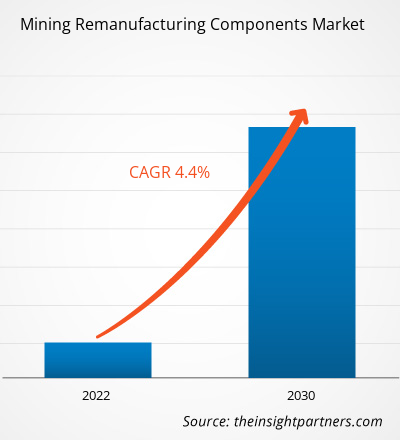

El mercado de componentes de remanufacturación minera se valoró en US$ 4.204,56 millones en 2022 y se proyecta que alcance los US$ 5.940,00 millones para 2030; se espera que registre una CAGR del 4,40% entre 2022 y 2030. Es probable que el creciente desarrollo del sector minero siga siendo una tendencia clave en el mercado.remanufacturing components market was valued at US$ 4,204.56 million in 2022 and is projected to reach US$ 5,940.00 million by 2030; it is expected to register a CAGR of 4.40% from 2022 to 2030. The growing development in the mining sector is likely to remain a key trend in the market.

Análisis del mercado de componentes de remanufacturación para mineríaRemanufacturing Components Market Analysis

Se prevé que el creciente desarrollo del sector minero y el creciente interés por reducir el gasto total del ciclo de vida de los equipos mineros impulsen el crecimiento del mercado de componentes de remanufacturación minera a nivel mundial. Los crecientes descubrimientos de nuevos yacimientos mineros también están impulsando la demanda de componentes de remanufacturación minera en todo el mundo. Los problemas de calidad relacionados con las piezas de remanufacturación o los componentes mineros podrían impedir el crecimiento del mercado de componentes de remanufacturación minera. Sin embargo, se prevé que la implementación de tecnologías de fabricación aditiva en el sector minero impulse el crecimiento del mercado durante el período de pronóstico.lifecycle expenditure of mining equipment is projected to fuel the growth of the remanufacturing components marketremanufacturing components worldwide. Quality issues related to remanufacturers parts or mining components might impede the growth of the mining remanufacturing components market. However, the implementation of additive manufacturing technologies in the mining sector is projected to drive market growth over the forecast period.

Descripción general del mercado de componentes de remanufacturación para minería

La minería es un sector que requiere mucho capital. Los equipos, componentes y dispositivos costosos se integran principalmente en el proceso general. Las empresas mineras se centran en gran medida en aumentar el ciclo de vida de los componentes con procesos periódicos de mantenimiento y remanufacturación para reducir las posibilidades de que el sistema se apague y falle el proceso. El creciente enfoque en el avance tecnológico y el énfasis creciente en la conveniencia del proyecto están impulsando la demanda de componentes de remanufacturación para minería. Tanto los distribuidores como los especialistas dedicados a la remanufacturación realizan inspecciones de los componentes del núcleo recuperados para evaluar si califican para la remanufacturación. Esta etapa elimina la necesidad del tiempo de espera que de otro modo se requeriría si las inspecciones solo se realizaran en la instalación receptora del núcleo. El paso de ingeniería y diseño de alto valor del proceso de remanufactura implica el uso de tecnología avanzada de fabricación aditiva para restaurar los componentes a las especificaciones originales y a la condición de nuevos. La sección dedicada a la remanufactura desarrolla muchas de las tecnologías utilizadas durante esta fase. El reensamblaje comprende tanto piezas remanufacturadas como nuevas, así como mejoras de ingeniería.lifecycle of components with periodic maintenance and remanufacturing processes to reduce the chances of system shutdown and process failure. Rising focus on technological advancement and growing emphasis on project convenience is driving the demand for mining remanufacturing components. Both dealers and dedicated remanufacturing specialists perform inspections of retrieved core components to assess whether they qualify for remanufacturing. This stage removes the need for waiting time that would otherwise be required if inspections were only performed at the core receiving facility. The high-value engineering and design step of the remanufacturing process entails the use of advanced remanufacturing section develops many of the technologies used during this phase. Reassembly comprises both remanufactured and new parts, as well as engineering improvements.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de componentes de remanufacturación para mineríaRemanufacturing Components Market Drivers and Opportunities

El crecimiento de la industria minera en los países desarrollados favorecerá el mercado

La industria minera en los EE. UU. consiste en la exploración, extracción, beneficio y procesamiento de minerales sólidos que existen naturalmente en la tierra. El carbón, los metales (como el hierro y el cobre) y los minerales industriales son ejemplos de minerales extraídos. Estados Unidos es un importante productor y usuario de minerales y metales en todo el mundo. Los materiales extraídos son cruciales para la tecnología industrial y de consumo y definen la expansión industrial general de los EE. UU. Además de los EE. UU., China es otro país donde la industria minera se ha multiplicado en los últimos años. Por lo tanto, el crecimiento continuo de la industria minera en países desarrollados como los EE. UU. y China. Este crecimiento de la minería ha afectado directamente a la demanda de equipos en la industria, como cargadores de ruedas y topadoras de ruedas, lo que en última instancia impulsa la demanda de componentes de remanufacturación minera en los países desarrollados.beneficiation, and processing of naturally existing solid minerals from the earth. Coal, metals (such as iron and copper), and industrial minerals are examples of mined minerals. The US is a major producer and user of minerals and metals worldwide. Mined materials are crucial to consumer and industrial technology and define the general industrial expansion of the US. Apart from the US, China is another country where the mining industry has grown multifold in the past few years. Thus, continuous growth in the mining industry in developed nations such as the US and China. This growth in mining has directly affected the demand for equipment in the industry, such as wheel loaders and wheel dozers, ultimately driving the demand for mining remanufacturing components in developed nations.

Mayor Implementación de Vehículos Eléctricos y Autónomos en la Industria Minera

El sector minero se está centrando en aprovechar los vehículos mineros "sin conductor" de bajas emisiones, lo que supone un paso avanzado hacia la descarbonización. Los vehículos eléctricos se combinan con otras flotas para aprovechar tanto las operaciones subterráneas como las de tajo abierto mediante la adquisición o la renovación de las flotas de vehículos con motor diésel existentes. La empresa Caterpillar había exhibido su primer prototipo de vehículo a batería en la planta de la empresa en Tucson, Arizona, en 2022. Además, Caterpillar lanzó su camión minero EV con una capacidad de 240 toneladas en 2023. Se prevé que las empresas de fabricación minera aumenten la adopción de camiones eléctricos para mayor comodidad operativa. Se espera que la mayor demanda de vehículos eléctricos en el sector minero cree grandes oportunidades para el mercado de componentes de remanufacturación minera durante el período de pronóstico.driverless" mine vehicles which is a advancned move for decarbonization. Electric vehicles are combined with other fleets for leveraging both in the underground and open pit operations by procuring or revamping existing diesel engine vehicle fleets. Caterpillar company had displayed its first battery-powered vehicle prototype at the company's Tuscon, Arizona, in 2022. Furthermore, Caterpillar launched its EV mining truck with a 240-ton capacity in 2023. The mining manufacturing companies are projected to increase the adoption of electric trucks for operational convenience. The augmented demand for electric vehicles in the mining sector is expected to create high opportunities for the mining remanufacturing component market during the forecast period.

Análisis de segmentación del informe de mercado de componentes de remanufacturación minera

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de componentes de remanufacturación minera son componentes, equipos e industria.

- Según los componentes, el mercado de componentes de remanufacturación minera se divide en motores, ejes, transmisiones, cilindros hidráulicos y otros. El segmento de motores tuvo la mayor participación del mercado en 2022.

- Por equipamiento, el mercado está segmentado en excavadoras, cargadoras de ruedas, topadoras de ruedas, topadoras de cadenas, camiones de transporte y otros. El segmento de topadoras de cadenas tuvo la mayor participación del mercado en 2022.

- En términos de industria, el mercado se divide en carbón, metales y otros. El segmento de metales tuvo una participación significativa del mercado en 2022.

Análisis de la cuota de mercado de componentes de remanufacturación minera por geografía

El alcance geográfico del informe del mercado de componentes de remanufactura minera se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

La región Asia Pacífico lidera el mercado. China es uno de los países más destacados en el mercado de componentes de remanufacturación minera en la región Asia Pacífico. La importante financiación del gobierno chino para el desarrollo del sector minero y el enfoque en la innovación de productos crean oportunidades para el mercado de componentes de remanufacturación minera. La industrialización y un número cada vez mayor de proyectos mineros están actuando como un importante impulsor del mercado.

Perspectivas regionales del mercado de componentes de remanufacturación minera

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de componentes de remanufacturación minera durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de componentes de remanufacturación minera en América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de componentes de remanufacturación minera

Alcance del informe de mercado de componentes de remanufacturación minera

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2022 | US$ 4.204,56 millones |

| Tamaño del mercado en 2030 | US$ 5.940,00 millones |

| CAGR global (2022-2030) | 4,4% |

| Datos históricos | 2020-2021 |

| Período de pronóstico | 2022-2030 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de componentes de remanufacturación para minería está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de componentes de remanufacturación minera son:

- AB Volvo

- Atlas Copco

- Caterpillar Inc.

- Epiroc AB

- Maquinaria de construcción Hitachi Co. Ltd.

- Compañía: JC Komatsu Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de componentes de remanufacturación minera

Noticias y desarrollos recientes del mercado de componentes de remanufacturación minera

El mercado de componentes de remanufacturación minera se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los desarrollos en el mercado de componentes de remanufacturación minera:

- SRC Holdings ha completado su nuevo almacén, ocupado por SRC Logistics (SRCL), en North Mulroy Road en Springfield. La instalación de 413.000 pies cuadrados, terminada después de 13 meses de construcción, es parte del plan de SRCL de crecer con los socios OEM actuales y aprovechar nuevas oportunidades comerciales. La tercera fase de expansión en North Mulroy Road sigue a la primera en 2021. (Fuente: SRC Holdings, comunicado de prensa, mayo de 2023)

- Komatsu Ltd. y Toyota están colaborando en un proyecto conjunto para desarrollar un vehículo ligero autónomo (ALV) utilizando el sistema de transporte autónomo (AHS) de Komatsu. El objetivo es mejorar la seguridad y la productividad en las minas mediante el uso de camiones de transporte autónomos y ALV automatizados. (Fuente: Komatsu Ltd, comunicado de prensa, mayo de 2023)

Informe sobre el mercado de componentes de remanufacturación minera: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de componentes de remanufactura minera (2020-2030)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de componentes de remanufacturación minera y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de componentes de remanufacturación minera, así como dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallados

- Análisis del mercado de componentes de remanufacturación minera que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes para el mercado de componentes de remanufacturación minera

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de componentes de remanufactura para minería

Obtenga una muestra gratuita para - Mercado de componentes de remanufactura para minería