Hospitals Held Largest Share of COPD Devices Market in 2022

According to our new research study on “COPD Devices Market Forecast to 2030 – Global Analysis – by Product Type, Age Group, and Distribution Channel,” the COPD devices market is expected to grow from US$ 8,849.16 million in 2022 to US$ 12,877.43 million by 2030; it is anticipated to record a CAGR of 4.8% from 2022 to 2030. The report emphasizes the trends prevalent in the global COPD devices market and drivers and deterrents affecting its growth.

Smart inhalers aim to assist individuals with COPD to ensure they take their medication as prescribed by recording the dosage and timing on their smart electronics. A doctor can use the data collected by the device to verify that the prescribed treatment is functioning, personalize COPD treatment, analyze the root causes of deteriorating symptoms, and provide early warning to the systems that inform when to visit a hospital. This technology can shift from one-size-fits-all COPD screening, which leads to less routine schedules, thereby decreasing pressure on the National Health Service (NHS). Smart inhalers benefit adults, especially the elderly population, as they struggle to take the same quantity of puffs due to uneven breathing because of their weakened muscles that support breathing. The diaphragm weakens with age in the geriatric population, which prevents air from exhaling or inhaling. Smart inhalers are equipped with sensors that are connected to conventional inhalers and assist in keeping track of when the medication is taken. Smart inhalers are Bluetooth-enabled and can also be remotely paired with a computer, phone, or tablet, which can automatically transfer data from the smart inhaler. In India, the requirement for smart inhalers has been boosted due to the rising prevalence of respiratory diseases, such as COPD, and smoking habits.

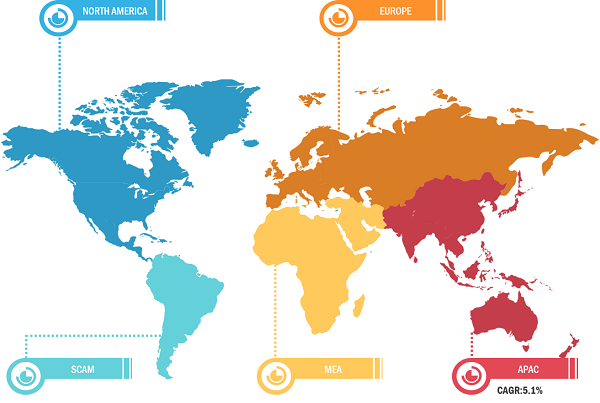

COPD Devices Market, by Region, 2022 (%)

COPD Devices Market Size and Forecast (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Inhaler and Nebulizer), Age Group (20-40 Years, 41-65 Years, 66-80 Years, and 85+ Years), End User (Hospitals Pharmacies, Retail Pharmacies, and Online Pharmacies), and Geography

COPD Devices Market Research Report | Size, Share by 2030

Download Free Sample

Source: The Insight Partners Analysis

The COPD devices market, by product type, is bifurcated into inhaler and nebulizer. In 2022, the inhaler segment held a larger market share and is expected to record a higher CAGR during the forecast period. Metered dose inhalers (MDI) and dry powder inhalers (DPI) are two major types of inhalers used for treating COPD. Unlike other inhalers that provide a puff of medicine, these inhalers hold the medicine as a dry powder. The patient needs to breathe in quickly and deeply to get the medicine into the lungs. Dry powder inhalers are clinically appropriate and cost-effective alternatives. Metered dose inhalers (MDIs) are handheld pressurized inhaler systems that directly provide small, precise doses of medication to a patient's airways. MDI devices include a valve and actuator that facilitates a consistent delivery of a precise dose of medicine to the patient in particles of an exact size distribution delivered via a propellant. These inhalers require gas propellants with vapor pressures that can be liquefied at temperatures between 40 and 70 psi inside the canister. The fuels used in these MDIs for medication inhalation must be certified by the Food and Drug Administration. They must comply with the current Good Manufacturing Practice (cGMP) inhalation grade with high purity levels. They should also meet cGMP requirements for the facilities, methods, and controls used in processing, manufacturing, and packaging to guarantee that the product is safe for use. The first HFC MDI approved in 1996 by the FDA was for albuterol sulfate utilizing HFC-134a propellant. In 2020, the number of FDA-approved MDI products reached 13, and it is expected to expand in the coming years.

The COPD devices market, by distribution channel, is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. In 2022, the retail pharmacies segment held the largest market share; the same segment is expected to record the highest CAGR during the forecast period. Online pharmacies are the fastest-growing distribution channel of the COPD devices market. Retail pharmacies sell prescription products, over-the-counter (OTC) products, fast-moving consumer goods, and related services. COPD devices are needed daily, making prescription-based devices mandatory, which helps expand retail pharmacies. Modern retail pharmacy chains are digitized, organized, and tech-enabled, which allows them to track medication inventories and sell 100% reliable goods. In addition, retail pharmacy chains provide value-added services for consumers who have medical claims or insurance filings to be done. They can also be requested to refurbish previous bills or memos.

AstraZeneca PLC, Beximco Pharmaceuticals Ltd, Getinge AB, Boehringer Ingelheim, GSK Plc, Medtronic PLC, Nephron Pharmaceuticals, Novartis AG, Sunovion Pharmaceuticals Inc, and Teva Pharmaceuticals are a few of the key companies operating in the COPD devices market. These companies adopt product innovation and product development strategies to meet evolving customer demands, which allows them to maintain their brand name.

The report segments the COPD devices market as follows:

The COPD devices market is segmented based on product type, age group, distribution channel, and geography. The COPD devices market, by type, is segmented into inhaler and nebulizer. The COPD devices market, by age group, is segmented into 20–40 years, 41–65 Years, 66–80 years, and 85+ years. The COPD devices market, by distribution channel, is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Based on geography, the COPD devices market is categorized into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Australia, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com