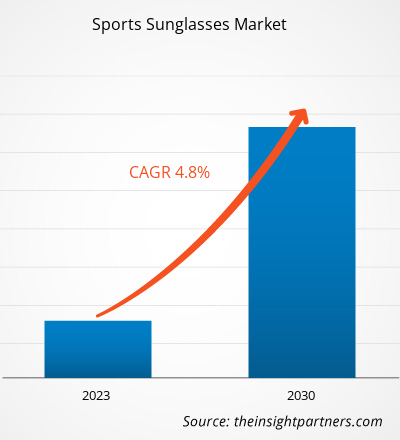

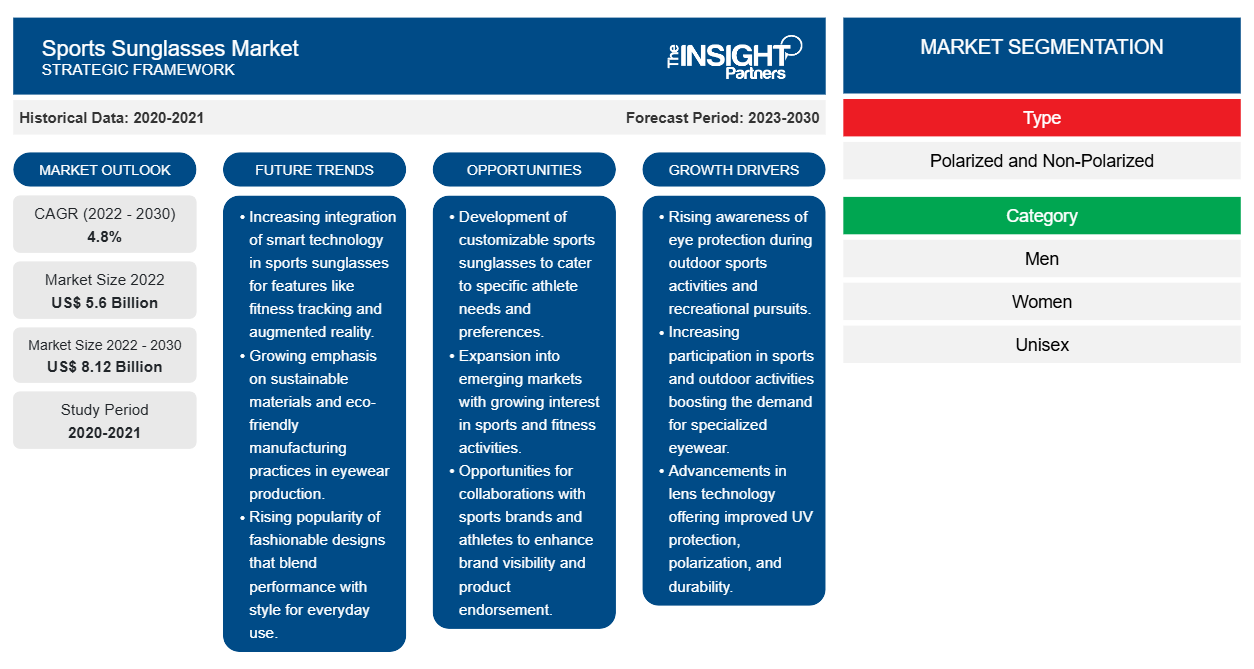

[Informe de investigación] Se proyecta que el tamaño del mercado de gafas de sol deportivas crecerá de US$ 5.597,08 millones en 2022 a US$ 8.115,06 millones en 2030; se espera que el mercado registre una CAGR del 4,8% entre 2022 y 2030.

Perspectivas del mercado y opinión de analistas:

Las gafas de sol deportivas son gafas protectoras que se utilizan para mejorar la visibilidad y la comodidad al practicar deportes al aire libre. Minimizan la exposición a la luz solar intensa para evitar daños en los ojos. Las lentes se fabrican con materiales de plástico o vidrio. Están recubiertas con bloqueadores de rayos ultravioleta (UV) y películas resistentes a los impactos que reducen el deslumbramiento y mejoran el contraste para proporcionar una mejor visibilidad en el campo. Las gafas de sol también están disponibles en tipos polarizados o no polarizados con lentes tintadas y no tintadas, lo que las hace adecuadas para el uso diario. Las gafas de sol deportivas se utilizan generalmente al realizar actividades deportivas como ciclismo, natación, ciclismo de montaña, ciclismo, béisbol, cricket y otras actividades al aire libre. Estos factores impulsan el mercado de las gafas de sol deportivas .

Factores impulsores del crecimiento y desafíos:

Muchas personas practican diversos deportes y actividades al aire libre. Los entusiastas del deporte comprenden la importancia de proteger sus ojos de posibles riesgos como el polvo, el viento y los escombros. Por ello, utilizan gafas de sol deportivas diseñadas para proporcionar una protección óptima y mejorar el rendimiento durante las actividades deportivas. Según la Asociación de la Industria del Deporte y el Fitness (SFIA), más del 76% de la población (es decir, 236,9 millones de personas) en los EE. UU. participó en al menos una actividad en 2022, un aumento del 9,2% en las tasas de participación total con respecto a 2017 y un aumento del 1,9% con respecto a 2021. Además, según Eurostat, en 2019, alrededor del 44% de la población europea practicó alguna actividad física al menos una vez a la semana. Además, una amplia gama de deportes y actividades al aire libre ha creado una demanda de gafas de sol deportivas diseñadas para satisfacer necesidades específicas.

Además, el cambio cultural hacia un estilo de vida más saludable y activo ha aumentado el número de personas que practican deportes y actividades al aire libre. Este cambio no se limita a los atletas de competición, sino que incluye a las personas que participan en deportes recreativos, carreras, senderismo y otras actividades de ocio. Las gafas de sol deportivas se han convertido en una declaración de moda y un símbolo de este estilo de vida activo.

La exposición prolongada a la radiación ultravioleta (UV), especialmente en entornos al aire libre, puede provocar diversas afecciones y enfermedades oculares, como cataratas, fotoqueratitis y pterigión. Estas afecciones pueden provocar molestias, deterioro de la visión y, en algunos casos, daño ocular permanente. Cuando se practican deportes u otras actividades al aire libre, las personas necesitan una visión clara y sin alteraciones para rendir al máximo. La exposición excesiva a los rayos UV puede provocar estrabismo, molestias y reducción de la claridad visual. Las gafas de sol deportivas con protección UV garantizan que los atletas puedan mantener una visión y una concentración óptimas durante sus actividades, lo que mejora su rendimiento general.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Segmentación y alcance del informe:

El “Mercado global de gafas de sol deportivas” está segmentado en función del tipo, la categoría, el canal de distribución y la geografía. Según el tipo, el mercado de gafas de sol deportivas se divide en polarizadas y no polarizadas. En términos de categoría, el mercado se segmenta en hombres, mujeres, unisex y niños. Según el canal de distribución, el mercado de gafas de sol deportivas se segmenta en supermercados e hipermercados, tiendas especializadas, venta minorista en línea y otros. Por geografía, el mercado se segmenta en América del Norte (EE. UU., Canadá y México), Europa (Alemania, Francia, Italia, Reino Unido, Rusia y el resto de Europa), Asia Pacífico (Australia, China, Japón, India, Corea del Sur y el resto de Asia Pacífico), Oriente Medio y África (Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos y el resto de Oriente Medio y África) y América del Sur y Central (Brasil, Argentina y el resto de América del Sur y Central).

Análisis segmental:

Según el tipo, el mercado de gafas de sol deportivas se segmenta en polarizadas y no polarizadas. El segmento no polarizado tuvo una participación significativa del mercado en 2022. La demanda de gafas de sol deportivas no polarizadas está aumentando entre los atletas y entusiastas del fitness que necesitan proteger sus ojos durante el rendimiento, además de garantizar el bienestar general. Los avances en la tecnología de lentes han dado como resultado la introducción de gafas de sol deportivas no polarizadas más ligeras, cómodas y duraderas, que atraen a un público más amplio. Además, la influencia de la industria de la moda en los accesorios deportivos ha aumentado la popularidad de las gafas de sol deportivas no polarizadas, elegantes y funcionales entre las personas que buscan rendimiento y estética en sus opciones de gafas.

Análisis regional:

Según la geografía, el mercado de gafas de sol deportivas está segmentado en cinco regiones clave: América del Norte, Europa, Asia Pacífico, América del Sur y Central, y Oriente Medio y África. América del Norte dominó el mercado mundial de gafas de sol deportivas. El mercado regional se valoró en 1.791 millones de dólares estadounidenses en 2022. Europa es el segundo mayor contribuyente al mercado, que posee casi el 25% del mercado mundial. Se espera que Oriente Medio y África registren una CAGR del 6,5% en el mercado de gafas de sol deportivas durante el período de pronóstico. En América del Norte, se espera que el mercado crezca significativamente debido al aumento de la participación en los deportes y al aumento de la conciencia relacionada con la protección ocular. Según la Asociación de la Industria del Deporte y el Fitness (SFIA), más del 76% de todos los estadounidenses, o 236,9 millones de personas, participaron en al menos una actividad deportiva durante 2022. Por lo tanto, la creciente participación de los norteamericanos en diferentes categorías deportivas impulsa aún más la demanda de gafas de sol deportivas en toda la región. Además, el mercado de Oriente Medio y África ha experimentado un crecimiento destacado debido a las amplias inversiones gubernamentales en el sector deportivo. Por ejemplo, los estados miembros del Consejo de Cooperación del Golfo (CCG), incluidos Arabia Saudita y los Emiratos Árabes Unidos, gastaron más de 65 mil millones de dólares en el desarrollo deportivo en 2022, con un enfoque principal en el fútbol y los deportes electrónicos, que se consideran que tienen el potencial más significativo de crecimiento de los ingresos. La creciente conciencia sobre la importancia del deporte y la aptitud física entre las personas y los entusiastas del fitness impulsa la demanda de gafas de sol deportivas en Oriente Medio y África.

Desarrollos industriales y oportunidades futuras:

A continuación se enumeran varias iniciativas adoptadas por los actores clave que operan en el mercado de gafas de sol deportivas:

- En diciembre de 2022, SunGod, una marca de gafas británica, colaboró con un equipo de ciclismo de criquet con sede en Londres para lanzar Tekkerz Vulcanz, las gafas de sol Vulcanz. El modelo incluye una lente fotocromática, una montura de polímero con memoria de luz ultravioleta y almohadillas y almohadillas nasales hidrófilas.

Perspectivas regionales del mercado de gafas de sol deportivas

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de gafas de sol deportivas durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de gafas de sol deportivas en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de gafas de sol deportivas

Alcance del informe de mercado de gafas de sol deportivas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2022 | 5.600 millones de dólares estadounidenses |

| Tamaño del mercado en 2030 | US$ 8,12 mil millones |

| CAGR global (2022-2030) | 4,8% |

| Datos históricos | 2020-2021 |

| Período de pronóstico | 2023-2030 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de gafas de sol deportivas: comprensión de su impacto en la dinámica empresarial

El mercado de gafas de sol deportivas está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de gafas de sol deportivas son:

- Decatlón

- adidas AG

- Grupo Luxottica

- Deporte libertad

- Nike Inc

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de gafas de sol deportivas

Impacto de la pandemia de COVID-19:

La pandemia de COVID-19 afectó negativamente a casi todas las industrias en varios países. Los confinamientos, las restricciones de viaje y los cierres de empresas en América del Norte, Europa, Asia Pacífico (APAC), América del Sur y Central, y Oriente Medio y África (MEA) obstaculizaron el crecimiento de varias industrias, incluida la industria de bienes de consumo. El cierre de las unidades de fabricación perturbó las cadenas de suministro globales, las actividades de fabricación, los cronogramas de entrega y las ventas de productos esenciales y no esenciales. Varias empresas informaron retrasos en las entregas de productos y una caída en sus ventas de productos en 2020. Además, en el período inicial de la crisis, los fabricantes dependían en gran medida del inventario existente. Debido a la recesión económica inducida por la pandemia, los consumidores se volvieron más cautelosos y selectivos en las decisiones de compra. Limitaron significativamente las compras no esenciales debido a los ingresos más bajos y las perspectivas de ingresos inciertas, especialmente en las regiones en desarrollo.

A finales de 2021, muchos países ya estaban completamente vacunados y los gobiernos anunciaron flexibilizaciones de ciertas normativas, como los confinamientos y las prohibiciones de viaje. Las tendencias cambiantes en el estilo de vida posteriores a la pandemia, como el mayor énfasis en la comodidad, la conveniencia y la personalización, influyeron en la demanda de gafas de sol deportivas. El crecimiento del comercio minorista en línea durante la pandemia también brindó oportunidades a los fabricantes de gafas de sol deportivas. Junto con esto, la relajación de las restricciones comerciales ayudó a las operaciones de importación y exportación, lo que tuvo un impacto positivo en el crecimiento del mercado de gafas de sol deportivas.

Panorama competitivo y empresas clave:

Entre los actores destacados que operan en el mercado mundial de gafas de sol deportivas se encuentran Columbia Sportswear Co, EssilorLuxottica SA, Liberty Sport Inc, Under Armour Inc, Nike Inc, Rapha Racing Ltd, Puma SE, Decathlon SE, Adidas AG y Safilo Group SpA. Estos actores del mercado adoptan iniciativas de desarrollo estratégico para expandirse, impulsando aún más el crecimiento del mercado.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de gafas de sol deportivas

Obtenga una muestra gratuita para - Mercado de gafas de sol deportivas