Functional Safety Market Outlook 2024-2031 | Industry Growth & Trends

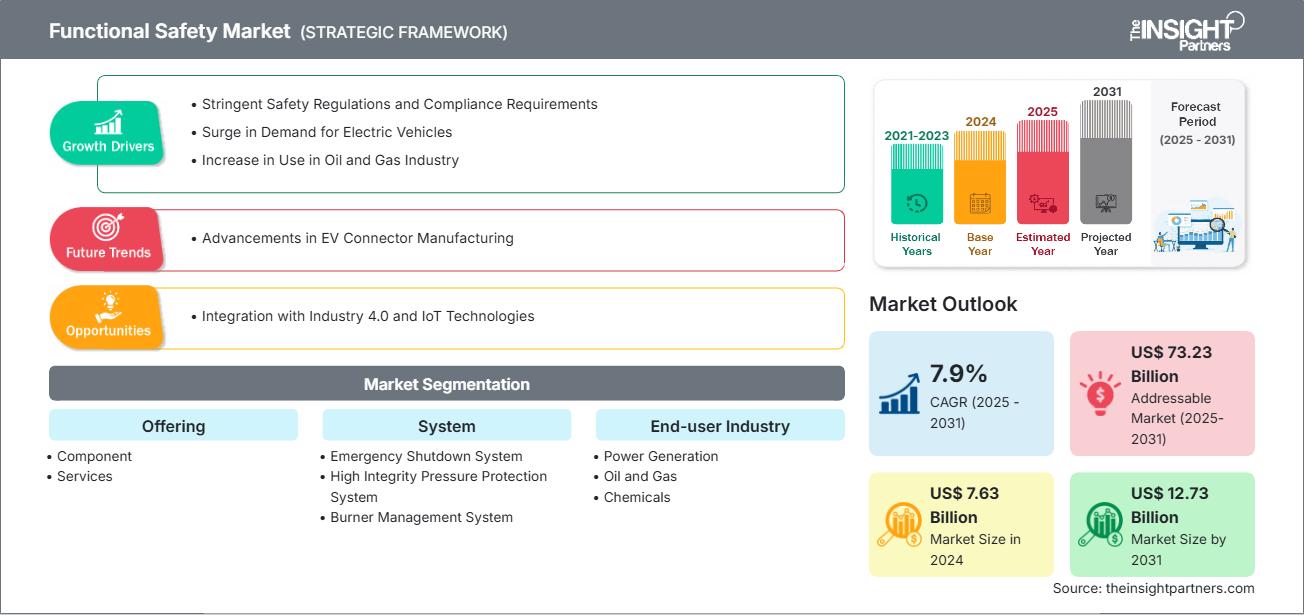

Functional Safety Market Forecast (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Coverage: by Offering (Component and Services), System (Emergency Shutdown System (ESD), High Integrity Pressure Protection System (HIPPS), Burner Management System (BMS), Fire and Gas Monitoring, Turbo Machinery Control (TMC), and Others), End-user Industry (Power Generation, Oil and Gas, Chemicals, Pharmaceutical, Food and Beverages, and Others), and Geography

Historic Data: 2021-2024 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00007633

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 186

The Functional Safety Market size is projected to reach US$ 12.73 billion by 2031 from US$ 7.63 billion in 2024. The market is expected to register a CAGR of 7.9% during 2025-2031.

Functional Safety Market Analysis

Functional safety systems are employed to negate the unacceptable risk of injury or damage to the asset’s health through the proper application of one or more automatic protection functions. As the controls utilized become more complicated, functional safety is becoming increasingly crucial in all industrial and consumer products to provide protection in a broader range of scenarios. It is critical for manufacturing facilities to ensure safe operations. These systems can give the operators improved operational data and control over the equipment in use. They also help manufacturers to operate with closer margins while maintaining a well-defined functional safety environment, which benefits them by enhancing efficiency, reducing downtime, and aiding cost savings.

Functional Safety Market Overview

Several safety-critical industries must adhere to safety requirements. DO-178C is one example of a safety standard that focuses on safe software development procedures. On the other hand, standards such as IEC 61508, ISO 26262, IEC 62304, and EN 50128 focus on system safety criteria. Such stringent safety regulations are fueling the growth of the functional safety market. In addition, the growing scale of electric vehicle production operations propels the demand for functional safety systems. The oil and gas sector is another end user of advanced functional safety systems meant to improve operational security and efficiency. The integration of emergency shutdown systems (ESD) and high-integrity pressure protection systems (HIPPS) is critical for reducing the impact of mishaps associated with hazardous operations.

Further, integrating functional safety systems with Industry 4.0 and IoT technologies may benefit enterprises with continuous data collection and analysis, enabling proactive risk management, which is expected to create an opportunity for the growth of the functional safety market in the coming years. The adoption of AI and ML in functional safety systems can help predict failures, assess risks in real time, and improve safety responses, thereby improving both preventive and corrective safety measures. Thus, the integration of advanced technologies such as AI and ML is bringing significant future trends in the market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFunctional Safety Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Functional Safety Market Drivers and Opportunities

Market Drivers:

- Rising Adoption of Industrial Automation As factories and production lines become more automated, the need for reliable safety systems to prevent hazards grows.

- Stringent Safety Regulations Across Industries Increasingly strict international safety standards (like IEC 61508, ISO 26262) are pushing industries to adopt functional safety systems.

- Growth of Automotive Electronics and ADAS The expansion of Advanced Driver Assistance Systems (ADAS) in vehicles is driving demand for safety-certified electronics.

- Increased Risk of Operational Hazards in High-Risk Industries Sectors like oil & gas, chemicals, and nuclear are investing in functional safety to mitigate risks and ensure fail-safe operations.

- Emergence of IoT and Smart Manufacturing The integration of IoT in industrial environments raises the need for advanced functional safety to manage complex, connected systems.

Market Opportunities:

- Integration of AI and Machine Learning in Safety Systems AI-driven predictive analytics can enhance functional safety by enabling smarter fault detection and real-time risk mitigation.

- Expansion of Functional Safety in Emerging Economies Rapid industrialization in Asia-Pacific, Latin America, and Africa presents vast untapped markets for safety solutions.

- Growth in Electric and Autonomous Vehicles EVs and self-driving cars require higher levels of safety assurance, creating new demand for certified functional safety solutions.

- Adoption of Industry 4.0 and Smart Manufacturing Digital transformation of factories opens opportunities for implementing next-gen safety systems integrated with IoT and cloud platforms.

- Retrofit and Modernization of Legacy Safety Systems Upgrading outdated safety infrastructure in industries offers a sizable opportunity for vendors of modern functional safety technologies.

Functional Safety Market Report Segmentation Analysis

The Functional Safety market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Offering:

- Component This segment includes critical components such as safety sensors, switches, programmable safety systems, final control elements, and emergency stop devices.

- Services Services offered by functional safety market players include safety consulting, system integration, training, and continuing maintenance, which support the implementation, maintenance, and optimization of safety systems.

By System:

- Emergency Shutdown System (ESD): The ESD is crucial for guaranteeing the safety of industrial processes, especially in high-risk industries such as oil and gas, chemicals and petrochemicals, and power generation.

- High Integrity Pressure Protection System (HIPPS): HIPPS are critical for protecting industrial processes from overpressure, which can result in catastrophic failures.

- Burner Management System (BMS): Burner management systems are critical for ensuring safety in combustion processes in the power generation, manufacturing, and petrochemical industries, among others.

- Fire and Gas Monitoring: Fire and gas monitoring systems are critical for maintaining safety in hazardous situations, particularly in industries such as oil and gas, chemical processing, and manufacturing.

- Turbo Machinery Control (TMC): Turbo machinery control systems are essential for maximizing the performance and safety of rotating equipment such as turbines and compressors, which are primarily utilized in the oil and gas, power generation, and petrochemical industries, among others.

- Others: Others include Distributed Control Systems (DCS), Distributed Control Systems (DCS) are automated control systems used in industrial processes to manage complex operations by distributing control functions across multiple controllers.

By End-User Industry:

- Power Generation

- Oil and Gas

- Chemicals

- Pharmaceutical

- Food and Beverages

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The Functional Safety market in Asia Pacific is expected to witness the fastest growth. This is due to rapid industrialization, expanding manufacturing sectors, and increasing adoption of automation across emerging economies like China and India.

Functional Safety Market Regional InsightsThe regional trends and factors influencing the Functional Safety Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Functional Safety Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Functional Safety Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 7.63 Billion |

| Market Size by 2031 | US$ 12.73 Billion |

| Global CAGR (2025 - 2031) | 7.9% |

| Historical Data | 2021-2024 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Functional Safety Market Players Density: Understanding Its Impact on Business Dynamics

The Functional Safety Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Functional Safety Market top key players overview

Functional Safety Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in Latin America, the Middle East, and Africa also have many untapped opportunities for Functional Safety providers to expand.

The Functional Safety market grows differently in each region. This is because of factors like digital technology, government regualtions, safety standards, among others. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Stringent Regulatory Compliance

- High Adoption of Industrial Automation

- Technological Advancements and Early Adoption

- Trends: Integration of AI, ML & IIoT in Safety Systems

2. Europe

- Market Share: Substantial share due to strict regulatory framework and EU safety mandates

-

Key Drivers:

- Strong Manufacturing & Automotive Base

- Rising Integration of ADAS, EVs and Autonomous Vehicles

- Environmental & Occupational Safety Focus

- Trends: Convergence of functional safety & cybersecurity

3. Asia Pacific

- Market Share: Fastest-growing region with rising market share every year

-

Key Drivers:

- Rapid Industrialization & Manufacturing Expansion

- Surge in Oil & Gas, Power & Chemical Industry Deployments

- Automotive Electrification & ISO 26262 Demand

- Trends: Smart Infrastructure & Smart City Safety Integration

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Dominance of Oil & Gas & Energy Projects

- Adoption of International Safety Standards

- Trends: Localization of Sensor & Electronics Assembly

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Government Push for Workplace Safety

- Industrialization in Oil, Gas & Chemicals

- Trends: Design Methodology Modernization

Functional Safety Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as ABB, Schneider Electric, and Rockwell Automation. Regional and niche providers like HIMA (Germany), Modelwise (Canada), Yokogawa and Omron (Asia Pacfic) are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Safety PLCs (e.g., SIMATIC Safety Integrated)

- Safety instrumented systems (SIS)

- Safety sensors and actuators

- Safety lifecycle management software

Opportunities and Strategic Moves

- Rapid industrialization and infrastructure development in APAC, MEA, and South America create huge demand for functional safety systems.

- Integration of functional safety with smart sensors, connected devices, and AI-driven predictive maintenance offers opportunities for advanced safety solutions.

- Increasing development of electric vehicles (EVs) and autonomous driving systems is driving demand for ISO 26262-compliant safety solutions.

Major Companies operating in the Functional Safety Market are:

- Omron Corp

- Schneider Electric SE

- Rockwell Automation Inc

- Siemens AG

- Yokogawa Electric Corp

- ABB Ltd

- Emerson Electric CO

- Honeywell International Inc.

- GE Vernova Inc.

- Hima Paul Hildebrandt GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Johnson Controls

- TÜV

- DEKRA

- Balluff GmbH

- Endress+Hauser

- SLB

- Texas Instruments

- SICK AG

- Pepperl+Fuchs

- Panasonic Holdings Corporation

- SGS SA

- Karnex

- Ignitarium

- Intertek

- UL Solutions

Functional Safety Market News and Recent Developments

- HIMA, a global leader of safety related automation solutions, announces a global partnership with Mangan Software Solutions In April 2022, HIMA, a global leader of safety related automation solutions, announces a global partnership with Mangan Software Solutions (MSS), a leading functional safety lifecycle management software provider. Powered by Mangan’s Safety Lifecycle Manager® (SLM®) software, HIMA is offering a TÜV-certified cloud-based platform that provides digitalization of the entire functional safety lifecycle.

- Honeywell (NASDAQ: HON) and NXP Semiconductors N.V. (NASDAQ: NXPI) announced at CES 2025 an expanded partnership In January 2025, Honeywell (NASDAQ: HON) and NXP Semiconductors N.V. (NASDAQ: NXPI) announced at CES 2025 an expanded partnership that will accelerate aviation product development and chart the path for autonomous flight. NXP's domain-based architecture paves the path to autonomy, featuring high-compute capabilities, integrated cybersecurity and functional safety, including technology developed for the automotive industry.

- ABB India in collaboration with Witt India In June 2024, ABB India in collaboration with Witt India - a premier manufacturer specializing in tunnel ventilation systems, is setting new benchmarks in tunnel ventilation technology. Harnessing its extensive domain expertise, ABB's cutting-edge smoke extraction motors are successfully deployed for tunnel safety and reliability across India's critical infrastructure development projects. This collaboration aims to contribute towards infrastructure development ensuring safer and more efficient journey for commuters through India’s road tunnels.

Functional Safety Market Report Coverage and Deliverables

The "Functional Safety Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Functional Safety Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Functional Safety Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Functional Safety Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Functional Safety Market

- Detailed company profiles

Frequently Asked Questions

2. High Integrity Pressure Protection System (HIPPS)—significantly-growing segment (~8.2% CAGR) .

2. Asia-Pacific growing rapidly (~8.5-8.7% CAGR)

3. Europe, South America, and MEA also show steady growth

2. High Adoption of Industrial Automation

3. Technological Advancements and Early Adoption

2. Shift Towards Software-Defined Safety Solutions

3. Rise of Autonomous and Electric Vehicles

2. Complexity in Compliance and Certification

3. Shortage of Skilled Professionals

Omron Corp, Schneider Electric SE, Rockwell Automation Inc, Siemens AG, Yokogawa Electric Corp, ABB Ltd, Emerson Electric CO, Honeywell International Inc., GE Vernova Inc., Hima Paul Hildebrandt GmbH., and many region-specific specialists

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For