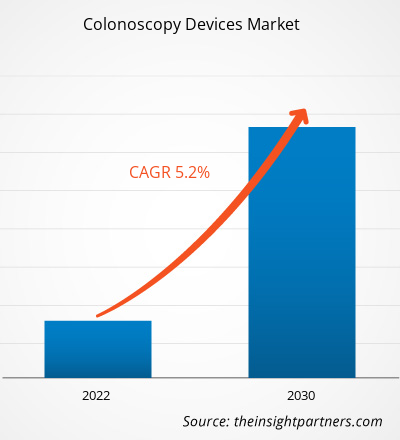

[Informe de investigación] Se proyecta que el mercado de dispositivos de colonoscopia crecerá de US$ 2.30 mil millones en 2024 a US$ 3.36 mil millones en 2031, registrando una CAGR del 5,7% durante 2025-2031.

Perspectivas del mercado y opinión de los analistas:

El pronóstico del mercado de dispositivos de colonoscopia puede ayudar a los actores de este mercado a planificar sus estrategias de crecimiento. El informe incluye perspectivas de crecimiento, junto con las tendencias del mercado y su impacto previsible durante el período de pronóstico.

Las colonoscopias se realizan con endoscopios reutilizables. Son instrumentos flexibles de fibra óptica que se introducen en el ano y se dirigen a través del colon. Los colonoscopios ayudan a los endoscopistas a detectar enfermedades crónicas y a evaluar a los pacientes para detectar enfermedades malignas o precancerosas. Las personas mayores de 50 años deben realizarse colonoscopias como parte de su programa regular de detección del cáncer. En hospitales o centros de cirugía ambulatoria (CAA), los procedimientos se realizan bajo sedación suave. La creciente prevalencia del cáncer colorrectal y los avances tecnológicos en dispositivos de colonoscopia por parte de los fabricantes contribuyen al crecimiento del mercado de estos dispositivos. Sin embargo, la disponibilidad de pruebas diagnósticas alternativas para enfermedades rectales frena el crecimiento del mercado.

Factores impulsores del crecimiento:

La creciente prevalencia del cáncer colorrectal impulsa el crecimiento del mercado de dispositivos de colonoscopia.

El cáncer colorrectal es un tumor maligno que se forma en los tejidos del recto o el colon. El cáncer de recto y el de colon suelen agruparse debido a las características comunes de ambas afecciones. Según la Organización Mundial de la Salud (OMS), el cáncer de colon ocupa el segundo lugar en cuanto a muertes por cáncer a nivel mundial. A nivel mundial, se registraron más de 1,9 millones de nuevos casos de cáncer colorrectal y más de 930.000 muertes por esta enfermedad en 2020. Se observaron diferencias regionales significativas en las tasas de incidencia y mortalidad. Europa, Australia y Nueva Zelanda registraron las tasas de incidencia más altas, mientras que Europa del Este registró las tasas de mortalidad más altas. Según datos del Sistema Europeo de Información sobre el Cáncer, en los países de la UE-27, el cáncer colorrectal representó el 12,7 % de todos los nuevos diagnósticos de cáncer y el 12,4 % del total de muertes causadas por la enfermedad en 2020. Su alta prevalencia lo convierte en el segundo cáncer más frecuente, después del cáncer de mama, y la segunda causa principal de muerte, después del cáncer de pulmón en Europa. Según la OMS, en 2020 hubo más de 1,9 millones de casos nuevos de cáncer colorrectal y se espera que la carga anual de cáncer colorrectal aumente a 3,2 millones de casos nuevos (un aumento del 63%) y 1,6 millones de muertes (un aumento del 73%) para 2040.

En Estados Unidos, el cáncer colorrectal es el tercer tipo de cáncer más común (excluyendo el cáncer de piel ) detectado anualmente. Según la Sociedad Americana del Cáncer, en 2023, aproximadamente 153.000 personas fueron diagnosticadas con cáncer colorrectal en el país. Estas cifras incluyen 106.950 nuevos casos de cáncer de colon (54.420 hombres y 52.550 mujeres) y 46.050 nuevos casos de cáncer de recto (27.440 hombres y 18.610 mujeres). Para el cáncer colorrectal, la colonoscopia es una prueba de detección importante y se ha convertido en parte del cribado rutinario del cáncer. Por lo tanto, la creciente prevalencia del cáncer colorrectal impulsa el crecimiento del mercado de dispositivos de colonoscopia.

Las alternativas a la colonoscopia incluyen la sigmoidoscopia, una forma menos invasiva de colonoscopia, y el análisis de heces, uno de los métodos no invasivos. Desde principios del siglo XXI, los médicos han recomendado ampliamente la colonoscopia para detectar el cáncer de colon en pacientes mayores de 50 años. Sin embargo, en los últimos años, han sentido la necesidad de un cambio de estrategia. Les preocupa el costo y la complejidad de la colonoscopia, lo que desalienta a las personas a someterse a estos procedimientos de detección. Además, existen pruebas igualmente eficaces, menos invasivas y menos arduas que la colonoscopia. Por lo tanto, la disponibilidad de pruebas diagnósticas alternativas obstaculiza el crecimiento del mercado de dispositivos de colonoscopia.

Recibirá personalización de cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

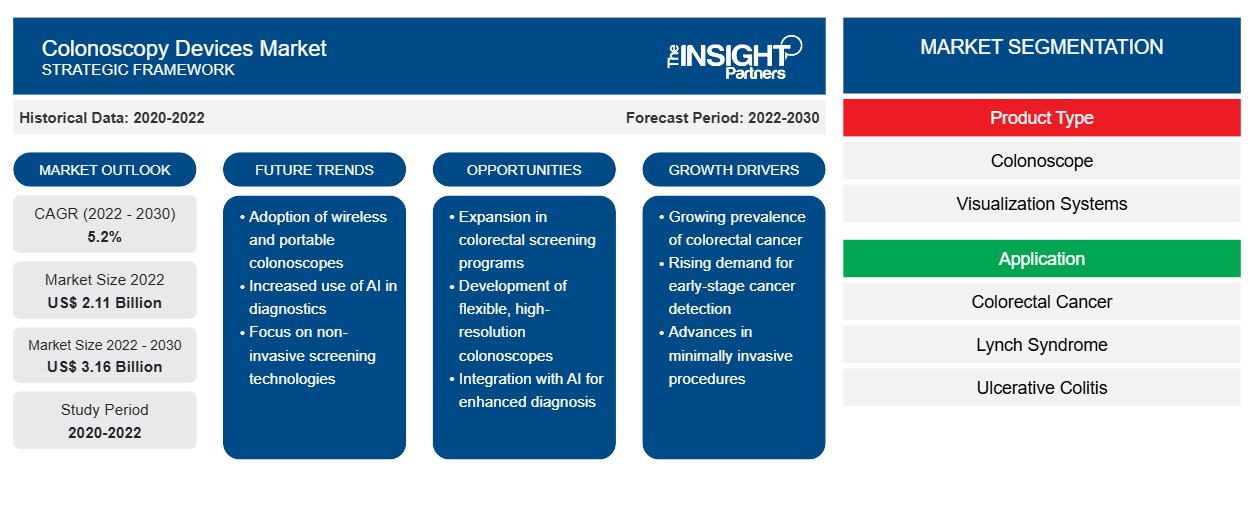

Mercado de dispositivos de colonoscopia: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Segmentación y alcance del informe:

El análisis del mercado de dispositivos de colonoscopia se ha realizado considerando los siguientes segmentos: tipo de producto, aplicación y usuario final.

Análisis segmentario:

Por tipo de producto, el mercado de dispositivos de colonoscopia se segmenta en colonoscopios, sistemas de visualización y otros. El segmento de colonoscopios tuvo la mayor participación de mercado en 2022. Sin embargo, se prevé que el segmento de sistemas de visualización registre la mayor tasa de crecimiento anual compuesta (TCAC) entre 2022 y 2030.

El mercado de dispositivos de colonoscopia, por aplicación, se segmenta en cáncer colorrectal, síndrome de Lynch, colitis ulcerosa, enfermedad de Crohn y otros. El segmento de cáncer colorrectal tuvo la mayor cuota de mercado de dispositivos de colonoscopia en 2022, y se prevé que este mismo segmento registre la mayor tasa de crecimiento anual compuesta (TCAC) entre 2022 y 2030. La colonoscopia puede detectar y extirpar lesiones malignas y promalignas con gran precisión. Es una valiosa herramienta de diagnóstico para la detección del cáncer colorrectal. Casi todas las sociedades nacionales e internacionales de enfermedades gastrointestinales y oncológicas recomiendan su uso como primer método de detección.

El mercado de dispositivos de colonoscopia, por usuario final, se segmenta en hospitales, centros de cirugía ambulatoria y otros. El segmento hospitalario tuvo la mayor cuota de mercado de dispositivos de colonoscopia en 2022 y se prevé que registre la mayor tasa de crecimiento anual compuesta (TCAC) entre 2022 y 2030, gracias a la adopción de avances tecnológicos en los hospitales y al aumento de las pruebas de detección en entornos hospitalarios.

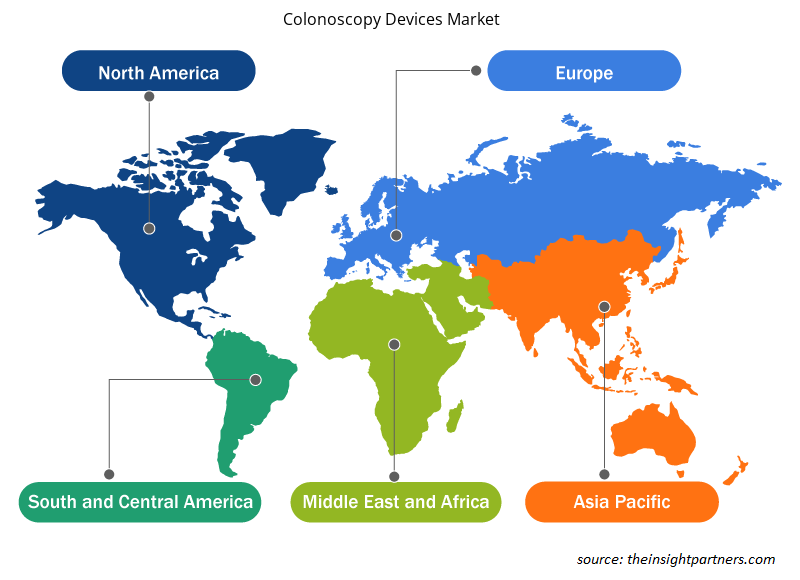

Análisis regional:

El alcance geográfico del informe de mercado de dispositivos de colonoscopia incluye América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central. América del Norte tuvo la mayor cuota de mercado en 2022. El crecimiento del mercado en América del Norte se debe al creciente envejecimiento de la población, el creciente número de lanzamientos de productos y las actividades de I+D para desarrollar dispositivos de colonoscopia avanzados.

Perspectivas regionales del mercado de dispositivos de colonoscopia

Los analistas de Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de dispositivos de colonoscopia durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de dispositivos de colonoscopia en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de dispositivos de colonoscopia

Alcance del informe de mercado de dispositivos de colonoscopia

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 2.30 mil millones |

| Tamaño del mercado en 2031 | US$ 3.36 mil millones |

| CAGR global (2025-2031) | 5,7% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de dispositivos de colonoscopia: comprensión de su impacto en la dinámica empresarial

El mercado de dispositivos de colonoscopia está en rápido crecimiento, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de empresas o compañías que operan en un mercado o sector en particular. Indica cuántos competidores (actores del mercado) hay en un mercado determinado en relación con su tamaño o valor total.

Las principales empresas que operan en el mercado de dispositivos de colonoscopia son:

- AMBU AS

- Fujifilm

- Endomed Systems GmbH

- Olimpo

- Pentax

- Vista GI

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de dispositivos de colonoscopia

Panorama competitivo y empresas clave:

AMBU AS, Fujifilm, Endomed Systems GmbH, Olympus, Steris PLC, GI View, Boston Scientific Corporation, PENTAX Medical, Avantis Medical Systems y SonoScape Medical Corp se encuentran entre las empresas destacadas que aparecen en el informe del mercado de dispositivos de colonoscopia. Estas empresas se centran en el desarrollo de nuevas tecnologías, la modernización de productos existentes y la expansión de su presencia geográfica para satisfacer la creciente demanda mundial de los consumidores. Según comunicados de prensa de las empresas, a continuación se presentan algunos de los principales desarrollos recientes:

- En abril de 2021, FUJIFILM Medical Systems lanzó el colonoscopio de la serie G-EYE 700. G-EYE, una tecnología desarrollada por Smart Medical, facilita las exploraciones de rutina. Los colonoscopios de la serie G-EYE 700 ampliaron la innovadora oferta de colonoscopios de Fujifilm. G-EYE se ofrecerá como una extensión de la familia de colonoscopios de la serie 700, compatible con el sistema de videoenscopia ELUXEO de Fujifilm.

- En octubre de 2020, Olympus recibió la autorización 510(k) y la comercialización de sus dos colonoscopios: el PCF-H190T y el PCF-HQ190. Estos productos ampliaron las capacidades actuales de los médicos para diagnosticar y tratar trastornos del tracto gastrointestinal.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de dispositivos de colonoscopia

Obtenga una muestra gratuita para - Mercado de dispositivos de colonoscopia