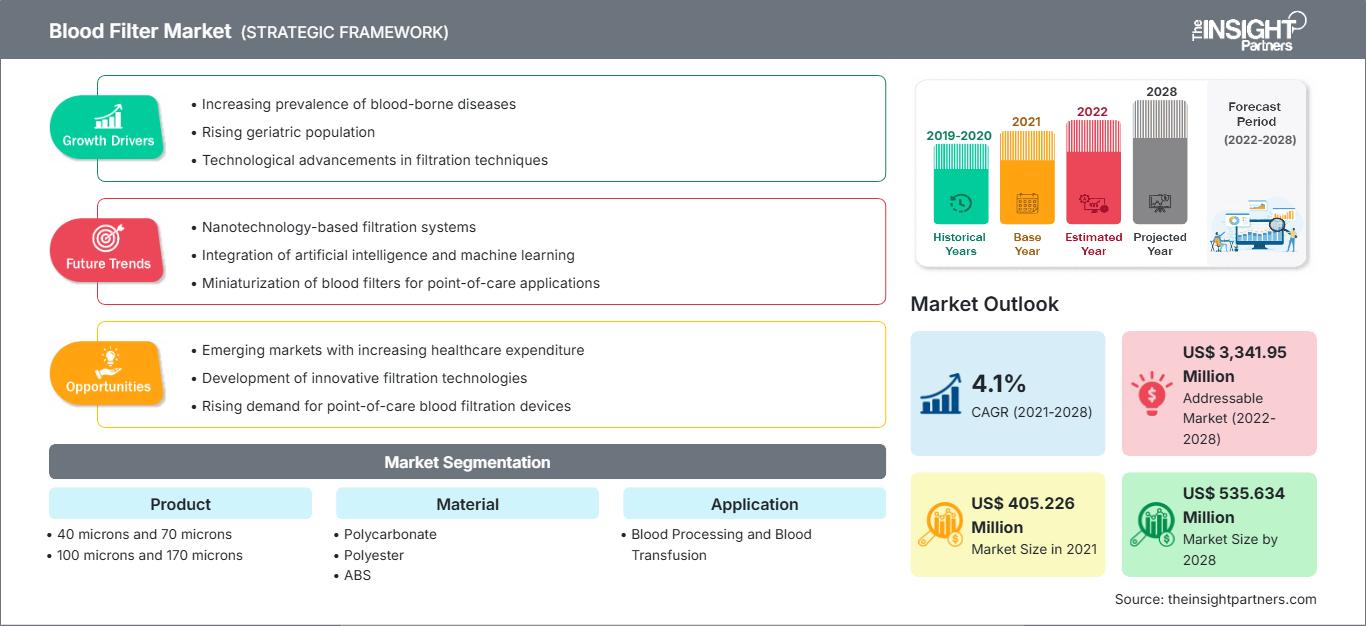

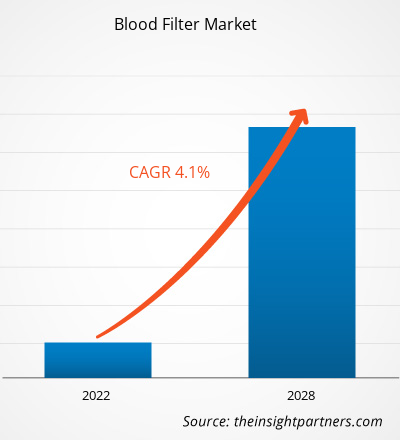

Se proyecta que el mercado de filtros de sangre alcance los US$ 535.634 millones para 2028 desde los US$ 405.226 millones en 2021; se estima que crecerá a una CAGR del 4,1% entre 2021 y 2028.

Un filtro de sangre es un filtro de malla tejido de poliéster o nailon que se coloca entre la bolsa del producto y el paciente para realizar la filtración. Estos filtros están diseñados para proteger a los pacientes de macroagregados y partículas no sanguíneas que podrían ser peligrosas si entran en el torrente sanguíneo. Eliminan macroagregados, como microagregados y agregados de fibrina, durante una transfusión sanguínea. La filtración consiste en capturar partículas y macroagregados de leucocitos, fibrina y plaquetas, que se forman durante el almacenamiento de sangre. Factores como el aumento de la carga de enfermedades crónicas, el aumento de casos de traumatismos y accidentes, y el creciente número de transfusiones sanguíneas impulsan el crecimiento del mercado de filtros de sangre. Sin embargo, las retiradas de productos del mercado obstaculizarán su crecimiento.

Obtendrá personalización en cualquier informe, sin carga, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de filtros de sangre: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluye análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

El creciente número de procedimientos de transfusión sanguínea impulsa el crecimiento del mercado de filtros de sangre.

Mejorar la disponibilidad de sangre segura y adecuada para los procedimientos de transfusión debe ser parte integral de las políticas e infraestructuras sanitarias nacionales de cada país. La necesidad de transfusiones de sangre puede surgir en cualquier momento, tanto en zonas urbanas como rurales. En el pasado, la falta de disponibilidad de sangre ha provocado la muerte de muchos pacientes por problemas de salud. Un suministro adecuado y confiable de sangre segura se puede garantizar mediante instalaciones estables para donantes de sangre regulares, voluntarios y no remunerados. Además, constituye el grupo de donantes más seguro, ya que la prevalencia de infecciones de transmisión sanguínea es la más baja entre ellos.

Las cirugías más comunes que requieren transfusiones de sangre incluyen procedimientos cardiovasculares, cesáreas y lesiones. Según estimaciones del Instituto Nacional del Corazón, los Pulmones y la Sangre y los Institutos Nacionales de la Salud (NIH), en EE. UU., más de 5 millones de personas requieren transfusiones de sangre cada año. Además, debido a desastres naturales y a las numerosas muertes, la demanda de transfusiones de sangre está aumentando en todo el mundo. Un aumento en la incidencia de trastornos sanguíneos como anemia, eritrocitosis, leucocitosis, leucopenia y trombocitosis también está impulsando el crecimiento del mercado de filtros de sangre. Según la OMS, la mayoría de los niños con talasemia nacen en países de bajos ingresos, donde el acceso a las transfusiones de sangre es difícil o está disponible para un pequeño porcentaje de la población.

Los filtros de sangre utilizados en procedimientos de transfusión son de malla tejida de poliéster o nailon; se trata de filtros tipo pantalla que se colocan entre la bolsa del producto y el paciente. Estos filtros están diseñados para proteger al paciente de macroagregados potencialmente dañinos, como plaquetas, leucocitos y proteínas de fibrina, así como de partículas no sanguíneas. En la mayoría de los países desarrollados, los filtros de transfusión sanguínea son proporcionados por los gobiernos o programas comunitarios. Por lo tanto, la disponibilidad de instalaciones adecuadas para la donación de sangre y la donación voluntaria impulsa el número de procedimientos de transfusión sanguínea, lo que impulsa el crecimiento del mercado de rellenos sanguíneos.

Perspectivas basadas en productos

Según el producto, el mercado de filtros de sangre se segmenta en 40 y 70 micras, 100 y 170 micras, entre otros. El segmento de 100 y 170 micras tendrá la mayor cuota de mercado en 2021 y se espera que registre una mayor tasa de crecimiento anual compuesta (TCAC) durante el período de pronóstico.

Perspectivas basadas en materiales

Según el material, el mercado de filtros de sangre se segmenta en policarbonato, poliéster, ABS y otros. El segmento de poliéster alcanzaría la mayor cuota de mercado, con un 35,47 %, en 2021, y se espera que mantenga su dominio durante el período de pronóstico.

Perspectivas basadas en aplicaciones

Según la aplicación, el mercado de filtros de sangre se segmenta en procesamiento de sangre y transfusión sanguínea. El segmento de transfusión sanguínea alcanzaría la mayor cuota de mercado, con un 73,83 %, en 2021, y se espera que mantenga su dominio durante el período de pronóstico.

Información basada en el usuario final

Según el usuario final, el mercado de filtros de sangre se segmenta en bancos de sangre, hospitales y otros. El segmento de bancos de sangre alcanzaría la mayor cuota de mercado, con un 47,38 %, en 2021, y se espera que mantenga su dominio durante el período de pronóstico.

Varias empresas que operan en el mercado de filtros de sangre están adoptando estrategias como lanzamientos de productos, fusiones y adquisiciones, colaboraciones, innovaciones de productos y expansiones de carteras de productos para expandir su presencia en todo el mundo, mantener la marca y satisfacer la creciente demanda de los usuarios finales.

Perspectivas regionales del mercado de filtros de sangre

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de filtros de sangre durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de filtros de sangre en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de filtros de sangre

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 405.226 millones |

| Tamaño del mercado en 2028 | US$ 535.634 millones |

| Tasa de crecimiento anual compuesta (TCAC) global (2021-2028) | 4,1% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por producto

|

| Regiones y países cubiertos |

América del Norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de filtros de sangre: comprensión de su impacto en la dinámica empresarial

El mercado de filtros de sangre está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de filtros de sangre.

Mercado de filtros de sangre: por producto

- 40 micras y 70 micras

- 100 micras y 170 micras

- Otros

Mercado de filtros de sangre: por material

- Policarbonato

- Poliéster

- abdominales

- Otros

Mercado de filtros de sangre: por aplicación

- Procesamiento de sangre

- Transfusión de sangre

Mercado de filtros de sangre: por usuario final

- Bancos de sangre

- Hospitales

- Otros

Mercado de filtros de sangre por geografía

-

América del Norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- España

- Resto de Europa

-

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

-

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

-

América del Sur y Central (SCAM)

- Brasil

- Argentina

- Resto de América del Sur y Central

Perfiles de empresas

- Corporación Asahi Kasei

- Fresenius Kabi AG

- Macopharma

- Corporación Haemonetics

- Infomed SA

- CORPORACIÓN KANEKA

- Laboratorios Kawasumi. Cª

- Sefar AG

- Shandong Zhongbaokang Implementos Médicos Co., Ltd.

- Nanjing Shuangwei Biotecnología Co., Ltd.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de filtros de sangre

Obtenga una muestra gratuita para - Mercado de filtros de sangre