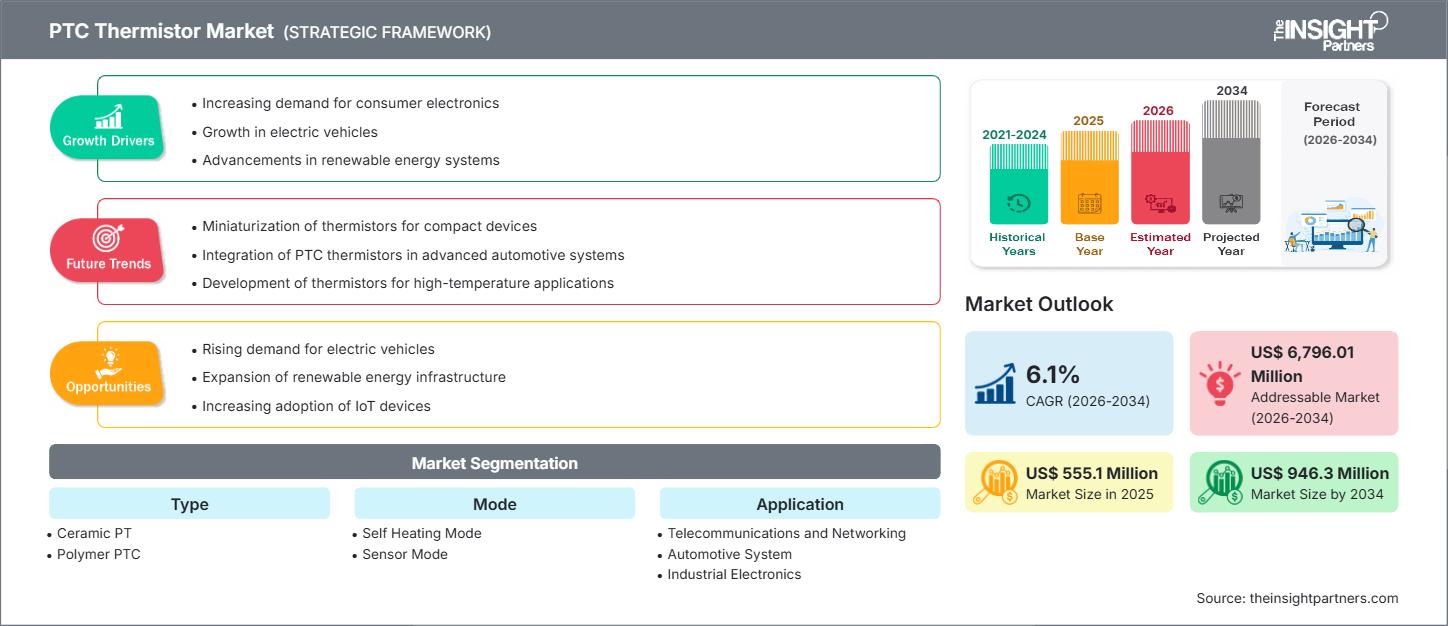

Il mercato dei termistori PTC (Positive Temperature Coefficient) è stato valutato a 555,1 milioni di dollari nel 2025. Si prevede che raggiungerà i 946,3 milioni di dollari nel 2034. Si prevede che il mercato crescerà a un CAGR del 6,1% dal 2026 al 2034.

Analisi del mercato dei termistori PTC

Si prevede che il mercato dei termistori PTC registrerà una crescita costante nei prossimi anni. Tra i fattori che contribuiranno a questa crescita ci sarà il crescente utilizzo dei termistori PTC nell'elettronica di consumo, in particolare nei dispositivi compatti come gli smartphone, dove la protezione da sovracorrente e la rapida risposta termica sono essenziali.

Altri fattori che contribuiscono alla crescente domanda di termistori PTC sono la crescente elettrificazione del settore automobilistico, in particolare nell'automazione industriale, e la necessità di elementi riscaldanti autoregolanti. Stabilità, affidabilità e autoripristino hanno reso i dispositivi PTC estremamente interessanti in diverse applicazioni di protezione e rilevamento.

Tuttavia, la crescita del mercato potrebbe essere ostacolata dai costi dei materiali, dalla concorrenza di tecnologie alternative di protezione termica e dalle limitazioni di scalabilità in alcune applicazioni ad alta precisione.

Panoramica del mercato dei termistori PTC

I termistori PTC sono tipi di resistori sensibili alla temperatura, la cui resistenza aumenta significativamente oltre la temperatura di soglia, trovando applicazione nella protezione da sovracorrente, nei riscaldatori autoregolanti e nel rilevamento termico.

Le caratteristiche dei termistori PTC includono un aumento della resistenza in caso di picchi di corrente in un circuito o di aumento della temperatura oltre un certo limite, limitando così la corrente per prevenire danni. Fungono da elementi autoregolanti nelle applicazioni di riscaldamento, poiché la loro resistenza varia dinamicamente al variare delle condizioni per fornire calore costante senza alcun controllo esterno.

Di conseguenza, i termistori PTC trovano applicazione in un ampio campo dell'elettronica, nei circuiti di protezione per veicoli e in altri sistemi, grazie alla loro compattezza, affidabilità e capacità di ripristinare efficacemente uno stato di bassa resistenza una volta raffreddati.

Personalizza questo report in base alle tue esigenze

Ottieni la PERSONALIZZAZIONE GRATUITAMercato dei termistori PTC: approfondimenti strategici

-

Scopri le principali tendenze di mercato di questo rapporto.Questo campione GRATUITO includerà analisi dei dati, che spaziano dalle tendenze di mercato alle tempi e alle previsioni.

Driver e opportunità del mercato dei termistori PTC

Fattori formativi del mercato:

- Protezione nell'elettronica miniaturizzata: la richiesta di dispositivi più piccoli ed efficienti (ad esempio gli smartphone) spinge all'uso di termistori PTC per proteggere i circuiti sensibili.

- Elettrificazione nel settore automobilistico: con l'aumento dell'adozione dei veicoli elettrici, aumenta anche la domanda di termistori PTC nei sistemi di gestione delle batterie, nella protezione del motore e nei circuiti di sovracorrente.

- Automazione industriale e riscaldamento: i termistori PTC fungono da elementi riscaldanti autoregolanti e dispositivi di protezione nei processi industriali, nei macchinari e negli elettrodomestici.

Opportunità di mercato:

- Innovazione avanzata dei materiali: c'è spazio per sviluppare nuovi materiali ceramici e polimerici PTC con prestazioni migliori (risposta più rapida, maggiore stabilità).

- Mercati emergenti: con lo spostamento della produzione verso le economie in via di sviluppo, si prevede un aumento della domanda di termistori PTC per l'elettronica di consumo di massa e per i veicoli elettrici.

- Integrazione con sistemi intelligenti: i termistori PTC potrebbero essere integrati in sistemi intelligenti abilitati all'IoT per l'automonitoraggio e la protezione dai guasti, creando valore nella manutenzione predittiva.

- Applicazioni sanitarie: l'impiego nei dispositivi medici come elementi di rilevamento della temperatura o di protezione da sovracorrente potrebbe espandersi, in particolare nelle apparecchiature diagnostiche o terapeutiche portatili.

Analisi della segmentazione del rapporto di mercato dei termistori PTC

Secondo il rapporto di The Insight Partners, il mercato dei termistori PTC è segmentato come segue:

-

Per tipo

- PTC ceramico

- Polimero PTC

-

Per modalità

- Modalità di auto-riscaldamento

- Modalità sensore

-

Per applicazione

- Telecomunicazioni e reti

- Sistemi automobilistici

- Elettronica industriale

- Elettronica di consumo ed elettrodomestici

- Strumenti medici

-

Per geografia

- America del Nord

- Europa

- Asia Pacifico

- Medio Oriente e Africa

- America meridionale e centrale

Approfondimenti regionali sul mercato dei termistori PTC

Le tendenze e i fattori regionali che hanno influenzato il mercato dei termistori PTC durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la distribuzione geografica del mercato dei termistori PTC in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto di mercato sui termistori PTC

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2025 | 555,1 milioni di dollari USA |

| Dimensioni del mercato entro il 2034 | 946,3 milioni di dollari USA |

| CAGR globale (2026 - 2034) | 6,1% |

| Dati storici | 2021-2024 |

| Periodo di previsione | 2026-2034 |

| Segmenti coperti |

Per tipo

|

| Regioni e paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dei termistori PTC: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei termistori PTC è in rapida crescita, formato dalla crescente domanda degli utenti finali, a causa di fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni una panoramica dei principali attori del mercato dei termistori PTC

Analisi della quota di mercato dei termistori PTC per area geografica

- Asia-Pacifico: si prevede una forte crescita, trainata dai grandi centri di produzione di elettronica (Cina, Giappone, Corea del Sud), dalla crescente elettrificazione dell'industria automobilistica e dall'automazione industriale.

- Nord America: anch'essa una regione importante, con adozione sia nella protezione automobilistica che nell'elettronica di consumo; relativamente maturazione ma continua a innovare.

- Europa, Medio Oriente e Africa, America Latina: queste regioni presentano opportunità di crescita, in particolare poiché la protezione termica e il riscaldamento stanno diventando sempre più critiche sia nei settori consumer che in quelli industriali. Il rapporto di Insight Partners analizza in dettaglio queste dinamiche regionali.

Densità degli operatori del mercato dei termistori PTC: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei termistori PTC è moderatamente frammentato. I principali attori competono su materiali, fattori di forma, affidabilità e applicazioni di nicchia. Le principali tendenze competitive includono:

- Sviluppo di termistori PTC ceramici ad alta stabilità rispetto a varianti polimeriche flessibili.

- Scalabilità dei termistori PTC per riscaldatori autoregolanti in dispositivi compatti.

- Fornitura di soluzioni integrate per la protezione da sovracorrente nei veicoli elettrici e in altri domini ad alta tensione.

- Sfruttare partnership e alleanze con produttori di componenti elettronici per integrare i termistori PTC nella progettazione.

Tra i principali attori identificati o rilevanti per il mercato dei termistori PTC figurano:

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Connettività TE

- Vishay Intertechnology

- Sensori avanzati Amphenol

- Texas Instruments Incorporated

- ZIEHL industrie-elektronik GmbH + Co. KG

- KRIWAN Industrie-Elektronik GmbH

- NXP Semiconduttori

Altre aziende analizzate nel corso della ricerca:

- Littelfuse, Inc.

- Compagnia elettrica generale

- Honeywell International Inc.

- Zhejiang Kejie Electronics Co., Ltd.

- Thinking Electronic Industrial Co., Ltd.

- KOA Corporation

- Shibaura Electronics Co., Ltd.

Notizie di mercato e sviluppi recenti sui termistori PTC

- Secondo il comunicato stampa di Insight Partners, i produttori di dispositivi mobili utilizzano sempre più spesso i termistori PTC per la protezione da sovracorrente nei dispositivi elettronici compatti.

- Innovazione nei materiali PTC: sono in corso ricerche su nuovi composti ceramici PTC (ad esempio a base di titanato di bario) per migliorare le prestazioni ed espandere gli intervalli di temperatura.

- Interesse di mercato più ampio: con l'accelerazione della produzione di veicoli elettrici da parte delle case automobilistiche, aumenta la domanda di termistori PTC per la protezione e la gestione termica.

Copertura e risultati del rapporto di mercato sui terministori PTC

Si prevede che il rapporto di mercato sui terministori PTC di The Insight Partners includa:

- Dimensioni dettagliate del mercato e previsioni (globali, regionali) per il periodo 2021-2034.

- Analisi delle tendenze e delle dinamiche del mercato (fattori trainanti, vincoli, opportunità)

- Analisi PEST e SWOT per il mercato dei termistori PTC

- Panorama competitivo: attori chiave, mappa di calore, concentrazione del mercato

- Sviluppi recenti e fattori normativi

- Profili aziendali dettagliati dei principali produttori di termistori PTC

- Analisi della segmentazione per tipo, modalità, applicazione e geografia

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei termistori PTC

Ottieni un campione gratuito per - Mercato dei termistori PTC