Cytotoxic Drugs Segment to Hold Significant Africa Anticancer Drugs Market Share During 2025–2031

According to our latest study on "Africa Anticancer Drugs Market Forecast to 2031 – Regional Analysis – Drug Class, Indication, Therapy Type, Sector, and Country," the market is expected to reach US$ 3.23 billion by 2031 from US$ 1.81 billion in 2024; it is expected to register the CAGR of 8.8% during 2025–2031. The report emphasizes the key factors driving the market and prominent players' developments. Factors such as the increasing incidence of cancer and surging initiatives to improve cancer awareness bolster the Africa anticancer drugs market. The report also includes growth prospects owing to the current Africa anticancer drugs market trends and their foreseeable impact during the forecast period.

Increasing Initiatives to Improve Cancer Awareness Drives Africa Anticancer Drugs Market Growth

Healthcare infrastructure that is still in a developing phase and the occurrence of late-stage diagnoses underline the vitality of awareness programs in Africa to bridge the knowledge gap and promote early detection and treatment. Governments, nongovernmental organizations (NGOs), and international health agencies have ramped up efforts to educate populations on symptoms, risk factors, and screening needs of cancer. These initiatives focus on encouraging early detection and timely treatment, which in turn fuels demand for anticancer medications. The PinkDrive initiative in South Africa raises awareness and encourages the early detection as well as screening of gender-related cancer conditions among the population under the motto "Early detection can help save and extend lives." It provides breast cancer screening services and educates different communities, particularly in underserved rural areas. This mobile screening campaign has been instrumental in diagnosing cancer at earlier stages. Similarly, Amref Health Africa has launched cervical cancer awareness and vaccination programs in East Africa, which not only prevent certain cancers but also foster the understanding of cancer treatment options among the masses and healthcare systems. Amref collaborates with local healthcare providers to strengthen cervical cancer screening programs for timely diagnosis among at-risk women, followed by treatment. In addition, the African Access Initiative (AAI) is a public–private partnership that targets the escalating cancer crisis in Africa.

Africa Anticancer Drugs Market

Africa Anticancer Drugs Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Drug Class (Cytotoxic Drugs, Targeted Drugs, Hormonal Drugs, Immunotherapy Drugs, Gene Therapy Drugs, Radiopharmaceuticals, and Others), Indication (Lung Cancer, Stomach Cancer, Colorectal Cancer, Breast Cancer, Prostrate Cancer, and Others), Dosage Form (Tablet and Capsule, Injectable, and Liquid), Therapy (Chemotherapy, Targeted Therapy, Immunotherapy, Gene Therapy, Radiopharmaceutical Therapy, and Others), Sector (Private and Public), and Country

Africa Anticancer Drugs Market Size, Growth, Share by 2031

Download Free Sample

In Kenya, the Division of Non-Communicable Diseases at the Ministry of Health manages the National Cancer Control Program (NCCP) Unit. The NCCP is designed to reduce cancer incidence and mortality, and improve the quality of life of cancer patients through evidence-based strategies for prevention, early detection, diagnosis, treatment, and palliation. Similarly, the Africa Cancer Foundation (ACF) was established in April 2011 as a charitable trust, followed by its official launch in July 2011 in Nairobi, Kenya. ACF is dedicated to working toward a cancer-free Africa by promoting cancer prevention and offering comprehensive support to individuals affected by the disease. Over the years, it has earned a reputation as a trusted provider of cancer screening services in Kenya. The organization has delivered screening and awareness services across 23 of 47 Kenyan counties, entailing over 27,000 men and women. ACF primarily focuses on the most prevalent cancers in the country—breast, cervical, and prostate cancer—and also offers treatment for pre-cancerous cervical lesions. It collaborates with healthcare providers to organize screening camps, distribute educational material, and provide subsidized treatment options. These efforts contribute toward enhanced public knowledge, in turn generating a demand for diagnostic services and chemotherapy drugs.

Since 2019, Institut Curie has been leading an ambitious and integrated public–private cancer initiative in Tanzania—the Tanzania Comprehensive Cancer Project (TCCP)—in collaboration with the Aga Khan Foundation's healthcare services. The project was supported by US$ 14.78 million (€13 million) in funding from the French Development Agency (AFD) and the Aga Khan. Over the past 4 years, the program has delivered promising and impactful results. Moreover, it has led to the establishment of a cancer center at the Aga Khan Hospital in Dar es Salaam, which is equipped with two advanced radiotherapy machines and an outpatient chemotherapy unit. In June 2023, Institut Curie and AFD strengthened their collaboration by signing a partnership agreement to deploy a team of French cancer experts to support similar initiatives in other developing countries.

Notably, international organizations such as the World Health Organization (WHO) have also been instrumental in promoting cancer awareness across Africa. It supports the cause by arranging training for healthcare professionals, establishing cancer registries, and launching continent-wide campaigns such as World Cancer Day, which stimulates public interest and mobilizes governments to invest more in cancer care, including drug therapies. Thus, by promoting early detection as well as by encouraging screening and cancer treatments, these health initiatives significantly fuel the demand for therapeutic solutions, thereby bolstering the Africa anticancer drugs market growth.

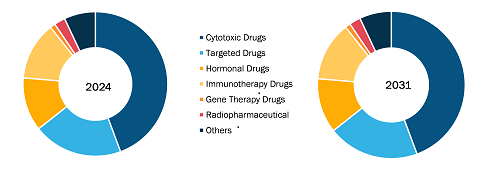

Africa Anticancer Drugs Market, by Drug Class:

The Africa anticancer drugs market, based on drug class, is segmented into cytotoxic drugs, targeted drugs, hormonal drugs, immunotherapy drugs, gene therapy drugs, radiopharmaceuticals, and others. The cytotoxic drugs segment held the largest market share in 2024, and the targeted drugs segment is anticipated to register the highest CAGR during 2025–2031. Cytotoxic drugs, including alkylating agents and antimetabolites, remain a crucial pillar in cancer treatment due to their broad-spectrum efficacy, established clinical use, and relative affordability compared to newer therapies. These drugs are particularly vital in low- and middle-income countries where healthcare systems often struggle to gain access to advanced cancer treatments. However, irrespective of their significance, the availability of cytotoxic drugs is frequently compromised by stockouts and supply chain inefficiencies, presenting a major challenge to effective cancer care. According to a study published in BMC Cancer, lower- and middle-income countries across Africa, the Americas, Southeast Asia, and Europe reported less than 50% stockouts for essential chemotherapy agents such as oral cyclophosphamide, IV cytarabine, IV dacarbazine, and oral methotrexate. However, they recorded high stockout rates for more critical drugs such as IV daunorubicin, oral etoposide, and oral thioguanine, which disrupt treatment regimens and negatively impact patient outcomes. In Ghana, the public sector faced complete stockouts of 12 essential cancer drugs, while private pharmacies reported a 100% stockout of procarbazine and a 50% stockout of six other critical drugs. Further, a leading private pharmacy supplier in Ghana documented an 88% stockout rate for cytotoxic drugs, with a median of 72.5 days of stockouts, highlighting the severe access issues faced by patients. A study conducted in Kenya, Uganda, Rwanda, and Tanzania revealed that less than 50% of essential cancer drugs were available in East Africa, underscoring the systemic challenges in drug availability across the continent.

The common issue of shortages in African countries highlights the urgent need for improved procurement strategies, efficient supply chain management, and significant investments in healthcare infrastructure to ensure the uninterrupted availability of life-saving medications. Despite these challenges, cytotoxic drugs continue to play a pivotal role in cancer care, especially in resource-limited settings where they provide the most accessible and cost-effective treatment options.

Africa Anticancer Drugs Market, by Indication:

In terms of Indication, the Africa anticancer drugs market is segmented into lung cancer, stomach cancer, colorectal cancer, breast cancer, prostate cancer, and others. The lung cancer segment held the largest market share in 2024, and the breast cancer segment is anticipated to register the highest CAGR during 2025–2031. According to GLOBOCAN data, lung cancer poses a significant health challenge in Africa; the region recorded nearly 49,831 new cases and 45,464 deaths caused by lung cancer in 2022, accounting for 4.2% of new cancer cases and 6% of all cancer-related deaths. Tobacco use remains the leading risk factor. As per Ogunbiyi, 2011, the high mortality rate is largely attributed to late-stage diagnosis and limited access to advanced diagnostic and therapeutic options. Yet, in several African countries, lung cancer is underdiagnosed and frequently misclassified as tuberculosis, delaying proper treatment. Diagnostic limitations, such as the scarcity of CT imaging and limitations of molecular testing for EGFR and ALK mutations, further hinder early detection and appropriate management. Treatment primarily relies on platinum-based chemotherapy agents such as cisplatin and carboplatin, which are more readily available. In contrast, access to advanced options such as tyrosine kinase inhibitors (e.g., osimertinib) and immunotherapies (e.g., nivolumab and pembrolizumab) is constrained to private centers, or they are made available via international aid and compassionate programs. The African anticancer drug market presents strong potential for the launch of generics and biosimilars, especially in the targeted therapy and immunotherapy segments. Regional procurement collaborations and investments in diagnostic infrastructure, alongside the development of comprehensive cancer care centers, are likely to play an instrumental role in reducing lung cancer mortality and bridging the treatment gap across the continent

Africa Anticancer Drugs Market, by Dosage Form:

By dosage form, the market is segmented into tablet and capsule, injectable, and liquid. The tablet and capsule segment dominated the Africa anticancer drugs market share in 2024 and is anticipated to register the highest CAGR during 2025–2031. Tablets and capsules represent a significant portion of the anticancer drug market in Africa, primarily due to their ease of administration and cost-effectiveness. Many chemotherapy agents, targeted therapies, and hormonal treatments are available in tablet and capsule forms. Drugs such as tamoxifen (for breast cancer), cyclophosphamide, and oral forms of methotrexate are commonly used in Africa, especially in the private healthcare sector and in settings where access to intravenous therapies is limited. Oral chemotherapy agents are highly sought after because they allow for treatment outside of a clinical setting, aiding better convenience for patients and reducing the burden on healthcare facilities. However, the availability of oral formulations of newer, more effective drugs, namely tyrosine kinase inhibitors (e.g., imatinib for leukemia) and oral drugs candidates for prostate cancer (e.g., enzalutamide), is often restricted to urban centers or private institutions due to high costs. Further, public health efforts aimed at providing education on the correct dosage and encouraging treatment adherence are crucial for enhancing the effectiveness of cancer care in Africa.

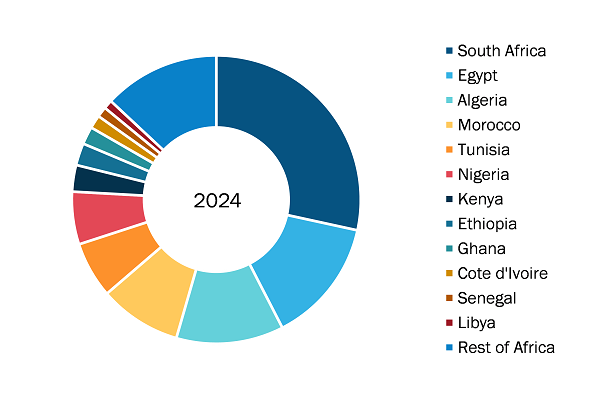

Africa Anticancer Drugs Market Analysis, by Country:

Africa Anticancer Drugs Market, by Country, 2024 (%)

Africa Anticancer Drugs Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Drug Class (Cytotoxic Drugs, Targeted Drugs, Hormonal Drugs, Immunotherapy Drugs, Gene Therapy Drugs, Radiopharmaceuticals, and Others), Indication (Lung Cancer, Stomach Cancer, Colorectal Cancer, Breast Cancer, Prostrate Cancer, and Others), Dosage Form (Tablet and Capsule, Injectable, and Liquid), Therapy (Chemotherapy, Targeted Therapy, Immunotherapy, Gene Therapy, Radiopharmaceutical Therapy, and Others), Sector (Private and Public), and Country

Africa Anticancer Drugs Market Size, Growth, Share by 2031

Download Free Sample

Source: The Insight Partners Analysis

The geographic scope of the Africa anticancer drugs market report entails the following countries: South Africa, Egypt, Algeria, Morocco, Tunisia, Nigeria, Kenya, Ethiopia, Ghana, Côte d'Ivoire, Senegal, Libya, and the Rest of Africa. The growth of the Africa anticancer drugs market size is attributed to the ongoing developments in healthcare systems, the high acceptance of anticancer drugs, and surging awareness about cancer and its treatment. The anticancer drugs market in South Africa is projected to reach 1.12 billion by 2031 and is expected to register a CAGR of 11.9% during 2025–2031. South Africa holds the largest share of the Africa anticancer drugs market owing to the availability of better healthcare services and supportive government policies, along with high awareness of the disease. Apart from presenting the factors driving the market, the Africa anticancer drugs market report also emphasizes major developments by prominent players. Amgen Inc, Gilead Sciences Inc, Novartis AG, F. Hoffmann-La Roche Ltd, BeiGene Ltd, Takeda Pharmaceutical Co Ltd, GSK Plc, Sanofi SA, Cipla Ltd, Johnson & Johnson, Aspen Holdings, Pfizer Inc, AstraZeneca Plc, Merck & Co Inc, and Daiichi Sankyo Co Ltd are among the prominent players operating in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com