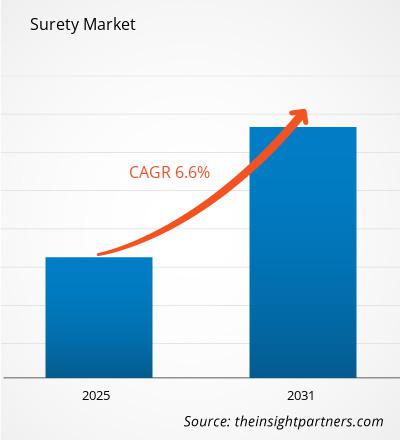

El mercado de fianzas se valoró en 20.260 millones de dólares estadounidenses en 2024 y se proyecta que alcance los 31.850 millones de dólares estadounidenses para 2031; se espera que registre una tasa de crecimiento anual compuesta (TCAC) del 6,6 % entre 2025 y 2031. Es probable que la creciente digitalización y el mayor enfoque en el desarrollo sostenible sigan siendo una tendencia clave en el mercado de fianzas.

Análisis del mercado de fianzas

El mercado de fianzas está creciendo a un ritmo acelerado debido al creciente número de actividades de construcción y a la transformación digital en los procesos de fianzas. El mercado se expande de forma constante, impulsado por la disponibilidad de fianzas personalizadas y la creciente adopción de las fianzas para la gestión de riesgos financieros. Además, el creciente uso de tecnologías avanzadas y la mayor atención a los factores ambientales, sociales y de gobernanza (ESG) ofrecen oportunidades lucrativas para el crecimiento del mercado.

Descripción general del mercado de fianzas

Una fianza es una garantía financiera o fianza, una promesa de responder por la deuda, el incumplimiento o la falta de pago de otra parte. Es un acuerdo tripartito en el que una parte (el fiador) garantiza el cumplimiento o las obligaciones de otra (el principal) a un tercero (el acreedor). Una fianza funciona como una garantía de que una persona u organización aceptará la responsabilidad de cumplir con los compromisos financieros si el deudor incumple y no puede pagar. La parte que garantiza la deuda se conoce como el fiador o el avalista. Las fianzas se pueden obtener mediante la emisión de bonos de garantía, que son contratos legales que obligan a una parte a pagar si la otra no cumple con el acuerdo. Estos bonos son ampliamente utilizados por las industrias de la construcción, los bienes raíces, las finanzas y el transporte para proteger al obligado contra el incumplimiento del principal.

Personalice este informe según sus necesidades

Recibirá personalización de cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de cauciones: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de fianzas

La transformación digital en los procesos de unión impulsa el mercado

La transformación digital se ha convertido en uno de los motores más destacados de los últimos años. La revolución digital en las operaciones de fianzas está sustituyendo el sistema tradicional en papel, lo que ayuda a los usuarios a reducir los costes operativos adicionales que impulsan el mercado. Los sistemas tradicionales en papel están siendo reemplazados por plataformas digitales que simplifican las solicitudes, aprobaciones y emisiones de fianzas. Las empresas constructoras del mercado medio pueden considerar el uso de estas soluciones digitales para reducir el papeleo, aumentar la eficiencia y acortar los plazos de tramitación de las solicitudes de fianzas.issuances. Middle-market construction companies can consider using these digital solutions to decrease paperwork, increase efficiency, and shorten bond application processing times.

Uso creciente de tecnologías avanzadas

La tecnología será cada vez más crucial en el sector de las fianzas. Las entidades afianzadoras están invirtiendo fuertemente en tecnologías avanzadas como inteligencia artificial, blockchain y análisis de big data para optimizar y mejorar sus operaciones. Por ejemplo, blockchain se utiliza para optimizar la emisión de fianzas y la tramitación de siniestros, mientras que el análisis de big data puede ayudar a detectar posibles riesgos y fraudes. Por lo tanto, los importantes beneficios que ofrecen las tecnologías avanzadas están creando oportunidades lucrativas en el mercado durante el período de pronóstico.

Análisis de segmentación del informe del mercado de fianzas

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de fianzas son el tipo de bono.

- Según el tipo de fianza, el mercado de cauciones se divide en fianzas contractuales, fianzas comerciales, fianzas de fidelidad y fianzas judiciales. El segmento de fianzas contractuales tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de las fianzas por geografía

El alcance geográfico del informe del mercado de fianzas se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur/América del Sur y Central.

En términos de ingresos, Norteamérica representó la mayor cuota de mercado en fianzas, debido a la creciente industrialización y al creciente número de pequeñas empresas en Estados Unidos y Canadá. Estos países cuentan con una economía sólida y el apoyo gubernamental para la promoción y el establecimiento de nuevas empresas está impulsando el mercado. Las fianzas son ampliamente utilizadas por las pequeñas empresas para obtener contratos que garanticen a sus clientes la ejecución y finalización puntual de la obra. Las fianzas, emitidas por las compañías afianzadoras, son necesarias para diversas transacciones gubernamentales y comerciales . Se prevé que el creciente número de pequeñas empresas en la industria de la construcción norteamericana, junto con la presencia de un número significativo de participantes en el mercado de fianzas en Estados Unidos y Canadá, impulsen el mercado de las fianzas.

Perspectivas regionales del mercado de fianzas

Los analistas de Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de cauciones durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de cauciones en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

- Obtenga los datos regionales específicos para el mercado de fianzas

Alcance del informe del mercado de fianzas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 20.26 mil millones |

| Tamaño del mercado en 2031 | US$ 31.85 mil millones |

| CAGR global (2025-2031) | 6,6% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo de bono

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de fianzas: comprensión de su impacto en la dinámica empresarial

El mercado de seguros de caución está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de empresas o compañías que operan en un mercado o sector en particular. Indica cuántos competidores (actores del mercado) hay en un mercado determinado en relación con su tamaño o valor total.

Las principales empresas que operan en el mercado de fianzas son:

- Crum y Forster

- Corporación Financiera CNA

- Las empresas de viajeros Inc.

- Liberty Mutual Holding Co. Inc.

- El grupo de seguros Hartford, Inc.

- Chubb Ltd

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de fianzas

Noticias del mercado de fianzas y desarrollos recientes

El mercado de fianzas se evalúa mediante la recopilación de datos cualitativos y cuantitativos tras la investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se presenta una lista de las novedades en el mercado de facturación y gestión de ingresos de telecomunicaciones y sus estrategias:

- Core Specialty Insurance Holdings, Inc., aseguradora de daños y responsabilidad civil, adquirirá American Surety mediante una transacción de acciones y efectivo, creando así un subsegmento de Fianzas, Crédito y Garantías junto con los programas de seguros especiales de daños y responsabilidad civil, daños y responsabilidad civil de corto plazo, y seguros fronterizos. Se espera que esta adquisición se complete en el primer trimestre de 2024. (Fuente: Core Specialty Insurance Holdings, Inc., Comunicado de prensa, 2023)

Cobertura y resultados del informe del mercado de fianzas

El informe "Tamaño y pronóstico del mercado de fianzas (2023-2031)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado PEST/de las cinco fuerzas de Porter y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de fianzas

Obtenga una muestra gratuita para - Mercado de fianzas