Mining Remanufacturing Components Market Growth and Forecast by 2030

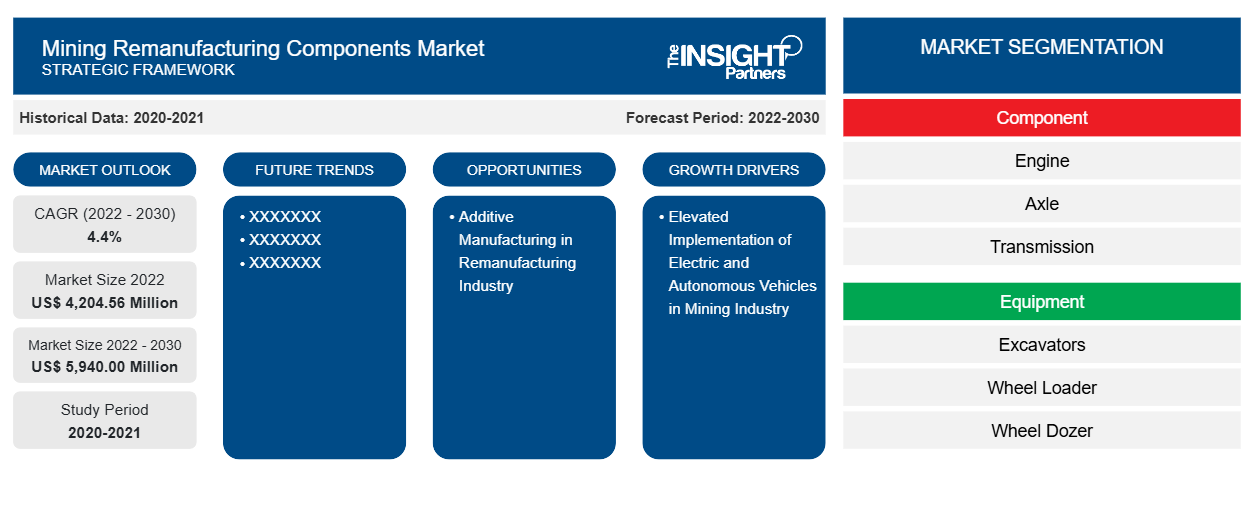

Mining Remanufacturing Components Market Size and Forecast (2020-2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Engine, Axle, Transmission, Hydraulic Cylinder, and Others), Equipment (Excavators, Wheel Loader, Wheel Dozer, Crawler Dozer, Haul Trucks, and Others), and Industry (Coal, Metal, and Others) and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Jan 2024

- Report Code : TIPRE00007379

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 210

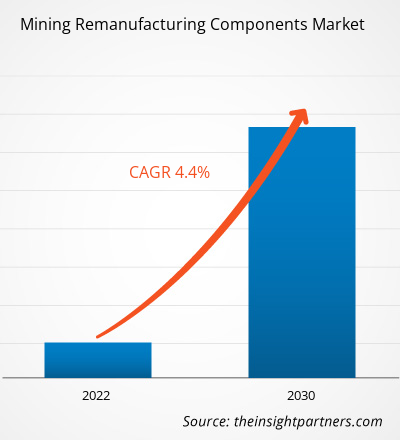

The mining remanufacturing components market was valued at US$ 4,204.56 million in 2022 and is projected to reach US$ 5,940.00 million by 2030; it is expected to register a CAGR of 4.40% from 2022 to 2030. The growing development in the mining sector is likely to remain a key trend in the market.

Mining Remanufacturing Components Market Analysis

The rising development in the mining sector and growing focus on reducing the overall lifecycle expenditure of mining equipment is projected to fuel the growth of the mining remanufacturing components market globally. The growing discoveries of new mining sites are also bolstering the demand for mining remanufacturing components worldwide. Quality issues related to remanufacturers parts or mining components might impede the growth of the mining remanufacturing components market. However, the implementation of additive manufacturing technologies in the mining sector is projected to drive market growth over the forecast period.

Mining Remanufacturing Components Market Overview

Mining is a capital-intensive sector. Expensive equipment, components, and devices are primarily integrated into the overall process. Mining companies are highly focused on increasing the lifecycle of components with periodic maintenance and remanufacturing processes to reduce the chances of system shutdown and process failure. Rising focus on technological advancement and growing emphasis on project convenience is driving the demand for mining remanufacturing components. Both dealers and dedicated remanufacturing specialists perform inspections of retrieved core components to assess whether they qualify for remanufacturing. This stage removes the need for waiting time that would otherwise be required if inspections were only performed at the core receiving facility. The high-value engineering and design step of the remanufacturing process entails the use of advanced additive manufacturing technology to restore components to original specifications and as-new condition. The dedicated remanufacturing section develops many of the technologies used during this phase. Reassembly comprises both remanufactured and new parts, as well as engineering improvements.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMining Remanufacturing Components Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mining Remanufacturing Components Market Drivers and Opportunities

Growth in the Mining Industry in Developed Nations to Favor Market

The mining industry in the US consists of the exploration, extraction, beneficiation, and processing of naturally existing solid minerals from the earth. Coal, metals (such as iron and copper), and industrial minerals are examples of mined minerals. The US is a major producer and user of minerals and metals worldwide. Mined materials are crucial to consumer and industrial technology and define the general industrial expansion of the US. Apart from the US, China is another country where the mining industry has grown multifold in the past few years. Thus, continuous growth in the mining industry in developed nations such as the US and China. This growth in mining has directly affected the demand for equipment in the industry, such as wheel loaders and wheel dozers, ultimately driving the demand for mining remanufacturing components in developed nations.

Elevated Implementation of Electric and Autonomous Vehicles in Mining Industry

The mining sector are focusing on leveraging low-emission "driverless" mine vehicles which is a advancned move for decarbonization. Electric vehicles are combined with other fleets for leveraging both in the underground and open pit operations by procuring or revamping existing diesel engine vehicle fleets. Caterpillar company had displayed its first battery-powered vehicle prototype at the company's Tuscon, Arizona, in 2022. Furthermore, Caterpillar launched its EV mining truck with a 240-ton capacity in 2023. The mining manufacturing companies are projected to increase the adoption of electric trucks for operational convenience. The augmented demand for electric vehicles in the mining sector is expected to create high opportunities for the mining remanufacturing component market during the forecast period.

Mining Remanufacturing Components Market Report Segmentation Analysis

Key segments that contributed to the derivation of the mining remanufacturing components market analysis are component, equipment, and industry.

- Based on component, the mining remanufacturing components market is divided into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest share of the market in 2022.

- By equipment, the market is segmented into excavators, wheel loader, wheel dozer, crawler dozer, haul trucks, and others. The crawler dozer segment held the largest share of the market in 2022.

- In terms of industry, the market is bifurcated into coal, metal, and others. The metal segment held a significant share of the market in 2022.

Mining Remanufacturing Components Market Share Analysis by Geography

The geographic scope of the mining remanufacturing components market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is leading the market. China is one of the prominent countries in the mining remanufacturing components market in the Asia Pacific. The significant financial funding from the Chinese government for the development of the mining sector and focus on product innovation create opportunities for the mining remanufacturing components market. Industrialization and an increasing number of mining projects are acting as a major driver for the market.

Mining Remanufacturing Components Market Regional Insights

The regional trends and factors influencing the Mining Remanufacturing Components Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Mining Remanufacturing Components Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Mining Remanufacturing Components Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,204.56 Million |

| Market Size by 2030 | US$ 5,940.00 Million |

| Global CAGR (2022 - 2030) | 4.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Mining Remanufacturing Components Market Players Density: Understanding Its Impact on Business Dynamics

The Mining Remanufacturing Components Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Mining Remanufacturing Components Market top key players overview

Mining Remanufacturing Components Market News and Recent Developments

The mining remanufacturing components market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Mining Remanufacturing Components market are listed below:

- SRC Holdings has completed its newest warehouse, occupied by SRC Logistics (SRCL), on North Mulroy Road in Springfield. The 413,000-square-foot facility, completed after 13 months of construction, is part of SRCL's plan to grow with current OEM partners and fulfill new business opportunities. The third expansion phase on North Mulroy Road follows the first in 2021. (Source: SRC Holdings, Press Release, May 2023)

- Komatsu Ltd. and Toyota are collaborating on a joint project to develop an Autonomous Light Vehicle (ALV) using Komatsu's Autonomous Haulage System (AHS). The aim is to enhance safety and productivity in mines by running autonomous haul trucks and automated ALVs. (Source: Komatsu Ltd, Press Release, May 2023)

Mining Remanufacturing Components Market Report Coverage and Deliverables

The “Mining Remanufacturing Components Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Mining remanufacturing components market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Mining remanufacturing components market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Mining remanufacturing components market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the mining remanufacturing components market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For