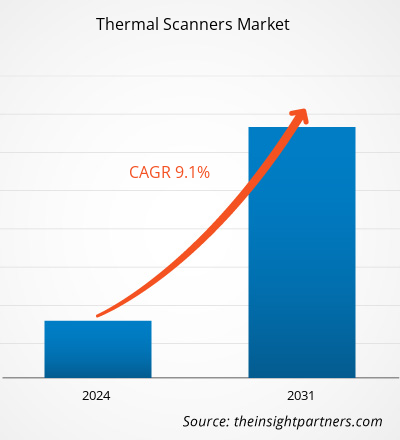

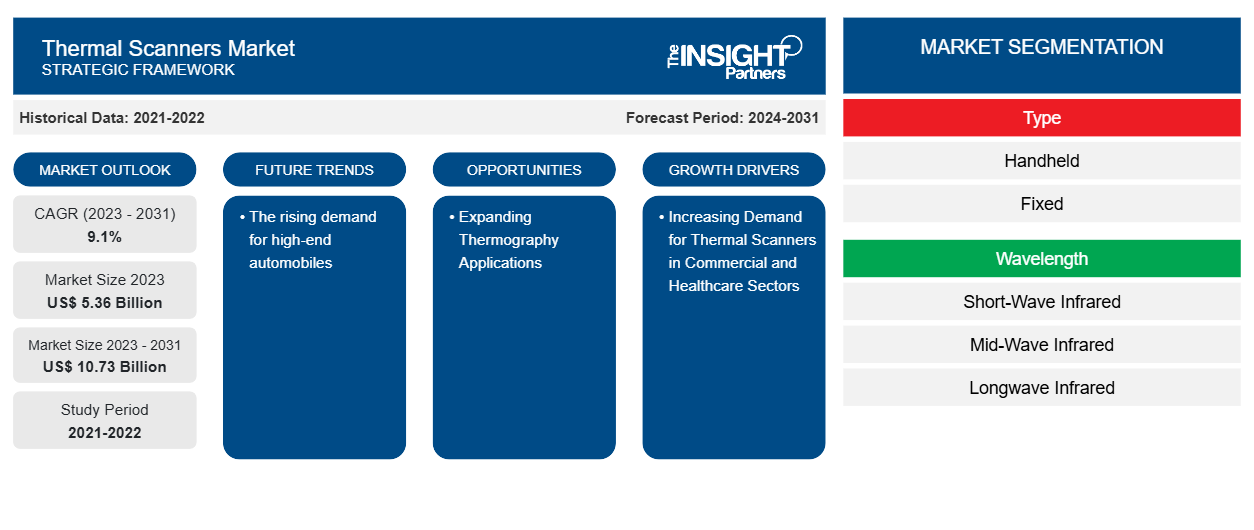

Si prevede che il mercato degli scanner termici raggiungerà i 10,73 miliardi di dollari entro il 2031, passando dai 5,36 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 9,1% nel 2023-2031. La crescente domanda di automobili di fascia alta rimarrà probabilmente una tendenza chiave del mercato degli scanner termici.

Analisi di mercato degli scanner termici

Il mercato degli scanner termici sta crescendo a un ritmo rapido a causa della crescente domanda di scanner termici nei settori commerciale e sanitario e dei crescenti investimenti in ricerca e sviluppo per lo sviluppo di scanner termici innovativi. Il mercato si sta espandendo costantemente, guidato dalla crescente installazione in vari luoghi pubblici tra cui aeroporti, ospedali e altri per scopi di rilevamento. Inoltre, l'espansione delle applicazioni della termografia, i progressi tecnologici e l'integrazione di tecnologie di intelligenza artificiale e riconoscimento facciale stanno offrendo opportunità redditizie per la crescita del mercato.

Panoramica del mercato degli scanner termici

Gli scanner termici a infrarossi sono strumenti di imaging non invasivi che rilevano il calore generato da qualsiasi oggetto e lo trasformano in segnali elettrici. Le loro applicazioni sono cresciute nel tempo in una varietà di contesti, tra cui operazioni industriali, centri di trattamento terapeutico, laboratori di ricerca e forze dell'ordine, tra gli altri. La diversificazione e la crescita di molte applicazioni hanno aumentato le vendite di scanner termici in diverse economie negli ultimi anni.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità di mercato degli scanner termici

La crescente domanda di scanner termici nei settori commerciale e sanitario sta guidando il mercato

Gli scanner termici sono molto richiesti nei settori commerciale e sanitario per applicazioni di sicurezza e sorveglianza. La crescente necessità di applicazioni di sicurezza e sorveglianza associata all'elevata necessità di maggiore sicurezza tra dipendenti e residenti sta guidando il mercato. Gli scanner termici offrono un elevato ritorno sull'investimento (ROI) agli utenti grazie alla loro disponibilità a basso costo rispetto ai sistemi CCTV . I costi totali di installazione di un sistema di sicurezza basato su telecamera termica sono molto inferiori a quelli di un sistema CCTV, il che ne aumenta l'adozione nei settori commerciale e sanitario. Tuttavia, si prevede che l'aumento degli investimenti in sistemi infrastrutturali da parte dei settori commerciale e sanitario, combinato con la necessità di sorveglianza professionale, guiderà il mercato.

Espansione delle applicazioni della termografia: un'opportunità nel mercato degli scanner termici

La termografia è ampiamente utilizzata nel settore medico per il monitoraggio della pressione sanguigna, la chirurgia cardiaca, la diagnosi di malattie del fegato e la rilevazione del cancro al seno, tra gli altri. L'applicazione della termografia utilizza una telecamera a infrarossi installata in uno scanner termico per aiutare a rilevare il flusso sanguigno e i modelli di calore nei tessuti corporei. Inoltre, la crescente spesa del settore medico e le crescenti attività di ricerca e sviluppo verso lo sviluppo di scanner termici avanzati stanno generando significative opportunità di crescita per il mercato durante il periodo di previsione.

Analisi della segmentazione del rapporto di mercato degli scanner termici

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato degli scanner termici sono tipologia, lunghezza d'onda e utilizzo finale.

- In base al tipo, il mercato degli scanner termici è diviso tra portatili e fissi. Il segmento fisso ha detenuto una quota di mercato maggiore nel 2023.

- In base alla lunghezza d'onda, il mercato degli scanner termici è suddiviso in infrarossi a onde corte, infrarossi a onde medie e infrarossi a onde lunghe. Il segmento degli infrarossi a onde lunghe ha detenuto una quota di mercato maggiore nel 2023.

- In termini di utilizzo finale, il mercato è categorizzato come industriale, aerospaziale e difesa, automobilistico, petrolio e gas e altri. Il segmento aerospaziale e difesa ha detenuto una quota di mercato maggiore nel 2023.

Analisi della quota di mercato degli scanner termici per area geografica

L'ambito geografico del rapporto di mercato sugli scanner termici è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud America/Sud e Centro America. In termini di fatturato, il Nord America ha rappresentato la quota di mercato degli scanner termici più grande, a causa dell'espansione dell'industria aerospaziale e della difesa.

Si prevede che il mercato nell'area Asia-Pacifico si espanderà nel prossimo futuro, attribuito a molti venditori che forniscono soluzioni a basso costo, il che aumenta la domanda di scanner termici tra gli utenti finali. L'aumento degli investimenti e l'espansione di numerosi settori, tra cui industriale, aerospaziale e difesa, automobilistico, petrolifero e del gas e altri, stanno creando opportunità nel mercato. Questi settori stanno adottando ampiamente gli scanner termici per scopi di sorveglianza, il che stimola la produzione di massa. Quindi, stimolando il mercato durante il periodo di previsione.

Approfondimenti regionali sul mercato degli scanner termici

Le tendenze regionali e i fattori che influenzano il mercato degli scanner termici durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato degli scanner termici in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato degli scanner termici

Ambito del rapporto di mercato sugli scanner termici

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 5,36 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 10,73 miliardi di dollari USA |

| CAGR globale (2023-2031) | 9,1% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato degli scanner termici: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli scanner termici sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato degli scanner termici sono:

- Sistemi FLIR, Inc.

- AMETEK Inc.

- Bosch Italia S.p.A.

- 3 milioni

- Leonardo

- Industrie elettro-ottiche

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato degli scanner termici

Notizie di mercato e sviluppi recenti sugli scanner termici

Il mercato degli scanner termici viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco di sviluppi nel mercato degli scanner termici e delle strategie:

- A gennaio 2024, Valeo e Teledyne FLIR consegneranno la prima tecnologia di imaging termico Automotive Safety Integrity Level (ASIL) B per ADAS con visione notturna. Questo sistema completerà la vasta gamma di sensori Valeo e si affiderà allo stack software ADAS di Valeo per supportare funzioni come la frenata automatica di emergenza (AEB) di notte per veicoli passeggeri e commerciali, nonché per auto autonome. (Fonte: Valeo, comunicato stampa, 2024)

Copertura e risultati del rapporto di mercato sugli scanner termici

Il rapporto "Dimensioni e previsioni del mercato degli scanner termici (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato globale e regionale che copre le principali tendenze di mercato, i principali attori, le normative e gli sviluppi recenti del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato degli scanner termici

Ottieni un campione gratuito per - Mercato degli scanner termici