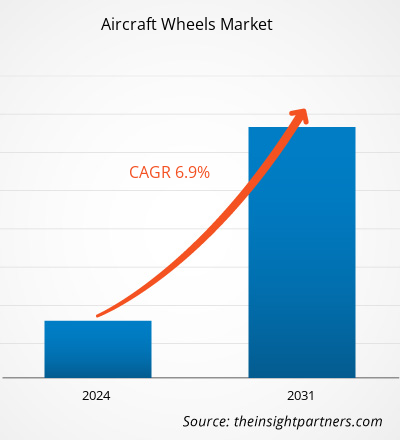

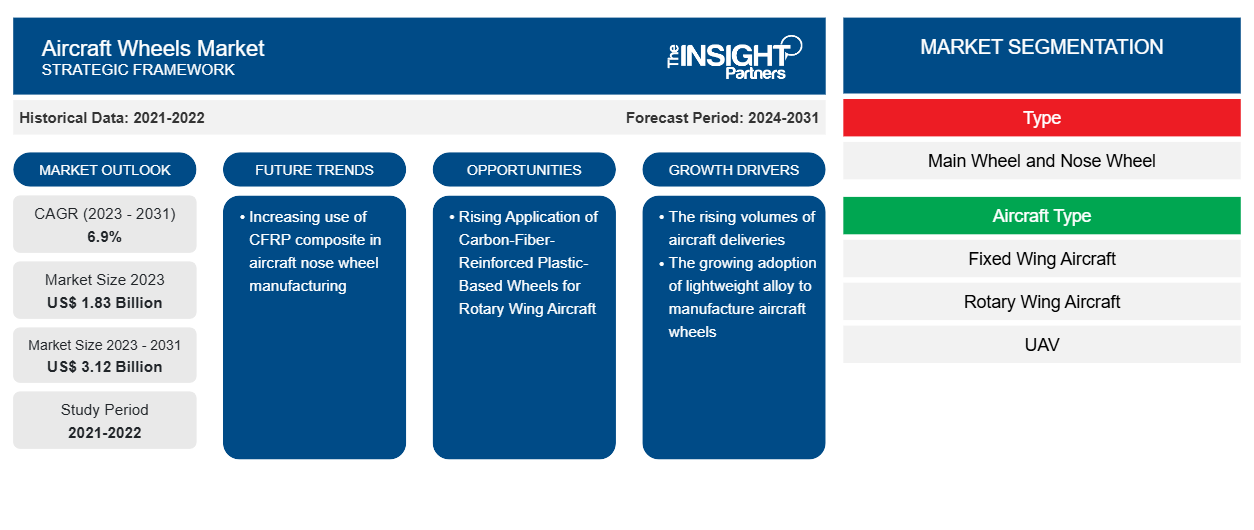

Se prevé que el tamaño del mercado de ruedas de aeronaves alcance los 3.120 millones de dólares en 2031, frente a los 1.830 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 6,9 % durante el período 2023-2031. Se espera que el uso creciente del compuesto CFRP en la fabricación de ruedas de morro de aeronaves siga siendo una tendencia clave en el mercado.CAGR of 6.9% during 2023–2031. Increasing use of CFRP composite in aircraft nose wheel manufacturing is expected to remain a key trend in the market.

Análisis del mercado de ruedas para aviones

Debido a la introducción del compuesto reforzado con fibra de carbono, los fabricantes de ruedas de aviones están utilizando ampliamente el material para diseñar y fabricar una rueda de morro de avión. El material es conocido por su alta rigidez y resistencia, lo que lo hace compatible con una rueda de morro de avión. Además, el material compuesto es más ligero que las aleaciones de aluminio y magnesio. Por lo tanto, se espera que la rueda basada en plástico reforzado con fibra de carbono (CFRP) reduzca la densidad de masa de un avión. Esto dará como resultado un menor consumo de combustible y el avión puede operar de manera económica. Además, se puede aumentar el alcance o la carga útil. En la actualidad, los fabricantes de ruedas de aviones están desarrollando ruedas de aviones hechas de compuesto CFRP. Por ejemplo, Fraunhofer LBF está utilizando el compuesto CFRP para desarrollar ruedas de morro para un avión Airbus A320. Por lo tanto, en los próximos años, se espera que los fabricantes de ruedas de aviones utilicen cada vez más material CFRP para fabricar ruedas de morro de aviones. Por lo tanto, se anticipa que el aumento en el uso del material compuesto CFRP para la fabricación de ruedas de morro de aviones crecerá entre los fabricantes de ruedas de aviones y se convertirá en una tendencia futura.CFRP) based wheel is expected to reduce the mass density of an aircraft. This will result in lower fuel consumption and the aircraft can be operated economically. Also, the range or payload can be increased. At present, aircraft wheel manufacturers are developing aircraft wheels made of CFRP composite. For instance, Fraunhofer LBF is using the CFRP composite to develop nose wheels for an Airbus A320 aircraft. Hence, in the coming years, aircraft wheel manufacturers are expected to use CFRP material increasingly to manufacture aircraft nose wheels. Hence, the rise in use of CFRP composite material for manufacturing aircraft nose wheels are anticipated to grow among aircraft wheel manufacturers and become future trend.

Descripción general del mercado de ruedas para aeronaves

El ecosistema del mercado de ruedas de aeronaves se compone de las siguientes partes interesadas: proveedores de materias primas y componentes, fabricantes de ruedas de aeronaves, fabricantes de aeronaves y usuarios finales. Los fabricantes de ruedas de aeronaves adquieren materias primas y componentes como acero, aluminio y aleación de magnesio y componentes como tuercas y tornillos, entre otros, se adquieren de los proveedores de materias primas y componentes. Los fabricantes de ruedas de aeronaves ensamblan materias primas y componentes y producen un producto terminado. Estos fabricantes son los actores clave del mercado de ruedas de aeronaves y tienen una cantidad significativa de participación en el mercado dado. Algunos de los actores destacados que operan en el mercado son Honeywell International Inc.; Safran SA; Parker Hannifin Corporation; Raytheon Technologies Corporation; y Matco Manufacturing Inc. entre otros. Además, estos fabricantes suministran ruedas de aeronaves a fabricantes de aeronaves como Airbus, Boeing, Dassault Aviation, Bombardier, Lockheed Martin Corporation y otros para los ajustes de línea de ruedas. Además, los fabricantes de ruedas de aeronaves venden las ruedas a proveedores de modernización de ruedas como Lufthansa Technik, AAR Corporation y TP Aerospace, entre otros. Estos proveedores de modernización adquieren ruedas de aeronaves para compañías aéreas y realizan la modernización de ruedas durante los servicios de mantenimiento, reparación y revisión (MRO) de las aeronaves.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de ruedas para aeronaves

Creciente adopción de aleaciones ligeras para fabricar ruedas de aeronaves

Las ruedas de los aviones convencionales están hechas de aleaciones de magnesio. Sin embargo, en los tiempos modernos, los fabricantes están explorando cada vez más materiales ligeros para fabricar ruedas de aviones para lograr una gran durabilidad y un bajo mantenimiento. Además, una rueda de avión hecha de aleaciones ligeras ayuda a un fabricante de aviones a lograr un nivel óptimo de eficiencia de combustible al reducir una parte del peso de la aeronave. Por lo tanto, a raíz de los nuevos desarrollos tecnológicos en ruedas de aviones, los fabricantes están utilizando ampliamente varios tipos de aleaciones de aluminio para hacer que las ruedas sean livianas y con mejor resistencia a la corrosión. Por ejemplo, UTC Aerospace Systems (UTAS) está explorando una aleación de aluminio a base de plata para desarrollar una rueda de avión. Se espera que la resistencia de las nuevas ruedas hechas de aluminio a base de plata aumente aproximadamente un 20%. Además, se proyecta que la nueva aleación de aluminio a base de plata aumente la tolerancia al daño en aproximadamente un 70% debido a su rigidez y resistencia a la corrosión mejorada. La variante de aluminio a base de plata también es probable que haga que la rueda de avión sea más liviana y reduzca el tiempo de inactividad por mantenimiento. Por lo tanto, la creciente adopción de aleaciones ligeras para fabricar ruedas de aviones impulsa el crecimiento del mercado de ruedas de aviones.UTAS) is exploring a silver-based aluminum alloy to develop an aircraft wheel. The strength of new wheels made of silver-based aluminum is expected to increase by about 20%. In addition, the new silver-based

Aplicación creciente de ruedas de plástico reforzado con fibra de carbono para aeronaves de ala rotatoria

En la actualidad, la mayoría de las ruedas de los helicópteros están hechas de materiales de aleación ligera metálica, como aluminio o magnesio. Sin embargo, las ruedas hechas de plástico reforzado con fibra de carbono (CFRP) pesan entre un 30% y un 40% menos que las de aleación de aluminio o magnesio. Se espera que las ruedas de CFRP ofrezcan una mejor resistencia a la corrosión y un mejor rendimiento en cuanto a ruido, vibración y aspereza (NVH). Además, estas ruedas son más rígidas y tienen una vida útil más prolongada, lo que prolongará su vida útil. Los fabricantes ya han iniciado el diseño de ruedas basadas en CFRP para aeronaves de ala giratoria. Por ejemplo, en enero de 2021, Carbon ThreeSixty, una empresa de fabricación de ruedas para aeronaves con sede en el Reino Unido, comenzó a desarrollar ruedas basadas en CFRP para aeronaves de ala giratoria. Se espera que la empresa complete el diseño de las ruedas en los próximos 18 meses. Estas ruedas compuestas también serán intercambiables con las ruedas existentes para que sean adecuadas para aplicaciones de modernización. Por lo tanto, con la introducción de ruedas de plástico reforzado con fibra de carbono en aeronaves de ala giratoria, se espera que el mercado florezca aún más en los próximos años con la oportunidad de penetrar en las ruedas de aeronaves de ala giratoria.CFRP) are ~30%–40% less in weight than aluminum or magnesium alloy wheels. CFRP wheels are expected to offer improved corrosion resistance and noise, vibration, and harshness (NVH) performance. Also, these wheels are stiffer with improved fatigue life, which will extend their life. Manufacturers have already initiated the designing of CFRP-based wheels for rotary wing aircraft. For instance, in January 2021, Carbon ThreeSixty, a UK-based aircraft wheels manufacturing company, began to develop CFRP-based wheels for rotary wing aircraft. The company is expected to complete the wheel designing in the next 18 months. These composite wheels will also be interchangeable with existing wheels to make them suitable for retrofit applications. Hence, with the introduction of carbon-fiber-reinforced plastic-based wheels in rotary wing aircraft, the market is expected to flourish further in the coming years with an opportunity to penetrate the rotary wing aircraft wheels.

Análisis de segmentación del informe de mercado de ruedas de aeronaves

El segmento clave que contribuyó a la derivación del análisis del mercado de ruedas de aeronaves es el tipo, el tipo de aeronave, el tipo de ajuste y el usuario final.

- Según el tipo, el mercado de ruedas para aeronaves se segmenta en rueda principal y rueda delantera. El segmento de ruedas principales tuvo una mayor participación de mercado en 2023.

- Según el tipo de aeronave, el mercado de ruedas para aeronaves se segmenta en aeronaves de ala fija, aeronaves de ala giratoria y vehículos aéreos no tripulados. El segmento de aeronaves de ala fija tuvo una mayor participación de mercado en 2023.UAV. The fixed wing aircraft segment held a larger market share in 2023.

- Según el tipo de ajuste, el mercado de ruedas para aeronaves se segmenta en ajuste de línea y reacondicionamiento. El segmento de ajuste de línea tuvo una mayor participación de mercado en 2023.

- Según el usuario final, el mercado de ruedas para aeronaves se segmenta en líneas comerciales y militares. El segmento comercial tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de ruedas de aeronaves por geografía

El alcance geográfico del informe del mercado de ruedas de aeronaves se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

En 2023, América del Norte dominó el mercado, seguida de las regiones de Asia Pacífico y Europa. Además, es probable que Asia Pacífico experimente la CAGR más alta en los próximos años. Además, es probable que Asia Pacífico supere el mercado de ruedas para aviones de América del Norte en los próximos años. China representó la mayor participación de mercado en el mercado de ruedas para aviones de Asia Pacífico en 2023, mientras que es probable que India experimente la CAGR más alta en los próximos años. El rápido crecimiento de la industria de la aviación y la mayor demanda de servicios de aerolíneas de pasajeros han impulsado los servicios de aerolíneas comerciales en el país. Por lo tanto, existe un enorme potencial y enormes oportunidades para crear empresas conjuntas y colaboración en el sector aeroespacial en la India para formar instalaciones MRO. Por lo tanto, se espera que un enfoque importante en la fabricación de aeronaves y el aumento de los servicios de aerolíneas comerciales en toda la India impulsen el crecimiento del mercado de ruedas para aviones en todo el país en los próximos años.

Perspectivas regionales del mercado de ruedas para aeronaves

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de ruedas para aeronaves durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de ruedas para aeronaves en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de ruedas de aeronaves

Alcance del informe de mercado de ruedas para aeronaves

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 1.830 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 3.12 mil millones |

| CAGR global (2023 - 2031) | 6,9% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de ruedas de aeronaves: comprensión de su impacto en la dinámica empresarial

El mercado de ruedas para aeronaves está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de ruedas para aeronaves son:

- Corporación Raytheon Technologies

- Honeywell Internacional Inc.

- Corporación Parker Hannifin

- Grupo Safran

- Beringer Aero Usa

- Tecnología de Lufthansa

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de ruedas para aeronaves

Noticias y desarrollos recientes del mercado de ruedas para aeronaves

El mercado de ruedas para aeronaves se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de ruedas para aeronaves:

- Safran Landing Systems ha inaugurado en su planta de Vélizy-Villacoublay (Francia) un laboratorio totalmente renovado, dedicado a probar sus ruedas y frenos de carbono, y equipado con un nuevo banco de pruebas. La empresa habrá invertido un total de 10 millones de euros para llevar a cabo este ambicioso proyecto. (Fuente: Safran, Comunicado de prensa, abril de 2024)

- Bauer, líder mundial en equipos de prueba y soporte para componentes de aeronaves, anunció la creación de una unidad de negocios de equipos para ruedas y frenos. (Fuente: Bauer Inc, comunicado de prensa, abril de 2024)

Informe sobre el mercado de ruedas para aeronaves: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de ruedas para aeronaves (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de ruedas de aeronaves y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de ruedas para aeronaves, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST detallado

- Análisis del mercado de ruedas para aeronaves que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de ruedas para aeronaves

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de ruedas de aeronaves

Obtenga una muestra gratuita para - Mercado de ruedas de aeronaves