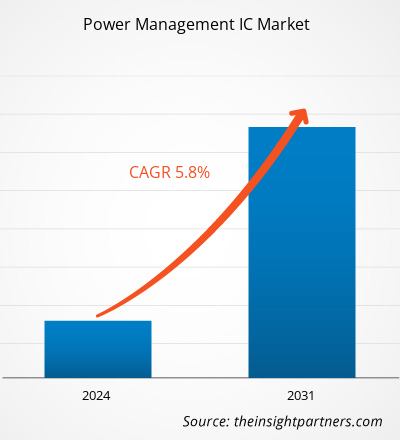

Si prevede che la dimensione del mercato dei circuiti integrati di gestione dell'alimentazione raggiungerà i 59,04 miliardi di dollari entro il 2031, rispetto ai 37,73 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 5,8% nel periodo 2023-2031. Le crescenti vendite di prodotti di elettronica di consumo e la crescente inclinazione verso i veicoli elettrici saranno probabilmente i principali motori e tendenze del mercato.

Analisi di mercato dei circuiti integrati di gestione dell'alimentazione

Il mercato dei circuiti integrati di gestione dell'alimentazione sta vivendo una crescita significativa a livello globale. Questa crescita è attribuita alle crescenti vendite di prodotti elettronici di consumo e alla crescente inclinazione verso i veicoli elettrici. Inoltre, si prevede che la crescente domanda di dispositivi alimentati a batteria e l'implementazione di reti 5G di prossima generazione offriranno diverse opportunità per il mercato nei prossimi anni.

Panoramica del mercato dei circuiti integrati di gestione dell'alimentazione

I circuiti integrati di gestione dell'alimentazione (PMIC), che integrano più regolatori di tensione e circuiti di controllo in un singolo chip, sono opzioni eccellenti per implementare soluzioni di alimentazione complete. Riducono il numero di componenti e lo spazio sulla scheda, gestendo al contempo l'alimentazione del sistema in modo semplice ed economico.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei circuiti integrati di gestione dell'alimentazione

Aumento delle vendite di prodotti elettronici di consumo per favorire il mercato

L'elettronica di consumo, come smartphone, tablet, occhiali intelligenti, visori per realtà virtuale, smartwatch e braccialetti fitness, sta diventando sempre più popolare tra i consumatori. Questi dispositivi servono a vari scopi, tra cui il monitoraggio dell'attività e della salute. La domanda di elettronica di consumo determina la necessità di circuiti integrati di gestione dell'alimentazione. Le aree di applicazione dei dispositivi indossabili si stanno espandendo oltre l'elettronica di consumo per includere dispositivi medici e dispositivi di comunicazione wireless. Nel settore medico, esiste un potenziale di crescita significativo per il mercato dei circuiti integrati di gestione dell'alimentazione nei dispositivi medici indossabili e nei sistemi di monitoraggio sanitario wireless, poiché il settore sta subendo una trasformazione tecnologica.

Crescente domanda di dispositivi alimentati a batteria.

Si prevede che la crescente domanda di dispositivi alimentati a batteria offrirà diverse opportunità per il mercato nei prossimi anni. Dispositivi come telefoni cellulari, custodie per la ricarica delle batterie dei telefoni cellulari, laptop, fotocamere, smartphone, elettronica, data logger, PDA contenenti batterie al litio, giochi, tablet, orologi, ecc. Dispositivi contenenti batterie al litio metallico o agli ioni di litio (laptop, smartphone, tablet, ecc.) Questi dispositivi devono massimizzare la loro energia per estendere la durata della batteria. I PMIC sono essenziali per ottimizzare la distribuzione di energia e ridurre lo spreco di energia.

Analisi della segmentazione del rapporto di mercato dei circuiti integrati di gestione dell'alimentazione

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato dei circuiti integrati di gestione dell'alimentazione sono il tipo di prodotto e l'uso finale.

- In base al tipo di prodotto, il mercato dei circuiti integrati di gestione dell'alimentazione è suddiviso in regolatori di tensione, controllo motore, gestione della batteria , circuiti integrati multicanale e altri. Si prevede che il segmento dei regolatori di tensione detenga una quota di mercato significativa nel periodo di previsione.

- In base all'uso finale, il mercato dei circuiti integrati di gestione dell'alimentazione è suddiviso in elettronica di consumo, automotive, sanità, IT e telecomunicazioni, industriale e altri. Si prevede che il segmento dell'elettronica di consumo detenga una quota di mercato significativa nel periodo di previsione.

Analisi della quota di mercato dei circuiti integrati di gestione dell'alimentazione per area geografica

L'ambito geografico del rapporto sul mercato dei circuiti integrati per la gestione dell'alimentazione è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, e Sud e Centro America.

Il Nord America ha dominato il mercato dei circuiti integrati di gestione dell'alimentazione. Le tendenze di adozione di tecnologie elevate in vari settori della regione nordamericana hanno alimentato la crescita del mercato dei circuiti integrati di gestione dell'alimentazione. Fattori quali l'adozione crescente di strumenti digitali, l'elevata spesa tecnologica da parte delle agenzie governative, l'aumento delle vendite di prodotti elettronici di consumo e la crescente inclinazione verso i veicoli elettrici dovrebbero guidare la crescita del mercato dei circuiti integrati di gestione dell'alimentazione nordamericana. Inoltre, una forte enfasi sulla ricerca e sviluppo nelle economie sviluppate di Stati Uniti e Canada sta costringendo gli operatori nordamericani a portare sul mercato soluzioni tecnologicamente avanzate. Inoltre, gli Stati Uniti hanno molti operatori del mercato dei circuiti integrati di gestione dell'alimentazione che si sono sempre più concentrati sullo sviluppo di soluzioni innovative. Tutti questi fattori contribuiscono alla crescita del mercato dei circuiti integrati di gestione dell'alimentazione nella regione.

Approfondimenti regionali sul mercato dei circuiti integrati di gestione dell'alimentazione

Le tendenze regionali e i fattori che influenzano il mercato dei circuiti integrati di gestione dell'alimentazione durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dei circuiti integrati di gestione dell'alimentazione in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato dei circuiti integrati di gestione dell'alimentazione

Ambito del rapporto di mercato sui circuiti integrati di gestione dell'alimentazione

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 37,73 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 59,04 miliardi di dollari USA |

| CAGR globale (2023-2031) | 5,8% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo di prodotto

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato dei circuiti integrati di gestione dell'alimentazione: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei circuiti integrati di gestione dell'alimentazione sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei circuiti integrati per la gestione dell'alimentazione sono:

- Semiconduttori NXP

- Dispositivi analogici Inc.

- Infineon Technologies AG

- ROHM CO, Ltd

- Microchip Technology Inc.

- Vishay Intertechnology, Inc.

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei circuiti integrati di gestione dell'alimentazione

Notizie e sviluppi recenti sul mercato dei circuiti integrati di gestione dell'alimentazione

Il mercato dei circuiti integrati di gestione dell'alimentazione viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati di associazioni e database. Di seguito sono elencati alcuni degli sviluppi nel mercato dei circuiti integrati di gestione dell'alimentazione:

- Nordic Semiconductor ha annunciato il lancio del suo nPM1300 PMIC (circuito integrato di gestione dell'alimentazione). Con i suoi due convertitori buck, due commutatori di carico/convertitori a bassa caduta di tensione (LDO) e la ricarica della batteria integrata, nPM1300 è ideale per applicazioni a batteria. (Fonte: sito Web della Nordic Semiconductor Company, giugno 2023)

- Magnachip Semiconductor Corporation ha annunciato di aver lanciato il suo primo circuito integrato di gestione dell'alimentazione (PMIC) per dispositivi IT dotati di schermi OLED. (Fonte: sito Web aziendale Magnachip Semiconductor Corporation/novembre 2023)

Copertura e risultati del rapporto di mercato sui circuiti integrati di gestione dell'alimentazione

Il rapporto "Dimensioni e previsioni del mercato dei circuiti integrati di gestione dell'alimentazione (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dei circuiti integrati per la gestione dell'alimentazione a livello globale, regionale e nazionale per tutti i principali segmenti di mercato trattati nell'ambito dell'indagine.

- Tendenze del mercato dei circuiti integrati per la gestione dell'alimentazione e dinamiche di mercato quali fattori trainanti, limitazioni e opportunità chiave.

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT.

- Analisi di mercato dei circuiti integrati per la gestione dell'alimentazione che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato.

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti nel mercato dei circuiti integrati di gestione dell'alimentazione.

- Profili aziendali dettagliati.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei circuiti integrati di gestione dell'alimentazione

Ottieni un campione gratuito per - Mercato dei circuiti integrati di gestione dell'alimentazione