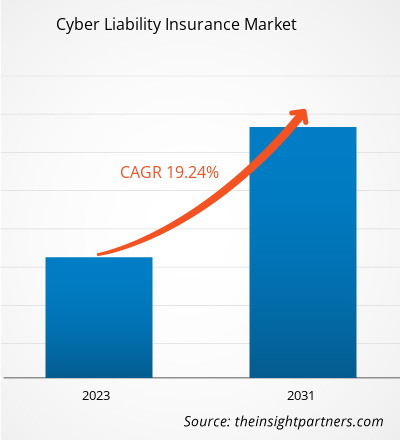

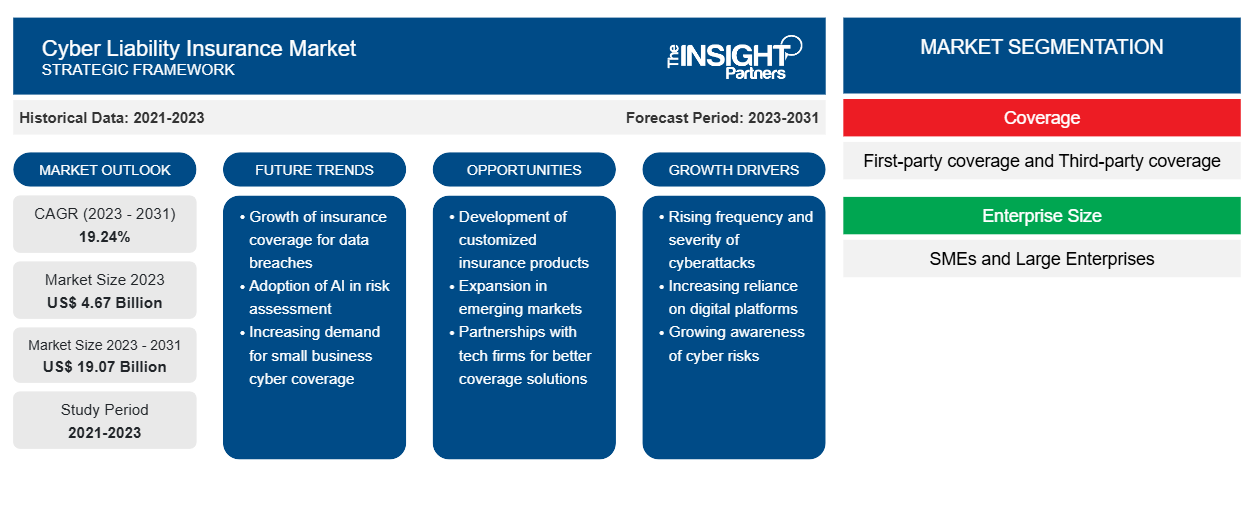

Si prevede che il mercato delle assicurazioni sulla responsabilità informatica crescerà da 4,67 miliardi di dollari nel 2023 a 19,07 miliardi di dollari entro il 2031; si prevede che si espanderà a un CAGR del 19,24% dal 2023 al 2031. Fattori come l'aumento delle minacce informatiche e la conformità normativa stanno guidando la crescita del mercato delle assicurazioni sulla responsabilità informatica.

Analisi del mercato assicurativo per la responsabilità informatica

Il mercato delle assicurazioni sulla responsabilità informatica è in continua evoluzione per affrontare le crescenti sfide poste dalle minacce informatiche. Man mano che le minacce informatiche diventano più diffuse e sofisticate, aumenta la domanda di copertura assicurativa sulla responsabilità informatica. Le organizzazioni di tutti i settori stanno riconoscendo la necessità di proteggersi da possibili perdite finanziarie e danni alla reputazione causati da attacchi informatici. Il rapido sviluppo della tecnologia, come l'intelligenza artificiale , l'Internet of Things (IoT) e la tecnologia operativa (OT), presenta sia opportunità che rischi nella crescita del mercato delle assicurazioni sulla responsabilità informatica. Mentre queste tecnologie offrono grandi vantaggi, creano anche nuove superfici di attacco e vulnerabilità. Gli assicuratori hanno l'opportunità di sviluppare soluzioni di copertura innovative per affrontare questi rischi emergenti.

Panoramica del mercato delle assicurazioni auto

- L'assicurazione sulla responsabilità informatica è un tipo di copertura assicurativa che aiuta a proteggere le aziende da perdite finanziarie e passività derivanti da incidenti informatici e violazioni dei dati. Fornisce copertura per le spese relative all'indagine e alla risoluzione di attacchi informatici, responsabilità legali, interruzione dell'attività, perdita di fatturato e ripristino dei dati, tra gli altri costi associati agli incidenti informatici.

- Le compagnie di assicurazione si stanno concentrando sulla fornitura di servizi completi di gestione del rischio e pre-violazione ai propri assicurati. Questi servizi aiutano le organizzazioni a valutare i propri rischi informatici, implementare solide strategie di gestione del rischio e migliorare la propria resilienza informatica. Ad esempio, Spring Insure ha introdotto un'offerta informatica commerciale su misura per le piccole e medie imprese (PMI), che include l'accesso ai servizi di gestione del rischio e pre-violazione.

- Il mercato ha visto cambiamenti nei premi e nelle coperture. I clienti assicurativi stanno optando per la copertura informatica a un ritmo crescente, portando ad aggiustamenti nei prezzi e nella disponibilità. Gli assicuratori stanno lavorando per trovare un equilibrio tra soddisfare la domanda di copertura e mantenere la redditività. Stanno anche adattando le loro offerte di copertura per affrontare i rischi informatici in evoluzione e le incertezze.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato assicurativo per la responsabilità informatica

L'aumento delle minacce informatiche guiderà il mercato delle assicurazioni sulla responsabilità informatica

- Il numero crescente e la complessità delle minacce informatiche, come violazioni dei dati, attacchi ransomware e incidenti di hacking, stanno guidando la domanda di assicurazione sulla responsabilità informatica nel mercato. Le organizzazioni stanno riconoscendo la necessità di proteggersi dalle perdite finanziarie e dai danni alla reputazione causati da incidenti informatici.

- Le minacce informatiche sono diventate più diffuse e avanzate, ponendo rischi significativi per le aziende. Le violazioni dei dati, in cui le informazioni sensibili vengono compromesse, possono causare perdite finanziarie, responsabilità legali e danni alla reputazione di un'azienda. Gli attacchi ransomware, in cui gli hacker crittografano i dati e chiedono un riscatto per il loro rilascio, possono interrompere le operazioni aziendali e portare a perdite finanziarie. Gli incidenti di hacking possono compromettere sistemi e reti, consentendo l'accesso non autorizzato a dati sensibili.

Analisi della segmentazione del rapporto di mercato dell'assicurazione sulla responsabilità informatica

- In base alla copertura, il mercato è segmentato in coperture di prima parte e coperture di terze parti. Si prevede che il segmento di copertura di prima parte deterrà una quota di mercato sostanziale nell'assicurazione sulla responsabilità informatica nel 2023.

- Il segmento di copertura di prima parte si riferisce alla copertura fornita dalle polizze assicurative di responsabilità informatica per le perdite e le spese della società assicurata derivanti da un incidente informatico. Questa copertura è progettata per ridurre l'impatto finanziario sulla società che ha acquistato l'assicurazione. Questa copertura aiuta a coprire le spese sostenute dalla società assicurata per rispondere a una violazione dei dati. Può includere costi quali indagini forensi per determinare la causa e l'entità della violazione, notifica alle persone interessate, servizi di monitoraggio del credito, sforzi di pubbliche relazioni e spese legali.

Analisi regionale del mercato assicurativo per la responsabilità informatica

L'ambito del rapporto di mercato dell'assicurazione sulla responsabilità informatica è suddiviso principalmente in cinque regioni: Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America. Il Nord America sta vivendo una rapida crescita e si prevede che detenga una quota di mercato significativa dell'assicurazione sulla responsabilità informatica. La regione del Nord America, in particolare gli Stati Uniti, domina il mercato del Nord America. Il Nord America trae vantaggio da un'infrastruttura tecnologica avanzata e da un elevato livello di adozione della tecnologia informatica. Ciò crea una maggiore necessità di assicurazione sulla responsabilità informatica poiché le organizzazioni si sforzano di proteggersi da perdite finanziarie e danni alla reputazione causati da incidenti informatici. Gli Stati Uniti, in particolare, mostrano significative opportunità per i fornitori di soluzioni assicurative sulla sicurezza informatica grazie alle sue rigide normative e alla presenza di una vasta gamma di settori. Gli attacchi informatici hanno un impatto finanziario considerevole sulle aziende di tutte le dimensioni, compresi i settori delle infrastrutture critiche. Di conseguenza, le organizzazioni in Nord America stanno riconoscendo sempre di più l'importanza dell'assicurazione sulla responsabilità informatica.

Approfondimenti regionali sul mercato assicurativo della responsabilità informatica

Le tendenze regionali e i fattori che influenzano il Cyber Liability Insurance Market durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del Cyber Liability Insurance Market in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato dell'assicurazione sulla responsabilità informatica

Ambito del rapporto sul mercato dell'assicurazione sulla responsabilità informatica

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 4,67 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 19,07 miliardi di dollari USA |

| CAGR globale (2023-2031) | 19,24% |

| Dati storici | 2021-2023 |

| Periodo di previsione | 2023-2031 |

| Segmenti coperti |

Per copertura

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dell'assicurazione sulla responsabilità informatica: comprendere il suo impatto sulle dinamiche aziendali

Il mercato delle assicurazioni sulla responsabilità informatica sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali compagnie che operano nel mercato dell'assicurazione sulla responsabilità informatica sono:

- AIG

- AmTrust Finanziario

- Società AXA SA

- Ciccione

- GEICO

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dell'assicurazione sulla responsabilità informatica

"Analisi del mercato assicurativo per la responsabilità informatica"è stato condotto in base a copertura, tipo di veicolo, applicazione e geografia. In termini di copertura, il mercato è segmentato in copertura di prima parte e copertura di terze parti. In base alle dimensioni aziendali, il mercato è segmentato in PMI e grandi imprese. In base all'utente finale, il mercato è segmentato in BFSI, IT e ITES, vendita al dettaglio ed e-commerce, viaggi e turismo, ospitalità e altri. In base alla geografia, il mercato è segmentato in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America.

Notizie e sviluppi recenti sul mercato dell'assicurazione sulla responsabilità informatica

Le aziende adottano strategie inorganiche e organiche come fusioni e acquisizioni nel mercato. La previsione del mercato dell'assicurazione sulla responsabilità informatica è stimata in base a vari risultati di ricerche secondarie e primarie, come pubblicazioni aziendali chiave, dati di associazioni e database. Di seguito sono elencati alcuni recenti sviluppi chiave del mercato:

- Nel febbraio 2024, RT Specialty, la divisione di distribuzione all'ingrosso di Ryan Specialty, una delle principali compagnie assicurative specializzate a livello internazionale, ha annunciato l'aggiunta di Cyber Liability alla sua piattaforma digitale proprietaria, RT Connector.

[Fonte: Ryan Specialty, LLC, sito web aziendale]

- A luglio 2023, Risk Strategies, una società di brokeraggio assicurativo e gestione del rischio, ha introdotto la sua Cyber Risk Management Platform (RMP), un'offerta di servizi innovativa incentrata sulla gestione del rischio informatico. Questa piattaforma va oltre le tradizionali scansioni di vulnerabilità esterne, fornendo ai clienti raccomandazioni pratiche per rafforzare le loro difese informatiche.

[Fonte: Risk Strategies, sito web aziendale]

Copertura e risultati del rapporto sul mercato dell'assicurazione sulla responsabilità informatica

Il rapporto di mercato "Dimensioni e previsioni del mercato dell'assicurazione sulla responsabilità informatica (2021-2031)", fornisce un'analisi dettagliata del mercato che copre le seguenti aree: -

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i principali segmenti di mercato interessati dall'indagine.

- Dinamiche di mercato quali fattori trainanti, limitazioni e opportunità chiave.

- Principali tendenze future.

- Analisi PEST e SWOT dettagliate

- Analisi del mercato globale e regionale che copre le principali tendenze del mercato, gli attori chiave, le normative e i recenti sviluppi del mercato.

- Analisi del panorama industriale e della concorrenza che comprende la concentrazione del mercato, l'analisi della mappa di calore, gli attori chiave e gli sviluppi recenti.

- Profili aziendali dettagliati.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle assicurazioni sulla responsabilità informatica

Ottieni un campione gratuito per - Mercato delle assicurazioni sulla responsabilità informatica