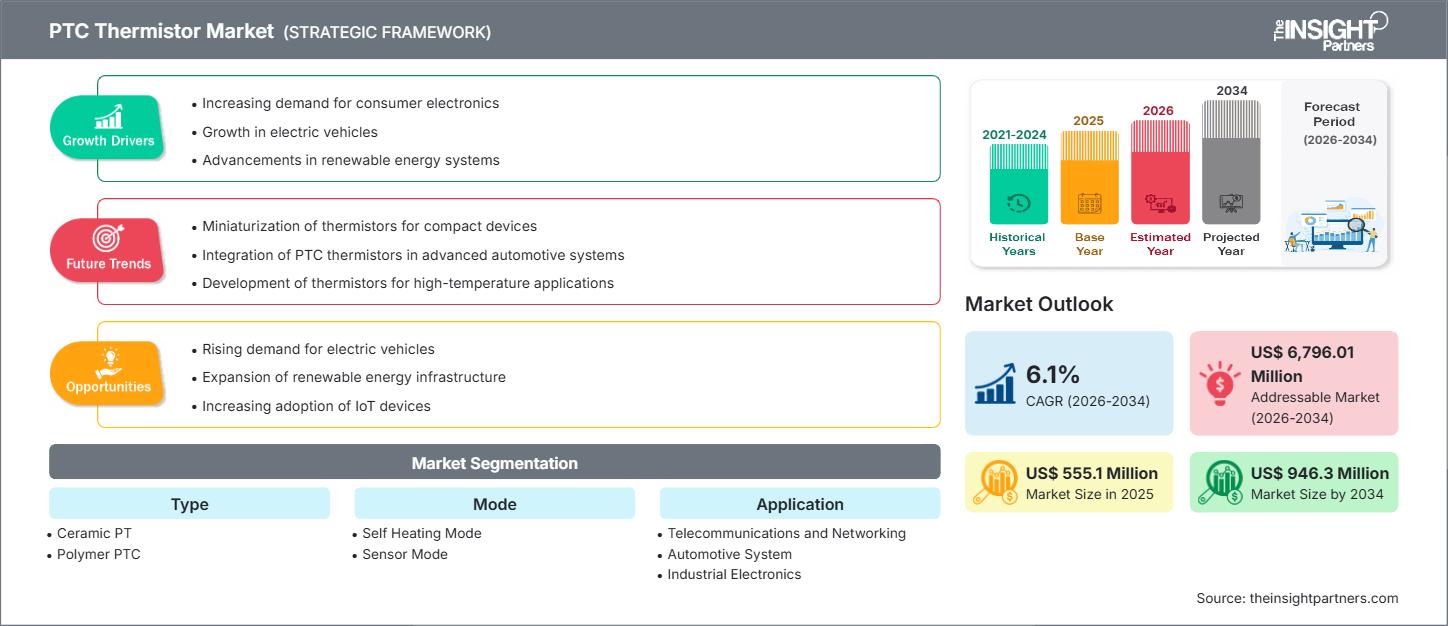

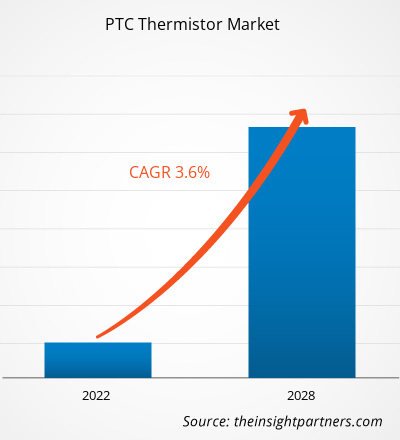

Der Markt für PTC-Thermistoren (Positive Temperature Coefficient) wurde im Jahr 2025 auf 555,1 Millionen US-Dollar geschätzt. Prognosen zufolge wird er bis 2034 auf 946,3 Millionen US-Dollar anwachsen. Für den Zeitraum 2026–2034 wird ein jährliches Wachstum von 6,1 % erwartet.

Marktanalyse für PTC-Thermistoren

Der Markt für PTC-Thermistoren dürfte in den kommenden Jahren ein stetiges Wachstum verzeichnen. Zu den Wachstumsfaktoren zählt der zunehmende Einsatz von PTC-Thermistoren in der Unterhaltungselektronik, insbesondere in kompakten Geräten wie Smartphones, wo Überstromschutz und schnelle thermische Reaktion von entscheidender Bedeutung sind.

Weitere Faktoren, die zur steigenden Nachfrage nach PTC-Thermistoren beitragen, sind die zunehmende Elektrifizierung der Automobilindustrie – insbesondere in der industriellen Automatisierung – und der Bedarf an selbstregulierenden Heizelementen. Stabilität, Zuverlässigkeit und Selbstrückstellung machen PTC-Bauelemente in zahlreichen Schutz- und Sensoranwendungen äußerst attraktiv.

Allerdings könnten Materialkosten, die Konkurrenz durch alternative Wärmeschutztechnologien und Skalierungsbeschränkungen bei einigen hochpräzisen Anwendungen das Marktwachstum beeinträchtigen.

Marktübersicht für PTC-Thermistoren

PTC-Thermistoren sind eine Art temperaturempfindlicher Widerstände, deren Widerstand oberhalb einer Schwellentemperatur deutlich ansteigt. Sie finden Anwendung im Überstromschutz, in selbstregulierenden Heizungen und in der Temperaturmessung.

PTC-Thermistoren zeichnen sich unter anderem dadurch aus, dass ihr Widerstand bei Stromspitzen oder Überschreitung einer bestimmten Temperatur ansteigt. Dadurch wird der Strom begrenzt und Schäden werden vermieden. In Heizanwendungen dienen sie als selbstregulierende Elemente, deren Widerstand sich dynamisch an veränderte Bedingungen anpasst, um ohne externe Steuerung eine konstante Wärmeleistung zu gewährleisten.

PTC-Thermistoren finden daher aufgrund ihrer Kompaktheit, Zuverlässigkeit und der Fähigkeit, sich beim Abkühlen effektiv in einen niederohmigen Zustand zurückzusetzen, Anwendung in einem breiten Spektrum der Elektronik, Schutzschaltungen für Fahrzeuge und anderen Systemen.

Passen Sie diesen Bericht Ihren Anforderungen an.

Sie erhalten eine kostenlose Anpassung aller Berichte – einschließlich Teilen dieses Berichts, Länderanalysen und Excel-Datenpaketen – sowie attraktive Angebote und Rabatte für Start-ups und Universitäten.

PTC-Thermistor-Markt: Strategische Einblicke

-

Ermitteln Sie die wichtigsten Markttrends dieses Berichts.Diese KOSTENLOSE Probe beinhaltet eine Datenanalyse, die von Markttrends bis hin zu Schätzungen und Prognosen reicht.

Markttreiber und Chancen für PTC-Thermistoren

Markttreiber:

- Schutz in miniaturisierter Elektronik: Die Nachfrage nach kleineren, effizienteren Geräten (z. B. Smartphones) treibt den Einsatz von PTC-Thermistoren zum Schutz empfindlicher Schaltungen voran.

- Elektrifizierung im Automobilbereich: Mit zunehmender Verbreitung von Elektrofahrzeugen steigt auch die Nachfrage nach PTC-Thermistoren in Batteriemanagementsystemen, Motorschutz und Überstromschaltungen.

- Industrieautomation & Heizung: PTC-Thermistoren dienen als selbstregulierende Heizelemente und Schutzvorrichtungen in industriellen Prozessen, Maschinen und Haushaltsgeräten.

Marktchancen:

- Fortschrittliche Materialinnovation: Es besteht Spielraum für die Entwicklung neuer keramischer und polymerer PTC-Materialien mit besserer Leistung (schnellere Reaktion, höhere Stabilität).

- Schwellenländer: Da sich die Produktion in Entwicklungsländer verlagert, wird mit einem Anstieg der Nachfrage nach PTC-Thermistoren für Massenmarktelektronik und Elektrofahrzeuge gerechnet.

- Integration mit intelligenten Systemen: PTC-Thermistoren könnten in intelligente, IoT-fähige Systeme zur Selbstüberwachung und Fehlererkennung integriert werden, wodurch ein Mehrwert in der vorausschauenden Wartung geschaffen wird.

- Anwendungen im Gesundheitswesen: Der Einsatz in medizinischen Geräten als Temperaturfühler oder Überstromschutzelemente könnte sich ausweiten, insbesondere bei tragbaren Diagnose- oder Therapiegeräten.

Marktbericht für PTC-Thermistoren: Segmentierungsanalyse

Laut dem Bericht von The Insight Partners ist der Markt für PTC-Thermistoren wie folgt segmentiert:

-

Nach Typ

- Keramische PTC-Technologie

- Polymer PTC

-

Nach Modus

- Selbstheizmodus

- Sensormodus

-

Durch Bewerbung

- Telekommunikation & Netzwerke

- Automobilsysteme

- Industrieelektronik

- Unterhaltungselektronik und Haushaltsgeräte

- Medizinische Instrumente

-

Nach Geographie

- Nordamerika

- Europa

- Asien-Pazifik

- Naher Osten und Afrika

- Süd- und Mittelamerika

Regionale Einblicke in den Markt für PTC-Thermistoren

Die regionalen Trends und Einflussfaktoren auf den Markt für PTC-Thermistoren im gesamten Prognosezeitraum wurden von den Analysten von The Insight Partners eingehend erläutert. Dieser Abschnitt behandelt außerdem die Marktsegmente und die geografische Verteilung des PTC-Thermistor-Marktes in Nordamerika, Europa, Asien-Pazifik, dem Nahen Osten und Afrika sowie Süd- und Mittelamerika.

Umfang des Marktberichts zu PTC-Thermistoren

| Berichtattribute | Details |

|---|---|

| Marktgröße im Jahr 2025 | 555,1 Millionen US-Dollar |

| Marktgröße bis 2034 | 946,3 Millionen US-Dollar |

| Globale durchschnittliche jährliche Wachstumsrate (2026 - 2034) | 6,1 % |

| Historische Daten | 2021-2024 |

| Prognosezeitraum | 2026–2034 |

| Abgedeckte Segmente |

Nach Typ

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Marktdichte der PTC-Thermistoren: Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für PTC-Thermistoren wächst rasant, angetrieben durch die steigende Nachfrage der Endverbraucher. Gründe hierfür sind unter anderem sich wandelnde Verbraucherpräferenzen, technologische Fortschritte und ein wachsendes Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln innovative Lösungen, um den Kundenbedürfnissen gerecht zu werden, und nutzen neue Trends, was das Marktwachstum zusätzlich beflügelt.

- Verschaffen Sie sich einen Überblick über die wichtigsten Akteure auf dem PTC-Thermistor-Markt.

Marktanteilsanalyse für PTC-Thermistoren nach Regionen

- Asien-Pazifik: Es wird mit einem starken Wachstum gerechnet, das durch große Elektronikfertigungszentren (China, Japan, Südkorea), die zunehmende Elektrifizierung des Automobilsektors und die industrielle Automatisierung getrieben wird.

- Nordamerika: Ebenfalls eine wichtige Region, in der sowohl im Bereich des Fahrzeugschutzes als auch der Unterhaltungselektronik Anwendung findet; relativ ausgereift, aber weiterhin innovationsfreudig.

- Europa, Naher Osten und Afrika, Lateinamerika: Diese Regionen bieten Wachstumschancen, insbesondere da Wärmeschutz und Heizung sowohl im Konsumgüter- als auch im Industriesektor immer wichtiger werden. Der Bericht von Insight Partners analysiert diese regionalen Entwicklungen detailliert.

Marktdichte der PTC-Thermistoren: Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für PTC-Thermistoren ist mäßig fragmentiert. Die wichtigsten Akteure konkurrieren hinsichtlich Material, Bauform, Zuverlässigkeit und Nischenanwendungen. Zu den wichtigsten Wettbewerbstrends zählen:

- Entwicklung von hochstabilen keramischen PTC-Thermistoren im Vergleich zu flexiblen Polymervarianten.

- Skalierung von PTC-Thermistoren für selbstregulierende Heizungen in kompakten Geräten.

- Bereitstellung integrierter Lösungen für den Überstromschutz in Elektrofahrzeugen und anderen Hochspannungsbereichen.

- Nutzung von Partnerschaften und Allianzen mit Elektronikherstellern zur Integration von PTC-Thermistoren in das Design.

Zu den prominenten Akteuren auf dem PTC-Thermistor-Markt bzw. den relevanten Akteuren gehören:

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- TE-Konnektivität

- Vishay Intertechnology

- Amphenol Advanced Sensors

- Texas Instruments Incorporated

- ZIEHL industrie-elektronik GmbH + Co. KG

- KRIWAN Industrie-Elektronik GmbH

- NXP Halbleiter

Weitere im Rahmen der Studie analysierte Unternehmen:

- Littelfuse, Inc.

- General Electric Company

- Honeywell International Inc.

- Zhejiang Kejie Electronics Co., Ltd.

- Thinking Electronic Industrial Co., Ltd.

- KOA Corporation

- Shibaura Electronics Co., Ltd.

PTC-Thermistor-Markt: Neuigkeiten und aktuelle Entwicklungen

- Laut einer Pressemitteilung von Insight Partners setzen Hersteller mobiler Geräte zunehmend auf PTC-Thermistoren zum Schutz vor Überströmen in kompakten Elektronikgeräten.

- Innovationen bei PTC-Materialien: Es wird an neuartigen keramischen PTC-Verbindungen (z. B. auf Bariumtitanatbasis) geforscht, um die Leistung zu verbessern und den Temperaturbereich zu erweitern.

- Breiteres Marktinteresse: Da die Automobilhersteller die Produktion von Elektrofahrzeugen beschleunigen, steigt die Nachfrage nach PTC-Thermistoren für Schutz- und Wärmemanagementanwendungen.

Marktbericht zu PTC-Thermistoren: Abdeckung und Ergebnisse

Der PTC-Thermistor-Marktbericht von The Insight Partners wird voraussichtlich Folgendes beinhalten:

- Detaillierte Marktgröße & Prognose (global, regional) für den Zeitraum 2021–2034.

- Analyse von Markttrends und -dynamiken (Treiber, Hemmnisse, Chancen)

- PEST- und SWOT-Analyse für den PTC-Thermistor-Markt

- Wettbewerbsumfeld: Hauptakteure, Heatmap, Marktkonzentration

- Aktuelle Entwicklungen und regulatorische Faktoren

- Detaillierte Unternehmensprofile der wichtigsten PTC-Thermistorhersteller

- Segmentierungsanalyse nach Typ, Modus, Anwendung und Geografie

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - PTC-Thermistor-Markt

Kostenlose Probe anfordern für - PTC-Thermistor-Markt