Colorectal Cancer Diagnostics Market Key Players and Opportunities by 2028

Colorectal Cancer Diagnostics Market Forecast to 2028 - Industry Analysis By Modality [Imaging Tests (Colonoscopy, CT Colonography, Flexible Sigmoidoscopy, Capsule Endoscopy, and Others), and Stool Based Tests [Faecal Immunochemical Test (FIT), Guaiac-based Faecal Occult Blood Test (gFOBT), and Stool DNA Test)] and End User (Hospitals, Diagnostic Laboratories, Cancer Research Institutes, and Others)

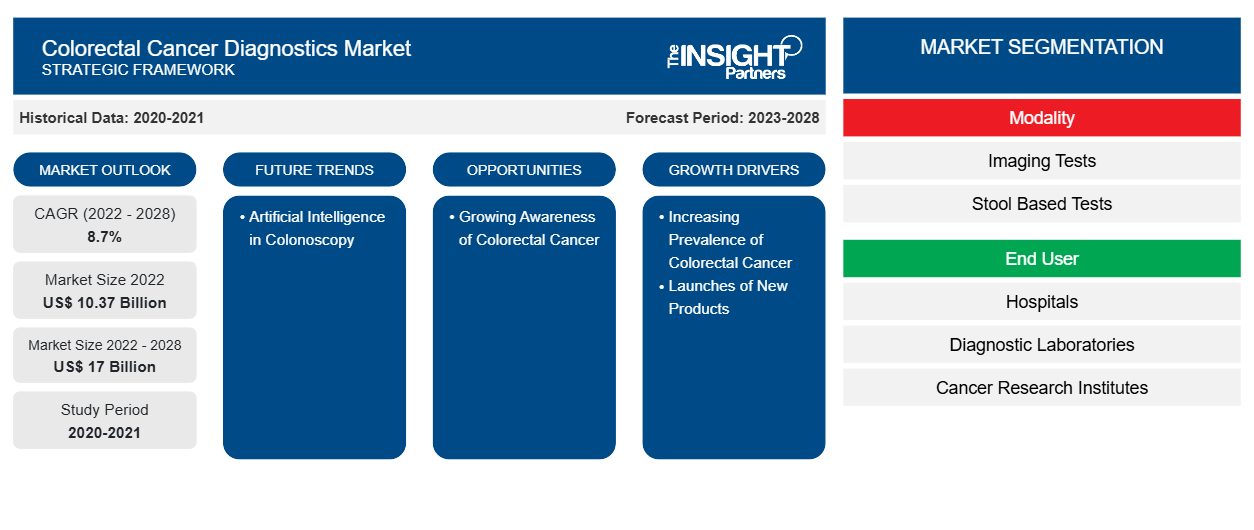

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : May 2023

- Report Code : TIPRE00013454

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 213

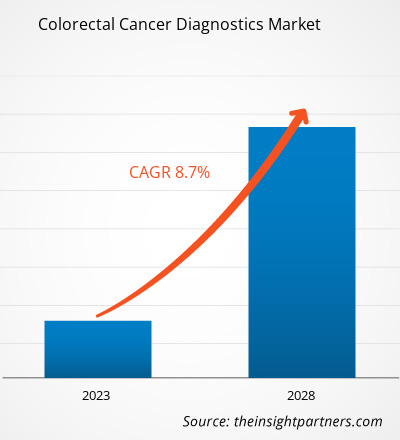

[Research Report] The colorectal cancer diagnostics market size is expected to grow from US$ 10,374.68 million in 2022 to US$ 16,996.48 million by 2028; it is estimated to record a CAGR of 8.7% from 2023 to 2028.

The colorectal cancer diagnostics market is segmented based on modality, end user, and geography. The report offers insights and in-depth market analysis, emphasizing parameters such as drivers, trends, opportunities, and competitive landscape analysis of leading market players across various regions. It also includes analyses of the impact of the COVID-19 pandemic across major regions.

Market Insights

Launches of New Products Drives Colorectal

Major players in the colorectal cancer diagnostics market manufacture a wide range of devices that help reduce the burden of colorectal cancer and other associated indications such as colon polyps, Crohn’s disease, colitis, and irritable bowel syndrome. In July 2022, US Digestive Health (USDH), a network of top-rated gastrointestinal (GI) practices, announced the commercialization of AI-assisted colonoscopy screenings with the country’s largest installation of Genious Intelligent GI endoscopy modules. These modules are expected to help physicians identify hard-to-detect and potentially cancerous polyps in real time. With the launch of this device, patients throughout southeastern, southwestern, and central Pennsylvania can now access AI-assisted colonoscopy with enhanced capabilities. In September 2020, Olympus Corporation announced the launch of ENDO-AID, a cutting-edge platform powered by artificial intelligence (AI). The platform includes ENDO-AID CADe application (app), a computer-aided endoscopic method for the detection of different conditions of the colon. This new AI platform enables the real-time display of automatically detected suspicious lesions and works in combination with its EVIS X1. Thus, the frequent developments and new product launches drive the colorectal cancer diagnostics market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONColorectal Cancer Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Modality-Based Insights

Based on modality, the colorectal cancer diagnostics market is bifurcated into stool-based tests and imaging tests. In 2022, the imaging tests segment held a larger share of the colorectal cancer diagnostics market and is anticipated to register a higher CAGR during the forecast period. The use of imaging tests in colorectal cancer diagnostics has evolved over the last few years. Imaging results are instrumental in surveillance, diagnosis, staging, treatment selection, and follow-up scheduling. Imaging tests involve looking at the structure of the colon and rectum for the presence of any abnormal areas. Imaging examinations use scopes, tube-like instruments with a light and tiny video camera at their end, inserted into the rectum. These tests scan the inside of the colon and rectum for any abnormal areas that might be cancer or polyps. These tests are used less often than stool-based tests and require more preparation beforehand and have some associated risks, unlike stool-based tests. The imaging tests is further classified into colonoscopy, CT colonography, flexible sigmoidoscopy, capsule endoscopy, and others.

Colonoscopy segment held the largest share of the market in 2022. However, CT colonography is expected to grow at a faster pace during the forecast period. CT colonography aids in the morphological analysis of wall deformities, providing information required for the preoperative assessment of T staging in colorectal cancer. As per the guidelines of Response Evaluation Criteria in Solid Tumors (RECIST), CT is the most widely used modality for assessing treatment response in patients with metastasized colon and rectal tumors. The common advantages of CT colonography are as follows: it is quick and safe, it helps to visualize the entire colon, and no sedation is required to perform the test. This test is recommended to be performed every five years in asymptomatic patients with average risk.

End User-Based Insights

Based on end user, the colorectal cancer diagnostics market is segmented into hospitals, diagnostic laboratories, cancer research institutes, and others. The hospitals segment accounted for the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period.

The colorectal cancer diagnostics market players adopt organic strategies such as product launch and expansion to expand their geographic footprint and product portfolios and meet the growing demands. Inorganic growth strategies adopted by market players allow them to expand their businesses and enhance their geographic presence. Additionally, these growth strategies help companies strengthen their clientele and enlarge their product portfolios.

- In December 2022, Epigenomics licenses protein biomarker technology for blood-based colorectal cancer test. The company has licensed from The University of Texas MD Anderson Cancer Center certain patent and technology rights to biomarkers associated with colorectal cancer detection.

- In August 2021, Illumina Acquired GRAIL to Accelerate Patient Access to Life-Saving Multi-Cancer Early-Detection Test. GRAIL's Galleri blood test detects 50 different cancers before they are symptomatic. Illumina's acquisition of GRAIL will accelerate access and adoption of this life-saving test worldwide.

Colorectal Cancer Diagnostics

Colorectal Cancer Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10.37 Billion |

| Market Size by 2028 | US$ 17 Billion |

| Global CAGR (2022 - 2028) | 8.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Colorectal Cancer Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Colorectal Cancer Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Company Profiles

- Medtronic Plc

- Illumina Inc

- Clinical Genomics Technologies Pty Ltd

- EDP Biotech Corp

- Epigenomics AG

- F. Hoffmann-La Roche Ltd

- Quest Diagnostics Inc

- Novigenix SA

- Siemens Healthineers AG

- Bruker Corp

- Eiken Chemical Co., Ltd.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For