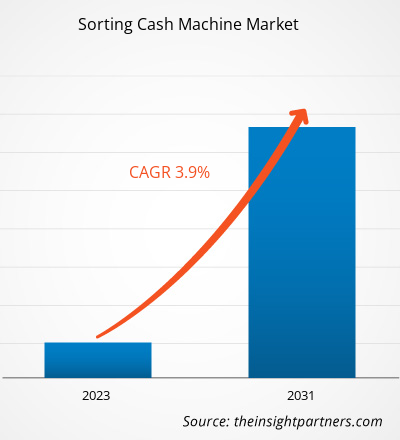

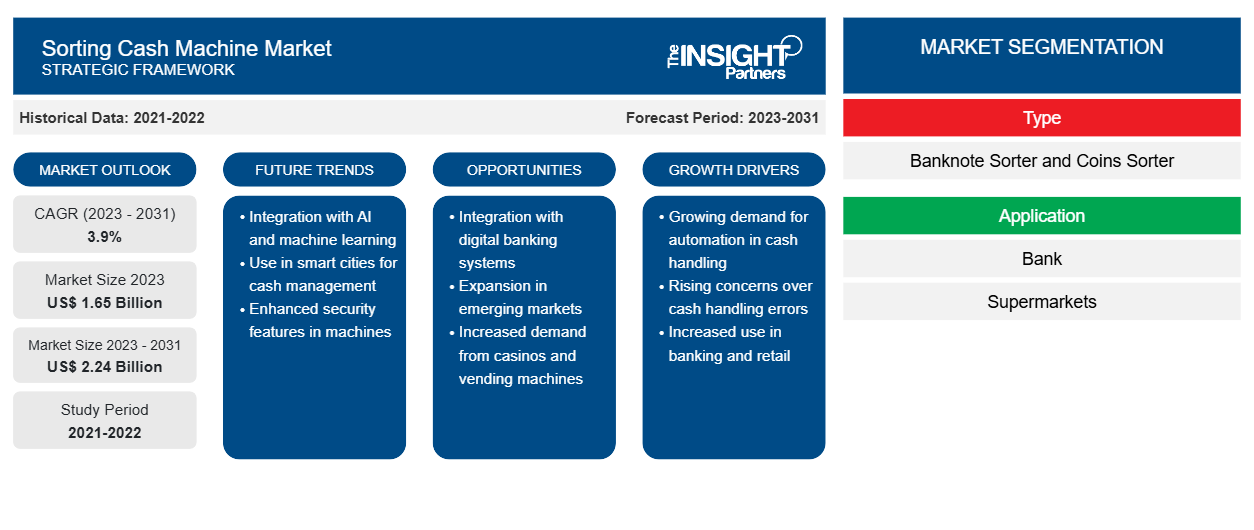

Se prevé que el mercado de cajeros automáticos clasificadores crezca de 1.650 millones de dólares en 2023 a 2.240 millones de dólares en 2031; se espera que se expanda a una CAGR del 3,9% entre 2023 y 2031. Se espera que los avances tecnológicos de los productos y el potencial de mercado sin explotar en las economías emergentes mejoren el mercado de cajeros automáticos clasificadores en el futuro cercano. El uso de esta máquina tiene otros beneficios conductuales, como menos errores en la clasificación y el recuento, gastos operativos más económicos, menos pérdidas financieras y menos peligros internos asociados con el recuento y la clasificación.

Análisis del mercado de cajeros automáticos clasificados

Los cajeros automáticos clasificadores se emplean en muchas empresas y organizaciones financieras que manejan grandes cantidades de efectivo, incluidos establecimientos minoristas, casinos, bancos comerciales y más. Algunos avances en las máquinas clasificadoras de efectivo, como la clasificación de efectivo basada en el peso, están haciendo que su implementación avanzada sea más factible. El mercado está impulsado por el flujo incontrolado y no intermitente de efectivo a través de bancos, casinos y otras instituciones financieras. La circulación regular de efectivo a granel de una industria a otra es una causa importante que alimenta la demanda de dispositivos de clasificación de efectivo.

Descripción general del mercado de cajeros automáticos clasificadores

- El dinero en efectivo, como las monedas y los billetes, se puede clasificar mediante un cajero automático clasificador. El dispositivo pasa por una pila de monedas o billetes y los clasifica según sus distintas denominaciones. Además, el dinero se cuenta y se divide en otras categorías según cantidades predeterminadas. Mediante el uso de ciertas medidas de seguridad, algunas máquinas clasificadoras de dinero altamente desarrolladas también pueden ayudar a identificar monedas o billetes falsos . Debido a que se acumula una gran cantidad de efectivo constantemente, los cajeros automáticos clasificadores se utilizan en bancos, casinos, instituciones financieras, hospitales, supermercados y grandes parques temáticos.

- Los cajeros automáticos clasificadores reducen la cantidad de trabajo necesario para clasificar el efectivo y ahorran una cantidad significativa de tiempo que de otro modo se dedicaría a clasificar y contar el dinero. Esto también reduce la posibilidad de errores que ocurren cuando el efectivo se clasifica y cuenta manualmente. Esto también da como resultado menos pérdidas financieras y menores costos operativos. Cuando se introduce un fajo de billetes, los cajeros automáticos clasificadores comienzan instantáneamente el proceso de clasificación y conteo de dinero, produciendo resultados precisos. La detección de billetes y monedas falsos ayuda a proteger la reputación de la organización. También reconoce los billetes defectuosos y comienza a emitir un pitido cuando encuentra dichos billetes o monedas.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Clasificación de los impulsores y oportunidades del mercado de cajeros automáticos

Los avances tecnológicos en las máquinas clasificadoras de efectivo impulsarán el mercado de las máquinas clasificadoras de efectivo

- Los avances tecnológicos contribuyen al crecimiento del mercado de los cajeros automáticos clasificadores. La industria de los cajeros automáticos clasificadores está impulsada por muchos avances en las máquinas clasificadoras de efectivo, como la clasificación de efectivo basada en el peso, que permite un mejor uso del efectivo.

- Las máquinas modernas dan prioridad a la eficiencia, lo que ahorra tiempo y aumenta la eficiencia operativa de una empresa. El gobierno europeo regula el uso de las máquinas clasificadoras de monedas en virtud del Reglamento (UE) n.º 1210/2010 para evitar la falsificación de moneda y validar las actividades de recuento y clasificación de efectivo. Para poder distribuir dispositivos de clasificación de efectivo en el mercado europeo, los fabricantes deben cumplir los requisitos de aceptación que se describen en las directrices de la Comisión.

Aumentar la conciencia sobre la falsificación de efectivo para crear oportunidades de mercado lucrativas

- Los participantes del mercado están desarrollando máquinas clasificadoras de billetes con medidas de seguridad suficientes para evitar la falsificación de efectivo, empleando tecnologías de última generación. Los fabricantes se esfuerzan por consolidar una posición más sólida en el mercado equipando estos dispositivos con algoritmos fiables y tecnologías de detección de efectivo.

- Si bien la seguridad, la precisión y la eficiencia siguen siendo las características más importantes de las máquinas clasificadoras de efectivo, los fabricantes están incorporando cada vez más pantallas táctiles programables, gráficos de máquina y manejo de efectivo con manos libres.

- Para obtener una ventaja competitiva, los fabricantes y distribuidores utilizan tecnología avanzada para incluir medidas de seguridad únicas y de alta calidad en las máquinas clasificadoras de efectivo. Se espera que el mercado de las máquinas clasificadoras de efectivo crezca a un ritmo moderado durante el período proyectado, debido a una variedad de características del mercado, incluida la disminución del uso de efectivo.

Análisis de segmentación del informe de mercado de máquinas de efectivo clasificadoras

El segmento clave que contribuyó a la derivación del análisis del mercado de cajeros automáticos clasificadores es el tipo.

- En función del tipo, el mercado se segmenta en clasificadores de billetes y clasificadores de monedas. La categoría de cajeros automáticos con clasificadores de billetes tiene la mayor participación de mercado debido a su capacidad para mejorar la gestión del efectivo al clasificar y empaquetar adecuadamente los billetes, lo que conduce a una mayor productividad, eficiencia y seguridad.

- Según la aplicación, el mercado se divide en tres: bancos, supermercados y otros. Se prevé que el segmento bancario se desarrolle más rápidamente debido a la adopción generalizada de pagos digitales, la creciente presencia de instituciones financieras y bancos y los avances tecnológicos en las máquinas clasificadoras bancarias.

Análisis de la cuota de mercado de los cajeros automáticos por geografía

- El alcance del mercado de cajeros automáticos clasificadores se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur. Se prevé que la región de Asia Pacífico crezca a la tasa compuesta anual más rápida durante el período de pronóstico.

- El creciente uso de la automatización del efectivo, impulsado por la llegada de los pagos digitales, está respaldando el crecimiento del mercado de máquinas de clasificación de efectivo en la región de Asia Pacífico a medida que las empresas y las instituciones financieras buscan aumentar la eficiencia y la precisión en las transacciones de efectivo de gran volumen que utilizan las máquinas.

Además, se prevé que el mercado se expanda debido al aumento del ingreso disponible, los avances tecnológicos en las máquinas clasificadoras de efectivo, la mayor demanda de máquinas clasificadoras de efectivo en las instituciones financieras y la creciente demanda de diversas industrias de uso final.

Perspectivas regionales del mercado de cajeros automáticos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de cajeros automáticos clasificadores durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de cajeros automáticos clasificadores en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos específicos regionales para clasificar el mercado de cajeros automáticos

Alcance del informe de mercado de máquinas de clasificación de efectivo

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 1.650 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 2.24 mil millones |

| CAGR global (2023 - 2031) | 3,9% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Clasificación de la densidad de actores del mercado de cajeros automáticos: comprensión de su impacto en la dinámica empresarial

El mercado de cajeros automáticos clasificadores está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de cajeros automáticos clasificadores son:

- Bcash, empresa de electrónica

- Cummins Allison

- De La Rue plc

- Giesecke+Devrient GmbH

- Glory Global Solutions (Internacional) Limitada

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de máquinas de efectivo clasificadoras

Noticias y desarrollos recientes del mercado de cajeros automáticos

Las empresas adoptan estrategias inorgánicas y orgánicas, como fusiones y adquisiciones, en el mercado de cajeros automáticos clasificadores. A continuación, se enumeran algunos de los desarrollos clave recientes del mercado:

- 2022: El Banco de la Reserva de la India (RBI) solicitó a los bancos que probaran trimestralmente sus máquinas clasificadoras de billetes para comprobar su coherencia y precisión, a fin de garantizar que los billetes cumplan con los parámetros prescritos. [Fuente: Comunicado de prensa]

Informe de mercado de cajeros automáticos clasificados: cobertura y resultados

El pronóstico del mercado de cajeros automáticos clasificadores se estima en función de varios hallazgos de investigación primaria y secundaria, como publicaciones de empresas clave, datos de asociaciones y bases de datos. El informe de mercado "Tamaño y pronóstico del mercado de cajeros automáticos clasificadores (2021-2031)" proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance.

- Dinámica del mercado como impulsores, restricciones y oportunidades clave.

- Principales tendencias futuras.

- Análisis PEST y FODA detallado

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los actores clave, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y la competencia que cubre la concentración del mercado, el análisis de mapas de calor, los actores clave y los desarrollos recientes.

- Perfiles detallados de empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Clasificación del mercado de cajeros automáticos

Obtenga una muestra gratuita para - Clasificación del mercado de cajeros automáticos