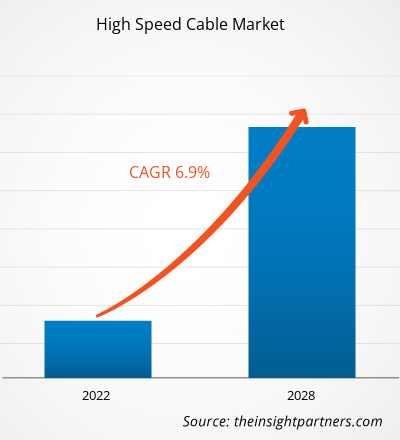

Se proyecta que el tamaño del mercado de cables de alta velocidad alcance los 24 990 millones de dólares estadounidenses para 2031, frente a los 12 900 millones de dólares estadounidenses de 2024. Se espera que registre una tasa de crecimiento anual compuesta (TCAC) del 10,2 % entre 2025 y 2031. Es probable que la aparición de ciudades inteligentes traiga nuevas tendencias al mercado en los próximos años.

Análisis del mercado de cables de alta velocidad

A medida que los servicios en la nube se expanden a un ritmo sin precedentes, la demanda de interconexiones de centros de datos rentables y de alto rendimiento aumenta rápidamente. Esto ha impulsado la creciente adopción de cables de alta velocidad. A diferencia de las interconexiones ópticas que se basan en módulos ópticos para la conversión de señales, los cables de alta velocidad, como los de cobre de conexión directa (DAC) y los cables ópticos activos (AOC), proporcionan una conexión física directa entre dos puertos mediante cables biaxiales. Esto garantiza la integridad de la señal a distancias específicas sin necesidad de componentes ópticos activos. Industrias como la electrónica, la automoción, las comunicaciones y las redes están evolucionando, introduciendo innovaciones que permiten una transferencia de datos más rápida. En consecuencia, la creciente necesidad de una conectividad eficiente impulsa el crecimiento del mercado de cables de alta velocidad . En el sector de la automoción, los fabricantes integran cada vez más sistemas electrónicos y de infoentretenimiento en los vehículos para mejorar la conectividad, lo que impulsa aún más esta demanda.

Descripción general del mercado de cables de alta velocidad

Los centros de datos requieren conexiones eficientes dentro y entre racks, y los cables de alta velocidad son ideales para este propósito. Ofrecen una conectividad rápida con un consumo inferior a 0,1 W de energía, lo que minimiza la generación de calor. Esta eficiencia energética ayuda a reducir la carga de refrigeración de los sistemas de aire acondicionado del centro de datos. Además, los cables de alta velocidad ofrecen una excelente durabilidad, lo que los hace menos propensos a sufrir daños por flexión o tensión física. Esta robustez minimiza el riesgo de fallos en entornos de alta densidad, lo que supone una ventaja significativa para las operaciones del centro de datos.

Recibirá personalización de cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

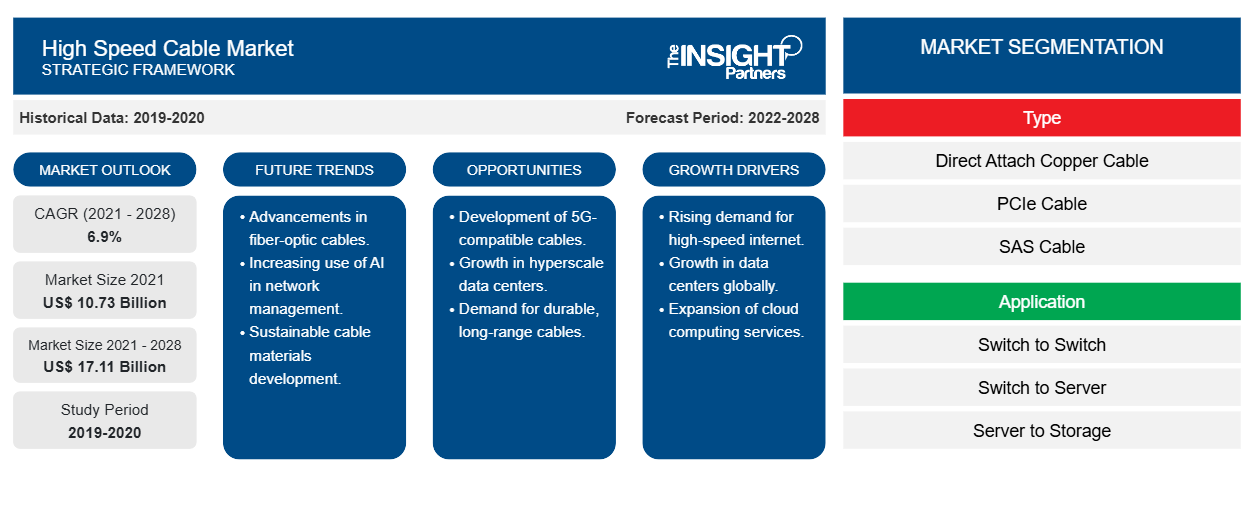

Mercado de cables de alta velocidad: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de cables de alta velocidad

Avances en los servicios de red 5G

Los DAC pasivos, que son básicamente cables de cobre premium sin electrónica integrada, son más económicos que los cables gracias a estos componentes. Los chipsets avanzados en AECS y los láseres VCSEL en AOCS añaden un coste adicional que puede duplicar o quintuplicar el coste. Los DAC se utilizan con frecuencia en redes 5G para conexiones de corto alcance en la misma zona, como estaciones base O-RAN y centros de datos perimetrales. Estos cables permiten el transporte de datos a alta velocidad con baja latencia y bajo consumo de energía. Por ejemplo, los DAC QSFP28 pasivos son adecuados para conexiones directas en armario, ya que admiten 100 Gb/s, mientras que los DAC SFP28 admiten 25 Gb/s. La densidad de celdas y el alto tráfico de las redes 5G requieren conexiones de retorno capaces de gestionar cientos de gigabits. Esto requiere conexiones Ethernet de mayor velocidad, como 400 G o superiores. Los DAC son esenciales para facilitar estas conexiones Ethernet de alta velocidad en distancias cortas y garantizar la transferencia de datos eficaz entre dispositivos de red. El menor consumo de energía por puerto también lo proporcionan los DAC pasivos, que utilizan entre un 91 % y un 97 % menos de energía por puerto que el cableado de fibra con transceptores independientes. El volumen de conexiones de acceso a la red de servidores de corto alcance aumenta rápidamente.

Creciente implementación de centros de datos

El aumento del consumo de internet y el desarrollo de soluciones de software avanzadas han impulsado el volumen de generación de datos a nivel mundial. La necesidad de procesar y almacenar grandes cantidades de datos ha impulsado a las organizaciones a adoptar soluciones avanzadas de procesamiento y almacenamiento, impulsando la implementación de centros de datos. Con la creciente tendencia a la digitalización, los centros de datos se han convertido en un aspecto fundamental de la industria y la economía modernas. Los centros de datos desempeñan un papel vital en la computación en la nube. A medida que la industria avanza hacia la adopción de la tecnología en la nube debido a sus ventajas en cuanto a costos y operaciones, las pymes están a la vanguardia en la adopción de esta tecnología. Además, las operaciones complejas de computación en la nube son realizadas por grandes empresas tecnológicas e instituciones de investigación. Los cables ópticos activos, los cables de cobre de conexión directa y los cables de fibra óptica se encuentran entre los cables de alta velocidad más utilizados en los centros de datos.

Análisis de segmentación del informe de mercado de cables de alta velocidad

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de cables de alta velocidad son los componentes, el usuario final y la conectividad.

- Según el tipo, el mercado se segmenta en cable de cobre de conexión directa (DAC), cable óptico activo (AOC), cable de cobre activo (ACC), cable PCIe, cable eléctrico activo (AEC) y cable SAS. El segmento de cable óptico activo (AOC) tuvo la mayor participación de mercado en 2024.

- Según la aplicación, el mercado se segmenta en interconexión de conmutador a conmutador, de conmutador a servidor y de servidor a almacenamiento. El segmento de interconexión de conmutador a conmutador tuvo la mayor participación de mercado en 2024.

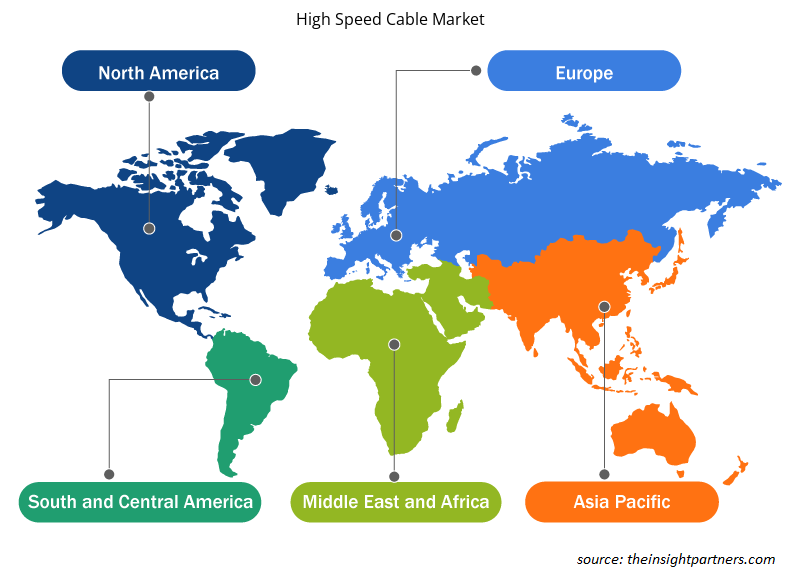

Análisis de la cuota de mercado de cables de alta velocidad por geografía

El alcance geográfico del informe del mercado de cables de alta velocidad se divide en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

Asia Pacífico mantuvo una cuota de mercado significativa en 2024. Esta región es la que registra un crecimiento más rápido en la demanda de cable de alta velocidad, gracias a la rápida urbanización, el crecimiento exponencial de usuarios de internet y los avances tecnológicos en países como China, Japón, Corea del Sur e India. La expansión de las redes 5G, la construcción de centros de datos a gran escala y el auge del mercado de vehículos eléctricos están creando importantes oportunidades para el despliegue de cable de alta velocidad en los sectores de las telecomunicaciones, el transporte y la energía.

La industria automotriz en Asia Pacífico es otro factor clave en la creciente demanda de cables de alta velocidad. En China, Japón, Corea del Sur y otros países, los fabricantes de automóviles requieren cables de alta velocidad para la transmisión de datos de imagen, pantallas multifunción y sistemas de infoentretenimiento para pasajeros traseros, entre otras aplicaciones, con el auge de los vehículos eléctricos (VE). China, como el mayor mercado de VE a nivel mundial, establece objetivos ambiciosos para la movilidad eléctrica, lo que impulsa la demanda de componentes de alto rendimiento. Según la Agencia Internacional de la Energía (AIE), el significativo crecimiento en la adopción de vehículos eléctricos (VE) en China, con nuevas matriculaciones de vehículos eléctricos que alcanzaron los 8,1 millones en 2023, un aumento del 35 % con respecto a 2022, pone de relieve la creciente demanda de cables de alta velocidad en la industria automotriz. Este auge en la producción de VE está estrechamente vinculado al aumento de los cables de alta velocidad, especialmente en Asia Pacífico. Los cables de alta velocidad en aplicaciones automotrices facilitan la transmisión rápida de datos para funciones como los sistemas avanzados de asistencia al conductor (ADAS), los sistemas de infoentretenimiento y los sistemas de cámaras. También permiten comunicaciones de vehículo a vehículo (V2V) y de vehículo a infraestructura (V2X).

Análisis regional del mercado de cables de alta velocidad

Los analistas de Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de cables de alta velocidad durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de cables de alta velocidad en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

- Obtenga los datos regionales específicos para el mercado de cables de alta velocidad

Alcance del informe de mercado de cables de alta velocidad

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 12.90 mil millones |

| Tamaño del mercado en 2031 | US$ 24.99 mil millones |

| CAGR global (2025-2031) | 10,2% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de cables de alta velocidad: comprensión de su impacto en la dinámica empresarial

El mercado de cables de alta velocidad está en rápido crecimiento, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y una mayor conciencia de las ventajas del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de empresas o compañías que operan en un mercado o sector en particular. Indica cuántos competidores (actores del mercado) hay en un mercado determinado en relación con su tamaño o valor total.

Las principales empresas que operan en el mercado de cables de alta velocidad son:

- Corporación Amphenol

- Cable Axon SAS

- Molex LLC

- Volex PLC

- CORPORACIÓN NVIDIA

- Samtec INC

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de cables de alta velocidad

Noticias y desarrollos recientes del mercado de cables de alta velocidad

El mercado de cables de alta velocidad se evalúa mediante la recopilación de datos cualitativos y cuantitativos tras la investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se enumeran algunos avances en el mercado de cables de alta velocidad:

- Amphenol Communications Services (ACS), líder mundial en soluciones de interconexión de alto rendimiento, y Semtech Corporation (Nasdaq: SMTC), proveedor líder de semiconductores de alto rendimiento, sistemas del Internet de las Cosas (IoT) y soluciones de conectividad en la nube, presentaron un cable de cobre activo (ACC) OSFP de 1.6T de vanguardia con circuitos integrados de ecualización/recontrolador lineal CopperEdge de 224G/carril de Semtech, diseñado para su uso en infraestructuras de IA/ML y centros de datos de próxima generación. (Fuente: Amphenol Communications, comunicado de prensa, abril de 2025)

- Samtec publicó una nueva Guía de Diseño de Cables de Alta Velocidad repleta de nuevos productos, tecnologías y elementos de la hoja de ruta. La Guía destaca la innovación de Samtec para arquitecturas de última generación: soluciones de paso elevado, HDR, óptica y RF, combinadas con un soporte líder en la industria, fabricación propia y capacidades de personalización para crear una solución para cualquier aplicación. (Fuente: Samtec, comunicado de prensa, junio de 2023)

Informe de mercado sobre cables de alta velocidad: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de cables de alta velocidad (2021-2031)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de cables de alta velocidad y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de cables de alta velocidad, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de cables de alta velocidad que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de cables de alta velocidad.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de cables de alta velocidad

Obtenga una muestra gratuita para - Mercado de cables de alta velocidad