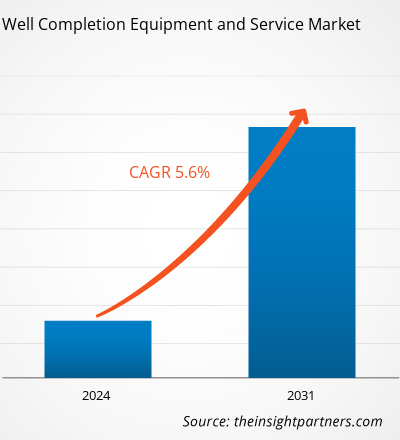

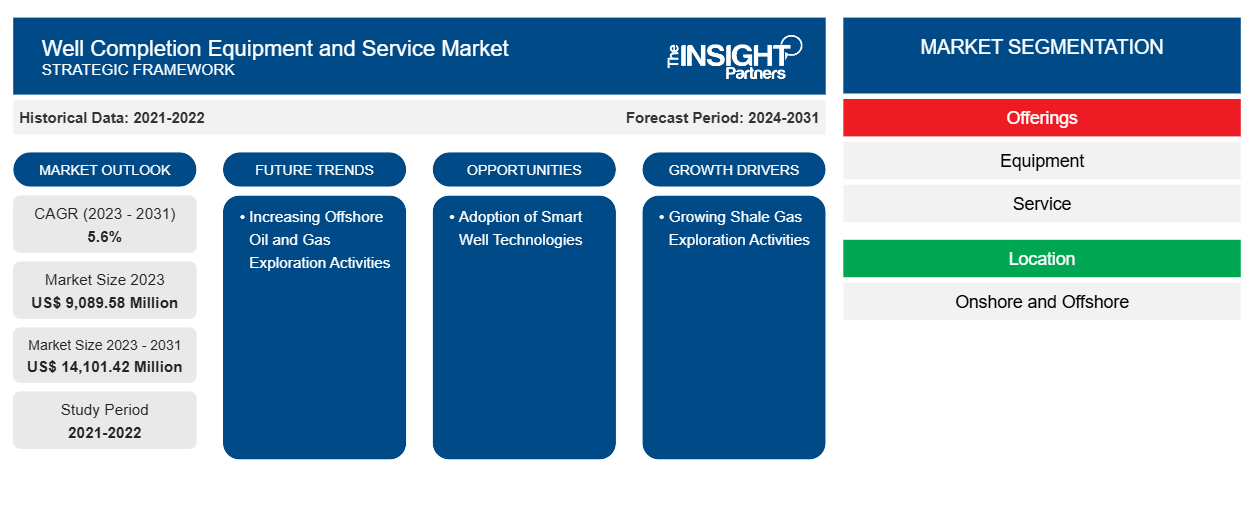

Se proyecta que el tamaño del mercado de equipos y servicios de terminación de pozos alcance los 14.101,42 millones de dólares estadounidenses en 2031, frente a los 9.089,58 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 5,6 % durante el período 2023-2031. Es probable que el creciente número de actividades de exploración de petróleo y gas en alta mar siga siendo una tendencia clave en el mercado.

Análisis del mercado de equipos y servicios de terminación de pozos

Los principales usuarios finales del mercado de equipos y servicios de terminación de pozos incluyen compañías de petróleo y gas. Se proyecta que el crecimiento urbano se producirá en barrios marginales y otras zonas de construcción informal de los estados y países en los próximos años. Las políticas y regulaciones gubernamentales favorables para el desarrollo de energía renovable, que es una de las principales razones del crecimiento del sector de petróleo y gas a nivel mundial. El creciente número de proyectos de exploración de petróleo y gas , tanto en tierra como en alta mar, está impulsando el crecimiento del mercado de equipos y servicios de terminación de pozos a nivel mundial.

Descripción general del mercado de equipos y servicios de terminación de pozos

Los principales actores en el ecosistema del mercado global de equipos y servicios de terminación de pozos incluyen proveedores de hardware/componentes, fabricantes/proveedores de equipos y servicios de terminación de pozos y usuarios finales. Los proveedores de componentes/hardware proporcionan diversos componentes/partes/materias primas a los fabricantes de equipos y servicios de terminación de pozos para la fabricación del producto final. Se utilizan diferentes tipos de materias primas para fabricar equipos de perforación . Algunos de los principales fabricantes del mercado global de equipos y servicios de terminación de pozos incluyen Halliburton Company, FTS International y Nov Inc., entre muchos otros.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de equipos y servicios de terminación de pozos

Crecientes actividades de exploración de gas de esquisto favorecerán el mercado

Las incertidumbres energéticas debido a las perturbaciones geopolíticas están impulsando la producción de gas de esquisto a nivel mundial, lo que probablemente creará grandes oportunidades para el crecimiento del mercado de equipos y servicios de terminación de pozos en los próximos años. América del Norte ha asegurado su posición como uno de los principales productores de gas de esquisto a nivel mundial. Canadá es el quinto mayor productor y el cuarto mayor exportador de gas natural a nivel mundial. Los principales yacimientos de gas de esquisto canadienses incluyen el de Utica en Quebec, el Colorado Group en Alberta y Saskatchewan, y el de Horton Bluff en New Brunswick y Nova Scotia. Por lo tanto, se proyecta que la creciente demanda de gas de esquisto actuará como un impulsor del mercado de equipos y servicios de terminación de pozos.

Adopción de tecnologías de pozos inteligentes

La creciente automatización de las tecnologías de pozos es uno de los principales factores que contribuyen al crecimiento del mercado a nivel mundial. La adopción de tecnologías de pozos inteligentes se ha convertido en una tendencia popular entre los proveedores de plataformas de pozos. Ofrece diferentes ventajas, como un aumento en las tasas de producción, ahorro de tiempo y costos, una disminución en las inyecciones de agua y el monitoreo de todas las operaciones de producción, junto con actualizaciones en tiempo real en el monitor o los dispositivos conectados. Inicialmente, el concepto de pozo inteligente se probó en pozos terrestres, pero ahora también se ha aplicado a plataformas marinas.

Informe de mercado de equipos y servicios de terminación de pozos Análisis de segmentación

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de equipos y servicios de terminación de pozos son las ofertas y la ubicación.

- En función de la oferta, el mercado de equipos y servicios de terminación de pozos se divide en equipos y servicios. El segmento de servicios tuvo una mayor participación de mercado en 2023.

- Según la ubicación, el mercado de equipos y servicios de terminación de pozos se divide en onshore y offshore. El segmento onshore tuvo una mayor participación de mercado en 2023.

Análisis de la participación de mercado de equipos y servicios de terminación de pozos por geografía

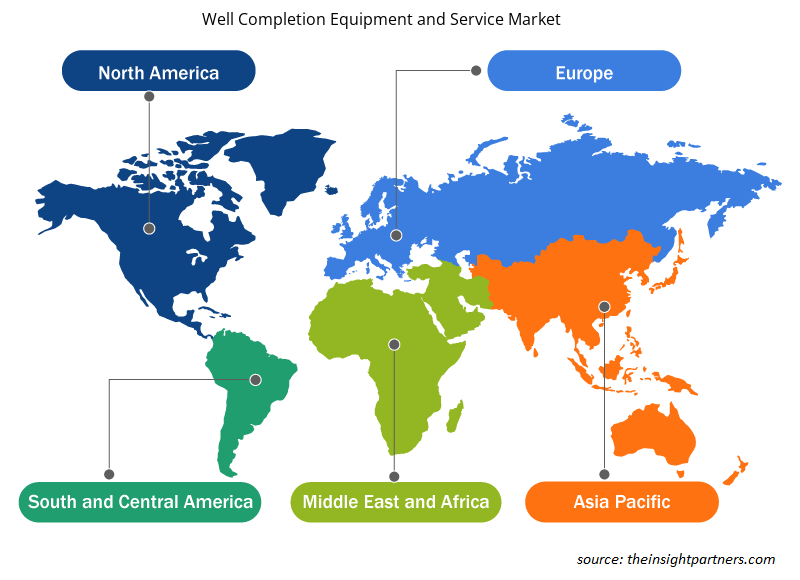

El alcance geográfico del informe de mercado de equipos y servicios de terminación de pozos se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

América del Norte lidera el mercado. El gobierno de Estados Unidos ha tomado varias iniciativas para apoyar al sector del petróleo y el gas en el país. La inversión y el enfoque en las actividades de gas en alta mar están creciendo en todo el mundo. Por ejemplo, en mayo de 2023, el gobierno chino declaró que había completado la construcción de una nueva plataforma de perforación en alta mar de 12.000 toneladas. En junio de 2023, el gobierno anunció la perforación profunda en plataformas marinas para reducir su dependencia de otros países en lo que respecta a la importación de petróleo y gas. Por lo tanto, se prevé que la creciente inversión para el desarrollo de infraestructura de pozos de petróleo y gas en alta mar impulse el crecimiento del mercado de equipos y servicios de terminación de pozos durante el período de pronóstico.

Perspectivas regionales del mercado de equipos y servicios de terminación de pozos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de equipos y servicios de terminación de pozos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de equipos y servicios de terminación de pozos en América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de equipos y servicios de terminación de pozos

Alcance del informe sobre el mercado de equipos y servicios de terminación de pozos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 9.089,58 millones |

| Tamaño del mercado en 2031 | US$ 14.101,42 millones |

| CAGR global (2023 - 2031) | 5,6% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por ofrendas

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de equipos y servicios para la terminación de pozos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de equipos y servicios de completación de pozos son:

- Compañía Baker Hughes

- FTS Internacional

- Compañía Halliburton

- Noviembre Inc.

- NCS Multietapa, LLC

- Shell holandesa real plc

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de equipos y servicios de terminación de pozos

Noticias y desarrollos recientes del mercado de equipos y servicios de terminación de pozos

El mercado de equipos y servicios para la terminación de pozos se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de equipos y servicios para la terminación de pozos:

- Baker Hughes obtuvo un contrato con Petrobras para iniciar los servicios de construcción de pozos en el gigantesco yacimiento presal de Buzios, en la cuenca de Santos, frente a las costas de Brasil. (Fuente: Baker Hughes, comunicado de prensa, febrero de 2024)

- Halliburton Company y Nabors Industries anunciaron un acuerdo para ofrecer soluciones líderes en automatización de la construcción de pozos. Según el acuerdo, Halliburton y Nabors colaborarán en sus tecnologías, incluidas las tecnologías de perforación digital de superficie y subsuelo Halliburton Well Construction 4.0, la plataforma de perforación autónoma LOGIX, la plataforma de automatización y controles de plataformas universales Nabors SmartROS y la plataforma de infraestructura digital de alto rendimiento RigCLOUD. (Fuente: Halliburton Company, comunicado de prensa, junio de 2023)

Informe sobre el mercado de equipos y servicios de terminación de pozos: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de equipos y servicios de terminación de pozos (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño y pronóstico del mercado de equipos y servicios de terminación de pozos a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos por el alcance

- Tendencias del mercado de equipos y servicios de terminación de pozos, así como dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallados

- Análisis del mercado de equipos y servicios de terminación de pozos que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes para el mercado de equipos y servicios de terminación de pozos

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de equipos y servicios de completación de pozos

Obtenga una muestra gratuita para - Mercado de equipos y servicios de completación de pozos