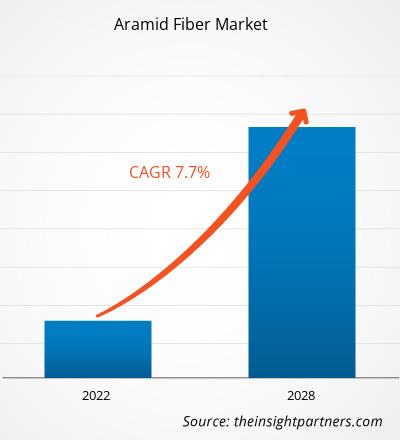

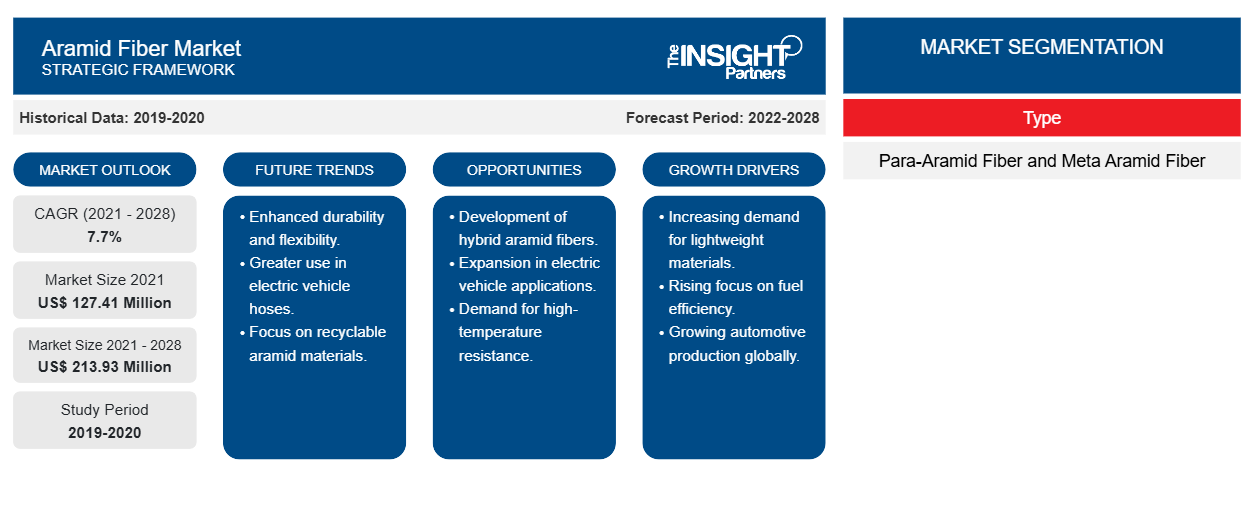

Se proyecta que el mercado de fibra de aramida para mangueras automotrices alcance los US$ 213,93 millones para 2028 desde los US$ 127,41 millones en 2021; se espera que crezca a una CAGR del 7,7% entre 2021 y 2028.

Las fibras de aramida son fibras sintéticas de alto rendimiento con moléculas caracterizadas por cadenas de polímeros relativamente rígidas. Estas moléculas están unidas entre sí por fuertes enlaces de hidrógeno que transmiten eficazmente la tensión mecánica. El término "aramida" significa "poliamida aromática". Las fibras de aramida tienen el aspecto de filamentos de color amarillo dorado brillante. Estas fibras se utilizan para reforzar neumáticos, componentes del sistema de propulsión, mangueras de turbocompresores, pastillas de freno, correas, juntas, embragues, tejidos de asientos, componentes electrónicos, sensores de asientos y materiales de motores híbridos. fibers are high-performance synthetic fibers with molecules characterized by relatively stiff polymer chains. These molecules are linked together by strong hydrogen bonds that efficiently transmit mechanical stress. The term "aramid" means "aromatic polyamide." Aramid fibers appear bright golden yellow filaments. These fibers are used to reinforce tires, powertrain components, turbocharger hoses, brake pads, belts, gaskets, clutches, seat textiles, electronics, seat sensors, and hybrid motor materials.

Se espera que el mercado de fibra de aramida para mangueras automotrices en Asia Pacífico crezca a la tasa de crecimiento anual compuesta más rápida durante el período de pronóstico. Se proyecta que el mercado regional será testigo de un crecimiento notable en el futuro cercano debido a la rápida expansión de la industria automotriz, que impulsa el florecimiento de la industria de fabricación de autopartes, especialmente en países como China, Corea del Sur e India. A medida que aumenta la producción de vehículos eléctricos, también lo hace la cantidad de piezas y componentes en el vehículo, lo que impulsará aún más el crecimiento del mercado de fibra de aramida para mangueras automotrices en la región.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado de fibra de aramida para mangueras automotricesAramid Fiber Market for Automotive Hoses

La pandemia de COVID-19 impactó significativamente el mercado de fibra de aramida para mangueras automotrices en 2020. Durante la pandemia, las industrias automotrices interrumpieron temporalmente sus procesos de producción, lo que provocó una disminución en la demanda de productos compuestos de fibras de aramida. Además, la industria automotriz mundial ha sido testigo de una caída recientemente. Según la OICA, se produjeron ~77,62 mil vehículos a nivel mundial en 2020, en comparación con 92,18 mil vehículos en 2019, lo que indica una caída del 15,8% en la producción. La caída se puede atribuir a una menor producción en los principales centros automotrices como EE. UU., China, Japón y Alemania, que experimentaron una disminución del 19%, 2%, 17% y 24%, respectivamente, en 2020, en comparación con 2019. Sin embargo, la industria ha comenzado a ganar impulso desde el cuarto trimestre de 2020 y se espera que sea testigo de un crecimiento significativo en los próximos años debido a la creciente demanda de vehículos eléctricos.aramid fiber market for automotive hoses in 2020. During the pandemic, the automotive industries temporarily discontinued their production processes, leading to a decrease in demand for products made up of aramid fibers. In addition, the global automotive industry has witnessed a downfall recently. According to the OICA, ~77.62 thousand vehicles were produced globally in 2020, compared to 92.18 thousand vehicles in 2019, indicating a 15.8% drop in production. The drop can be attributed to a lower output in major automobile hubs such as the US, China, Japan, and Germany, which experienced a 19%, 2%, 17%, and 24% decline, respectively, in 2020, compared to 2019. However, the industry has started to gain momentum since the Q4 of 2020 and is expected to witness significant growth in the coming years owing to the rising demand for electric vehicles.

Perspectivas del mercado

Aumento de la demanda del mercado de combustibles de la industria automotriz

La fibra de aramida es un polímero sintético que pertenece a la clase de fibras sintéticas resistentes y resistentes al calor. Ofrecen una buena resistencia a la abrasión y a los disolventes orgánicos, y presentan un alto punto de fusión, baja conductividad y baja inflamabilidad. Se ha producido un aumento en el uso de fiber is a man-made polymer belonging to the class of strong synthetic and heat-resistant fibers. They provide good resistance to abrasion and organic solvents, and exhibit high melting point, low conductivity, and low flammability. There has been an increase in the use of fibras de aramida fibers en la industria automotriz en aplicaciones como neumáticos, mangueras de turbocompresores, componentes del tren motriz, correas, pastillas de freno, juntas, embragues, telas de asientos, componentes electrónicos, sensores de asientos y materiales de motores híbridos. Estas fibras se utilizan para reforzar las mangueras de transmisión, radiador y turbocompresor. Las mangueras reforzadas con fibras de aramida son más fuertes y duraderas y pueden soportar las condiciones más duras.powertrain components, belts, brake pads, gaskets, clutches, seat fabrics, electronics, seat sensors, and hybrid motor materials. These fibers are used to reinforce transmission, radiator, and turbocharger hoses. The hoses that are reinforced with aramid fibers are stronger and long-lasting and can withstand the toughest conditions.

La producción de automóviles o vehículos implica una serie de materiales, como hierro, aluminio, plástico, acero y vidrio. Las fibras de aramida se utilizan ampliamente como sustituto del aluminio y el acero debido a su peso ligero, alta resistencia a la tracción y resistencia superior a la corrosión. Los fabricantes de la industria automotriz se esfuerzan continuamente por introducir productos innovadores para seguir siendo competitivos en los mercados a los que sirven. Los aspectos de seguridad, el excelente rendimiento y la necesidad de sostenibilidad presionan a la industria automotriz para desarrollar productos de alta calidad. Necesitan garantizar un excelente rendimiento de las mangueras automotrices independientemente de las condiciones cada vez más difíciles. Por ejemplo, los sistemas de mangueras debajo del capó deben soportar condiciones de funcionamiento cada vez más duras; en consecuencia, los hilos de refuerzo de las mangueras deben tener una resistencia superior, así como estabilidad química, térmica y dimensional. Las fibras de aramida ayudan a mejorar la seguridad, el rendimiento y la durabilidad de los componentes automotrices, incluidas las mangueras y las correas automotrices. Además, ayudan a prolongar la vida útil del producto, mejorar el rendimiento del producto, etc.Aramid fibers are extensively used as a substitute for aluminum and steel due to their lightweight, high tensile strength, and superior corrosion resistance. Manufacturers in the automotive industry are continuously striving to introduce innovative products to stay competitive in the markets they serve. Safety aspects, excellent performance, and the need for sustainability, pressure the automotive industry to develop high-quality products. They need to ensure a fine performance of automotive hoses irrespective of increasingly difficult conditions. For example, under-hood hose systems must withstand increasingly harsh operating conditions; consequently, the hose reinforcing yarns must have superior strength, as well as chemical, thermal, and dimensional stability. Aramid fibers help improve the safety, performance, and durability of automotive components, including automotive hoses and automotive belts. In addition, they help extend product life, improve product performance, and so on.

Información sobre el tipo de material

Según el tipo, el mercado de fibra de aramida para mangueras automotrices se bifurca en fibra de para-aramida y fibra de meta-aramida. El segmento de para-aramida registrará una CAGR más alta en el mercado durante 2021-2028. Las para-aramidas tienen una alta resistencia a la tracción (la tensión más alta que un material puede soportar) y un comportamiento de módulo (la tendencia de un material a deformarse cuando se aplica fuerza). Además, las fibras de para-aramida son más rígidas y tienen mayor tenacidad y resistencia que las fibras de meta-aramida. Sin embargo, son químicamente sensibles y los ácidos, álcalis y blanqueadores debilitan la resistencia de la poliamida de para-aramida. Algunos de los ejemplos de fibras de para-aramida son Kevlar, Technora, Twaron y Herron. La demanda de fibras de para-aramida está impulsada por su uso cada vez mayor en aplicaciones de seguridad y protección. Se utilizan en aplicaciones críticas como ropa de protección, incluidos chalecos antibalas, cascos y blindaje de vehículos, debido a su resistencia ultraalta y su estructura molecular rígida y altamente orientada.

Algunas de las empresas que operan en el mercado de fibra de aramida para mangueras automotrices sonContitech Ag, Dupont, Teijin Limited, Yokohama Rubber Co., Ltd., Schaeffler Ag, Bando Chemical Industries Ltd., Hutchinson Sa, Toyobo Co. Ltd., Aramid Hpm, LLC, Fiberline y Kolon Industries, Inc. Las empresas clave implementan las fusiones y adquisiciones, y las estrategias de investigación y desarrollo para expandir la base de clientes y ganar una participación significativa en el mercado global, lo que les permite mantener su marca a nivel mundial.

Informe Destacado

- Tendencias progresivas de la industria en el mercado de fibra de aramida para mangueras automotrices para ayudar a los actores a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por los mercados desarrollados y en desarrollo

- Análisis cuantitativo del mercado de fibra de aramida para mangueras automotrices de 2020 a 2028

- Estimación de la demanda mundial de fibra de aramida para mangueras automotrices

- Análisis de Porter para ilustrar la eficacia de los compradores y proveedores que operan en la industria

- Avances recientes para comprender el escenario competitivo del mercado

- Tendencias y perspectivas del mercado, así como factores que impulsan y restringen el crecimiento del mercado de fibra de aramida para mangueras automotrices

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial, lo que conduce al crecimiento del mercado.

- El tamaño del mercado de fibra de aramida para mangueras automotrices en varios nodos

- Descripción detallada y segmentación del mercado, así como la dinámica de la industria de las mangueras automotrices de fibra de aramida

- Tamaño del mercado de fibra de aramida para mangueras automotrices en varias regiones con prometedoras oportunidades de crecimiento

Perspectivas regionales del mercado de fibra de aramida

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de fibra de aramida durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de fibra de aramida en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de fibra de aramida

Alcance del informe sobre el mercado de fibra de aramida

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 127,41 millones |

| Tamaño del mercado en 2028 | US$ 213,93 millones |

| CAGR global (2021-2028) | 7,7% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de la fibra de aramida está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de fibra de aramida son:

- ARAMID HPM, LLC

- EMPRESA DE CAUCHO ARTEL

- EMPRESA FABRICANTE DE CASTORES

- CONTINENTAL AG

- DUPONT DE NEMOURS, INC.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de fibra de aramida

Mercado de fibra de aramida para mangueras automotrices (por tipo)

- Fibra de para-aramida

- Fibra de meta-aramida

Perfiles de empresas

- Contitech Ag

- Dupont

- Teijin limitada

- Compañía de caucho Yokohama, Ltd.

- Schaeffler AG (empresa)

- Industrias Químicas Bando Ltd.

- Hutchinson S.A.

- Compañía Toyobo Ltd.

- Aramid Hpm, Llc

- Línea de fibra

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de fibra de aramida

Obtenga una muestra gratuita para - Mercado de fibra de aramida