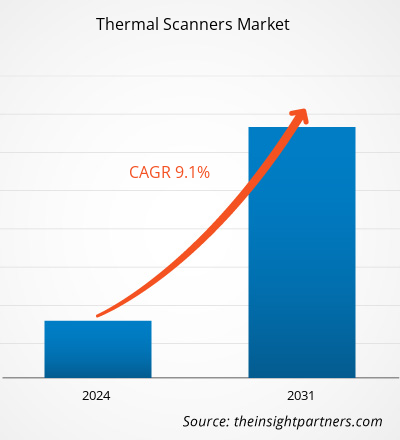

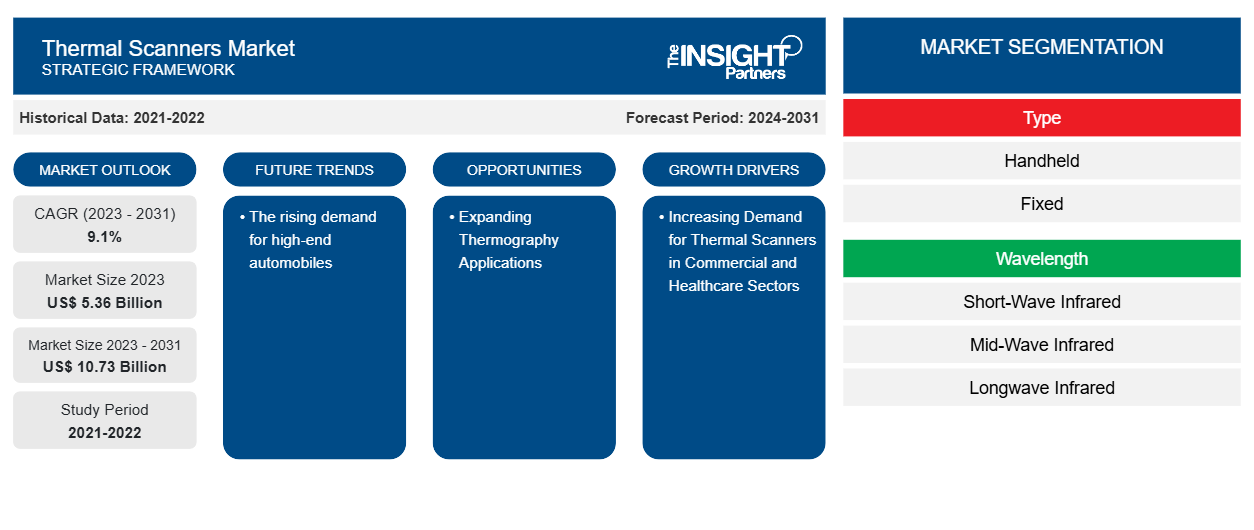

Se proyecta que el tamaño del mercado de escáneres térmicos alcance los 10.730 millones de dólares estadounidenses en 2031, frente a los 5.360 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 9,1 % entre 2023 y 2031. Es probable que la creciente demanda de automóviles de alta gama siga siendo una tendencia clave en el mercado de escáneres térmicos.

Análisis del mercado de escáneres térmicos

El mercado de los escáneres térmicos está creciendo a un ritmo rápido debido a la creciente demanda de escáneres térmicos en los sectores comercial y sanitario y al aumento de la inversión en investigación y desarrollo para desarrollar escáneres térmicos innovadores. El mercado se está expandiendo de forma constante, impulsado por la creciente instalación en diversos lugares públicos, incluidos aeropuertos, hospitales y otros, con fines de detección. Además, la expansión de las aplicaciones de termografía, los avances tecnológicos y la integración de tecnologías de inteligencia artificial y reconocimiento facial están brindando oportunidades lucrativas para el crecimiento del mercado.

Descripción general del mercado de escáneres térmicos

Los escáneres térmicos infrarrojos son instrumentos de obtención de imágenes no invasivos que detectan el calor generado por cualquier objeto y lo transforman en señales eléctricas. Sus aplicaciones han aumentado a lo largo del tiempo en una variedad de entornos, incluidas operaciones industriales, centros de tratamiento terapéutico, laboratorios de investigación y fuerzas policiales, entre otros. La diversificación y el crecimiento de muchas aplicaciones han aumentado las ventas de escáneres térmicos en varias economías en los últimos años.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de escáneres térmicos

La creciente demanda de escáneres térmicos en los sectores comercial y sanitario está impulsando el mercado

Los escáneres térmicos tienen una gran demanda en los sectores comercial y sanitario para aplicaciones de seguridad y vigilancia. La creciente necesidad de aplicaciones de seguridad y vigilancia asociadas a la gran necesidad de una mayor seguridad entre los empleados y los residentes está impulsando el mercado. Los escáneres térmicos ofrecen un alto retorno de la inversión (ROI) a los usuarios debido a su disponibilidad de bajo costo en comparación con los sistemas de CCTV . Los costos totales de instalación de un sistema de seguridad basado en cámaras térmicas son mucho más bajos que los de un sistema de CCTV, lo que aumenta su adopción en los sectores comercial y sanitario. Sin embargo, se espera que el aumento de la inversión en sistemas de infraestructura por parte de los sectores comercial y sanitario, combinado con la necesidad de una vigilancia profesional, impulse el mercado.

Ampliación de las aplicaciones de la termografía: una oportunidad en el mercado de los escáneres térmicos

La termografía se utiliza mucho en la industria médica para controlar la presión arterial, la cirugía cardíaca, el diagnóstico de enfermedades hepáticas y la detección del cáncer de mama, entre otros. La aplicación de la termografía utiliza una cámara infrarroja desplegada en un escáner térmico para ayudar a detectar el flujo sanguíneo y los patrones de calor en los tejidos corporales. Además, el aumento del gasto de la industria médica y el aumento de las actividades de investigación y desarrollo para el desarrollo de escáneres térmicos avanzados están generando importantes oportunidades de crecimiento para el mercado durante el período de pronóstico.

Análisis de segmentación del informe de mercado de escáneres térmicos

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de escáneres térmicos son el tipo, la longitud de onda y el uso final.

- Según el tipo, el mercado de escáneres térmicos se divide en portátiles y fijos. El segmento fijo tuvo una mayor participación de mercado en 2023.

- En función de la longitud de onda, el mercado de los escáneres térmicos se divide en infrarrojos de onda corta, infrarrojos de onda media e infrarrojos de onda larga. El segmento de infrarrojos de onda larga tuvo una mayor participación de mercado en 2023.

- En términos de uso final, el mercado se clasifica en industrial, aeroespacial y de defensa, automotriz, petróleo y gas, entre otros. El segmento aeroespacial y de defensa tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de los escáneres térmicos por geografía

El alcance geográfico del informe de mercado de escáneres térmicos se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur/América del Sur y Central. En términos de ingresos, América del Norte representó la mayor participación en el mercado de escáneres térmicos, debido a la expansión de la industria aeroespacial y de defensa.

Se prevé que el mercado de Asia Pacífico se expanda en el futuro cercano, debido a que muchos proveedores ofrecen soluciones de bajo costo, lo que aumenta la demanda de escáneres térmicos entre los usuarios finales. El aumento de la inversión y la expansión de numerosas industrias, incluidas la industrial, aeroespacial y de defensa, automotriz, de petróleo y gas, y otras, están creando oportunidades en el mercado. Estas industrias están adoptando en gran medida los escáneres térmicos para fines de vigilancia, lo que impulsa la producción en masa. Por lo tanto, impulsa el mercado durante el período de pronóstico.

Perspectivas regionales del mercado de escáneres térmicos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de escáneres térmicos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de escáneres térmicos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de escáneres térmicos

Alcance del informe de mercado de escáneres térmicos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 5.360 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 10,73 mil millones |

| CAGR global (2023 - 2031) | 9,1% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de escáneres térmicos: comprensión de su impacto en la dinámica empresarial

El mercado de escáneres térmicos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de escáneres térmicos son:

- Sistemas FLIR, Inc.

- Compañía AMETEK Inc.

- Robert Bosch GmbH

- 3M

- Leonardo

- Industrias electroópticas

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de escáneres térmicos

Noticias y desarrollos recientes del mercado de escáneres térmicos

El mercado de escáneres térmicos se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de investigaciones primarias y secundarias, que incluyen publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de escáneres térmicos y las estrategias:

- En enero de 2024, Valeo y Teledyne FLIR entregarán la primera tecnología de imagen térmica con nivel de integridad de seguridad automotriz (ASIL) B para sistemas ADAS de visión nocturna. Este sistema complementará la amplia gama de sensores de Valeo y se basará en el conjunto de software ADAS de Valeo para respaldar funciones como el frenado automático de emergencia (AEB) por la noche para vehículos comerciales y de pasajeros, así como para automóviles autónomos. (Fuente: Valeo, nota de prensa, 2024)

Informe de mercado sobre escáneres térmicos: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de escáneres térmicos (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de escáneres térmicos

Obtenga una muestra gratuita para - Mercado de escáneres térmicos