Instruments and Accessories Segment to Lead Minimally Invasive Surgery Robot Market During 2025–2031

According to our new research study named "Minimally Invasive Surgery Robot Market Forecast to 2031 – Global Analysis – by Product and Services, Application, and End Use," the market was valued at US$ 11.16 billion in 2024 and is projected to reach US$ 29.13 billion by 2031; it is expected to register a CAGR of 14.8% during 2025–2031. The growing number of microsurgeries and the increasing prevalence of chronic diseases drive the adoption of minimally invasive surgery robots. However, the high cost of robotic systems hinders the market growth. Untapped markets in emerging economies are projected to bring new minimally invasive surgery robot market trends in the coming years.

Minimally Invasive Surgery (MIS) robots are advanced medical devices that assist surgeons in performing complex procedures through small incisions with high precision. These robotic systems enhance dexterity, reduce tremors, and offer 3D visualization, improving outcomes in procedures such as laparoscopic, urologic, gynecologic, and cardiac surgeries. Common systems, such as the da Vinci Surgical System, allow for better control and minimal disruption to surrounding tissues, resulting in less pain, reduced blood loss, and quicker recovery for patients. MIS robots are increasingly used in hospitals to increase surgical efficiency, minimize complications, and enhance patient outcomes with shorter hospital stays.

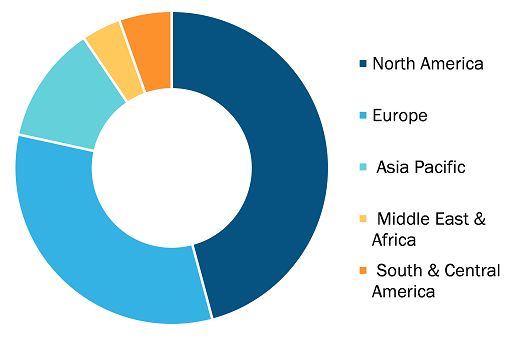

Minimally Invasive Surgery Robot Market, by Region, 2024 (%)

Minimally Invasive Surgery Robot Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product and Services (Robotic Systems, Instruments and Accessories, and Services), Application (General Surgery, Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, and Others), End Use (Hospitals, Ambulatory Surgery Centers, and Others), and Geography

Minimally Invasive Surgery Robot Market Analysis by Size & Share 2031

Download Free Sample

Source: The Insight Partners Analysis

The growing demand for advanced surgical techniques that offer faster recovery and reduced hospital stays is contributing to the growing minimally invasive surgery robot market size. The rising prevalence of chronic diseases, an aging global population, and increasing preference for robot-assisted surgeries boost market adoption. Technological advancements such as AI integration, enhanced imaging, and real-time navigation contribute to improved accuracy and safety. Additionally, rising healthcare expenditure, greater awareness, and expanding applications across specialties such as orthopedics and oncology further support market expansion. Supportive government initiatives and increasing investments in robotic surgery innovation also play a significant role in market development.

Minimally Invasive Surgery Robot Market Analysis Based on Segmental Evaluation:

Based on product and services, the minimally invasive surgery robot market is segmented into robotic systems, instruments and accessories, and services. The instruments and accessories segment held a significant minimally invasive surgery robot market share in 2024. Robotic surgical instruments and accessories enable precision during surgical procedures. The instruments and accessories segment is further sub-segmented into forceps, irrigators, needle drivers, energy instruments, and others. With a variety of modalities, these instruments can be used for a range of procedures. Surgical robot developers offer an extensive set of instruments and accessories for conducting robotic surgeries. Apart from selling the robot systems, surgical robot companies generate recurring revenues through selling these instruments and accessories. As instruments and accessories are consumable, there is continued demand for them with each robotic surgery.

Intuitive Surgical's exclusive Endowrist instruments are designed to provide surgeons with natural dexterity and a full range of motion for precise operations through tiny incisions. Energy instruments, such as monopolar and bipolar cautery instruments (electrical energy), the Harmonic ACE (mechanical energy), the PK Dissecting Forceps (advanced bipolar), and lasers, are used by da Vinci surgeons to provide coagulation, cutting, and tissue dissection. Suture Cut Needle drivers include an integral cutting blade for efficient cutting of sutures after tying knots and increased surgeon autonomy and efficiency. In addition, clip appliers, probe graspers, and cardiac stabilizers are available to allow da Vinci surgeons to perform specialized procedures such as vessel clipping, cryoablation, and beating heart surgery.

The geographic scope of the minimally invasive surgery robot market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. North America dominated the minimally invasive surgery robot market in terms of revenue share in 2024. The increasing adoption of automated surgical instruments, the rising government initiatives to encourage healthcare providers, and the growing prevalence of chronic diseases are propelling the growth of the minimally invasive surgery robot market in the region. In addition, the rise in regulatory approvals for surgical robots across the region also favors the minimally invasive surgery robot market growth in North America.

The US comprises the largest minimally invasive surgery robot market in the world and is estimated to lead the global market during the forecast period. The growth of the minimally invasive surgery market in the US is attributed to the enormous demand for technologically advanced products ensuring better healthcare delivery to patients and the growing prevalence of bone degenerative diseases.

The US is receiving approval for technologically advanced medical equipment. In March 2024, Intuitive—a global technology leader in minimally invasive care and the pioneer of robotic-assisted surgery—announced that the US Food and Drug Administration (FDA) provided 510(k) clearance for da Vinci 5, the company’s next-generation multiport robotic system. Similarly, in June 2024, Moon Surgical—a French-American pioneer in surgical innovation—received clearance from the FDA for the commercial version of its unique Maestro surgical system.

Hospitals in the US are launching robotic surgery programs. For instance, in June 2023, South Texas Health System Heart launched a robotic surgery program aimed at improving patient outcomes and the overall patient experience. Thus, strategic initiatives by market players and public authorities are fueling the growth of the minimally invasive surgery robot market in the US, thereby contributing to the minimally invasive surgery robot market growth.

Canada is among the fastest-growing countries in North America. The increasing prevalence of chronic diseases and the growing number of robotic surgeries in Canada propels the demand for surgical robots in the country. For instance, in 2021, the National Center for Biotechnology reported that 30 surgical robots were operating in 14 Canadian cities, performing ~6000 operations each year.

Key market players are adopting organic growth strategies such as new product launches and product approvals. In October 2021, Medtronic Canada announced the commercial launch of the Mazor X System (referred to as Mazor) for robotic-guided spine surgery. It is the first dedicated robotic-assisted spine surgery platform to be launched in Canada. The Mazor platform offers a fully integrated procedural solution for surgical planning, workflow, execution, and confirmation and is the first dedicated robotic-assisted spine surgery platform being launched in Canada. Furthermore, In December 2021, Medtronic Canada ULC received a Health Canada license for the Hugo robotic-assisted surgery (RAS) system. This system is intended for use in urologic and gynecologic laparoscopic surgical procedures, which account for approximately half of all robotic procedures performed, which bolsters the growth of the minimally invasive surgery robot market.

Johnson and Johnson; Stryker Corp.; Medtronic Plc; Intuitive Surgical Inc.; Asensus Surgical Inc.; Smith and Nephew Plc.; Zimmer Biomet Holdings Inc.; CMR Surgical Ltd; Moon Surgical; and Curexo, Inc. are among the leading companies profiled in the minimally invasive surgery robot market report.

Based on product and services, the minimally invasive surgery robot market is segmented into robotic systems, instruments and accessories, and services. By application, the market is categorized into general surgery, gynecological surgery, urological surgery, neurosurgery, orthopedic surgery, and others. In terms of end use, the minimally invasive surgery robot market is segmented into hospitals, ambulatory surgery centers, and others. Geographically, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East and Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East and Africa), and South and Central America (Brazil, Argentina, and the Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com