任何其他封闭空间内有火灾或烟雾。因此,预计建筑活动的增加将在预测期内为美国火灾报警系统承包商市场的增长创造有利可图的机会。

美国火灾报警系统承包商市场报告细分分析

有助于得出美国火灾报警系统承包商市场分析的关键部分是技术、产品类型和应用。

- 根据技术,美国火灾报警系统承包商市场分为可寻址系统和传统系统。可寻址系统部分在 2023 年占据了市场主导地位。

- 根据产品类型,美国火灾报警系统承包商市场分为探测器类型和警报类型。探测器类型细分市场进一步细分为烟雾探测器、热探测器、火焰探测器等。同样,警报类型细分市场细分为声音警报、视觉警报和手动呼叫点警报。探测器类型细分市场在 2023 年占据了市场主导地位。

- 根据应用,美国火灾报警系统承包商市场分为商业、工业和住宅。商业部门在 2023 年占据了市场主导地位。

美国火灾报警系统承包商市场份额分析(按国家)

美国建筑业正在经历巨大的增长。根据美国人口普查局的数据,截至 2024 年 8 月,美国的住宅建筑支出约为 9114.29 亿美元,非住宅建筑支出为 12205.07 亿美元。建筑业的这种增长预计将增加对火灾报警系统的需求,因为它有助于缩短应急服务的响应时间、在偏远地区探测火灾、在必要时更好地规划疏散、满足区域健康和安全规范以及确保重要运营资产的安全。此外,该国的火灾事件数量也在增加。根据美国国家消防协会 (NFPA) 的数据,2022 年,美国地方消防部门应对了约 150 万起火灾。这些事件导致 3,790 名平民火灾死亡和 13,250 名平民火灾受伤。此外,这些火灾造成的财产损失预计为 180 亿美元。此外,2022 年,美国每 21 秒就会有消防部门对某地的火灾做出响应。每 88 秒就会报告一起房屋结构火灾,每三小时十四分钟就会报告一起家庭火灾死亡事件,每 53 分钟就会报告一起家庭火灾受伤事件。此外,522,500 起火灾(占火灾总数的 35%)始于建筑物内或建筑物上。此外,25% 的火灾发生在住宅物业中,包括一户或两户住宅、公寓或其他多户建筑。因此,美国火灾事件数量的增加正在推动对火灾报警系统的需求。

美国火灾报警系统承包商市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响美国火灾报警系统承包商市场的区域趋势和因素。本节还讨论了美国火灾报警系统承包商市场在北美、欧洲、亚太地区、中东和非洲以及南美洲和中美洲的细分市场和地理位置。

- 获取美国火灾报警系统承包商市场的区域特定数据

美国火灾报警系统承包商市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 14.9亿美元 |

| 2031 年市场规模 | 24.3亿美元 |

| 全球复合年增长率(2023 - 2031) | 6.3% |

| 史料 | 2021-2022 |

| 预测期 | 2024-2031 |

| 涵盖的领域 | 按技术分类

|

| 覆盖地区和国家 | 我们

|

| 市场领导者和主要公司简介 |

|

美国火灾报警系统承包商市场参与者密度:了解其对业务动态的影响

美国火灾报警系统承包商市场正在快速增长,这得益于最终用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明相对于给定市场空间的规模或总市场价值,有多少竞争对手(市场参与者)存在于该市场空间中。

在美国火灾报警系统承包商市场运营的主要公司有:

- 西部各州消防局(API 集成商)

- 埃弗隆有限责任公司

- 安科集团

- Pye-Barker 消防与安全有限责任公司

- 辛塔斯公司

- 顶峰消防公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解美国火灾报警系统承包商市场顶级关键参与者概况

美国火灾报警系统承包商市场新闻和最新发展

美国火灾报警系统承包商市场通过收集主要和次要研究后的定性和定量数据进行评估,其中包括重要的公司出版物、协会数据和数据库。美国火灾报警系统承包商市场的一些发展情况如下:

- Pye-Barker Fire & Safety 收购了 Legacy Fire Services,后者总部位于内华达州里诺,专门为商业、工业和多户住宅系统提供消防系统和灭火器。Legacy Fire Services 将与 Pye-Barker 在里诺地区现有的消防和安全警报团队合作,为更多客户提供完全符合消防法规的服务。(来源:Pye-Barker Fire & Safety,新闻稿,2024 年 9 月)

- Summit Fire Protection 通过收购 Cofessco Fire Protection 增强了 Midwest 的影响力。Cofessco Fire Protection 提供服务和全面的消防解决方案,服务范围覆盖密歇根州各地 5,000 多家不同规模的商业、工业、市政和零售企业。Cofessco 团队经验丰富,致力于追求卓越,提供消防喷淋系统、火灾报警、监控、应急/出口照明和灭火系统等服务,增强了 Summit Fire Protection 的服务范围。(来源:Summit Fire Protection,新闻稿,2024 年 4 月)

美国火灾报警系统承包商市场报告覆盖范围和交付成果

“美国火灾报警系统承包商市场规模和预测(2021-2031 年)”对市场进行了详细的分析,涵盖了以下领域:

- 美国火灾报警系统承包商市场规模以及范围内所有主要细分市场的国家级预测

- 美国火灾报警系统承包商市场趋势以及市场动态,如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 美国火灾报警系统承包商市场分析涵盖主要市场趋势、国家框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者以及美国火灾报警系统承包商市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 美国火灾报警系统承包商市场

获取免费样品 - 美国火灾报警系统承包商市场