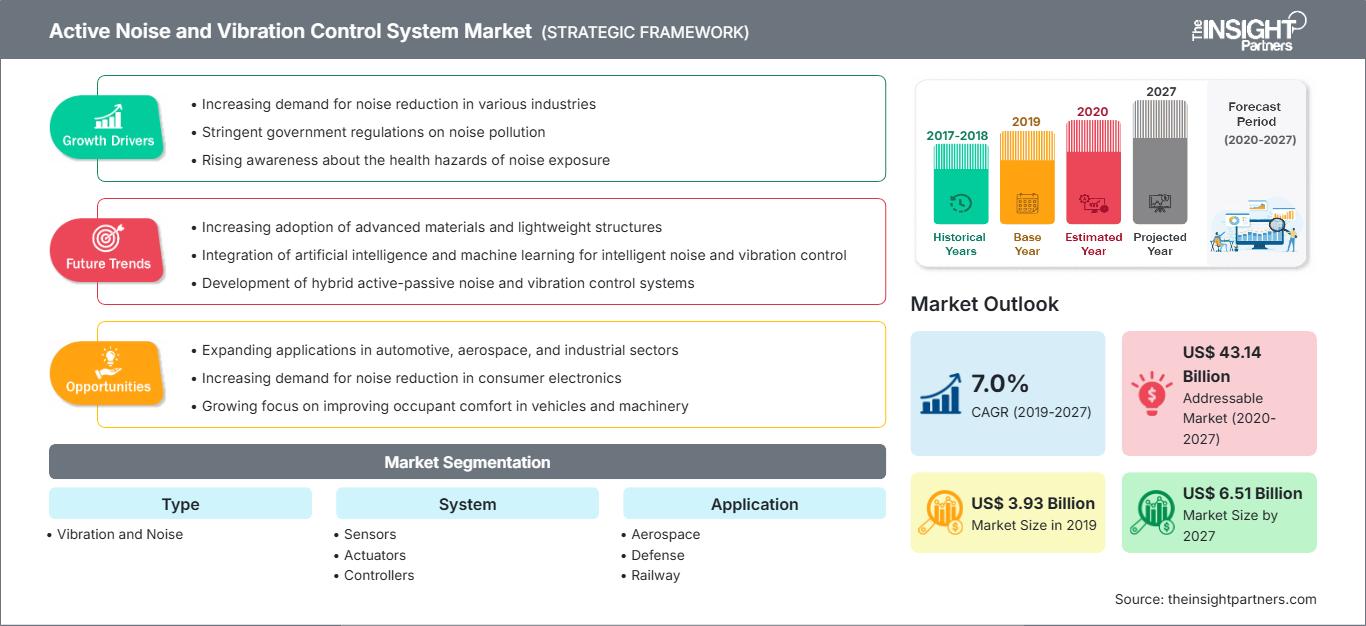

En términos de ingresos, el mercado mundial de sistemas activos de control de ruido y vibraciones se valoró en 3.925,61 millones de dólares estadounidenses en 2019 y se prevé que alcance los 6.505,28 millones de dólares estadounidenses en 2027; se espera que crezca a una tasa de crecimiento anual compuesta (TCAC) del 7,0% durante el período de previsión de 2020 a 2027.

El mercado de sistemas activos de control de ruido y vibraciones se divide en cinco regiones principales: Norteamérica, Europa, Asia-Pacífico, Oriente Medio y África (MEA) y Sudamérica. La industria aeroespacial y de defensa en Norteamérica está consolidada, con un gran número de fabricantes de aeronaves y el apoyo constante del Departamento de Defensa de EE. UU. La demanda de tecnologías avanzadas es enorme en la región, y todos los usuarios finales mencionados están familiarizados con las nuevas tecnologías. El Departamento de Defensa de EE. UU. invierte continuamente tiempo y recursos en la modernización de la flota existente y en el desarrollo de tecnología robusta para vehículos blindados terrestres y buques de guerra, con el objetivo de mantener una fuerza operativa. La presencia de numerosos fabricantes de sistemas activos de control de ruido y vibraciones en la región respalda la creciente demanda, lo que impulsa el mercado de estos sistemas.

Obtendrá personalización gratuita de cualquier informe, incluyendo partes de este informe, análisis a nivel de país y paquetes de datos de Excel. Además, podrá aprovechar excelentes ofertas y descuentos para empresas emergentes y universidades.

Mercado de sistemas activos de control de ruido y vibraciones: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado que se describen en este informe.Esta muestra GRATUITA incluirá análisis de datos, que abarcarán desde tendencias de mercado hasta estimaciones y pronósticos.

Perspectivas del mercado: Mercado de sistemas de control activo de ruido y vibraciones

Mayor adopción de sistemas activos en la fabricación ferroviaria

La industria ferroviaria mundial ha experimentado un crecimiento considerable en los últimos años, con avances tecnológicos que se traducen en viajes más seguros y confortables. El material rodante (bogies y vagones de carga) sufre vibraciones verticales y ruido significativos, lo que incrementa los riesgos durante su funcionamiento. Para mitigar estas vibraciones y el ruido, los fabricantes de material ferroviario se centran cada vez más en la adopción de sistemas de control de ruido y vibraciones. El control pasivo de ruido y vibraciones es común entre los fabricantes, ya que les permite ofrecer productos más seguros y confortables. Sin embargo, la mayoría de los sistemas pasivos son hidráulicos, y en los últimos años, los fabricantes de material ferroviario están priorizando los sistemas controlados electrónicamente, lo que refleja un creciente interés por los sistemas activos de control de ruido y vibraciones. Un sistema activo con actuadores de masa inercial montados en los bogies puede controlar el ruido y las vibraciones de baja frecuencia dentro de los compartimentos. Además, los sistemas activos suelen ser electromecánicos, lo que los convierte en la opción preferida de los fabricantes de material ferroviario. Se prevé que este factor genere una demanda significativamente mayor de sistemas activos entre los fabricantes de equipos ferroviarios, catalizando así el mercado de sistemas activos de control de ruido y vibraciones.

Información sobre segmentos de tipo

En 2019, el segmento de control de vibraciones dominó el mercado global de sistemas activos de control de ruido y vibraciones, según su tipo. Los sistemas activos de control de vibraciones son sistemas de aislamiento que responden dinámicamente a las vibraciones externas. Estos sistemas se utilizan para reducir la fricción y controlar las vibraciones en máquinas móviles o estáticas.

Información sobre el segmento del sistema

En 2019, el segmento de actuadores dominó el mercado global de sistemas de control activo de ruido y vibraciones. Los actuadores se integran en estos sistemas para controlar diversas fuerzas dentro de la planta y así optimizar su funcionamiento. Estos actuadores emplean diferentes tecnologías, como la piezoeléctrica, la electrodinámica y la electrodinámica hidráulica.

Perspectivas del segmento de la industria

En 2019, el sector aeroespacial dominó el mercado mundial de sistemas activos de control de ruido y vibraciones. La industria aeroespacial ha experimentado un crecimiento exponencial en los últimos años, con un elevado número de producciones y entregas. Los fabricantes de aeronaves y componentes se enfrentan a una presión considerable por parte de los usuarios finales del sector de la aviación comercial para entregar un mayor número de aeronaves.

Los agentes del mercado se centran en la innovación y el desarrollo de nuevos productos, integrando tecnologías y características avanzadas para competir con la competencia.

- En 2019, Creo Dynamics anunció la adquisición de la participación mayoritaria por parte de Faurecia, con el objetivo de combinar la competencia de la compañía en control activo de ruido y acústica para la automoción con la de Faurecia y desarrollar nuevas soluciones únicas para el mercado.

- En 2019, Terma anunció que había firmado un contrato con la UASF para proporcionar sistemas de audio 3D para los aviones A-10.

- En 2018, Vicoda GmbH anunció que había suministrado amortiguadores de masa sintonizados para pasarelas peatonales en Gante para controlar y reducir las vibraciones inducidas por los peatones y ofrecer los requisitos de confort al prevenir el efecto de "bloqueo".

El mercado global de sistemas activos de control de ruido y vibraciones se ha segmentado de la siguiente manera:

Perspectivas regionales del mercado de sistemas activos de control de ruido y vibraciones

Los analistas de The Insight Partners han explicado en detalle las tendencias regionales y los factores que influyen en el mercado de sistemas activos de control de ruido y vibraciones durante el período de previsión. Esta sección también analiza los segmentos y la geografía del mercado de sistemas activos de control de ruido y vibraciones en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de sistemas activos de control de ruido y vibraciones

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2019 | 3.930 millones de dólares estadounidenses |

| Tamaño del mercado para 2027 | 6.510 millones de dólares estadounidenses |

| Tasa de crecimiento anual compuesto global (2019 - 2027) | 7,0% |

| Datos históricos | 2017-2018 |

| período de previsión | 2020-2027 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de los actores del mercado de sistemas activos de control de ruido y vibraciones: comprensión de su impacto en la dinámica empresarial.

El mercado de sistemas activos de control de ruido y vibraciones está experimentando un rápido crecimiento, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las nuevas tendencias, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una visión general de los principales actores del mercado de sistemas de control activo de ruido y vibraciones.

Mercado de sistemas activos de control de ruido y vibraciones – Por tipo

- Vibración

- Ruido

Mercado de sistemas de control activo de ruido y vibraciones – Por sistema

- Sensores

- Actuadores

- Controladores

- Amortiguadores

Mercado de sistemas de control activo de ruido y vibraciones – Por sistema

-

Aeroespacial

- Ala fija

- Ala rotatoria

-

Defensa

- Vehículo terrestre

- Buques de la Armada

- Ferrocarril

-

Industrias generales

- Fabricación

- Energía y potencia

Mercado de sistemas de control activo de ruido y vibraciones – Por sistema

- Sensores

- Actuadores

- Controladores

- Amortiguadores

Mercado de sistemas activos de control de ruido y vibraciones por región

-

América del norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- Rusia

- El resto de Europa

-

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

-

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

-

Sudamérica (SAM)

- Brasil

- El resto de SAM

Mercado de sistemas activos de control de ruido y vibraciones: perfiles de empresas

- FABREEKA

- Honeywell International Inc.

- Hutchinson

- Terma A/S

- Moog Inc.

- Parker Hannifin

- Faurecia Creo AB

- Supershock

- Trelleborg AB

- VICODA GmbH

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas de control activo de ruido y vibraciones

Obtenga una muestra gratuita para - Mercado de sistemas de control activo de ruido y vibraciones