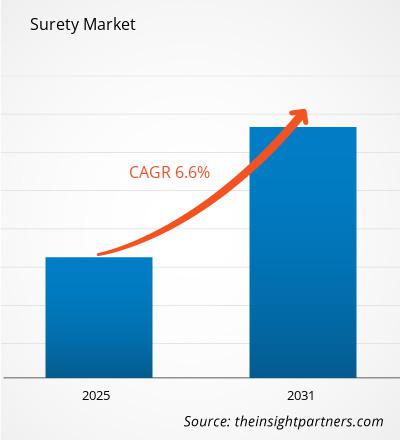

Le marché du cautionnement était évalué à 20,26 milliards de dollars américains en 2024 et devrait atteindre 31,85 milliards de dollars américains d'ici 2031 ; il devrait enregistrer un TCAC de 6,6 % entre 2025 et 2031. La numérisation croissante et l'importance croissante accordée au développement durable devraient rester une tendance clé du marché du cautionnement.

Analyse du marché des cautions

Le marché du cautionnement connaît une croissance rapide en raison de la multiplication des activités de construction et de la transformation numérique des processus de cautionnement. Ce marché connaît une croissance constante, portée par la disponibilité de cautions personnalisées et l'adoption croissante du cautionnement pour la gestion des risques financiers. De plus, l'utilisation croissante des technologies de pointe et l'attention accrue portée aux facteurs environnementaux, sociaux et de gouvernance ( ESG ) offrent des opportunités de croissance lucratives.

Aperçu du marché des cautions

Une caution est une garantie financière, un engagement de responsabilité pour la dette, le défaut ou la défaillance d'autrui . Il s'agit d'un accord tripartite par lequel une partie (la caution) garantit l'exécution des obligations d'une autre (le mandant) à un tiers (le créancier ). Une caution garantit qu'une personne ou une organisation assumera la responsabilité du respect de ses engagements financiers si le débiteur fait défaut et est incapable de payer. La partie qui garantit la dette est appelée caution ou garant. Les cautions peuvent être obtenues par l'émission de cautions, contrats juridiques obligeant une partie à payer si l'autre ne respecte pas les engagements pris. Ces cautions sont largement utilisées dans les secteurs de la construction, de l'immobilier, de la finance et des transports pour protéger le créancier contre le non-respect des obligations du mandant.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris des parties de ce rapport, ou d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

Marché des cautions : perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des cautions

La transformation numérique des processus de collage stimule le marché

La transformation numérique est devenue l'un des moteurs majeurs de ces dernières années. La révolution numérique des opérations de cautionnement remplace le système papier traditionnel, ce qui permet aux utilisateurs de réduire les coûts opérationnels supplémentaires qui pèsent sur le marché. Les systèmes papier traditionnels sont remplacés par des plateformes numériques qui simplifient les demandes, les approbations et les émissions de cautionnement . Les entreprises de construction du marché intermédiaire peuvent envisager d'utiliser ces solutions numériques pour réduire la paperasserie, accroître leur efficacité et raccourcir les délais de traitement des demandes de cautionnement.

Utilisation croissante des technologies avancées

La technologie deviendra de plus en plus cruciale dans le secteur du cautionnement. Les organismes de cautionnement investissent massivement dans des technologies de pointe telles que l'intelligence artificielle, la blockchain et l'analyse du big data pour rationaliser et améliorer leurs opérations. Par exemple, la blockchain est utilisée pour simplifier l'émission de cautions et le traitement des sinistres, tandis que l'analyse du big data peut aider à détecter d'éventuels risques et fraudes. Ainsi, les avantages considérables offerts par les technologies de pointe créent des opportunités lucratives sur le marché pendant la période de prévision.

Analyse de segmentation du rapport sur le marché des cautions

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des cautions sont le type de caution.

- Selon le type de caution, le marché du cautionnement se divise en cautions contractuelles, cautions commerciales, cautions de détournement de fonds et cautions judiciaires. Le segment des cautions contractuelles détenait une part de marché plus importante en 2023.

Analyse des parts de marché du cautionnement par zone géographique

La portée géographique du rapport sur le marché de la caution est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale.

En termes de chiffre d'affaires, l'Amérique du Nord représente la plus grande part du marché du cautionnement, grâce à l'industrialisation croissante et au nombre croissant de petites entreprises aux États-Unis et au Canada. Ces pays bénéficient d'une économie forte et le soutien favorable des gouvernements à la promotion et à la création de start-ups stimule le marché. Les cautionnements sont largement utilisés par les petites entreprises pour obtenir des contrats et garantir à leurs clients que les travaux seront exécutés et terminés dans les délais. Les cautionnements, émis par les sociétés de cautionnement, sont requis pour diverses transactions gouvernementales et commerciales . Le nombre croissant de petites entreprises dans le secteur de la construction en Amérique du Nord, ainsi que la présence d'un nombre important d'acteurs du marché du cautionnement aux États-Unis et au Canada, devraient stimuler le marché du cautionnement.

Aperçu régional du marché des cautions

Les tendances et facteurs régionaux influençant le marché du cautionnement tout au long de la période de prévision ont été analysés en détail par les analystes d'Insight Partners. Cette section aborde également les segments et la géographie du marché du cautionnement en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des cautions

Portée du rapport sur le marché des cautions

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2024 | 20,26 milliards de dollars américains |

| Taille du marché d'ici 2031 | 31,85 milliards de dollars américains |

| TCAC mondial (2025-2031) | 6,6% |

| Données historiques | 2021-2023 |

| Période de prévision | 2025-2031 |

| Segments couverts |

Par type d'obligation

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des cautions : comprendre son impact sur la dynamique des entreprises

Le marché du cautionnement connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

La densité des acteurs du marché désigne la répartition des entreprises opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché du cautionnement sont :

- Crum & Forster

- CNA Financial Corp

- Les Compagnies de Voyageurs Inc.

- Liberty Mutual Holding Co Inc

- Le groupe d'assurance Hartford, Inc.

- Chubb Ltée

Avertissement : Les entreprises répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de la caution

Actualités et développements récents du marché des cautions

Le marché du cautionnement est évalué en collectant des données qualitatives et quantitatives issues d'études primaires et secondaires, incluant des publications d'entreprises importantes, des données d'associations et des bases de données. Voici une liste des évolutions du marché de la facturation et de la gestion des revenus des télécommunications, ainsi que des stratégies associées :

- Core Specialty Insurance Holdings, Inc., assureur IARD, va acquérir American Surety par le biais d'une transaction en actions et en numéraire, créant ainsi un sous-secteur d'activité Cautionnement, Crédit et Garanties aux côtés des programmes IARD, IARD et Courte Durée, et Fronted. Cette acquisition devrait être finalisée au premier trimestre 2024. (Source : Core Specialty Insurance Holdings, Inc., Communiqué de presse, 2023)

Rapport sur le marché des cautions : couverture et livrables

Le rapport « Taille et prévisions du marché des cautions (2023-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des cautions

Obtenez un échantillon gratuit pour - Marché des cautions