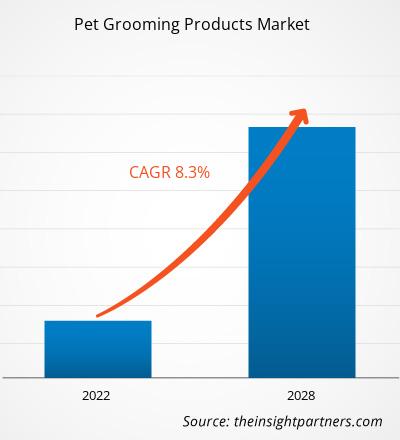

Se proyecta que el tamaño del mercado de productos para el cuidado de mascotas alcance los US$ 28.216,11 millones para 2028 desde los US$ 16.099,78 millones en 2021; se espera que crezca a una CAGR del 8,3% entre 2021 y 2028.

El cuidado de mascotas se refiere al mantenimiento del bienestar y la salud de los animales. Los productos básicos para el cuidado de mascotas incluyen champús y acondicionadores para bañarlos, cortaúñas y tijeras para cortar y recortar las uñas, y peines y cepillos para limpiar el pelo. Otros productos incluyen pasta de dientes para cepillar y aceites de masaje para diferentes cuerpos de mascotas. El mercado de productos para el cuidado de mascotas es uno de los mercados más pequeños pero más establecidos con un crecimiento financiero constante durante la última década.

En 2020, Europa representó la mayor parte de la participación de mercado mundial de productos para el cuidado de mascotas. Según WZF GmbH, organizador de la feria comercial de mascotas Interzoo, en 2020, el 47% de los hogares alemanes tenían una mascota. Una gran población ha desarrollado el hábito de tener mascotas debido a la estructura familiar nuclear y al cambio de estilo de vida. La gente está cada vez más preocupada por la salud y el bienestar de sus mascotas. Para los dueños de mascotas, una letanía de problemas de salud ha surgido como una gran preocupación. La creciente demanda de productos para el cuidado de mascotas puede estar relacionada con un aumento en la tenencia de mascotas y una mayor conciencia de los consumidores sobre el bienestar de las mascotas, lo que ha contribuido significativamente al crecimiento del mercado de productos para el cuidado de mascotas.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el crecimiento del mercado de productos para el cuidado de mascotas

El cierre de las unidades de fabricación, la dificultad en la adquisición de materias primas y las restricciones en la logística tuvieron un impacto negativo en el crecimiento del mercado de productos de cuidado de mascotas desde una perspectiva de suministro. Sin embargo, ha habido un aumento en la tasa de adopción de mascotas durante la pandemia de COVID-19, lo que está teniendo un impacto positivo en el crecimiento del mercado de productos de cuidado de mascotas. Según el Foro Económico Mundial, hubo un aumento en las búsquedas de mascotas en Google, incluida la adopción de perros y gatos, durante las primeras fases de la pandemia. Hubo un aumento del 250% en las búsquedas globales de posibles dueños de mascotas durante abril y mayo de 2020, en comparación con el mismo período en 2019. Junto con esto, el cierre de las instalaciones de peluquería de mascotas ha llevado a un aumento en las actividades de Hágalo usted mismo (DIV) que llevaron a los dueños de mascotas a familiarizarse con el cuidado de mascotas en el hogar durante el encierro.lockdown.

Perspectivas del mercado

Aumento de la adopción de mascotas

En todo el mundo se ha producido un aumento de la tasa de propietarios de mascotas, lo que ha provocado un aumento de la demanda de productos para el cuidado de mascotas. En regiones como América del Norte y Europa, se está observando un aumento de la cantidad de adopciones de mascotas, lo que las convierte en un mercado favorable para los productos de cuidado de mascotas. Factores como la etapa de la vida (solteros o parejas), el tamaño del hogar y los ingresos de los consumidores pueden contribuir a la mayor prevalencia de propietarios de mascotas entre la población. Según la Encuesta Nacional de Propietarios de Mascotas de la Asociación Estadounidense de Productos para Mascotas (APPA), el 70 % de los hogares estadounidenses tienen una mascota, lo que equivale a 90,5 millones de hogares.

Perspectivas de la industria del producto Tipo de mascota

Según el tipo de mascota, el mercado mundial de productos de aseo para mascotas se ha segmentado en perros, gatos y otros. El segmento de perros tuvo la mayor participación del mercado mundial de productos de aseo para mascotas en 2020. Según el informe de Sosland Publishing Company, en Europa, Rusia tiene la mayor población de perros con 17,1 millones, seguida de Alemania con 10,7 millones de perros y el Reino Unido con 8,5 millones de perros. Ancol Pet Products Limited Company fabricó varios productos de aseo para perros, como peines, cepillos, cortaúñas, cepillos pulidores, almohadillas para la palma, herramientas para garrapatas, guantes de aseo, almohadillas de masaje, toallitas y tijeras.

Entre los actores clave que operan en el mercado global de productos para el cuidado de mascotas se encuentran Ancol Pet Products Limited; Beaphar; Wahl Clipper; The Hartz Mountain Corporation; Johnson's Veterinary Products Ltd; Earthwhile Endeavors, Inc.; Coastal Pet Products Inc; Nexderma; Glo-Marr Pet Products; y Resco Pet Products. Los actores que operan en el mercado están altamente enfocados en el desarrollo de ofertas de productos innovadores y de alta calidad para satisfacer los requisitos de los clientes.

Perspectivas regionales del mercado de productos para el cuidado de mascotas

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de productos para el cuidado de mascotas durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de productos para el cuidado de mascotas en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de productos para el cuidado de mascotas

Alcance del informe de mercado de productos para el cuidado de mascotas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 16.1 mil millones |

| Tamaño del mercado en 2028 | US$ 28,22 mil millones |

| CAGR global (2021-2028) | 8,3% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tipo de mascota

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de productos para el cuidado de mascotas: comprensión de su impacto en la dinámica empresarial

El mercado de productos para el cuidado de mascotas está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de productos para el cuidado de mascotas son:

- Productos para mascotas Ancol Limited

- Beaphar

- Maquinilla Wahl

- La Corporación Hartz Mountain

- Johnson

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de productos para el cuidado de mascotas

Informe Destacado

- Tendencias progresivas en la industria de productos para el cuidado de mascotas que ayudarán a los actores a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por los actores del mercado en países desarrollados y en desarrollo

- Análisis cuantitativo del mercado de productos para el cuidado de mascotas desde 2019 hasta 2028

- Estimación de la demanda mundial de productos para el cuidado de mascotas

- Análisis de las cinco fuerzas de Porter para ilustrar la eficacia de los compradores y proveedores que operan en la industria

- Avances recientes para comprender el escenario competitivo del mercado

- Tendencias y perspectivas del mercado, así como factores que impulsan y restringen el crecimiento del mercado de productos para el cuidado de mascotas

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial, lo que conduce al crecimiento del mercado.

- El tamaño del mercado de productos para el cuidado de mascotas en varios nodos

- Descripción detallada y segmentación del mercado, así como de la dinámica de la industria.

- Tamaño del mercado de productos para el cuidado de mascotas en varias regiones con prometedoras oportunidades de crecimiento

Mercado mundial de productos para el cuidado de mascotas

Por producto para mascotas

- Perros

- Gatos

- Otros

Por tipo de producto

- Champús y acondicionadores

- Herramientas de corte y recorte

- Peines y cepillos

- Otros

Por canal de distribución

- Supermercados e Hipermercados

- Tiendas especializadas

- Venta minorista en línea

- Otros

Perfiles de empresas

- Productos para mascotas Ancol Limited

- Beaphar

- Maquinilla Wahl

- La Corporación Hartz Mountain

- Productos veterinarios de Johnson Ltd.

- Esfuerzos terrestres, Inc.

- Productos para mascotas costeras, inc.

- Nexderma

- Productos para mascotas Glo-Marr

- Productos para mascotas Resco

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de productos para el cuidado de mascotas

Obtenga una muestra gratuita para - Mercado de productos para el cuidado de mascotas