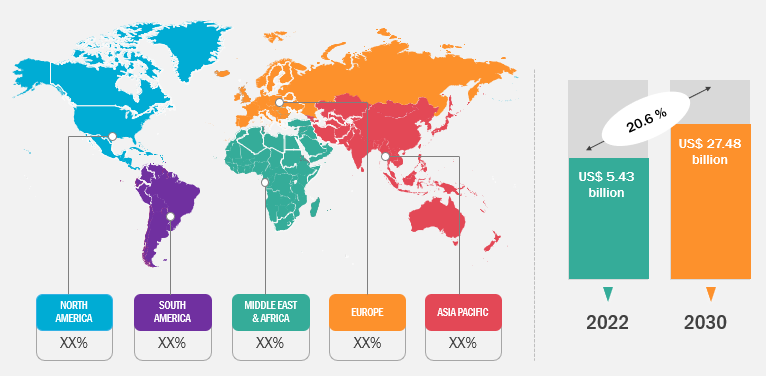

The drone camera market size is expected to reach US$ 27.48 billion by 2028; registering at a CAGR of 20.6% during 2022–2028, according to a new research study conducted by The Insight Partners.

Increase in Demand for Drones in Defense Forces is Catalyzing the Drone Camera Market Growth

Drone Camera Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by Type (Embedded Camera, Infrared Camera, and Thermal Camera), Application (Photography and Videography, Thermal Imaging, and Surveillance and Mapping), Resolution (Below 12 MP, 12–20 MP, 20–32 MP, and Above 32 MP), End User (Entertainment and Media, Defense and Law Enforcement, Transport and Logistics, Construction, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Drone Camera Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Download Free Sample

Defense sectors in developed and developing nations have been the major adopters of camera-integrated drones for surveillance and monitoring applications. For instance, in June 2020, the US Army awarded a contract to FLIR to supply nano drones [Black Hornet 3 Personal Reconnaissance Systems (PRS)] worth US$ 85 million. The US Army has benefited significantly since the delivery of these drones, as the technology helped army departments collect crucial information across critical environments. The army further plans to procure additional Blacker Hornet 3 PRS in the coming years.

Further, the demand for high-definition drone cameras is significantly increasing in commercial applications such as the inspection of confined spaces. According to the agreement finalized in 2020 between MFE Enterprises, Inc. and Flyability, MFE Enterprises gained exclusive rights to sell Flyability’s collision-tolerant inspection and monitoring drones in the11 US states. Elios and the Elios 2 drones of Flyability have been integrated with full HD cameras for clear inspection of confined spaces.

Continuous innovations in the drone industry over the last couple of years have encouraged the adoption of technologically advanced cameras, such as infrared and thermal cameras, in drones. The inspection and monitoring capabilities of thermal cameras go beyond the abilities of the naked eye, thereby enabling end users to enhance the overall security and safety of the location under surveillance. Thus, there is a high demand for technologically advanced drone cameras across the world.

Workswell; Canon Inc.; Controp Precision Technologies Ltd.; Kappa optronics GmbH; BaySpec, Inc.; FLIR Teledyne, Inc.; Homeland Surveillance & Electronics, LLC; Adorama; Octopus ISR Systems; and Phase One are the key drone camera market players profiled in the study. Several other major companies were also studied and analyzed in this research study to get a holistic view of the market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com