Bulk Tray Lyophilization Leads Bulk Lyophilization Services Market Growth Based on Lyophilization Format

According to our new research study on “Bulk Lyophilization Services Market Forecast to 2031 – Global Analysis – by Lyophilization Format, Scale, Service Type, End User,” the bulk lyophilization services market size is expected to grow from US$ 839.19 million in 2024 to US$ 1,370.56 million by 2031; the market is expected to register a CAGR of 7.4% during 2025–2031. Major factors driving the bulk lyophilization services market growth include the rising demand for biologics and vaccines requiring advanced preservation, and the surging demand for outsourcing pharmaceutical manufacturing to specialized CDMOs.

Bulk lyophilization services are essentially the large-scale, freeze-drying of drug and biologic products done by a third party before the final packaging of the product into dosage forms. Such services are available from specially equipped Contract Development and Manufacturing Organizations (CDMOs) that have high-capacity lyophilizers suitable for commercial-scale production. The shift toward sustainable and energy-efficient lyophilization systems, AI-driven predictive cycle optimization and digital twins, and the rise of modular and containerized lyophilization units for decentralized production are expected to be major bulk lyophilization services market trend in the coming years.

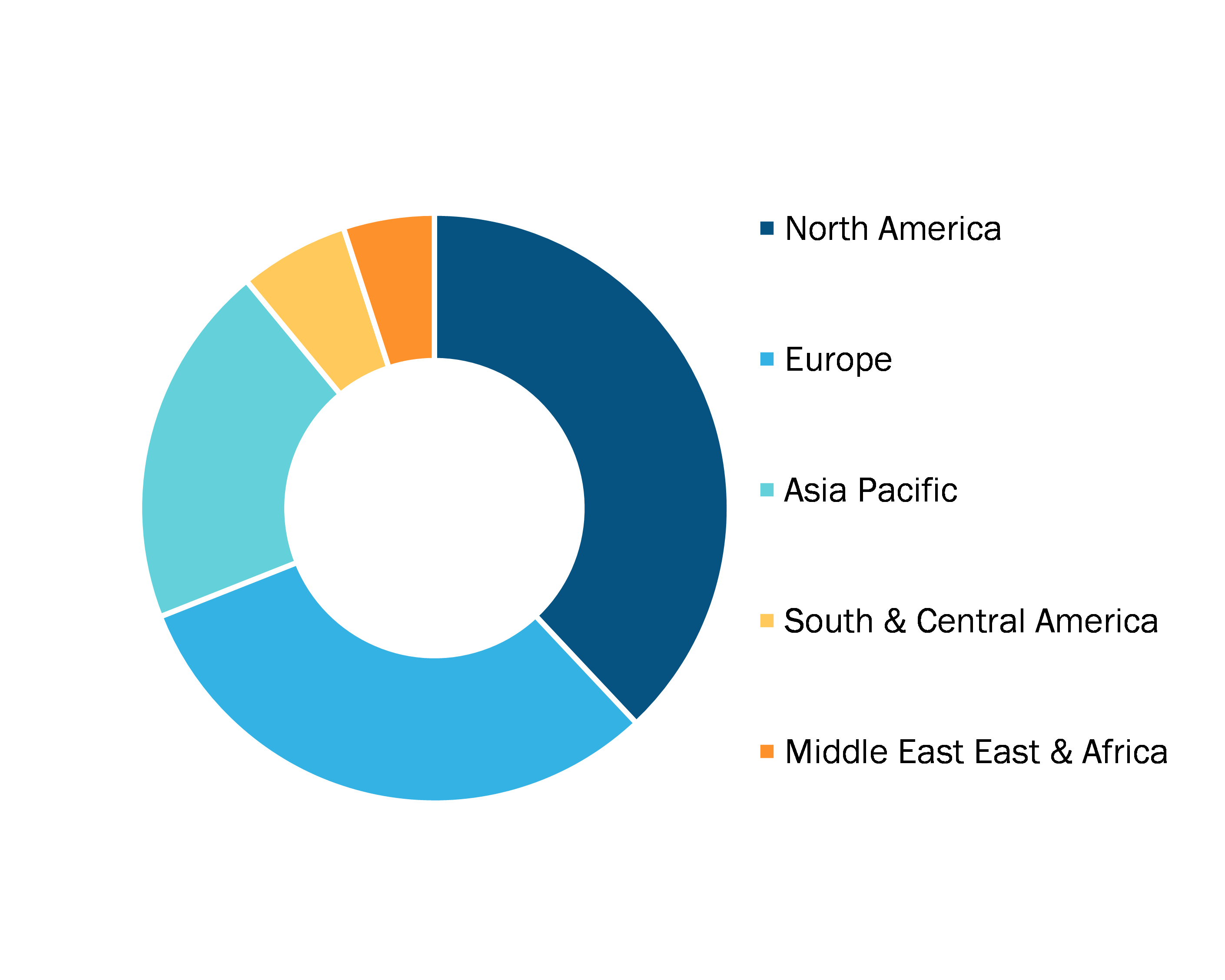

Bulk Lyophilization Services Market, by Region, 2024 (%)

Bulk Lyophilization Services Market Insights & Growth Scope 2031

Download Free SampleBulk Lyophilization Services Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Lyophilization Format (Bulk Tray Lyophilization, Drum Lyophilization, Shelf Freeze-Drying, Tunnel or Conveyer Based Freeze Drying, and Hybrid Methods), Scale (Small Scale or Lab Scale, Pilot Scale, and Commercial and Industrial Scale), Service Type (Custom Process Development and Optimization, Pilot Scale and R and D Lyophilization, and Full Scale Commercial Bulk Lyophilization), and End User (Pharmaceutical and Biotechnology Companies, Research and Academic Institutes, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Source: The Insight Partners Analysis

Bulk Lyophilization Services Market Analysis Based on Segmental Evaluation:

Based on lyophilization format, the bulk lyophilization services market is segmented into bulk tray lyophilization, drum lyophilization, shelf freeze-drying, tunnel or conveyor-based freeze drying, and hybrid methods. The bulk tray lyophilization segment held a significant bulk lyophilization services market share in 2024. Bulk tray lyophilization is a landmark method in the market, where large volumes of pharmaceutical, biotechnological, and nutraceutical products are processed on stacked trays inside controlled freeze-drying chambers, thus allowing freezing, primary drying under vacuum, and secondary drying to remove bound moisture to be carried out uniformly. The main advantage of this format is that it can handle biologics that are sensitive and active pharmaceutical ingredients (APIs) that need precise temperature control to keep their structural integrity and bioactivity; hence, it is a must for contract development and manufacturing organizations (CDMOs) serving the biopharma sector, which is growing rapidly. One of the best illustrations is the freeze-drying of monoclonal antibodies for cancer immunotherapies, such as those by Amgen and Genentech, where trays enable scalable batch processing without a drop in potency.

The segment expansion is mainly due to the demand for stable injectables with extended shelf-life, which have been approved rapidly by the US Food and Drug Administration (FDA), with more than 50 novel biologics being approved annually, and the rise of personalized medicine that requires tailoring of drying protocols. The growth in vaccine manufacturing—made visible by the post-pandemic mRNA vaccine stabilizer capacity increase—has led to a higher dependency on tray systems for their load-size and formulation adaptability flexibility. Environmental sustainability fosters the use of trays, as energy-efficient tray models lower carbon footprints in line with EPA regulations. The progress in automated loading and unloading stages shortens the operational time by up to 30%.

The scope of the bulk lyophilization services market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. In terms of revenue, North America dominated the bulk lyophilization services market share in 2024.

Lyophilization or freeze-drying is the method of removing water under vacuum to preserve the product without the use of excessive heat, thus facilitating aseptic processing and reconstitution and stabilizing temperature-sensitive compounds. As per the FDA, unstable drugs in the solution are the main reason that new parenteral products, including semi-synthetic penicillins, cephalosporins, erythromycin salts, doxycycline, chloramphenicol, and corticosteroids such as hydrocortisone sodium succinate and methylprednisolone sodium succinate, are produced in lyophilized form.

This process is responsible for a large part of the industry's output, with lyophilized injectables making up 13% of all products on the FDA's drug shortage list, thus pointing to supply chain vulnerabilities and the need for robust contract development and manufacturing organization (CDMO) services. The US pharmaceutical industry, which is a major employer of over 800,000 people in research, manufacturing, and technical roles, spent US$ 83 billion on research and development in 2019, a large part of which goes toward advanced lyophilization technologies.

CDMOs such as Lyophilization Technology, Inc. (LTI) are the one-stop solution providers offering services from the manufacturing of clinical supplies for sterile pre-clinical to Phase II materials to full-scale freeze-drying of healthcare products. In July 2025, Coriiis Pharma made public a US$ 10 million investment in a new Morrisville, North Carolina facility, its first site in the US, to provide formulation development and lyophilization for liquid and solid biopharmaceuticals, thus creating 50 high-skilled jobs. Sow Good Inc. invested more than US$10 million into the development of a freeze-drying manufacturing facility specifically designed for nutritional products, thus showing the technology's versatility beyond the pharma industry into food and biotech. Controlled nucleation technologies such as ControLyo help optimize drying uniformity and minimize cycle times. As the biotech pipelines get longer, bulk lyophilization services will be the ones to support bringing products to the market at a faster pace.

Hudson Valley Lyomac; Alcami Corporation; Affinity Life Sciences; OFD Life Sciences; Quality BioResources; Symbiosis; Lyophilization Technology, Inc.; Attwill; PCI Pharma Services; Catachem Inc are among the leading companies profiled in the bulk lyophilization services market report.

By scale, the bulk lyophilization services market is segmented into small-scale or lab-scale, pilot-scale, and commercial and industrial-scale. By service type, the market is segmented into custom process development and optimization, pilot scale and R and D lyophilization, and full-scale commercial bulk lyophilization. By end user, pharmaceutical and biotechnology companies, research and academic institutes, and others. In terms of geography, the market is categorized into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of APAC), South and Central America (Brazil, Argentina, and the Rest of South and Central America), and the Middle East and Africa (Saudi Arabia, the UAE, South Africa, and the Rest of Middle East and Africa).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com