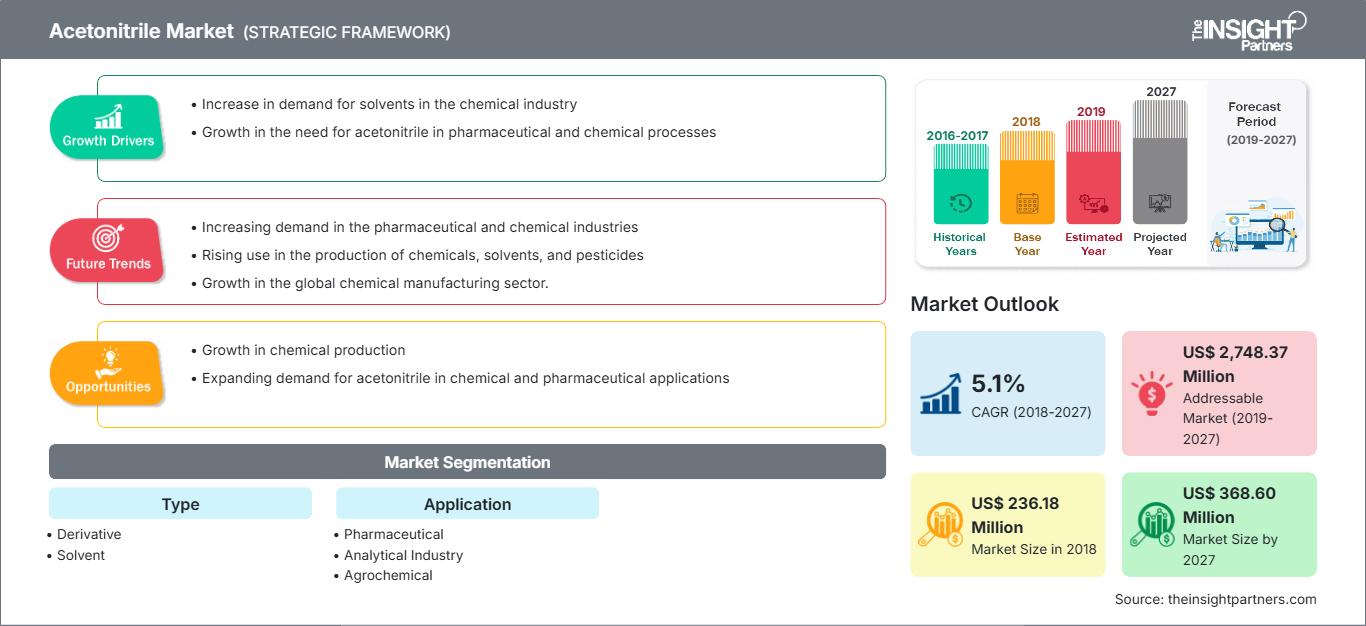

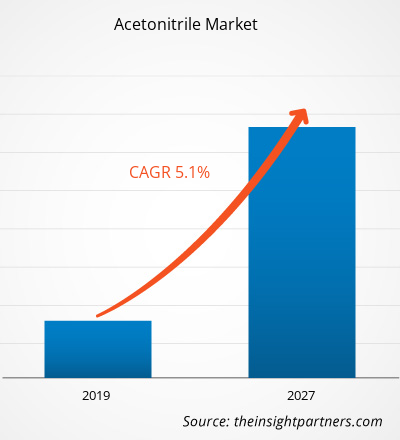

[Informe de investigación] El mercado de acetonitrilo se valoró en US$ 236,18 millones en 2018 y se espera que crezca a una CAGR del 5,1% entre 2019 y 2027 para alcanzar los US$ 368,60 millones en 2027.

El acetonitrilo, también llamado cianuro de metilo o etanonitrilo, es un disolvente opaco, volátil, inflamable y letal. Es el nitrilo natural más fácil de disolver y se puede mezclar con agua junto con la mayoría de los disolventes orgánicos. Además, presenta una alta miscibilidad con alcohol, CH3)2CO y resina epoxi, sin presentar problemas de polimerización. Este líquido seco es el nitrilo natural más fácil de sintetizar. Se obtiene principalmente a partir de compuestos de acrilonitrilo. Se utiliza como disolvente aprótico polar en la amalgamación orgánica y la refinación de butadieno. Se utiliza en la fabricación de productos farmacéuticos, aromas, productos elásticos, pesticidas, quitaesmaltes acrílicos y baterías. También se utiliza para eliminar grasas insaturadas de aceites animales y vegetales.

En 2018, Asia Pacífico concentró la mayor cuota de mercado de acetonitrilo gracias a la creciente industrialización. La demanda de acetonitrilo está cobrando impulso debido a su creciente uso en la fabricación de vitaminas A y B1, cortisona, principios activos farmacéuticos (API), fármacos carbonatados, sulfamidas pirimidinas y varios aminoácidos. Los avances en la industria farmacéutica y biotecnológica han impulsado el crecimiento del mercado de acetonitrilo.

La COVID-19 comenzó en Wuhan (China) en diciembre de 2019 y, desde entonces y en el futuro previsible, se ha extendido rápidamente por todo el mundo. China, Italia, Irán, España, la República de Corea, Francia, Alemania y Estados Unidos se encuentran entre los países más afectados en cuanto a casos confirmados y fallecimientos notificados hasta abril de 2020. Según las últimas cifras de la OMS, la pandemia ha provocado unos 2.719.896 casos confirmados y un total de 187.705 fallecimientos a nivel mundial. La COVID-19 ha afectado a las economías e industrias de diversos países debido a confinamientos, prohibiciones de viaje y cierres de empresas. La industria química y de materiales mundial es una de las principales que se enfrenta a graves disrupciones, como interrupciones en las cadenas de suministro e interrupciones en la fabricación debido al confinamiento y el cierre de oficinas. Por lo tanto, la pandemia ha afectado gravemente al mercado mundial del acetonitrilo.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado del acetonitrilo: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

Importancia del acetonitrilo en las industrias industriales y farmacéuticasacetonitrile in industrial and pharmaceuticals industries

El acetonitrilo se considera un disolvente fundamental en la industria química, especialmente en la farmacéutica, que representa aproximadamente el 70 % de la demanda mundial. Esta alta demanda se debe a su excelente capacidad de solvatación frente a una amplia gama de solutos polares y apolares, y a sus propiedades físicas, como sus bajos puntos de congelación y ebullición, su baja viscosidad y su relativamente baja toxicidad. Actualmente, la industria farmacéutica mundial informa sobre dos usos principales del acetonitrilo: como disolvente de laboratorio, en particular como fase móvil en técnicas analíticas de cromatografía líquida, y como disolvente de procesos industriales en la fabricación de antibióticos. Debido a la necesidad de disolventes de alta pureza en técnicas analíticas como la cromatografía líquida de alta resolución (HPLC), los laboratorios suelen utilizar acetonitrilo de grado "Analar", mientras que las aplicaciones industriales prefieren el acetonitrilo de "grado técnico" debido a sus requisitos de volumen y menor coste. En ambos casos, el disolvente está muy refinado en términos de pureza, típicamente >99,9% para Analar y >99,5% para grado técnico.

Perspectivas basadas en tipos

El mercado del acetonitrilo, basado en la naturaleza, se ha segmentado en derivados y solventes. En 2018, el segmento de solventes representó una mayor participación en el mercado global de acetonitrilo, mientras que se espera que el mercado de derivados crezca a una CAGR más alta durante el período de pronóstico. El acetonitrilo, en su forma de solvente, se utiliza para hilar fibras, para la fundición y el moldeo de materiales plásticos, para la extracción de ácidos grasos de aceites vegetales y animales, y en la fabricación de baterías de litio. Como solvente, el acetonitrilo posee un fuerte momento dipolar, lo que implica que el modificador orgánico utilizado en la fase móvil podría tener un poderoso efecto en la selectividad de la cromatografía. También se aplica en la hilatura y fundición de polímeros, la síntesis de ADN, la secuenciación de péptidos y las titulaciones no acuosas. Se espera que el creciente uso de solventes de acetonitrilo en diversas bases de aplicación impulse la demanda de acetonitrilo de tipo solvente en el futuro cercano.

Perspectivas basadas en aplicaciones

El mercado del acetonitrilo, basado en sus aplicaciones, se ha segmentado en productos farmacéuticos, industria analítica, agroquímicos, extracción y otros. En 2018, el segmento farmacéutico representó la mayor participación en el mercado mundial de acetonitrilo y también se espera que registre la CAGR más rápida durante el período de pronóstico. El acetonitrilo actúa como un solvente clave en la industria farmacéutica. Se utiliza como reactivo, solvente o solvente de extracción, y como materia prima para sintetizar vitamina A, vitamina B1, cortisona, fármacos carbonatados y algunos aminoácidos. Aproximadamente el 50 % del acetonitrilo producido se utiliza en la producción de insulina y antibióticos, incluidas las cefalosporinas de tercera generación. También se utiliza en la fabricación de productos farmacéuticos sintéticos. El aumento en el uso de acetonitrilo en la fabricación de vitamina B1 y la destilación azeotrópica de sulfa-pirimidinas ha impulsado el crecimiento del mercado farmacéutico.

Los actores del mercado del acetonitrilo adoptan diversas estrategias para expandir su presencia global. Formosa Plastic Corporation, Honeywell International Inc., Imperial Chemical Corporation, Ineos AG, Mitsubishi Chemical Taekwang Industrial Co. Ltd. y Tedia Company, Inc. se encuentran entre los principales actores del mercado y se centran en ampliar su cartera de clientes para obtener una participación significativa en el mercado global, lo que, a su vez, les permite mantener su marca en él.

Perspectivas regionales del mercado del acetonitrilo

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado del acetonitrilo durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado del acetonitrilo en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de acetonitrilo

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2018 | US$ 236,18 millones |

| Tamaño del mercado en 2027 | US$ 368,60 millones |

| CAGR global (2018-2027) | 5,1% |

| Datos históricos | 2016-2017 |

| Período de pronóstico | 2019-2027 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de acetonitrilo: comprensión de su impacto en la dinámica empresarial

El mercado del acetonitrilo está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de acetonitrilo

Mercado de acetonitrilo: por tipo

- Derivado

- Solvente

Mercado del acetonitrilo: por aplicación

- productos farmacéuticos

- Industria analítica

- Agroquímicos

- Extracción

- Otras aplicaciones

Perfiles de empresas

- AnQore BV

- Concord Technology (Tianjin) Co., Ltd

- Corporación Plástica FORMOSA

- Corporación Química Imperial

- Honeywell International Inc.

- INEOS AG

- CORPORACIÓN QUÍMICA MITSUBISHI

- Tecnologías moleculares Nova

- Taekwang Industrial Co. Ltd.

- Compañía Tedia, Inc.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado del acetonitrilo

Obtenga una muestra gratuita para - Mercado del acetonitrilo