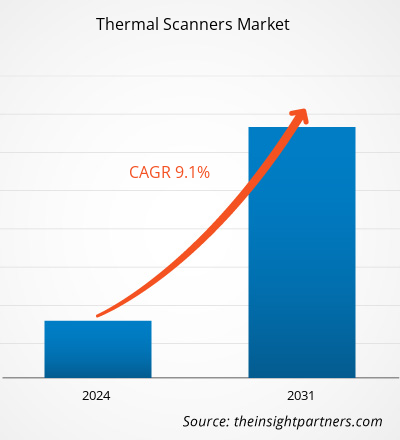

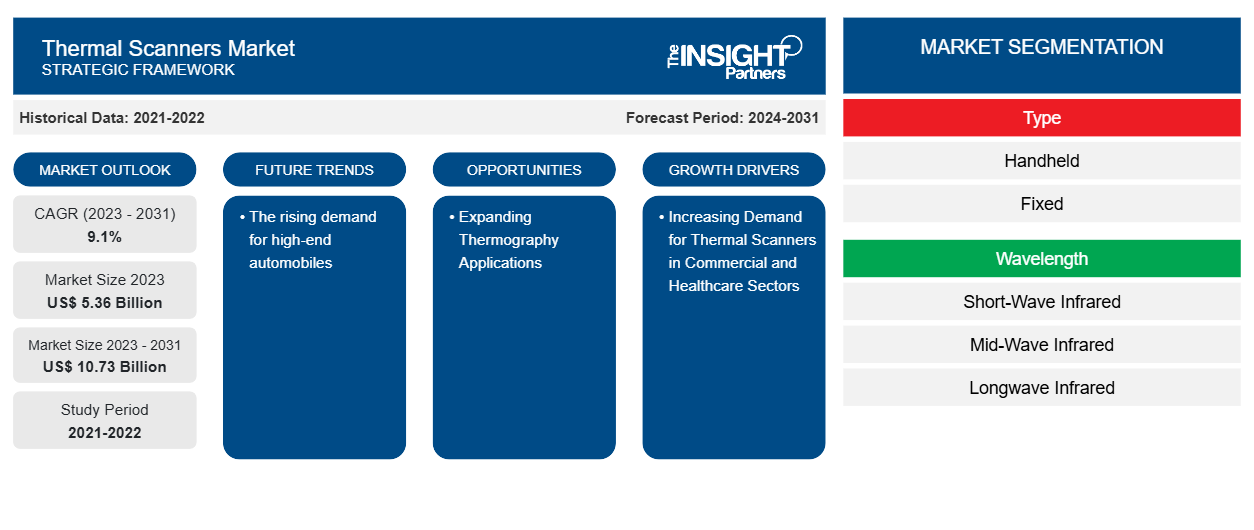

La taille du marché des scanners thermiques devrait atteindre 10,73 milliards USD d'ici 2031, contre 5,36 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 9,1 % en 2023-2031. La demande croissante d'automobiles haut de gamme devrait rester une tendance clé du marché des scanners thermiques.

Analyse du marché des scanners thermiques

Le marché des scanners thermiques connaît une croissance rapide en raison de la demande croissante de scanners thermiques dans les secteurs commercial et de la santé et de l'augmentation des investissements dans la recherche et le développement pour développer des scanners thermiques innovants. Le marché est en constante expansion, stimulé par l'installation croissante dans divers lieux publics, notamment les aéroports, les hôpitaux et autres, à des fins de détection. De plus, l'expansion des applications de thermographie, les avancées technologiques et l'intégration des technologies d'intelligence artificielle et de reconnaissance faciale offrent des opportunités lucratives de croissance du marché.

Aperçu du marché des scanners thermiques

Les scanners thermiques infrarouges sont des instruments d'imagerie non invasifs qui détectent la chaleur générée par n'importe quel objet et la transforment en signaux électriques. Leurs applications se sont développées au fil du temps dans divers contextes, notamment les opérations industrielles, les centres de traitement thérapeutique, les laboratoires de recherche et les services de police, entre autres. La diversification et la croissance de nombreuses applications ont fait augmenter les ventes de scanners thermiques dans plusieurs économies ces dernières années.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des scanners thermiques

La demande croissante de scanners thermiques dans les secteurs commercial et de la santé stimule le marché

Les scanners thermiques sont très demandés dans les secteurs commercial et de la santé pour les applications de sécurité et de surveillance. Le besoin croissant d'applications de sécurité et de surveillance associé au besoin élevé de plus grande sécurité parmi les employés et les résidents stimule le marché. Les scanners thermiques offrent un retour sur investissement (ROI) élevé aux utilisateurs en raison de leur disponibilité à faible coût par rapport aux systèmes de vidéosurveillance . Les coûts totaux d'installation d'un système de sécurité basé sur une caméra thermique sont bien inférieurs à ceux d'un système de vidéosurveillance, ce qui augmente son adoption dans les secteurs commercial et de la santé. Cependant, l'augmentation des investissements dans les systèmes d'infrastructure par les secteurs commercial et de la santé, combinée à l'exigence d'une surveillance professionnelle, devrait stimuler le marché.

Expansion des applications de thermographie – Une opportunité sur le marché des scanners thermiques

La thermographie est largement utilisée dans le secteur médical pour surveiller la pression artérielle, la chirurgie cardiaque, le diagnostic des maladies du foie et la détection du cancer du sein, entre autres. L'application de thermographie utilise une caméra infrarouge déployée dans un scanner thermique pour aider à détecter le flux sanguin et les schémas de chaleur dans les tissus corporels. De plus, les dépenses croissantes du secteur médical et l'augmentation des activités de recherche et développement en vue du développement de scanners thermiques avancés génèrent des opportunités de croissance importantes pour le marché au cours de la période de prévision. is highly used in the medical industry for monitoring blood pressure, cardiac surgery, diagnosis of liver diseases, and detecting breast cancer, among others. The thermography application uses an infrared camera deployed in a thermal scanner to helps in detecting blood flow and heat patterns in bodily tissues. Moreover, growing spending from the medical industry and increasing research & development activities towards the development of advanced thermal scanners are generating significant growth opportunities for the market during the forecast period.

Analyse de segmentation du rapport sur le marché des scanners thermiques

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des scanners thermiques sont le type, la longueur d’onde et l’utilisation finale.

- En fonction du type, le marché des scanners thermiques est divisé en scanners portables et fixes. Le segment fixe détenait une part de marché plus importante en 2023.

- Sur la base de la longueur d'onde, le marché des scanners thermiques est divisé en infrarouge à ondes courtes, infrarouge à ondes moyennes et infrarouge à ondes longues. Le segment infrarouge à ondes longues détenait une part de marché plus importante en 2023.longwave infrared. The longwave infrared segment held a larger market share in 2023.

- En termes d'utilisation finale, le marché est catégorisé comme industriel, aérospatial et défense, automobile, pétrole et gaz, et autres. Le segment de l'aérospatiale et de la défense détenait une part de marché plus importante en 2023.

Analyse des parts de marché des scanners thermiques par zone géographique

La portée géographique du rapport sur le marché des scanners thermiques est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale. En termes de chiffre d'affaires, l'Amérique du Nord représentait la plus grande part de marché des scanners thermiques, en raison de l'expansion de l'industrie aérospatiale et de la défense.

Le marché de la région Asie-Pacifique devrait connaître une expansion dans un avenir proche, grâce à de nombreux fournisseurs proposant des solutions à faible coût, ce qui augmente la demande de scanners thermiques parmi les utilisateurs finaux. L'augmentation des investissements et l'expansion de nombreuses industries, notamment l'industrie, l'aérospatiale et la défense, l'automobile, le pétrole et le gaz, entre autres, créent des opportunités sur le marché. Ces industries adoptent massivement les scanners thermiques à des fins de surveillance, ce qui encourage la production de masse. Le marché devrait ainsi être stimulé au cours de la période de prévision.

Aperçu régional du marché des scanners thermiques

Les tendances et facteurs régionaux influençant le marché des scanners thermiques tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des scanners thermiques en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des scanners thermiques

Portée du rapport sur le marché des scanners thermiques

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 5,36 milliards de dollars américains |

| Taille du marché d'ici 2031 | 10,73 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 9,1% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des scanners thermiques : comprendre son impact sur la dynamique commerciale

Le marché des scanners thermiques connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des scanners thermiques sont :

- Systèmes FLIR, Inc.

- AMETEK Inc.

- Robert Bosch GmbH

- 3M

- Léonard de Vinci

- Industries électro-optiques

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des scanners thermiques

Actualités et développements récents du marché des scanners thermiques

Le marché des scanners thermiques est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Voici une liste des développements sur le marché des scanners thermiques et des stratégies :

- En janvier 2024, Valeo et Teledyne FLIR livreront la première technologie d'imagerie thermique ASIL B (Automotive Safety Integrity Level) pour les systèmes d'aide à la conduite (ADAS) à vision nocturne. Ce système viendra compléter la large gamme de capteurs de Valeo et s'appuiera sur la pile logicielle ADAS de Valeo pour prendre en charge des fonctions telles que le freinage automatique d'urgence (AEB) de nuit pour les véhicules de tourisme et utilitaires ainsi que pour les voitures autonomes. (Source : Valeo, Communiqué de presse, 2024)

Rapport sur le marché des scanners thermiques : couverture et livrables

Le rapport « Taille et prévisions du marché des scanners thermiques (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des scanners thermiques

Obtenez un échantillon gratuit pour - Marché des scanners thermiques