Optical Transceiver Market Dynamics and Developments by 2031

Optical Transceiver Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage:by Form Factor (SFF & SFP, SFP+ & SFP28, QSFP, QSFP+, QSFP14 & QSFP28, CFP, CFP2 & CFP4, XFP, CXP, and Others); Wavelength (850 nm Band, 1310 nm Band, 1550 nm Band, and Others); and End-User (Data Center, Telecommunication, Enterprise, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

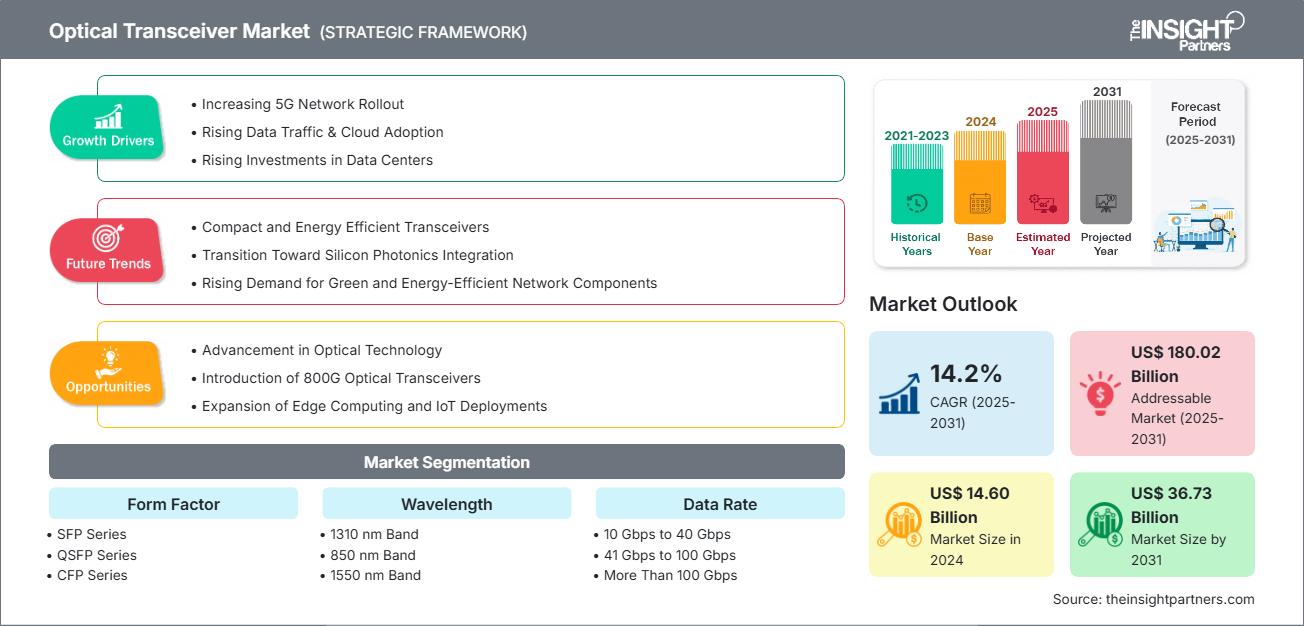

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPTE100001069

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 245

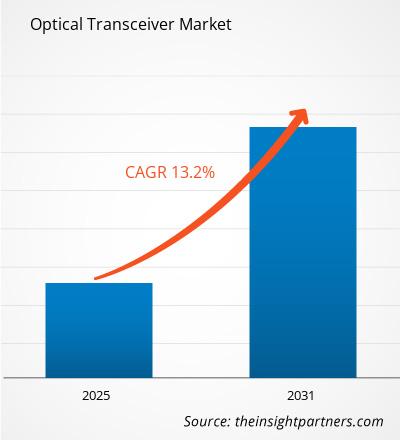

The Optical Transceiver Market size was valued at US$ 14.60 billion in 2024 and is projected to reach US$ 36.73 billion by 2031; it is expected to register a CAGR of 14.2% during 2025–2031.

Optical Transceiver Market Analysis

The global optical transceiver market is driven by the growing demand for faster and more reliable communication infrastructure, fueled by the proliferation of cloud services, 5G rollout, and increasing internet traffic. Technological advancements such as developing 400G and 800G transceivers, silicon photonics, and the push for energy-efficient, compact modules provide lucrative opportunities for the optical transceiver market growth. However, challenges such as high costs of advanced transceivers, lack of universal standards, and interoperability issues are restraining the optical transceiver market growth.

Optical Transceiver Market Overview

An optical transceiver is a critical hardware device that transmits and receives data over optical fiber networks by converting electrical signals into optical signals and vice versa. These modules enable high-speed, long-distance communication with minimal signal loss and interference. The benefits of optical transceivers include high bandwidth capabilities, low latency, energy efficiency, and scalability, making them indispensable in modern telecommunication networks. They are widely used in data centers, telecommunications, enterprise networking, and cloud computing applications. Various types of optical transceivers exist, including Small Form-factor Pluggable (SFP), SFP+, Quad Small Form-factor Pluggable (QSFP), and more advanced versions such as CFP and CFP2/4, designed to support data rates ranging from 1 Gbps to 800 Gbps and beyond.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOptical Transceiver Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Optical Transceiver Market Drivers and Opportunities

Market Drivers:

- Increasing 5G Network Rollout: The inherent requirements of 5G for higher bandwidth, lower latency, and more extensive fiber deployment increase the demand for advanced optical transceiver modules. Thus, the rapid expansion of 5G networks globally is a major catalyst propelling the optical transceiver market growth.

- Rising Data Traffic & Cloud Adoption: As businesses and consumers increasingly rely on cloud services for storage, applications, and processing, large volumes of data need to be transmitted quickly and efficiently over fiber-optic networks. Optical transceivers play a crucial role by enabling high-speed data transfer with low latency, supporting the growing need for seamless cloud access and real-time interaction. Furthermore, advanced cloud workloads such as artificial intelligence and big data analytics require enhanced bandwidth, pushing the development and deployment of higher-capacity optical transceivers to meet these needs. Thus, the convergence of unprecedented growth in global data traffic and enterprise cloud adoption accelerates global optical transceiver market growth.

- Rising Investments in Data Centers: Data centers rely on optical transceivers to connect server racks, switches, and storage over fiber. As data centers scale up, thousands of these transceivers are needed to handle internal traffic. As investments in data centers grows, the demand for optical transceivers rises. These components are essential for managing the high-speed data flow within and between data center facilities.

Market Opportunities:

- Advancements in Optical Technology: Innovations in optical components and design are enabling the development of more compact, energy-efficient, and higher-capacity transceivers, which are crucial for next-generation data centers, 5G infrastructure, and high-performance computing environments. As these technologies mature, they will not only enhance the performance of optical transceivers but also lower the total cost of ownership, opening up new opportunities in emerging markets and enabling broader deployment of advanced optical networks worldwide

- Introduction of 800G Optical Transceivers: The introduction of 800G optical transceivers marks a transformative opportunity for the global optical transceiver market. As data traffic surges due to cloud computing, video streaming, AI workloads, and 5G networks, the need for higher-capacity optical solutions has become more urgent. 800G transceivers offer double the bandwidth of the widely adopted 400G modules, enabling faster, more efficient data transfer across data centers and telecom networks. The deployment of 800G optical transceivers represents a major growth opportunity for the market, unlocking new levels of speed, efficiency, and scalability essential for the digital infrastructure.

- Expansion of Edge Computing and IoT Deployments: The growing adoption of edge computing and the proliferation of Internet of Things (IoT) devices are creating new demand for localized data processing and high-speed connectivity. As edge data centers and micro data hubs emerge closer to end-users to reduce latency, there is an increasing need for compact, low-power optical transceivers capable of supporting high-bandwidth communication in constrained environments. This shift toward decentralized network architectures presents a significant opportunity for transceiver manufacturers to develop specialized solutions that cater to edge infrastructure and the evolving IoT ecosystem.

Optical Transceiver Market Report Segmentation Analysis

The optical transceiver market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Form Factor:

- SFP Series: The Small Form-factor Pluggable (SFP) series remains prominent in the optical transceiver market due to its compact size, cost-efficiency, and adaptability across various network environments. The SFP series includes multiple variants: SFP (up to 4 Gbps), SFP+ (10 Gbps), SFP28 (25 Gbps), and DSFP (Dual SFP, 50 Gbps).

- QSFP Series: The Quad Small Form-factor Pluggable (QSFP) series represents one of the most dynamic and high-growth segments in the optical transceiver market, driven by rising data traffic and demand for high-speed connectivity. This series includes a range of powerful variants: QSFP (4x1 Gbps), QSFP+ (4x10 Gbps = 40 Gbps), QSFP28 (4x25 Gbps = 100 Gbps), QSFP56 (4x50 Gbps = 200 Gbps), and QSFP-DD (8x50 Gbps = 400 Gbps).

- CFP Series: The C Form-factor Pluggable (CFP) series addresses high-speed, long-reach applications within the optical transceiver market, particularly in telecom backbones and high-capacity data networks. The series encompasses several key variants: CFP (100 Gbps), CFP2 (100/200 Gbps), and CFP4 (100 Gbps).

- Others: The Others category in the optical transceiver market includes older and specialized transceiver types such as X2, XENPAK, XFP, and CXP. These were the first models developed for 10G and 100G networks.

By Wavelength:

- 1310 nm Band: The 1310 nm band is one of the most widely used wavelengths in optical transceivers, especially for medium-distance data transmission. It is commonly used in data centers, metro networks, and enterprise environments where signals need to travel up to around 10–40 kilometers.

- 850 nm Band: The 850 nm band is mainly used for short-distance data transmission and is widely deployed in data centers and LAN (Local Area Network) environments. This wavelength is typically used with multimode fiber, which is cheaper and easier to install than single-mode fiber but works best over shorter distances, usually under 300 meters.

- 1550 nm Band: The 1550 nm band is used for long-distance, high-capacity optical communication and is especially important in telecommunications, long-haul networks, and internet backbone infrastructure. This wavelength is ideal for traveling long distances.

- Others: The other category includes additional wavelengths. Some examples include 1490 nm, used in Passive Optical Networks (PON) for broadband access; 1625 nm, often used for fiber monitoring; and 1270/1330 nm, common in bidirectional (BiDi) transceivers that send and receive data over a single fiber.

By Data Rate:

- 10 Gbps to 40 Gbps

- 41 Gbps to 100 Gbps

- More Than 100 Gbps

- Less Than 10 Gbps

By Application:

- Data Centers

- Telecommunications

- Enterprise Networking

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The North America optical transceiver market is the largest globally, due to its advanced digital infrastructure and widespread adoption of high-speed internet, cloud computing, and 5G networks. The US leads the region in demand and innovation, driven by hyperscale data centers operated by companies such as Google, Meta, Amazon, and Microsoft. The region's push toward artificial intelligence and machine learning further necessitates low-latency, high-bandwidth optical interconnects. Network service providers are upgrading to 400G and 800G optics to support increasing data consumption, particularly in urban centers.

Optical Transceiver Market Regional Insights

The regional trends and factors influencing the Optical Transceiver Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Optical Transceiver Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Optical Transceiver Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 14.60 Billion |

| Market Size by 2031 | US$ 36.73 Billion |

| Global CAGR (2025 - 2031) | 14.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Form Factor

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Optical Transceiver Market Players Density: Understanding Its Impact on Business Dynamics

The Optical Transceiver Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Optical Transceiver Market top key players overview

Optical Transceiver Market Share Analysis by Geography

Asia Pacific is the most dynamic and fastest-evolving region in the optical transceiver market, fueled by massive urbanization, digitization, and government-driven broadband initiatives. China is at the forefront, with state-backed 5G deployments, smart city projects, and a booming data center industry. Chinese manufacturers are also aggressively producing cost-competitive optical components, strengthening the country's self-reliance in critical technologies. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for optical transceiver providers to expand.

The optical transceiver market grows differently in each region owing to telecom infrastructure, data center expansion, government initiatives, and the pace of 5G and fiber deployments. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a major share of the global optical transceiver market

-

Key Drivers:

- Advanced telecom and cloud infrastructure

- Strong demand from hyperscale data centers (e.g., Amazon, Microsoft, Google)

- Growing adoption of 400G and 800G modules for AI and cloud networking

- Trends: Focus on high-speed, short-reach optical modules for intra-data center connections and energy-efficient solutions for scalable infrastructure

2. Europe

- Market Share: Substantial share

-

Key Drivers:

- Continued investment in 5G and fiber broadband rollouts

- Demand from financial, industrial, and healthcare sectors for high-speed connectivity

- Growth in regional cloud and colocation data centers

- Trends: Increasing adoption of 100G and 400G modules, with rising interest in energy-efficient and green optical solutions for sustainable infrastructure

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Expanding 5G networks and fiber-to-the-home (FTTH) in countries such as China, India, and Japan

- High volume of electronics manufacturing and cost-efficient production

- Surge in regional hyperscale data centers and cloud adoption

- Trends: Rapid shift to 400G and 800G optical transceivers, growing use of pluggable optics in telecom and cloud, and increasing research and development in advanced packaging technologies

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Investment in broadband and mobile backhaul infrastructure

- Telecom modernization efforts in Brazil, Mexico, and the surrounding regions

- Trends: Adoption of mid-range (10G to 100G) optical transceivers is increasing, with a focus on expanding coverage in underserved areas

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Government-led digital transformation and smart city initiatives in GCC countries

- Expanding internet and mobile penetration

- Trends: Demand for 25G and 100G modules driven by telecom upgrades, with increased focus on local data centers and fiber connectivity projects.

Optical Transceiver Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Cisco, Lumentum, Coherent, Broadcom, and Intel. Regional and specialized vendors such as Innolight (Asia), Accelink (China), and II-VI are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- High-speed, low-latency modules (e.g., 400G/800G)

- Co-packaged optics and silicon photonics for next-gen applications

- Customization for telecom, enterprise, and data center use cases

- Lower power consumption and compact form factors

Opportunities and Strategic Moves

- Building strong partnerships with cloud providers, telecom operators, and OEMs is becoming essential

- Companies are investing in next-gen optical technologies such as coherent optics and CPO (co-packaged optics)

- Software-defined and modular transceiver designs are gaining popularity for flexible deployment and upgrade cycles

- Increased focus on vertical integration and in-house chip manufacturing to control costs and enhance performance

Major Companies operating in the Optical Transceiver Market are:

- Coherent Corp (US)

- Lumentum Holdings Inc (US)

- Broadcom Inc (US)

- Sumitomo Electric Industries Ltd (Japan)

- Cisco Systems Inc (US)

- Intel Corp (US)

- Amphenol Corporation (US)

- Accelink Technology Co Ltd (China)

- NEC Corp (US)

- Samtec Inc (US)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Smiths Interconnect

- Radiall

- InnoLight Technology (Suzhou) Ltd.

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

- Hisense Broadband, Inc.

- Formerica Optoelectronics Inc.

- ETU-Link Technology CO ., LTD

- ATOP Corporation

- Shenzhen Sopto Technology Co., Ltd.

- Beijing Fibridge Co., Ltd.

- Source Photonics

- Shenzhen Hilink Technology Co., Ltd.

- FS.COM INC.

- Huawei Technologies Co., Ltd.

- Molex

- Moog Inc.

- T1Nexus

- Fibermarkt

- Xtel Technologies

- GAO Tek & GAO Group Inc.

- Inphitech

- Chengdu Superxon Communication Technology Co., Ltd.

- Perle Systems

- Optix Communications, Inc.

- Hangzhou Minghuo Communication Technology Co., LTD

Optical Transceiver Market News and Recent Developments

- Coherent Corp Announces the Shipment of its 300-Millionth Optical Transceiver In June 2025, Coherent Corp., a global leader in materials, networking, and lasers, proudly announces the shipment of its 300-millionth optical transceiver from its manufacturing facility in Ipoh, Malaysia. This significant milestone underscores the scale, resiliency, and flexibility of Coherent supply chain solutions for customers.

- Lumentum Holdings Inc. Announced Limited Sampling of its New 400/800G ZR+ L-band Pluggable Transceivers In April 2025, Lumentum Holdings Inc. ("Lumentum"), a global leader in optical and photonic solutions for the cloud and networking markets, announced limited sampling of its new 400/800G ZR+ L-band pluggable transceivers, along with general availability of its 800G ZR+ C-band module. Both products will be showcased in live demonstrations at the 2025 Optical Fiber Communications Conference and Exhibition (OFC) at Lumentum Booth #2119 in San Francisco, California, April 1-3.

- Broadcom Inc. Announced the Expansion of its Portfolio of Optical Interconnect Solutions In march 2025, Broadcom Inc. (NASDAQ: AVGO) announced the expansion of its portfolio of optical interconnect solutions to enable AI infrastructure. These innovative technologies, including advancements in co-packaged optics (CPO), 200G/lane DSP and SerDes, 400G optics, and PCIe Gen6 over optics, will be showcased at the 2025 Optical Fiber Communications Conference and Exhibition (OFC). Broadcom's demonstrations highlight the company's roadmap towards 200T optical interconnect solutions.

- Cisco Announced Plans for an Expanded Partnership with NVIDIA In February 2025, Cisco announced plans for an expanded partnership with NVIDIA to provide AI technology solutions to enterprises. Enterprises recognize that AI is essential to growth, but remain early in their adoption as they navigate the unique technical complexity and security demands of operating AI-ready data centers. The expanded partnership aims to give organizations flexibility and choice as they look to meet the demand of AI workloads for high-performance, low-latency, highly power-efficient connectivity within and between data centers, clouds, and users

Optical Transceiver Market Report Coverage and Deliverables

The "Optical Transceiver Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Optical Transceiver Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Optical Transceiver Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Optical Transceiver Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Optical Transceiver Market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For