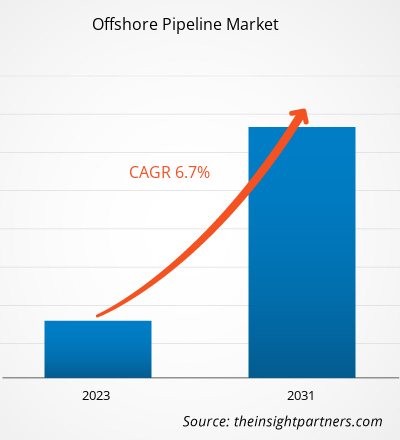

Le marché des pipelines offshore devrait atteindre 21 044,7 millions USD d'ici 2031, contre 15 277,3 millions USD en 2022. Le marché devrait enregistrer un TCAC de 6,7 % au cours de la période 2023-2031. L'augmentation de la production pétrolière et gazière offshore, la production croissante de nouvelles plates-formes pétrolières et la reconstruction des plates-formes pétrolières et gazières offshore existantes et anciennes sont parmi les principaux facteurs qui stimulent le marché des pipelines offshore.

Analyse du marché des pipelines offshore

Le marché des pipelines offshore devrait connaître une croissance considérable en raison du nombre croissant de projets de gaz naturel ainsi que de la découverte de nouveaux gisements pétroliers, en particulier dans des endroits reculés. En outre, l'épuisement des réserves de pétrole et de gaz existantes dans divers pays a créé une demande de pipelines transfrontaliers pour l' approvisionnement en produits liés au pétrole et au gaz, ce qui stimule la croissance du marché des pipelines offshore. La demande croissante de méthodes de transport rentables pour le pétrole et le gaz est également l'un des principaux facteurs qui devraient stimuler la demande de pipelines offshore dans le secteur pétrolier et gazier à l'échelle mondiale.

Aperçu du marché des pipelines offshore

L’explosion démographique et l’industrialisation qui en découle ont entraîné une augmentation de la demande énergétique à l’échelle mondiale. L’augmentation de la consommation énergétique a stimulé les besoins en pétrole et en gaz dans les économies en développement et développées. Elle a entraîné une augmentation de la demande d’infrastructures de pipelines offshore dans le monde entier. L’Asie-Pacifique est le plus grand consommateur de pétrole brut et de gaz. En outre, les pays hautement industrialisés de la région Asie-Pacifique, notamment la Chine, l’Inde, le Japon et la Corée du Sud, signalent une augmentation de leur consommation globale d’énergie. Leur objectif de stimuler la production nationale de pétrole grâce à diverses techniques de récupération assistée du pétrole favorise le marché des pipelines offshore en Asie-Pacifique pour répondre à la demande croissante de pétrole.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

Marché des pipelines offshore : informations stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des pipelines offshore

Demande croissante de gaz naturel et de pétrole brut

La demande de pétrole et de gaz naturel connaît une augmentation constante dans le monde entier. Les États-Unis et la Chine ont enregistré la croissance la plus marquée. L'augmentation de la production industrielle, ainsi que la forte demande de services de transport par camion, stimulent la demande de produits pétrochimiques, alimentant ainsi la croissance du marché des pipelines offshore. En outre, la croissance du trafic aérien dans le monde, en particulier en Asie, est un autre facteur important entraînant une augmentation de la consommation de pétrole.fuelling the growth of the offshore pipeline market. Moreover, the growth in air traffic volumes worldwide, particularly in Asia, is another significant factor resulting in increased oil consumption.

Français L'Organisation des pays exportateurs de pétrole (OPEP) a publié « Les perspectives mondiales du pétrole de l'OPEP pour 2020 » en octobre 2020. Selon les perspectives, la pandémie de COVID-19 a entraîné une baisse de la demande de pétrole ; cependant, on s'attendait à ce que la demande mondiale d'énergie enregistre une croissance constante à l'avenir, augmentant de 25 % d'ici 2045. Les perspectives prévoient en outre que le pétrole sera le plus grand contributeur au marché du mix énergétique, contribuant à 27 % de la part globale de l'énergie d'ici 2045. La demande de produits pétroliers devrait augmenter de plus d'environ 47 Mb/jour au cours de la période 2022-2025 dans les pays de l'OCDE. D'autre part, la demande dans les pays non membres de l'OCDE devrait augmenter de 22,5 Mb/jour au cours de la période de prévision.OECD countries. On the other hand, the demand in non-OECD countries is projected to rise by 22.5 MB/day during the forecast period.

Efforts constants pour améliorer les opérations de récupération du pétrole

Plusieurs pays investissent dans le renouvellement de leurs ressources pétrolières existantes afin d'augmenter leur production nationale de pétrole et de réduire leur dépendance aux importations de pétrole. Au cours des dernières décennies, la méthode d'injection de vapeur a été exploitée commercialement pour améliorer la récupération des réservoirs de pétrole lourd conventionnels dans leurs derniers stades de développement. La vapeur injectée augmente la pression globale d'un réservoir de pétrole offshore, ce qui contribue à améliorer le taux de mobilité du pétrole brut et lui permet de s'écouler efficacement. En conséquence, les méthodes de récupération améliorée du pétrole aident à revitaliser les processus d'extraction dans les puits de pétrole offshore existants. Ainsi, l'expansion des opérations pétrolières et gazières devrait offrir des opportunités de croissance prometteuses aux acteurs du marché des pipelines offshore dans les années à venir.

Analyse de segmentation du rapport sur le marché des pipelines offshore

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des pipelines offshore sont le type et l’utilisateur final.

- En fonction du diamètre, le marché des pipelines offshore a été divisé en moins de 24 pouces et plus de 24 pouces. Le segment des moins de 24 pouces détenait une part de marché plus importante en 2023.

- Par type de ligne, le marché des pipelines offshore est segmenté en lignes de transport, lignes d'exportation et autres. Le segment des lignes de transport détenait la plus grande part de marché en 2023.

- En termes de produits, le marché est segmenté en pétrole, gaz et produits raffinés. Le segment des produits raffinés a dominé le marché en 2023.

Analyse des parts de marché des pipelines offshore par zone géographique

La portée géographique du rapport sur le marché des pipelines offshore est principalement divisée en cinq régions : l’Amérique du Nord, l’Europe, l’Asie-Pacifique, le Moyen-Orient et l’Afrique, et l’Amérique du Sud et l’Amérique centrale.

L'Europe a dominé le marché des pipelines offshore en 2023. Le marché européen est segmenté en Allemagne, Norvège, Italie, Russie, Royaume-Uni et reste de l'Europe. L'Europe est le deuxième producteur mondial de produits pétroliers, avec une capacité de raffinage du pétrole de plus de 15 %. L'industrie gazière en Europe a connu divers changements en raison de la demande croissante de GNL. En outre, la Norvège et la Russie conservent toujours leur position de fournisseurs de gaz naturel, tandis que l'Allemagne, la France et l'Italie sont les principaux importateurs de gaz naturel. Ainsi, le nombre croissant de projets de gaz naturel, ainsi que la découverte de nouveaux gisements de pétrole, en particulier dans des endroits reculés, vont très probablement accélérer la demande de systèmes et de services de pipelines offshore.

Aperçu régional du marché des pipelines offshore

Les tendances et facteurs régionaux influençant le marché des pipelines offshore tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des pipelines offshore en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des pipelines offshore

Portée du rapport sur le marché des pipelines offshore

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2022 | 15 277,3 millions de dollars américains |

| Taille du marché d'ici 2031 | 21 044,7 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 6,7% |

| Données historiques | 2021-2022 |

| Période de prévision | 2023-2031 |

| Segments couverts |

Par diamètre

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des pipelines offshore : comprendre son impact sur la dynamique des entreprises

Le marché des pipelines offshore connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des pipelines offshore sont :

- Enbridge Inc

- Saipem S.A.

- McDermott International Ltée.

- Groupe Allseas SA

- Ingénierie des pipelines pétroliers de Chine Ltée

- Kinder Morgan

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs clés du marché des pipelines offshore

Actualités et développements récents du marché des pipelines offshore

Le marché des pipelines offshore est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprises, des données d'associations et des bases de données. Quelques-uns des développements sur le marché des pipelines offshore sont énumérés ci-dessous :

- En juillet 2023, Kinder Morgan et Howard Energy Partners ont étendu leurs systèmes de transport de gaz naturel Eagle Ford. Tejas construit un pipeline de 67 miles et Dos Caminos un pipeline de 62 miles. Les projets devraient être achevés au quatrième trimestre 2023 et fournir jusqu'à 2 milliards de pieds cubes/jour de gaz naturel aux marchés de la côte du golfe du Mexique aux États-Unis. Le projet d'expansion de 251 millions de dollars américains est un lien d'approvisionnement essentiel pour les producteurs d'électricité , les clients industriels et les exportateurs de GNL le long du réseau de pipelines intra-étatiques du Texas.

- En février 2023, Enagas a signé un accord avec Reganosa, dans lequel Enagas a versé 54 millions d'euros à Reganosa pour l'achat d'un réseau de 130 km de gazoducs. Le fonctionnement efficace et la sécurité d'approvisionnement du marché ibérique du gaz dépendent de ce réseau.

Rapport sur le marché des pipelines offshore : couverture et livrables

Le rapport « Taille et prévisions du marché des pipelines offshore (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des pipelines offshore aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché des pipelines offshore ainsi que dynamique du marché telles que les moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché des pipelines offshore couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents du marché des pipelines offshore

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des pipelines offshore

Obtenez un échantillon gratuit pour - Marché des pipelines offshore