According to our new research study on “Colorectal Cancer Diagnostics Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Modality and End User,” the Colorectal Cancer Diagnostics market was valued at US$ 10,374.68 million in 2022 and is projected to reach US$ 16,996.48 million by 2028; it is estimated to grow at a CAGR of 8.7% from 2023 to 2028. Factors driving the growth of the colorectal cancer diagnostics market include an increasing prevalence of colorectal cancer and launches of new products.

Based on modality, the colorectal cancer diagnostics market is bifurcated into imaging tests and stool-based tests. Imaging test segment held the larger share of the market in 2022 and is anticipated to register a CAGR of 8.8% in the market during the forecast period. The use of imaging tests in colorectal cancer diagnostics has evolved over the last few years. Imaging results are instrumental in surveillance, diagnosis, staging, treatment selection, and follow-up scheduling. Imaging tests involve looking at the structure of the colon and rectum for the presence of any abnormal areas. Imaging examinations use scopes, tube-like instruments with a light and tiny video camera at their end, inserted into the rectum. These tests scan the inside of the colon and rectum for any abnormal areas that might be cancer or polyps. These tests are used less often than stool-based tests and require more preparation beforehand and have some associated risks, unlike stool-based tests. Such aforementioned factors contribute to the overall colorectal cancer diagnostics market size and growth during the forecast period.

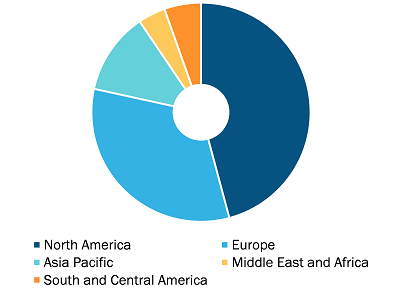

Colorectal Cancer Diagnostics Market, by Region, 2022 (%)

Colorectal Cancer Diagnostics Market Forecast to 2028 - Global Analysis By Modality [Imaging Tests (Colonoscopy, CT Colonography, Flexible Sigmoidoscopy, Capsule Endoscopy, and Others), and Stool Based Tests [Faecal Immunochemical Test (FIT), Guaiac-based Faecal Occult Blood Test (gFOBT), and Stool DNA Test)] and End User (Hospitals, Diagnostic Laboratories, Cancer Research Institutes, and Others)

Colorectal Cancer Diagnostics Market Report | Size, Share, Growth 2028

Download Free Sample

Source: The Insight Partners Analysis

The imaging tests is further classified into colonoscopy, CT colonography, flexible sigmoidoscopy, capsule endoscopy, and others. Colonoscopy held the largest segment in 2022. However, CT colonography is expected to grow at a faster pace with a CAGR of 9.2% during the forecast period. Computed tomographic (CT) colonography, also known as virtual colonoscopy, is an anatomical imaging method that utilizes special X-ray equipment (a CT scanner) to create a series of 3D images of the interior of the colon and the rectum from outside the body. The colon is usually inflated with air while performing the procedure. Pictures taken during colonography are then assembled using computer systems into detailed images that may display polyps and other abnormalities. If polyps or other abnormalities are observed during a CT colonography, it is followed by a standard colonoscopy to remove these abnormalities. CT colonography also produces images of areas surrounding the colon and rectum, leading to the unintentional detection of medical findings in these areas that may require additional follow-up procedures.

CT colonography aids in the morphological analysis of wall deformities, providing information required for the preoperative assessment of T staging in colorectal cancer. As per the guidelines of Response Evaluation Criteria in Solid Tumors (RECIST), CT is the most widely used modality for assessing treatment response in patients with metastasized colon and rectal tumors. The common advantages of CT colonography are as follows: it is quick and safe, it helps to visualize the entire colon, and no sedation is required to perform the test. This test is recommended to be performed every five years in asymptomatic patients with average risk. By stool based tests, the colorectal cancer diagnostics market is segmented into fecal immunochemical test (FIT), guaiac-based fecal occult blood test (gFOBT), and stool DNA test. The FIT segment held the largest share in 2022 and it is expected to grow at a faster pace with a CAGR of 7.9%. By end user, the market is classified into hospitals, diagnostic laboratories, cancer research institutes, and others. The hospitals segment held the largest market share in 2022 and it is expected to grow at a faster pace during the forecast period with a CAGR of 9.2%. By geography, the colorectal cancer diagnostics market is segmented into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

In terms of revenue, North America dominated the colorectal cancer diagnostics market growth accounting highest market share. On the other hand, Asia Pacific accounts for highest CAGR for colorectal cancer diagnostics market during the forecast period.

Impact of COVID-19 Pandemic on Colorectal Cancer Diagnostics Market

Lockdown and travel restrictions due to the pandemic disrupted regular cancer patient visits to centers. The healthcare resources implemented extra protective measures and social distancing to prevent cancer patients from getting infected by the novel coronavirus. The oncology services implemented measures such as reducing a number of patients in outpatient clinics and discharging patients from inpatient services. The low and middle-income countries in Asia Pacific were adversely impacted by limited resources, poor infrastructure, shortage of healthcare providers, and insufficient medical and personal protective equipment. Due to the COVID-19 pandemic, colorectal cancer screening was moderately affected in Asia Pacific countries. Japan and South Korea were the most affected countries, followed by Singapore, Australia, New Zealand, and Taiwan. A survey was conducted to examine the status of colorectal cancer screening services before and after COVID-19 outbreak in Asia Pacific. It was observed only minor and temporary disruptions paused the screening programs in the region. According to Johns Hopkins University Centre for Systems Science and Engineering, in 2021, the following were the reported COVID-19 cases and deaths per 100,000 population in major organized CRC screening programs in Asia Pacific. In Japan, 225 cases and 3 deaths, South Korea 133 cases and 2 deaths, Singapore 1,045 cases and 1 death, Hong Kong 124 cases and 2 deaths, Australia 114 cases and 4 deaths, and New Zealand 45 cases and 1 death. Therefore, colorectal cancer screening programs in Asia Pacific were moderately affected during the COVID-19 pandemic when compared to the other regions.

Medtronic Plc, Illumina Inc, Clinical Genomics Technologies Pty Ltd, EDP Biotech Corp, Epigenomics AG F. Hoffmann-La Roche Ltd, Quest Diagnostics Inc, Novigenix SA, Siemens Healthineers AG, Bruker Corp, and Eiken Chemical Co., Ltd. amongst others are among the leading companies operating in the colorectal cancer diagnostics market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com