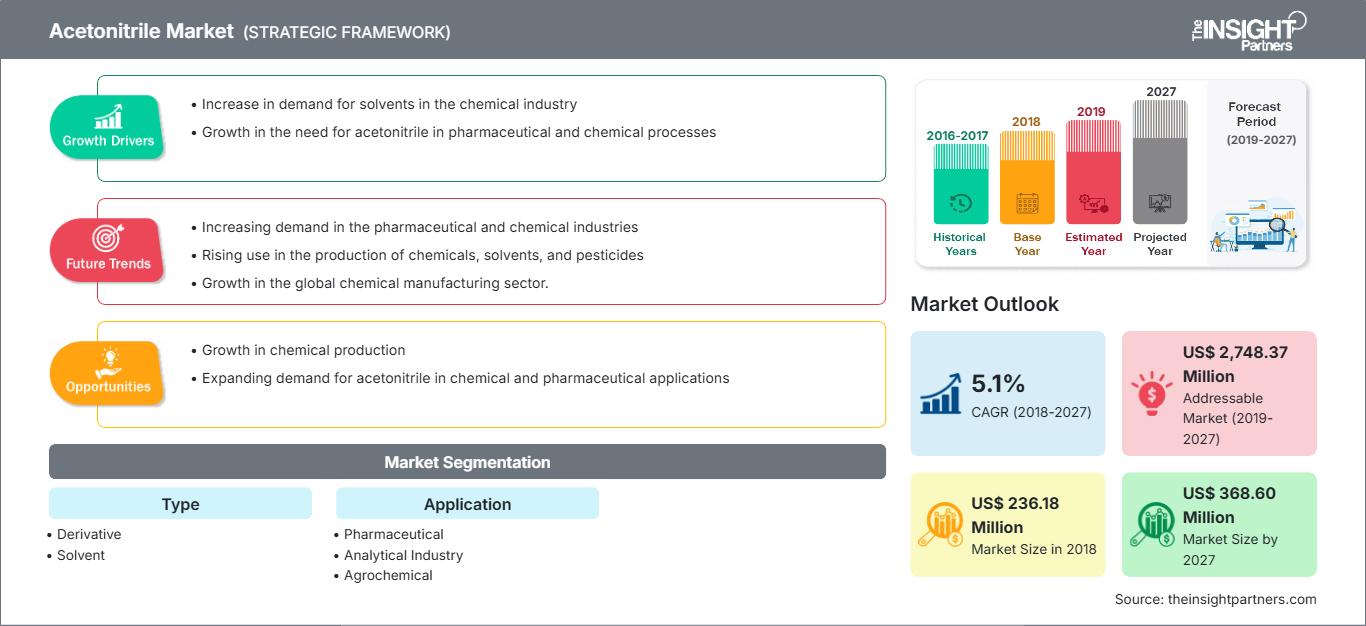

Acetonitrile Market Segments and Growth by 2027

Acetonitrile Market Forecast to 2027 - Analysis by Type (Derivative, Solvent); Application (Pharmaceutical, Analytical Industry, Agrochemical, Extraction, Others) and Geography

Historic Data: 2016-2017 | Base Year: 2018 | Forecast Period: 2019-2027- Report Date : Apr 2020

- Report Code : TIPRE00004840

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 152

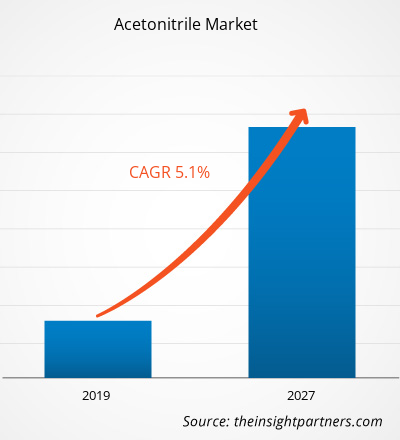

[Research Report] The acetonitrile market was valued at US$ 236.18 million in 2018 and is expected to grow at a CAGR of 5.1% from 2019 to 2027 to reach US$ 368.60 million by 2027.

Acetonitrile, otherwise called methyl cyanide or ethanenitrile, is a dull, unpredictable, combustible, and lethal solvent. It is the least difficult natural nitrile and can be blended in with water alongside most natural solvents. It additionally shows high miscibility with liquor, CH3)2CO, and epoxy gum with no obstruction with epoxy polymerization. This dry fluid is the least complex natural nitrile to synthesize. It is delivered for the most part as a result of acrylonitrile produce. It is utilized as a polar aprotic dissolvable in natural amalgamation and butadiene refinement. It is utilized to make pharmaceuticals, aromas, elastic items, pesticides, acrylic nail removers, and batteries. It is also used to remove unsaturated fats from animal and vegetable oils.

In 2018, Asia Pacific held the largest share of the acetonitrile on the back of growing industrialization. The demand for acetonitrile is gaining pace due to its increased utilization in the manufacturing of vitamins A and B1, cortisone, APIs, carbonate drugs, sulfa pyrimidine, and several amino acids. The advancement in the pharmaceutical and biotechnology industry have supported the growth of acetonitrile market.

Covid-19 at first began in Wuhan (China) during December 2019, and starting now and into the foreseeable future, it has spread over the globe at a brisk pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the worst-affected countries in terms of confirmed cases and reported deaths as of April 2020. According to the latest WHO figures, the pandemic has led to ~2,719,896 confirmed cases and 187,705 total deaths globally. Covid-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global chemical and materials industry is one of the major industries facing serious disruptions such as breaks in supply chains and disruptions in manufacturing due to lockdown and office shutdowns. Thus, the pandemic has seriously hit the global acetonitrile market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAcetonitrile Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Importance of acetonitrile in industrial and pharmaceuticals industries

Acetonitrile is regarded as a core solvent in the chemical industries, particularly in the pharmaceuticals industry, which accounts for ~70 % of the global demand for the same. The high demand for acetonitrile is due to its impeccable solvation ability toward a wide range of polar and nonpolar solutes, and physical properties such as low freezing/boiling points, low viscosity, and relatively low toxicity. Currently, the global pharmaceuticals industry reports two primary uses of acetonitrile, i.e., as laboratory solvents, particularly as a mobile phase in liquid chromatography analytical techniques and as an industrial process solvents in the manufacturing of antibiotics. Due to the need for high purity solvents in analytical techniques such as high performance liquid chromatography (HPLC), laboratories tend to use “Analar” grade acetonitrile, while industrial applications favor “technical grade” acetonitrile due to bulk requirements and lower cost. In both cases, the solvent is very highly refined in terms of purity, typically >99.9% for Analar and >99.5% for technical grade.

Type-Based Insights

The acetonitrile market based on nature has been segmented derivative and solvent. In 2018, the solvent segment accounted for a larger share of the global acetonitrile market, whereas the market for derivatives is expected to grow at a higher CAGR during the forecast period. Acetonitrile, in its solvent form, is used for spinning fibers, for casting and molding of plastic materials, for extraction of fatty acids from vegetable and animal oils and in the manufacture of lithium batteries. As a solvent, acetonitrile possesses strong dipole moment, which implied that the organic modifier used in the mobile phase could have a powerful effect on the selectivity of chromatography. It is also applied in polymer spinning and casting, DNA synthesis, peptide sequencing, and non-aqueous titrations. The growing use of acetonitrile solvents in several application bases is expected to boost the demand for solvent type acetonitrile in the near future.

Application-Based Insights

The acetonitrile market based on applications has been segmented into pharmaceuticals, analytical industry, agrochemical, extraction, and others. In 2018, the pharmaceuticals segment accounted for the largest share in the global acetonitrile market and is also expected to register the fastest CAGR during the forecast period. Acetonitrile act as a key solvent in the pharmaceuticals industry. It is used as a reagent, solvent or extraction solvent, and a starting material for synthesizing vitamin A, vitamin B1, cortisone, carbonate drugs, and a few amino acids. ~50 % of acetonitrile produced is used in the production of insulin and antibiotics, including third-generation cephalosporins. It is also used in the manufacture of synthetic pharmaceuticals. The increase in the use of acetonitrile in the manufacturing of vitamin B1 and sulfa-pyrimidine azeotropic distillation has been supporting the pharmaceutical market growth.

The acetonitrile market players adopt several strategies to expand their footprint worldwide. Formosa Plastic Corporation, Honeywell International Inc, Imperial Chemical Corporation, Ineos AG, Mitsubishi Chemical Taekwang Industrial Co. Ltd., and Tedia Company, Inc are among the major market players, and they are focused toward enlarging their customer base to gain significant share in the global market, which, in turn, permits them to maintain their brand name in it.

Acetonitrile Market Regional InsightsThe regional trends and factors influencing the Acetonitrile Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Acetonitrile Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Acetonitrile Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 236.18 Million |

| Market Size by 2027 | US$ 368.60 Million |

| Global CAGR (2018 - 2027) | 5.1% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Acetonitrile Market Players Density: Understanding Its Impact on Business Dynamics

The Acetonitrile Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Acetonitrile Market top key players overview

Acetonitrile Market – By Type

- Derivative

- Solvent

Acetonitrile Market – By Application

- Pharmaceuticals

- Analytical Industry

- Agrochemicals

- Extraction

- Other Applications

Company Profiles

- AnQore B.V

- Concord Technology (Tianjin) Co., Ltd

- FORMOSA Plastic Corporation

- Imperial Chemical Corporation

- Honeywell International Inc.

- INEOS AG

- MITSUBISHI CHEMICAL CORPORATION

- Nova Molecular Technologies

- Taekwang Industrial Co Ltd

- Tedia Company, Inc

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For